It's only natural that many investors, especially those who are new to the game, prefer to buy shares in 'sexy' stocks with a good story, even if those businesses lose money. And in their study titled Who Falls Prey to the Wolf of Wall Street?' Leuz et. al. found that it is 'quite common' for investors to lose money by buying into 'pump and dump' schemes.

In contrast to all that, I prefer to spend time on companies like Lifco (STO:LIFCO B), which has not only revenues, but also profits. While profit is not necessarily a social good, it's easy to admire a business that can consistently produce it. In comparison, loss making companies act like a sponge for capital - but unlike such a sponge they do not always produce something when squeezed.

See our latest analysis for Lifco

How Quickly Is Lifco Increasing Earnings Per Share?

The market is a voting machine in the short term, but a weighing machine in the long term, so share price follows earnings per share (EPS) eventually. That makes EPS growth an attractive quality for any company. As a tree reaches steadily for the sky, Lifco's EPS has grown 20% each year, compound, over three years. So it's not surprising to see the company trades on a very high multiple of (past) earnings.

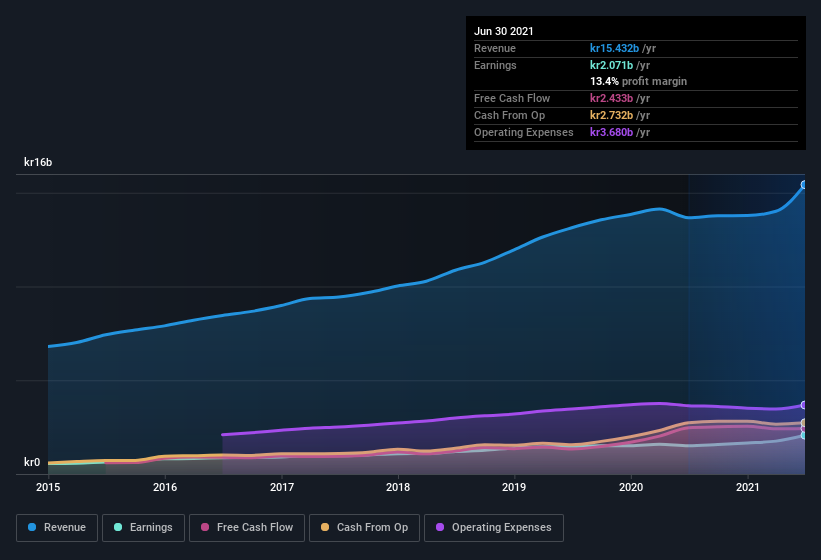

I like to take a look at earnings before interest and (EBIT) tax margins, as well as revenue growth, to get another take on the quality of the company's growth. Lifco shareholders can take confidence from the fact that EBIT margins are up from 15% to 19%, and revenue is growing. That's great to see, on both counts.

The chart below shows how the company's bottom and top lines have progressed over time. To see the actual numbers, click on the chart.

Fortunately, we've got access to analyst forecasts of Lifco's future profits. You can do your own forecasts without looking, or you can take a peek at what the professionals are predicting.

Are Lifco Insiders Aligned With All Shareholders?

Like the kids in the streets standing up for their beliefs, insider share purchases give me reason to believe in a brighter future. This view is based on the possibility that stock purchases signal bullishness on behalf of the buyer. However, insiders are sometimes wrong, and we don't know the exact thinking behind their acquisitions.

It's a pleasure to note that insiders spent kr68m buying Lifco shares, over the last year, without reporting any share sales whatsoever. As if for a flower bud approaching bloom, I become an expectant observer, anticipating with hope, that something splendid is coming. Zooming in, we can see that the biggest insider purchase was by Independent Chairman of the Board Carl Bennet for kr57m worth of shares, at about kr186 per share.

And the insider buying isn't the only sign of alignment between shareholders and the board, since Lifco insiders own more than a third of the company. Indeed, with a collective holding of 51%, company insiders are in control and have plenty of capital behind the venture. This makes me think they will be incentivised to plan for the long term - something I like to see. At the current share price, that insider holding is worth a whopping kr53b. That means they have plenty of their own capital riding on the performance of the business!

Is Lifco Worth Keeping An Eye On?

Given my belief that share price follows earnings per share you can easily imagine how I feel about Lifco's strong EPS growth. On top of that, insiders own a significant stake in the company and have been buying more shares. So I do think this is one stock worth watching. Even so, be aware that Lifco is showing 1 warning sign in our investment analysis , you should know about...

The good news is that Lifco is not the only growth stock with insider buying. Here's a list of them... with insider buying in the last three months!

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About OM:LIFCO B

Lifco

Engages in the dental, demolition and tools, and systems solutions businesses in Sweden, Norway, Germany, rest of Europe, the United Kingdom, Asia, Australia, Italy, North America, and internationally.

Excellent balance sheet with acceptable track record.

Similar Companies

Market Insights

Community Narratives