- Sweden

- /

- Construction

- /

- OM:SKA B

The Market Doesn't Like What It Sees From Skanska AB (publ)'s (STO:SKA B) Earnings Yet

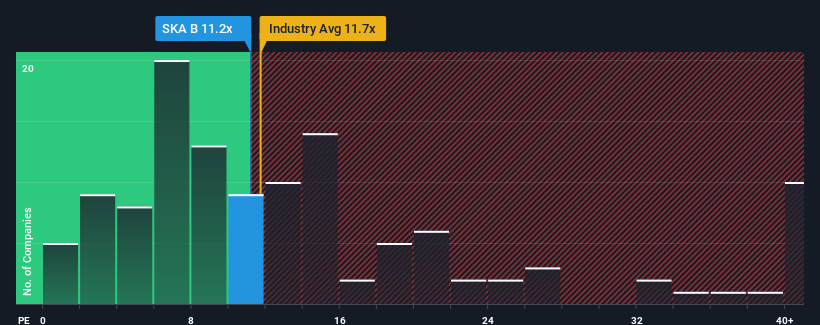

With a price-to-earnings (or "P/E") ratio of 11.2x Skanska AB (publ) (STO:SKA B) may be sending bullish signals at the moment, given that almost half of all companies in Sweden have P/E ratios greater than 22x and even P/E's higher than 39x are not unusual. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the reduced P/E.

Skanska hasn't been tracking well recently as its declining earnings compare poorly to other companies, which have seen some growth on average. The P/E is probably low because investors think this poor earnings performance isn't going to get any better. If this is the case, then existing shareholders will probably struggle to get excited about the future direction of the share price.

Check out our latest analysis for Skanska

What Are Growth Metrics Telling Us About The Low P/E?

In order to justify its P/E ratio, Skanska would need to produce sluggish growth that's trailing the market.

Retrospectively, the last year delivered a frustrating 8.1% decrease to the company's bottom line. This means it has also seen a slide in earnings over the longer-term as EPS is down 7.2% in total over the last three years. Accordingly, shareholders would have felt downbeat about the medium-term rates of earnings growth.

Shifting to the future, estimates from the seven analysts covering the company suggest earnings growth is heading into negative territory, declining 22% over the next year. That's not great when the rest of the market is expected to grow by 24%.

With this information, we are not surprised that Skanska is trading at a P/E lower than the market. Nonetheless, there's no guarantee the P/E has reached a floor yet with earnings going in reverse. There's potential for the P/E to fall to even lower levels if the company doesn't improve its profitability.

The Final Word

We'd say the price-to-earnings ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

We've established that Skanska maintains its low P/E on the weakness of its forecast for sliding earnings, as expected. At this stage investors feel the potential for an improvement in earnings isn't great enough to justify a higher P/E ratio. It's hard to see the share price rising strongly in the near future under these circumstances.

Before you take the next step, you should know about the 2 warning signs for Skanska (1 can't be ignored!) that we have uncovered.

You might be able to find a better investment than Skanska. If you want a selection of possible candidates, check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About OM:SKA B

Skanska

Operates as a construction and project development company in the Nordic region, Europe, and the United States.

Flawless balance sheet with moderate growth potential.