- Poland

- /

- Commercial Services

- /

- WSE:MBR

3 European Stocks Estimated To Be 34.8% Below Intrinsic Value

Reviewed by Simply Wall St

As European markets recently faced a downturn, with the pan-European STOXX Europe 600 Index ending 1.10% lower amid political turmoil in France and international trade tensions, investors are increasingly seeking opportunities to capitalize on undervalued stocks. In this environment of uncertainty, identifying stocks trading below their intrinsic value can offer potential for growth when market conditions stabilize and economic policies begin to take effect.

Top 10 Undervalued Stocks Based On Cash Flows In Europe

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Vimi Fasteners (BIT:VIM) | €1.18 | €2.32 | 49.2% |

| Spindox (BIT:SPN) | €12.75 | €24.84 | 48.7% |

| Profoto Holding (OM:PRFO) | SEK17.85 | SEK35.19 | 49.3% |

| Micro Systemation (OM:MSAB B) | SEK63.00 | SEK122.92 | 48.7% |

| Lingotes Especiales (BME:LGT) | €5.70 | €11.29 | 49.5% |

| Kitron (OB:KIT) | NOK58.65 | NOK117.03 | 49.9% |

| High Quality Food (BIT:HQF) | €0.604 | €1.21 | 49.9% |

| Atea (OB:ATEA) | NOK143.80 | NOK282.84 | 49.2% |

| Allegro.eu (WSE:ALE) | PLN33.20 | PLN66.10 | 49.8% |

| Aker BioMarine (OB:AKBM) | NOK87.40 | NOK170.77 | 48.8% |

Let's dive into some prime choices out of the screener.

Elopak (OB:ELO)

Overview: Elopak ASA manufactures and supplies paper-based packaging solutions for liquid food globally, with a market cap of NOK12.14 billion.

Operations: Elopak's revenue is primarily derived from its operations in EMEA, generating €873.46 million, and the Americas, contributing €335.36 million.

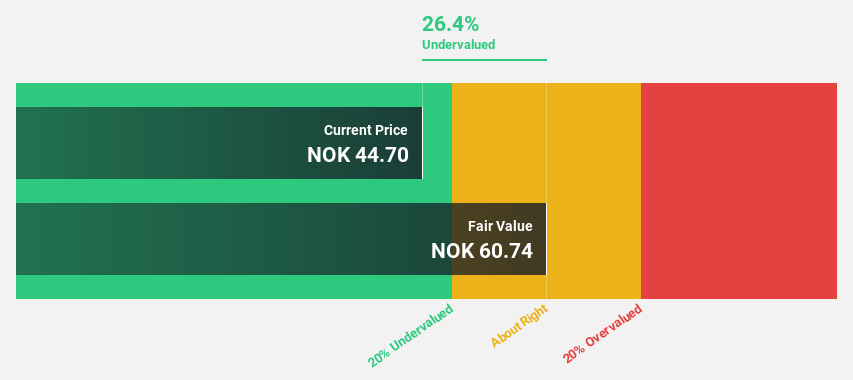

Estimated Discount To Fair Value: 34.8%

Elopak is trading at a significant discount, approximately 34.8% below its estimated fair value of NOK69.33, with a current price of NOK45.2. Despite lower profit margins compared to last year and high debt levels, Elopak's earnings are expected to grow at 17.2% annually, outperforming the Norwegian market's 13.4%. Recent inclusion in the S&P Global BMI Index and ongoing share repurchase initiatives highlight strategic moves that could enhance shareholder value despite cash flow challenges affecting dividend sustainability.

- The growth report we've compiled suggests that Elopak's future prospects could be on the up.

- Navigate through the intricacies of Elopak with our comprehensive financial health report here.

Invisio (OM:IVSO)

Overview: Invisio AB (publ) develops and sells communication and hearing protection systems for defense, law enforcement, and security professionals globally, with a market cap of SEK14.18 billion.

Operations: Invisio generates revenue primarily from its Aerospace & Defense segment, which accounted for SEK1.71 billion.

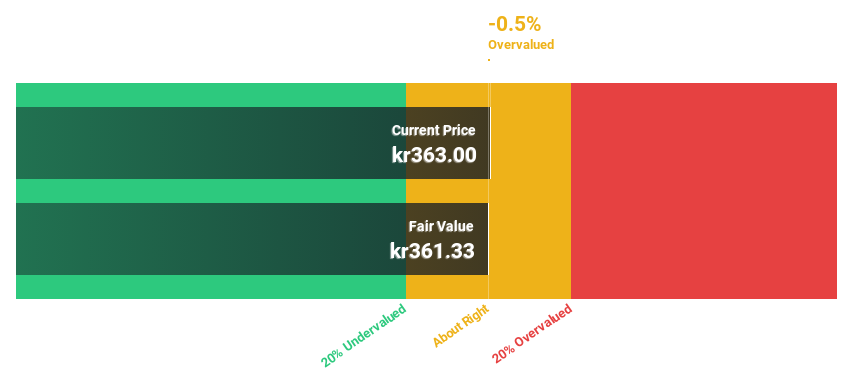

Estimated Discount To Fair Value: 9.1%

Invisio is trading at SEK307, slightly below its estimated fair value of SEK345.28. Despite recent earnings declines, Invisio's anticipated annual profit growth of 32.1% outpaces the Swedish market average of 16.4%. The company secured a significant SEK930 million agreement with the US Coast Guard and launched the versatile T30 headset, enhancing tactical communication capabilities. These developments position Invisio for robust revenue growth projected at 16.1% annually, supporting its valuation based on cash flows.

- Our comprehensive growth report raises the possibility that Invisio is poised for substantial financial growth.

- Take a closer look at Invisio's balance sheet health here in our report.

Mo-BRUK (WSE:MBR)

Overview: Mo-BRUK S.A. is involved in processing industrial, hazardous, and municipal waste across several European countries with a market capitalization of PLN1.06 billion.

Operations: The company's revenue is primarily derived from Waste Management, which accounts for PLN265.88 million, and Fuel Stations, contributing PLN24.92 million.

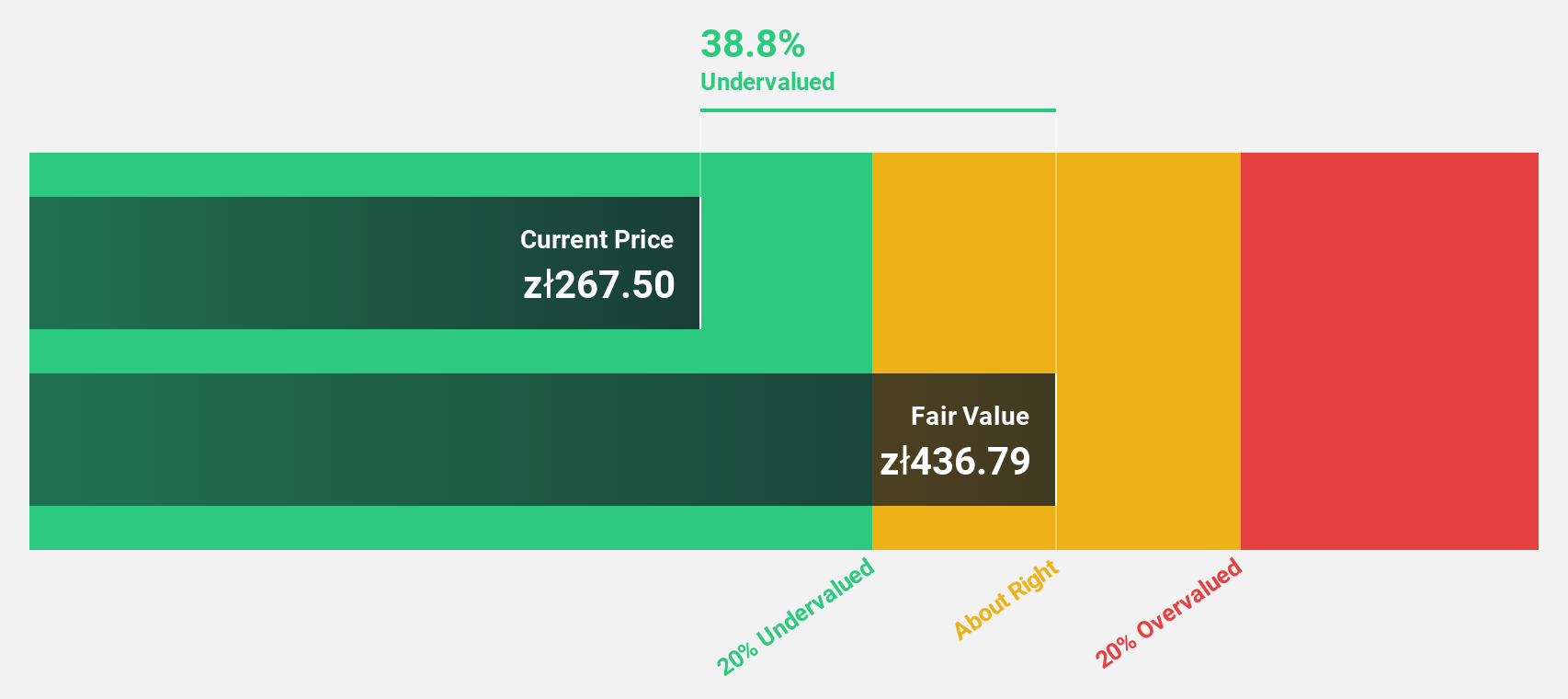

Estimated Discount To Fair Value: 48.4%

Mo-BRUK is trading at PLN301, significantly below its estimated fair value of PLN583.85, presenting an opportunity based on cash flows. Despite a decline in net income to PLN26.4 million for the first half of 2025, earnings are forecast to grow annually by 18%, outpacing the Polish market average. Revenue growth is projected at 6.8% per year, surpassing the market's 4.2%. However, its dividend yield of 4.38% isn't well covered by free cash flows.

- Our expertly prepared growth report on Mo-BRUK implies its future financial outlook may be stronger than recent results.

- Unlock comprehensive insights into our analysis of Mo-BRUK stock in this financial health report.

Taking Advantage

- Unlock more gems! Our Undervalued European Stocks Based On Cash Flows screener has unearthed 209 more companies for you to explore.Click here to unveil our expertly curated list of 212 Undervalued European Stocks Based On Cash Flows.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About WSE:MBR

Mo-BRUK

Processes industrial, hazardous, and municipal waste in Poland, Germany, Italy, Slovenia, Denmark, Romania, and Lithuania.

Reasonable growth potential with adequate balance sheet.

Market Insights

Community Narratives