- Netherlands

- /

- Capital Markets

- /

- ENXTAM:CVC

3 Insider-Favored Growth Companies To Consider

Reviewed by Simply Wall St

As global markets continue to rise, buoyed by optimism surrounding potential trade deals and advancements in artificial intelligence, growth stocks have notably outperformed their value counterparts. In this environment of heightened investor enthusiasm, companies with high insider ownership can be particularly appealing as they often signal confidence from those closest to the business.

Top 10 Growth Companies With High Insider Ownership

| Name | Insider Ownership | Earnings Growth |

| Kirloskar Pneumatic (BSE:505283) | 30.3% | 26.3% |

| Archean Chemical Industries (NSEI:ACI) | 22.9% | 41.2% |

| Laopu Gold (SEHK:6181) | 36.4% | 36.6% |

| Waystream Holding (OM:WAYS) | 11.3% | 113.3% |

| Medley (TSE:4480) | 34.1% | 27.3% |

| Brightstar Resources (ASX:BTR) | 16.2% | 84.1% |

| Fine M-TecLTD (KOSDAQ:A441270) | 17.2% | 135% |

| Fulin Precision (SZSE:300432) | 13.6% | 71% |

| HANA Micron (KOSDAQ:A067310) | 18.2% | 119.4% |

| Elliptic Laboratories (OB:ELABS) | 26.8% | 121.1% |

Below we spotlight a couple of our favorites from our exclusive screener.

CVC Capital Partners (ENXTAM:CVC)

Simply Wall St Growth Rating: ★★★★★☆

Overview: CVC Capital Partners plc is a private equity and venture capital firm focusing on various investment strategies including middle market secondaries, infrastructure, credit, and management buyouts, with a market cap of €22.86 billion.

Operations: CVC Capital Partners plc operates through diverse revenue segments, focusing on middle market secondaries, infrastructure investments, credit solutions, management and leveraged buyouts, growth equity initiatives, mature company investments, recapitalizations, strip sales, and spinouts.

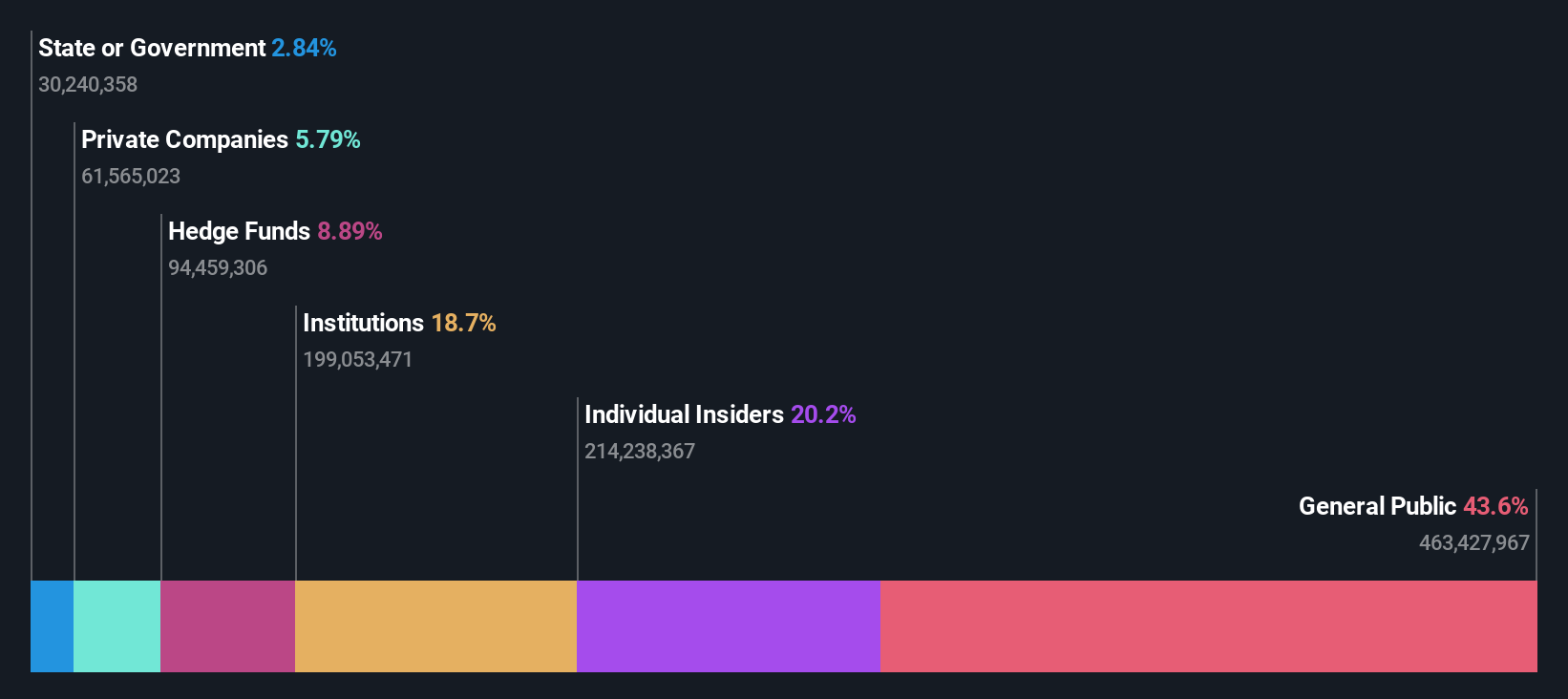

Insider Ownership: 20.2%

CVC Capital Partners is positioned for significant earnings growth, forecasted at 32.9% annually, outpacing the Dutch market. Despite high debt levels, its return on equity is expected to be very high in three years. Trading below estimated fair value suggests potential upside. Recent M&A discussions include acquiring Vivendi's stake in Telecom Italia and selling its stake in HealthCare Global Enterprises to KKR, highlighting strategic repositioning efforts and potential future growth opportunities.

- Dive into the specifics of CVC Capital Partners here with our thorough growth forecast report.

- The valuation report we've compiled suggests that CVC Capital Partners' current price could be inflated.

NIBE Industrier (OM:NIBE B)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: NIBE Industrier AB (publ) develops, manufactures, markets, and sells energy-efficient solutions for indoor climate comfort and intelligent heating and control components internationally, with a market cap of SEK89.19 billion.

Operations: The company generates revenue from its segments as follows: SEK5.08 billion from Stoves, SEK13.24 billion from Element, and SEK33.89 billion from Climate Solutions.

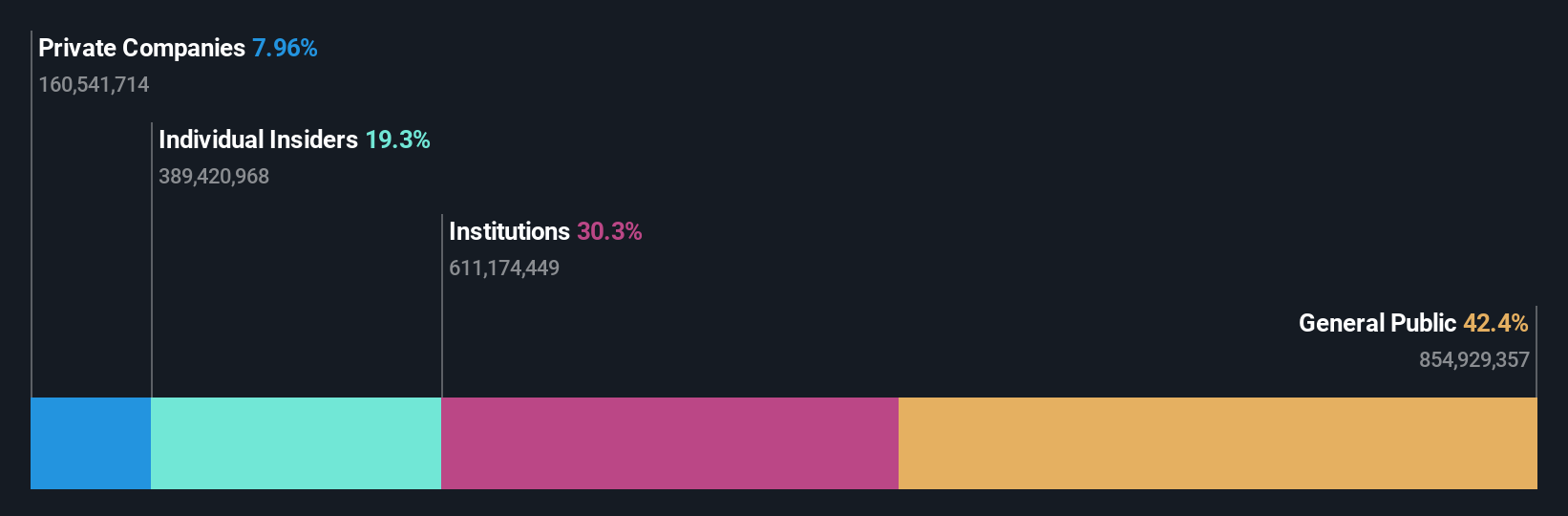

Insider Ownership: 20.2%

NIBE Industrier is poised for substantial earnings growth, forecasted at 58.6% annually, surpassing the Swedish market. Despite a decline in profit margins to 1.9% and interest payments not being well covered by earnings, its revenue is expected to grow faster than the market at 7.1% per year. Trading at 16.6% below estimated fair value indicates potential upside, although recent financial results show decreased sales and net income compared to the previous year.

- Unlock comprehensive insights into our analysis of NIBE Industrier stock in this growth report.

- Our valuation report here indicates NIBE Industrier may be overvalued.

Truecaller (OM:TRUE B)

Simply Wall St Growth Rating: ★★★★★★

Overview: Truecaller AB (publ) develops and publishes mobile caller ID applications for individuals and businesses across India, the Middle East, Africa, and internationally, with a market cap of SEK22.61 billion.

Operations: The company generates revenue from its communications software segment, amounting to SEK1.78 billion.

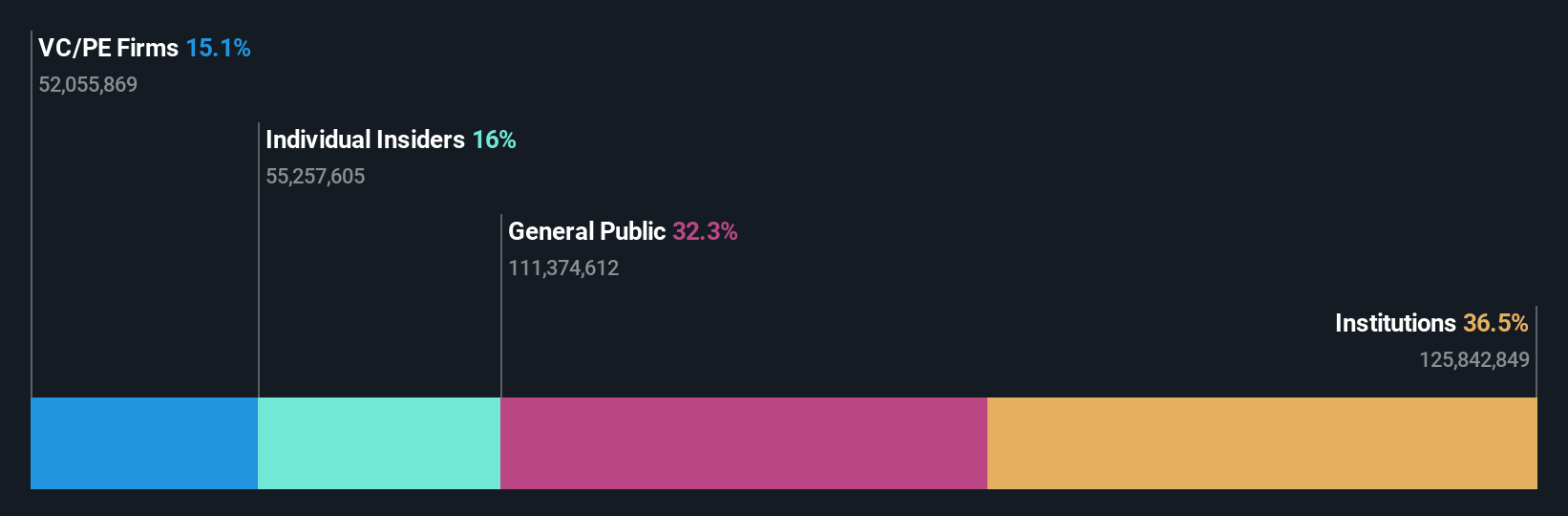

Insider Ownership: 29.7%

Truecaller is positioned for significant growth, with earnings expected to increase by 25.8% annually, outpacing the Swedish market. Recent product updates for iOS users could enhance subscription revenue, leveraging new AI and caller ID capabilities. Insider activity shows more shares bought than sold recently, indicating confidence in future prospects. The company trades at a substantial discount to its estimated fair value, suggesting potential upside despite no substantial insider buying in recent months.

- Click here to discover the nuances of Truecaller with our detailed analytical future growth report.

- According our valuation report, there's an indication that Truecaller's share price might be on the cheaper side.

Make It Happen

- Click here to access our complete index of 1470 Fast Growing Companies With High Insider Ownership.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTAM:CVC

CVC Capital Partners

A private equity and venture capital firm specializing in middle market secondaries, infrastructure and credit, management buyouts, leveraged buyouts, growth equity, mature, recapitalizations, strip sales, and spinouts.

High growth potential slight.

Similar Companies

Market Insights

Community Narratives