- Sweden

- /

- Aerospace & Defense

- /

- OM:MILDEF

Why Did MilDef Group (OM:MILDEF) Climb After Strong Q3 Earnings and a Major Facility Expansion?

Reviewed by Sasha Jovanovic

- MilDef Group AB recently reported third quarter 2025 earnings, showing sales of SEK 539.7 million and net income of SEK 45.4 million, both up significantly from a year ago, and simultaneously announced the opening of its new purpose-built production facility, Bastionen, in Rosersberg to serve increasing defense sector demand.

- This expansion quadruples MilDef's integration capacity, positioning the company to meet rising requirements for advanced defense solutions as Sweden upgrades its defense capabilities and aligns further with NATO standards.

- We'll examine how MilDef's earnings growth and the new Bastionen facility affect the company's investment narrative and capacity outlook.

The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

MilDef Group Investment Narrative Recap

To be a shareholder in MilDef Group right now, you would need to believe that the company can continue converting its large order backlog and recent defense sector tailwinds into consistent revenue growth, while successfully scaling up its operations to handle more complex integrations. The recent earnings jump and the Bastionen facility launch boost MilDef’s capacity and seem to address short-term concerns about meeting demand, but execution risk in managing rapid expansion and maintaining earnings visibility remains the biggest watchpoint for investors.

The announcement of MilDef’s new Rosersberg facility is highly relevant to current investor catalysts, as it directly targets the company's ability to meet high defense sector demand and process record orders more efficiently. This quadrupling of integration capacity should enhance delivery reliability and supports the narrative around top-line growth, though it also raises the stakes for managing operational scale and avoiding project delays as volumes increase.

By contrast, investors should be aware that as MilDef accelerates growth and increases production, the risk of operational missteps and cost overruns...

Read the full narrative on MilDef Group (it's free!)

MilDef Group's narrative projects SEK4.2 billion revenue and SEK707.6 million earnings by 2028. This requires 44.9% yearly revenue growth and a SEK930.7 million increase in earnings from SEK -223.1 million today.

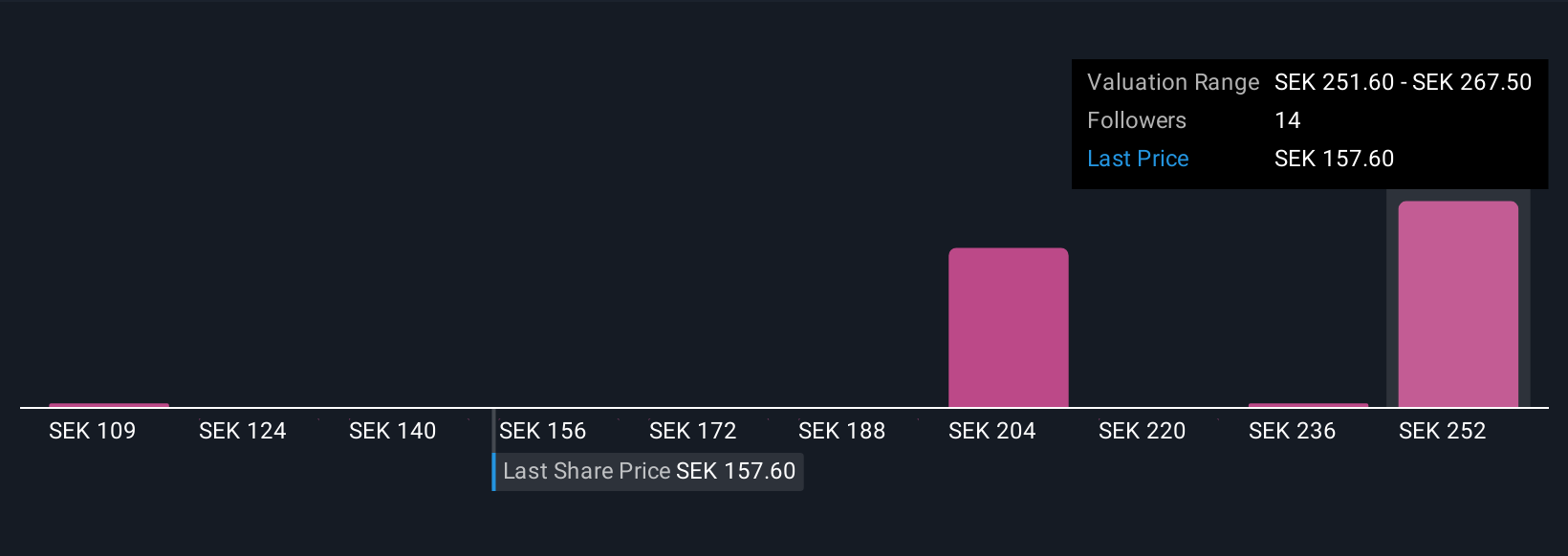

Uncover how MilDef Group's forecasts yield a SEK267.50 fair value, a 68% upside to its current price.

Exploring Other Perspectives

Five members of the Simply Wall St Community offered fair value estimates for MilDef, ranging from SEK108.5 to SEK267.5. As you explore these differing viewpoints, consider how the company's ability to deliver on its growing order book could affect future performance.

Explore 5 other fair value estimates on MilDef Group - why the stock might be worth 32% less than the current price!

Build Your Own MilDef Group Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your MilDef Group research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free MilDef Group research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate MilDef Group's overall financial health at a glance.

Looking For Alternative Opportunities?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- The latest GPUs need a type of rare earth metal called Dysprosium and there are only 35 companies in the world exploring or producing it. Find the list for free.

- We've found 21 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:MILDEF

MilDef Group

Develops, manufactures, and sells rugged IT solutions in Sweden, Norway, Finland, Denmark, the United Kingdom, Germany, Switzerland, the United States, Australia, and internationally.

Exceptional growth potential and undervalued.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Butler National (Buks) outperforms.

A tech powerhouse quietly powering the world’s AI infrastructure.

Keppel DC REIT (SGX: AJBU) is a resilient gem in the data center space.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)