- Hong Kong

- /

- Capital Markets

- /

- SEHK:1282

Jumbo Group And 2 Other Penny Stocks To Consider

Reviewed by Simply Wall St

As global markets experience mixed movements, with U.S. consumer confidence declining and major stock indexes showing moderate gains, investors are exploring diverse opportunities. Penny stocks, though often seen as a relic of past market eras, remain relevant for those seeking value in smaller or newer companies that might offer unique growth potential. This article will explore three penny stocks that stand out for their financial strength and resilience in today's market landscape.

Top 10 Penny Stocks

| Name | Share Price | Market Cap | Financial Health Rating |

| DXN Holdings Bhd (KLSE:DXN) | MYR0.515 | MYR2.56B | ★★★★★★ |

| Embark Early Education (ASX:EVO) | A$0.765 | A$140.36M | ★★★★☆☆ |

| Hil Industries Berhad (KLSE:HIL) | MYR0.895 | MYR297.09M | ★★★★★★ |

| MGB Berhad (KLSE:MGB) | MYR0.73 | MYR431.91M | ★★★★★★ |

| ME Group International (LSE:MEGP) | £2.05 | £772.37M | ★★★★★★ |

| Bosideng International Holdings (SEHK:3998) | HK$3.88 | HK$42.73B | ★★★★★★ |

| Datasonic Group Berhad (KLSE:DSONIC) | MYR0.41 | MYR1.14B | ★★★★★★ |

| Begbies Traynor Group (AIM:BEG) | £0.948 | £149.54M | ★★★★★★ |

| Lever Style (SEHK:1346) | HK$0.86 | HK$545.92M | ★★★★★★ |

| Secure Trust Bank (LSE:STB) | £3.62 | £69.04M | ★★★★☆☆ |

Click here to see the full list of 5,813 stocks from our Penny Stocks screener.

Underneath we present a selection of stocks filtered out by our screen.

Jumbo Group (Catalist:42R)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Jumbo Group Limited is an investment holding company that operates and manages a network of restaurants in Singapore, the People's Republic of China, and Taiwan, with a market cap of SGD165.61 million.

Operations: The company generates SGD190.42 million in revenue from its restaurant business.

Market Cap: SGD165.61M

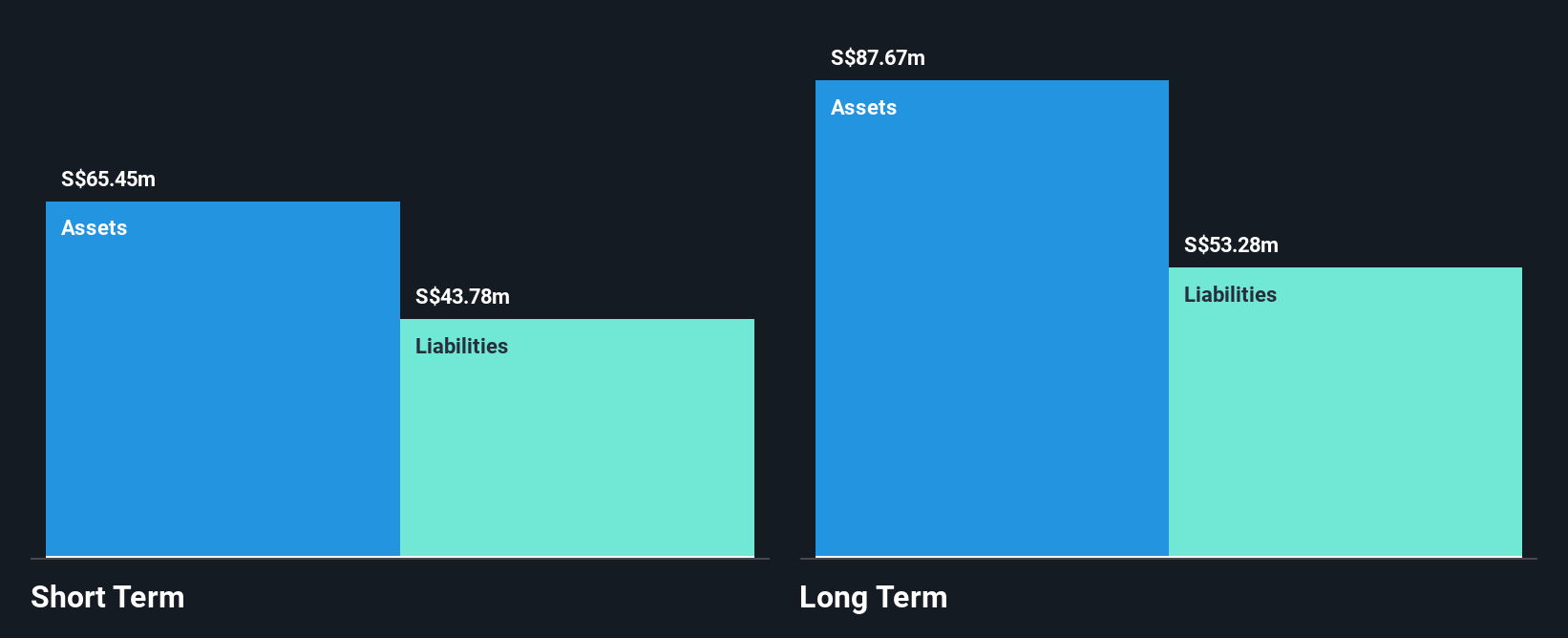

Jumbo Group Limited, with a market cap of SGD165.61 million, operates in the restaurant sector across Singapore and other regions. The company has demonstrated financial stability with short-term assets exceeding both short and long-term liabilities and cash reserves surpassing total debt. Despite a high return on equity at 23.2%, Jumbo's earnings growth was negative last year, contrasting its significant profit growth over the past five years. Recent developments include appointing Dr Tan Khee Giap as an independent director, while dividends have decreased from 1 cent to 0.5 cent per share amid stable earnings but slightly reduced net income year-on-year.

- Unlock comprehensive insights into our analysis of Jumbo Group stock in this financial health report.

- Learn about Jumbo Group's historical performance here.

Renze Harvest International (SEHK:1282)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Renze Harvest International Limited, with a market cap of HK$302.84 million, operates as an investment holding company involved in manufacturing technology, industrial parks, financial services, and industrial investment activities in China.

Operations: The company's revenue is derived from Automation (HK$456.96 million), Financial Services (HK$34.63 million), and Property Investment and Development (HK$337.04 million).

Market Cap: HK$302.84M

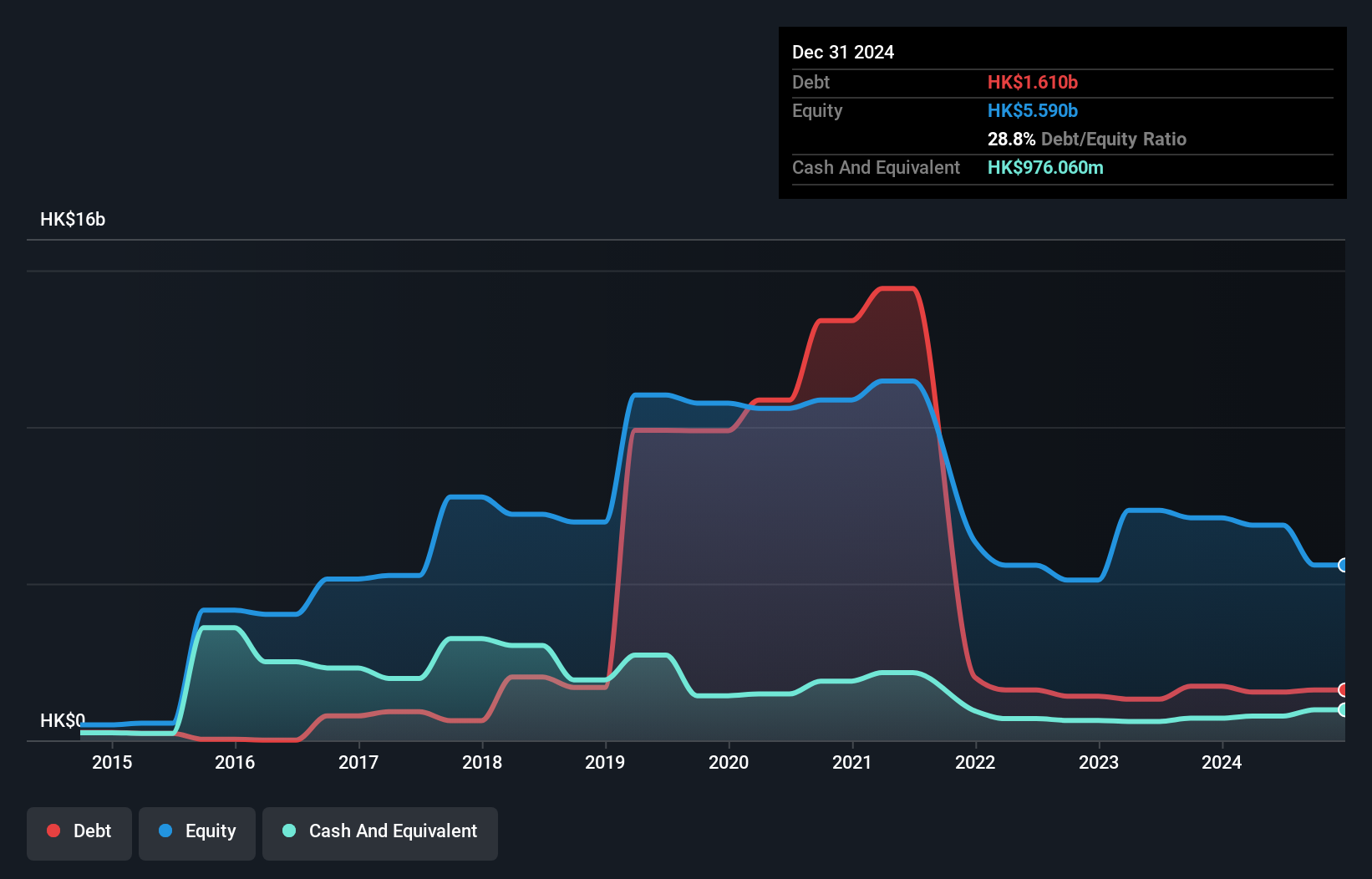

Renze Harvest International Limited, with a market cap of HK$302.84 million, faces challenges as it remains unprofitable with declining earnings over the past five years. The company has experienced significant executive changes, including the resignation of its CEO and chairman, which may impact strategic direction. Despite these hurdles, Renze Harvest maintains a strong balance sheet with short-term assets of HK$5.2 billion surpassing both short and long-term liabilities. While its debt to equity ratio has improved significantly to 22.4%, negative operating cash flow indicates potential difficulties in covering debt obligations without additional financing or revenue growth initiatives.

- Get an in-depth perspective on Renze Harvest International's performance by reading our balance sheet health report here.

- Understand Renze Harvest International's track record by examining our performance history report.

Madison Holdings Group (SEHK:8057)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Madison Holdings Group Limited is an investment holding company that focuses on the retail and wholesale of wine products and other alcoholic beverages in the People's Republic of China and Hong Kong, with a market cap of HK$99.70 million.

Operations: The company's revenue is primarily derived from its Loan Financing Services, amounting to HK$48.85 million, and the Sales of Alcoholic Beverages, totaling HK$19.00 million.

Market Cap: HK$99.7M

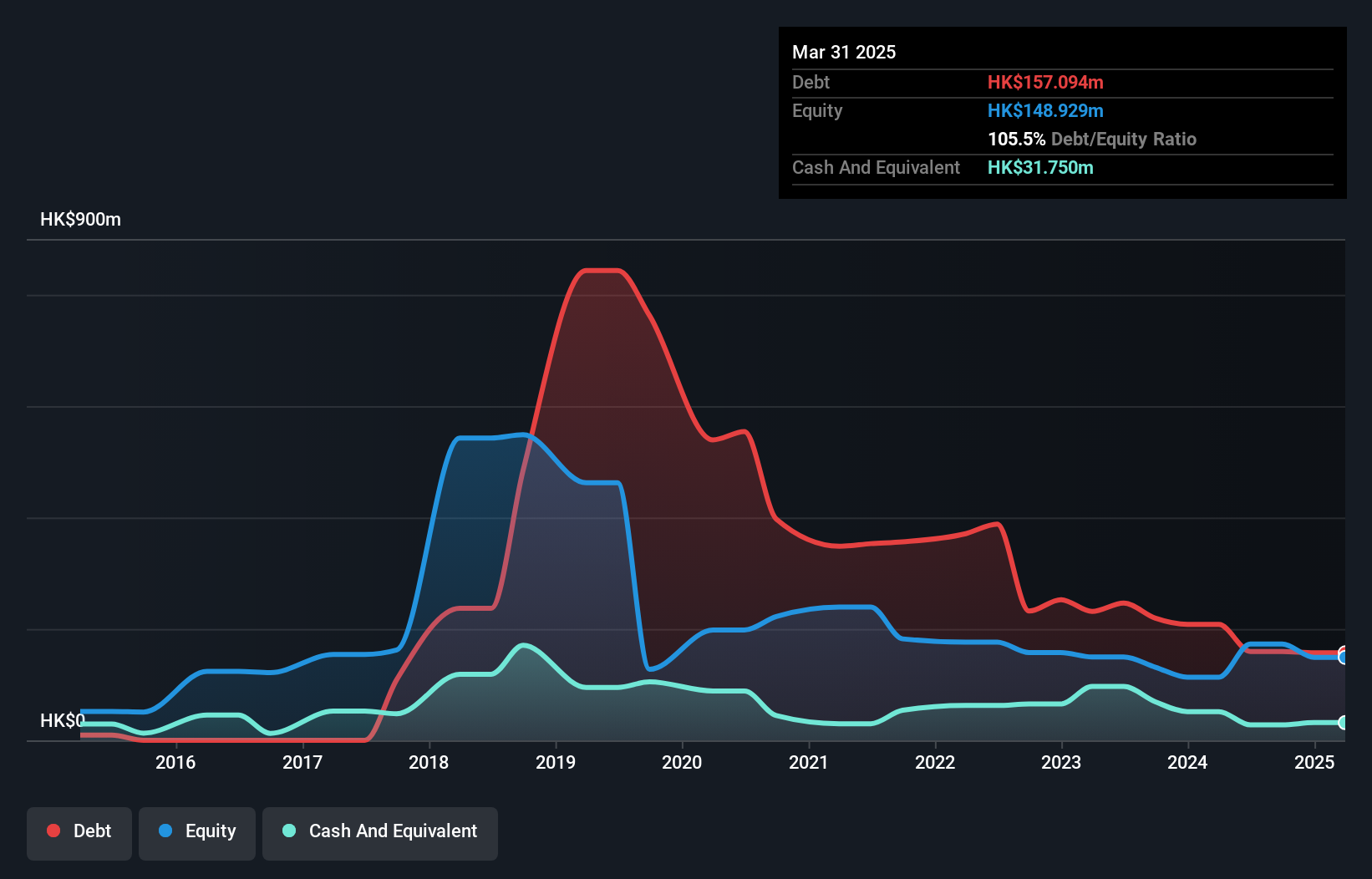

Madison Holdings Group, with a market cap of HK$99.70 million, faces financial challenges as it remains unprofitable and reported a net loss of HK$6.89 million for the recent half-year period. Despite this, the company has reduced its debt to equity ratio significantly over five years and maintains a strong cash runway exceeding three years due to positive free cash flow. Short-term assets of HK$322.8 million comfortably cover both short and long-term liabilities, though management's inexperience may pose strategic risks as they navigate fluctuating earnings primarily driven by loan financing services and alcoholic beverage sales.

- Click to explore a detailed breakdown of our findings in Madison Holdings Group's financial health report.

- Explore historical data to track Madison Holdings Group's performance over time in our past results report.

Where To Now?

- Discover the full array of 5,813 Penny Stocks right here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:1282

Renze Harvest International

An investment holding company, engages in manufacturing technology, industrial parks, financial services, and industrial investment activities in China.

Adequate balance sheet with low risk.

Market Insights

Community Narratives

Recently Updated Narratives

Astor Enerji will surge with a fair value of $140.43 in the next 3 years

Proximus: The State-Backed Backup Plan with 7% Gross Yield and 15% Currency Upside.

A case for for IMPACT Silver Corp (TSXV:IPT) to reach USD $4.52 (CAD $6.16) in 2026 (23 bagger in 1 year) and USD $5.76 (CAD $7.89) by 2030

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.