- Germany

- /

- Capital Markets

- /

- XTRA:O4B

3 Reliable Dividend Stocks Offering At Least 3.4% Yield

Reviewed by Simply Wall St

As global markets grapple with tariff uncertainties and mixed economic signals, investors are seeking stability amidst the volatility. With U.S. stocks ending the week lower and manufacturing showing signs of recovery, dividend stocks offering reliable yields can provide a buffer against market fluctuations.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Guaranty Trust Holding (NGSE:GTCO) | 5.87% | ★★★★★★ |

| Chongqing Rural Commercial Bank (SEHK:3618) | 8.35% | ★★★★★★ |

| Padma Oil (DSE:PADMAOIL) | 7.54% | ★★★★★★ |

| Peoples Bancorp (NasdaqGS:PEBO) | 4.79% | ★★★★★★ |

| Daito Trust ConstructionLtd (TSE:1878) | 4.04% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.52% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 4.46% | ★★★★★★ |

| Citizens & Northern (NasdaqCM:CZNC) | 5.11% | ★★★★★★ |

| Nihon Parkerizing (TSE:4095) | 4.00% | ★★★★★★ |

| DoshishaLtd (TSE:7483) | 3.88% | ★★★★★★ |

Click here to see the full list of 1969 stocks from our Top Dividend Stocks screener.

Here we highlight a subset of our preferred stocks from the screener.

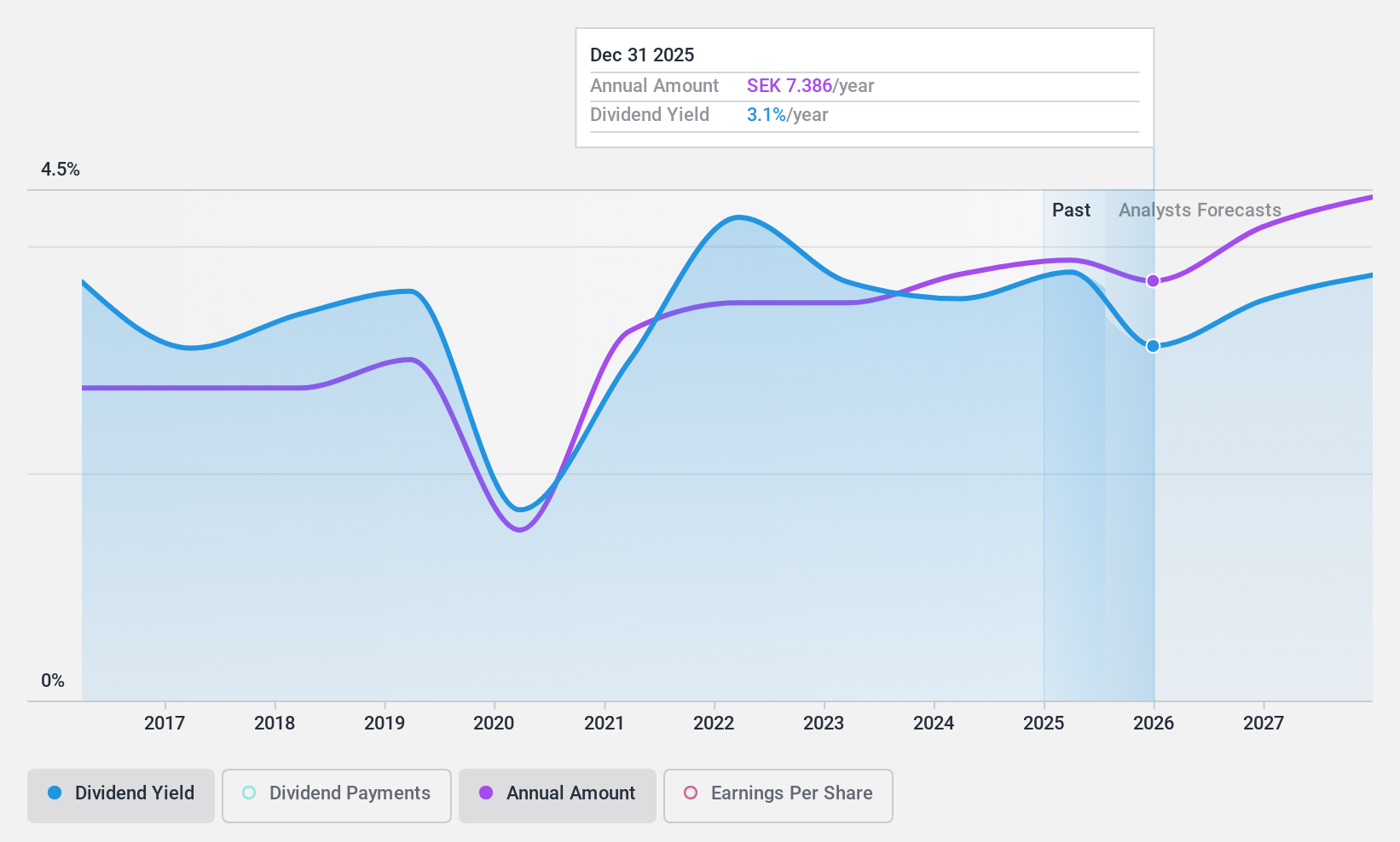

AB SKF (OM:SKF B)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: AB SKF (publ) is a global company that designs, manufactures, and sells bearings and units, seals, lubrication systems, condition monitoring products, and services with a market cap of approximately SEK100.09 billion.

Operations: AB SKF generates revenue primarily from its Industrial segment, which accounts for SEK69.48 billion, and its Automotive segment, contributing SEK29.25 billion.

Dividend Yield: 3.5%

AB SKF's dividend payments, while covered by earnings and cash flows with payout ratios of 54.5% and 69.1%, have been volatile over the past decade, lacking reliability. Although trading at a good value compared to peers, its dividend yield of 3.47% is below the top quartile in Sweden. Recent Q4 results show improved net income at SEK 1.51 billion from SEK 623 million year-on-year, despite removal from the OMX Nordic 40 Index in December 2024.

- Click to explore a detailed breakdown of our findings in AB SKF's dividend report.

- The valuation report we've compiled suggests that AB SKF's current price could be quite moderate.

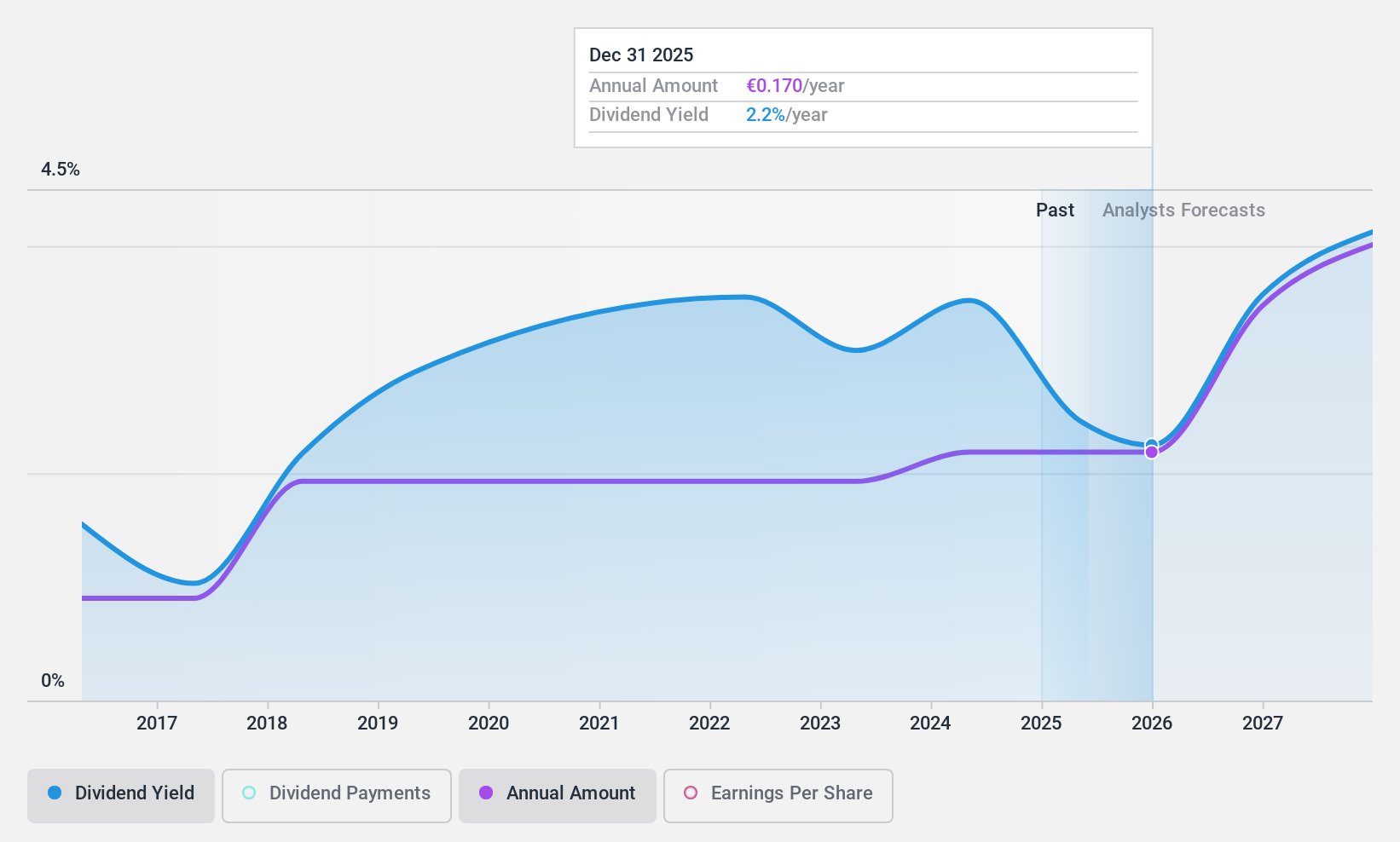

DEUTZ (XTRA:DEZ)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: DEUTZ Aktiengesellschaft develops, manufactures, and sells diesel and gas engines across Europe, the Middle East, Africa, the Asia Pacific, and the Americas with a market cap of €646.91 million.

Operations: DEUTZ generates its revenue primarily from the Classic segment, which accounts for €1.85 billion, and the Green segment, contributing €7 million.

Dividend Yield: 3.6%

DEUTZ's dividend payments, despite being well-covered by earnings and cash flows with payout ratios of 44.3% and 53.7%, have been unreliable over the past decade due to volatility. While trading significantly below its estimated fair value, DEUTZ offers a lower dividend yield of 3.64% compared to the top quartile in Germany. Recent presentations at investor conferences may provide insights into future strategies but profit margins have declined from last year’s levels.

- Click here and access our complete dividend analysis report to understand the dynamics of DEUTZ.

- The analysis detailed in our DEUTZ valuation report hints at an deflated share price compared to its estimated value.

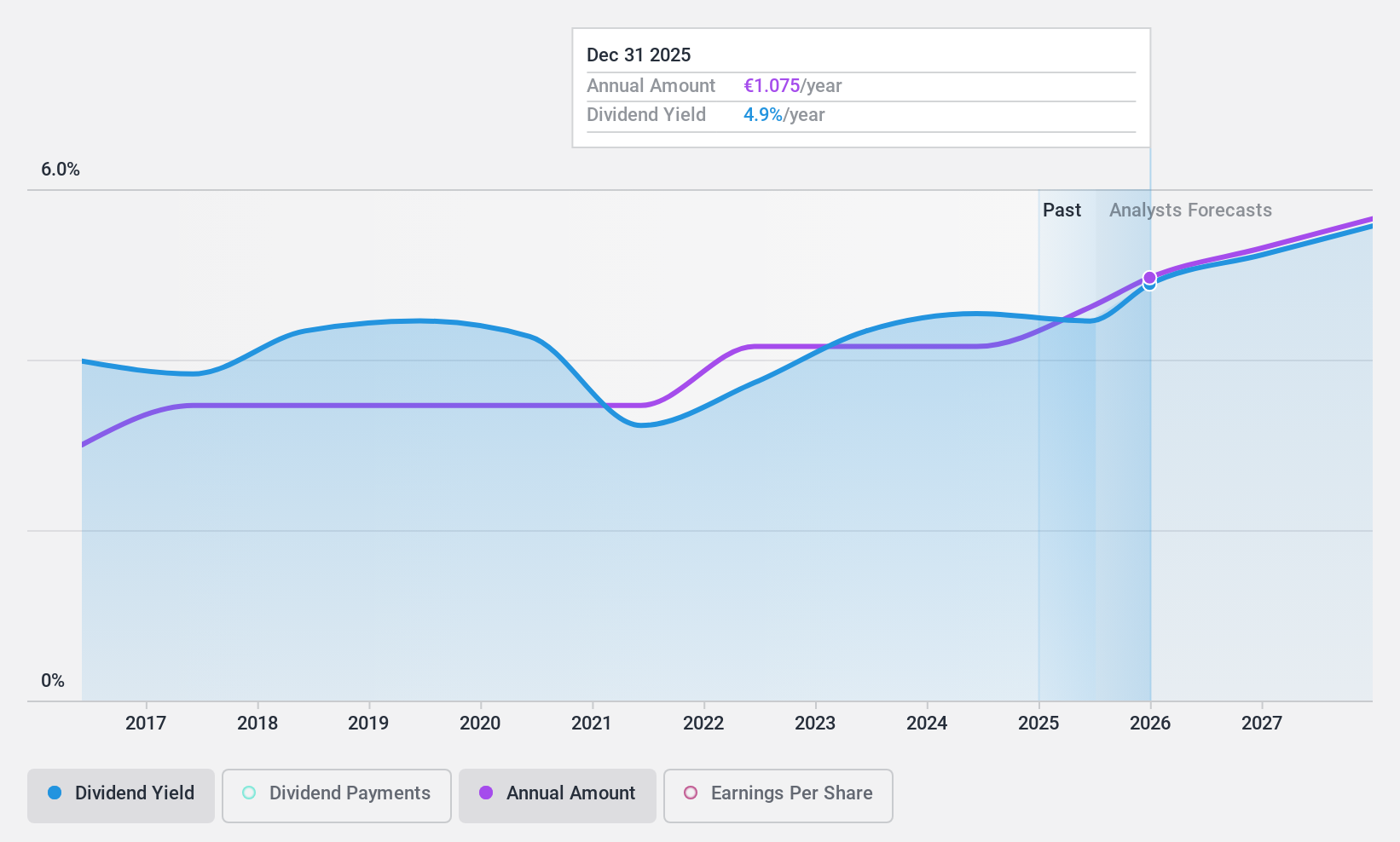

OVB Holding (XTRA:O4B)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: OVB Holding AG, with a market cap of €279.33 million, operates through its subsidiaries to offer advisory and brokerage services to private households across Europe.

Operations: OVB Holding AG generates revenue primarily from its insurance brokerage segment, amounting to €392.74 million.

Dividend Yield: 4.4%

OVB Holding's dividends are well-supported by earnings and cash flows, with payout ratios of 69.3% and 68.3%, respectively. Over the past decade, dividend payments have been stable and growing, though its yield of 4.41% is slightly below the top tier in Germany (4.57%). Trading at a discount to its estimated fair value, OVB offers a reliable dividend track record amidst consistent earnings growth of 26.3% last year.

- Get an in-depth perspective on OVB Holding's performance by reading our dividend report here.

- In light of our recent valuation report, it seems possible that OVB Holding is trading beyond its estimated value.

Key Takeaways

- Take a closer look at our Top Dividend Stocks list of 1969 companies by clicking here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About XTRA:O4B

OVB Holding

Through its subsidiaries, provides advisory and brokerage services to private households in Europe.

Flawless balance sheet 6 star dividend payer.

Market Insights

Community Narratives