It's only natural that many investors, especially those who are new to the game, prefer to buy shares in 'sexy' stocks with a good story, even if those businesses lose money. Unfortunately, high risk investments often have little probability of ever paying off, and many investors pay a price to learn their lesson.

So if you're like me, you might be more interested in profitable, growing companies, like Nolato (STO:NOLA B). While profit is not necessarily a social good, it's easy to admire a business that can consistently produce it. Conversely, a loss-making company is yet to prove itself with profit, and eventually the sweet milk of external capital may run sour.

See our latest analysis for Nolato

How Fast Is Nolato Growing?

As one of my mentors once told me, share price follows earnings per share (EPS). That makes EPS growth an attractive quality for any company. We can see that in the last three years Nolato grew its EPS by 16% per year. That's a good rate of growth, if it can be sustained.

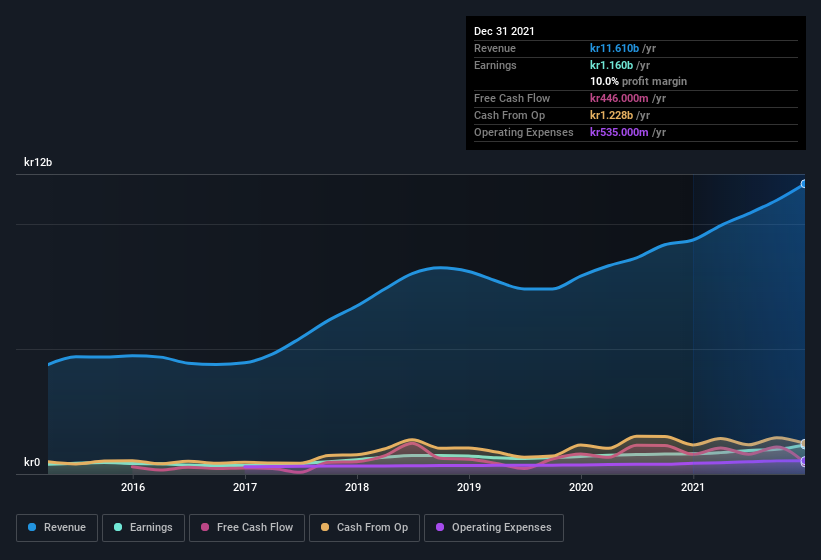

I like to take a look at earnings before interest and (EBIT) tax margins, as well as revenue growth, to get another take on the quality of the company's growth. Nolato maintained stable EBIT margins over the last year, all while growing revenue 24% to kr12b. That's progress.

You can take a look at the company's revenue and earnings growth trend, in the chart below. For finer detail, click on the image.

In investing, as in life, the future matters more than the past. So why not check out this free interactive visualization of Nolato's forecast profits?

Are Nolato Insiders Aligned With All Shareholders?

Like that fresh smell in the air when the rains are coming, insider buying fills me with optimistic anticipation. This view is based on the possibility that stock purchases signal bullishness on behalf of the buyer. However, insiders are sometimes wrong, and we don't know the exact thinking behind their acquisitions.

We do note that, in the last year, insiders sold -kr5.7m worth of shares. But that's far less than the kr42m insiders spend purchasing stock. This makes me even more interested in Nolato because it suggests that those who understand the company best, are optimistic. We also note that it was the Director, Lovisa Hamrin, who made the biggest single acquisition, paying kr27m for shares at about kr87.40 each.

Along with the insider buying, another encouraging sign for Nolato is that insiders, as a group, have a considerable shareholding. Indeed, they have a glittering mountain of wealth invested in it, currently valued at kr5.1b. Coming in at 21% of the business, that holding gives insiders a lot of influence, and plenty of reason to generate value for shareholders. Very encouraging.

While insiders already own a significant amount of shares, and they have been buying more, the good news for ordinary shareholders does not stop there. That's because on our analysis the CEO, Christer Wahlquist, is paid less than the median for similar sized companies. For companies with market capitalizations between kr19b and kr60b, like Nolato, the median CEO pay is around kr11m.

The Nolato CEO received kr9.0m in compensation for the year ending . That seems pretty reasonable, especially given its below the median for similar sized companies. CEO compensation is hardly the most important aspect of a company to consider, but when its reasonable that does give me a little more confidence that leadership are looking out for shareholder interests. It can also be a sign of a culture of integrity, in a broader sense.

Does Nolato Deserve A Spot On Your Watchlist?

As I already mentioned, Nolato is a growing business, which is what I like to see. Better yet, insiders are significant shareholders, and have been buying more shares. To me, that all makes it well worth a spot on your watchlist, as well as continuing research. It's still necessary to consider the ever-present spectre of investment risk. We've identified 2 warning signs with Nolato , and understanding these should be part of your investment process.

As a growth investor I do like to see insider buying. But Nolato isn't the only one. You can see a a free list of them here.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

Valuation is complex, but we're here to simplify it.

Discover if Nolato might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About OM:NOLA B

Nolato

Develops, manufactures, and sells plastic, silicone, and thermoplastic elastomer products for medical technology, pharmaceutical, consumer electronics, telecom, automotive, hygiene, and other industrial sectors in Sweden, Other Nordic countries, Asia, Rest of Europe, and North America, and internationally.

Excellent balance sheet with proven track record and pays a dividend.