SaltX Technology Holding AB (publ)'s (STO:SALT B) Share Price Is Still Matching Investor Opinion Despite 27% Slump

SaltX Technology Holding AB (publ) (STO:SALT B) shareholders that were waiting for something to happen have been dealt a blow with a 27% share price drop in the last month. The recent drop has obliterated the annual return, with the share price now down 9.7% over that longer period.

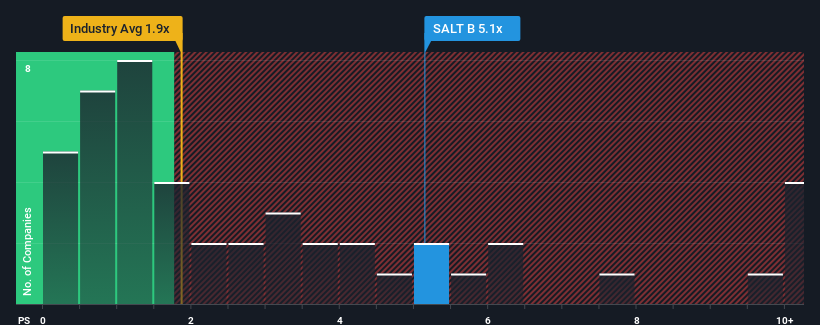

Even after such a large drop in price, given around half the companies in Sweden's Machinery industry have price-to-sales ratios (or "P/S") below 1.9x, you may still consider SaltX Technology Holding as a stock to avoid entirely with its 5.1x P/S ratio. However, the P/S might be quite high for a reason and it requires further investigation to determine if it's justified.

View our latest analysis for SaltX Technology Holding

How Has SaltX Technology Holding Performed Recently?

SaltX Technology Holding certainly has been doing a great job lately as it's been growing its revenue at a really rapid pace. It seems that many are expecting the strong revenue performance to beat most other companies over the coming period, which has increased investors’ willingness to pay up for the stock. However, if this isn't the case, investors might get caught out paying too much for the stock.

Want the full picture on earnings, revenue and cash flow for the company? Then our free report on SaltX Technology Holding will help you shine a light on its historical performance.What Are Revenue Growth Metrics Telling Us About The High P/S?

The only time you'd be truly comfortable seeing a P/S as steep as SaltX Technology Holding's is when the company's growth is on track to outshine the industry decidedly.

Retrospectively, the last year delivered an explosive gain to the company's top line. Spectacularly, three year revenue growth has also set the world alight, thanks to the last 12 months of incredible growth. Therefore, it's fair to say the revenue growth recently has been superb for the company.

Comparing that recent medium-term revenue trajectory with the industry's one-year growth forecast of 3.2% shows it's noticeably more attractive.

With this in consideration, it's not hard to understand why SaltX Technology Holding's P/S is high relative to its industry peers. It seems most investors are expecting this strong growth to continue and are willing to pay more for the stock.

What Does SaltX Technology Holding's P/S Mean For Investors?

A significant share price dive has done very little to deflate SaltX Technology Holding's very lofty P/S. While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

We've established that SaltX Technology Holding maintains its high P/S on the strength of its recent three-year growth being higher than the wider industry forecast, as expected. At this stage investors feel the potential continued revenue growth in the future is great enough to warrant an inflated P/S. Barring any significant changes to the company's ability to make money, the share price should continue to be propped up.

Before you take the next step, you should know about the 5 warning signs for SaltX Technology Holding (1 is concerning!) that we have uncovered.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

If you're looking to trade SaltX Technology Holding, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About OM:SALT B

SaltX Technology Holding

Engages in the development and sale of sustainable technology in Sweden.

Moderate with mediocre balance sheet.

Market Insights

Community Narratives