Top Growth Companies With Strong Insider Ownership November 2024

Reviewed by Simply Wall St

As global markets approach record highs with broad-based gains, the recent drop in U.S. initial jobless claims and positive home sales reports have further fueled investor optimism despite ongoing geopolitical uncertainties. In this buoyant environment, stocks with strong insider ownership often signal confidence from those closest to the company, making them appealing candidates for growth-focused investors looking to align their interests with company insiders.

Top 10 Growth Companies With High Insider Ownership

| Name | Insider Ownership | Earnings Growth |

| Kirloskar Pneumatic (BSE:505283) | 30.3% | 26.3% |

| Seojin SystemLtd (KOSDAQ:A178320) | 31.1% | 43.2% |

| SKS Technologies Group (ASX:SKS) | 32.4% | 24.8% |

| Archean Chemical Industries (NSEI:ACI) | 22.9% | 41.3% |

| Laopu Gold (SEHK:6181) | 36.4% | 34% |

| Medley (TSE:4480) | 34% | 31.7% |

| Findi (ASX:FND) | 34.8% | 71.5% |

| Global Tax Free (KOSDAQ:A204620) | 19.9% | 78.4% |

| Plenti Group (ASX:PLT) | 12.8% | 120.1% |

| UTI (KOSDAQ:A179900) | 33.1% | 134.6% |

We're going to check out a few of the best picks from our screener tool.

NIBE Industrier (OM:NIBE B)

Simply Wall St Growth Rating: ★★★★☆☆

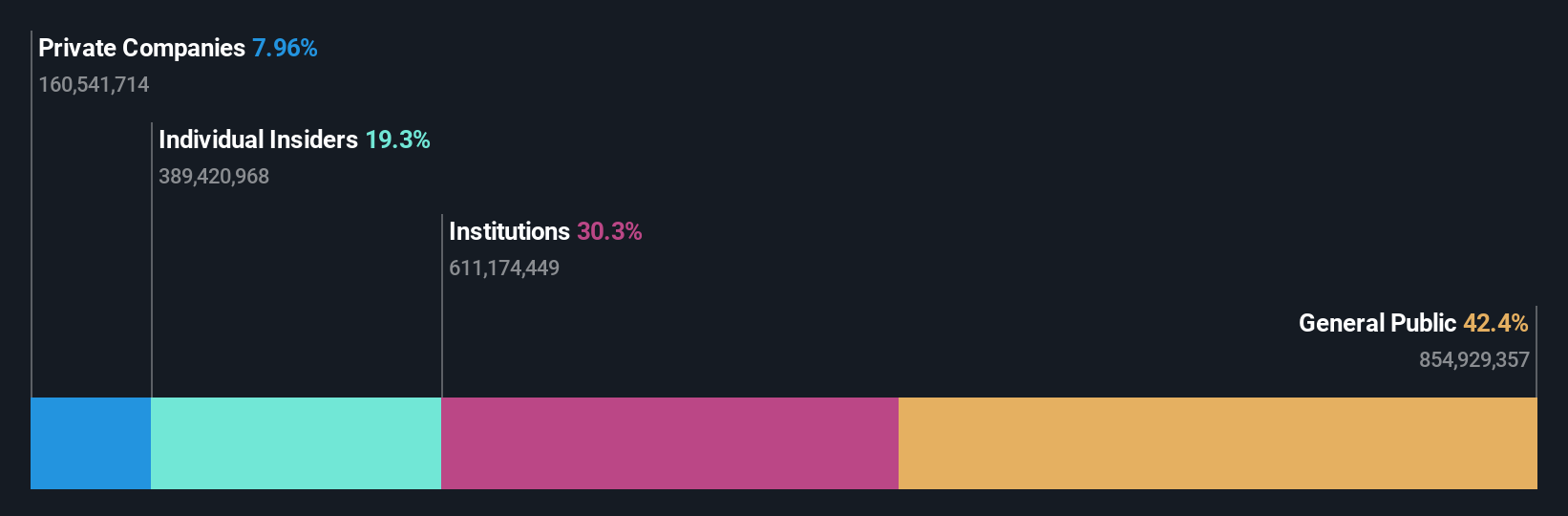

Overview: NIBE Industrier AB (publ) is a company that develops, manufactures, markets, and sells energy-efficient solutions for indoor climate comfort and intelligent heating and control across the Nordic countries, Europe, North America, and internationally with a market cap of approximately SEK98.02 billion.

Operations: The company's revenue segments are comprised of SEK5.08 billion from Stoves, SEK13.24 billion from Element, and SEK33.89 billion from Climate Solutions.

Insider Ownership: 20.2%

Earnings Growth Forecast: 56.0% p.a.

NIBE Industrier's earnings are projected to grow significantly at 56% annually, outpacing the Swedish market's 15% growth rate. However, recent financial results show a decline with third-quarter sales dropping to SEK 9.97 billion from SEK 11.51 billion and net income falling to SEK 434 million from SEK 1.22 billion year-over-year. Despite these challenges, no substantial insider trading activity was reported in the past three months, indicating stable insider confidence amidst fluctuating performance metrics.

- Click here and access our complete growth analysis report to understand the dynamics of NIBE Industrier.

- According our valuation report, there's an indication that NIBE Industrier's share price might be on the expensive side.

Beijing Fourth Paradigm Technology (SEHK:6682)

Simply Wall St Growth Rating: ★★★★☆☆

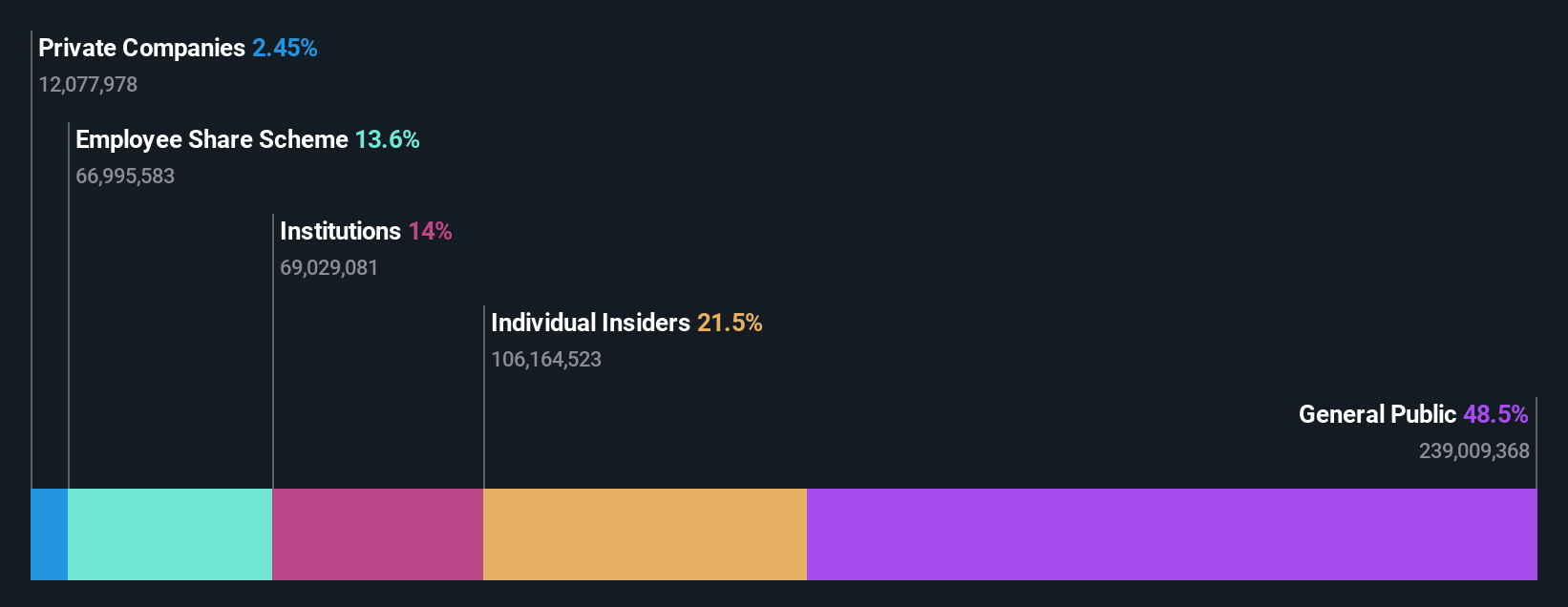

Overview: Beijing Fourth Paradigm Technology Co., Ltd. is an investment holding company that offers platform-centric artificial intelligence solutions in the People's Republic of China, with a market cap of HK$22.13 billion.

Operations: The company's revenue segments include CN¥3.00 billion from the Sage AI Platform, CN¥448.10 million from Sagegpt Aigs Services, and CN¥1.15 billion from Shift Intelligent Solutions.

Insider Ownership: 22.8%

Earnings Growth Forecast: 113.1% p.a.

Beijing Fourth Paradigm Technology is expected to achieve profitability within three years, with earnings projected to grow over 113% annually. Despite revenue growth forecasts of 19.3% per year, which surpass the Hong Kong market average, its return on equity is anticipated to be low at 2.4%. Recent inclusion in the S&P Global BMI Index and a new CFO appointment highlight strategic shifts. No significant insider trading activity has been reported recently.

- Click here to discover the nuances of Beijing Fourth Paradigm Technology with our detailed analytical future growth report.

- The analysis detailed in our Beijing Fourth Paradigm Technology valuation report hints at an inflated share price compared to its estimated value.

Offcn Education Technology (SZSE:002607)

Simply Wall St Growth Rating: ★★★★★★

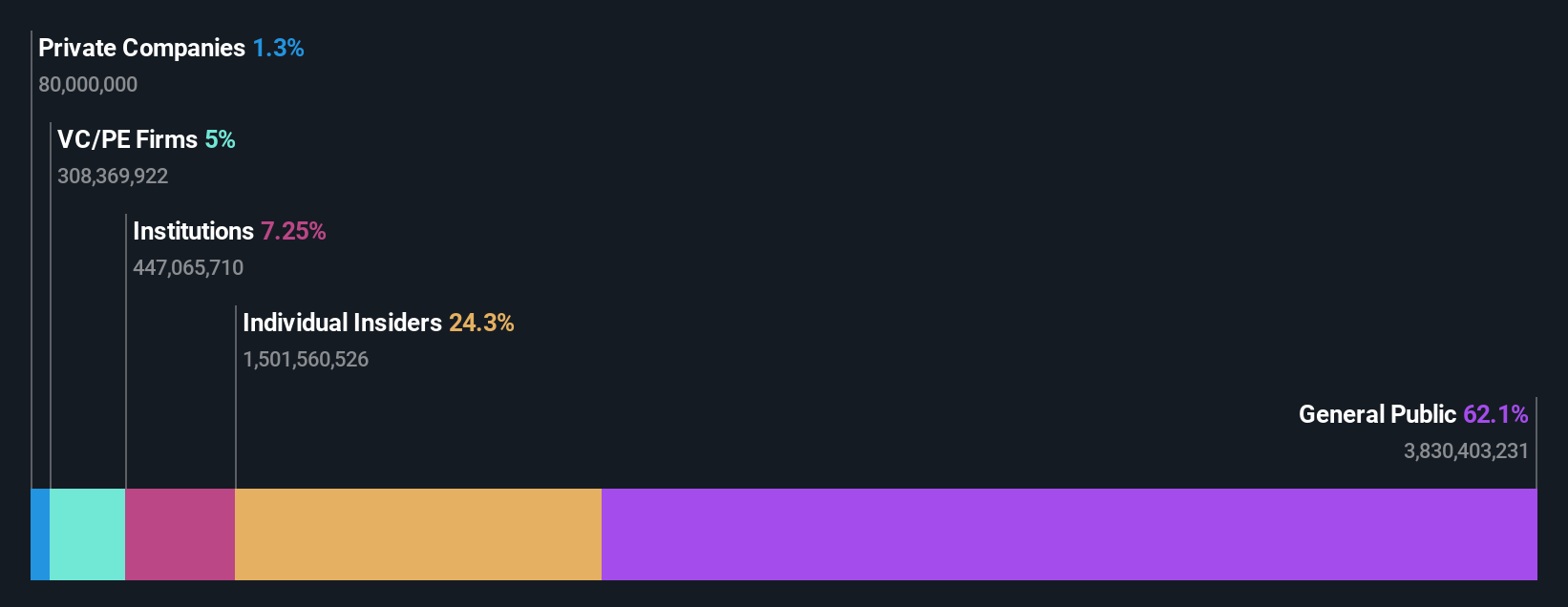

Overview: Offcn Education Technology Co., Ltd. operates as a multi-category vocational education institution in China with a market cap of CN¥20.23 billion.

Operations: Offcn Education Technology Co., Ltd. generates revenue through its diverse vocational education offerings in China.

Insider Ownership: 25.1%

Earnings Growth Forecast: 92.1% p.a.

Offcn Education Technology's earnings are forecast to grow 92.07% annually, with revenue expected to increase by 27.7% per year, outpacing the Chinese market average of 13.8%. Despite high volatility in its share price recently, the company is anticipated to become profitable within three years and achieve a return on equity of 39.6%. Recent nine-month results showed a decline in sales and net income compared to last year, indicating challenges despite growth prospects.

- Dive into the specifics of Offcn Education Technology here with our thorough growth forecast report.

- Our valuation report here indicates Offcn Education Technology may be overvalued.

Next Steps

- Click through to start exploring the rest of the 1527 Fast Growing Companies With High Insider Ownership now.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Valuation is complex, but we're here to simplify it.

Discover if Beijing Fourth Paradigm Technology might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:6682

Beijing Fourth Paradigm Technology

An investment holding company, provides platform-centric artificial intelligence (AI) solutions in the People's Republic of China.

Excellent balance sheet with reasonable growth potential.