Here's Why I Think Inwido (STO:INWI) Might Deserve Your Attention Today

Some have more dollars than sense, they say, so even companies that have no revenue, no profit, and a record of falling short, can easily find investors. But as Warren Buffett has mused, 'If you've been playing poker for half an hour and you still don't know who the patsy is, you're the patsy.' When they buy such story stocks, investors are all too often the patsy.

In contrast to all that, I prefer to spend time on companies like Inwido (STO:INWI), which has not only revenues, but also profits. Now, I'm not saying that the stock is necessarily undervalued today; but I can't shake an appreciation for the profitability of the business itself. While a well funded company may sustain losses for years, unless its owners have an endless appetite for subsidizing the customer, it will need to generate a profit eventually, or else breathe its last breath.

Check out our latest analysis for Inwido

Inwido's Earnings Per Share Are Growing.

As one of my mentors once told me, share price follows earnings per share (EPS). That makes EPS growth an attractive quality for any company. Impressively, Inwido has grown EPS by 30% per year, compound, in the last three years. As a general rule, we'd say that if a company can keep up that sort of growth, shareholders will be smiling.

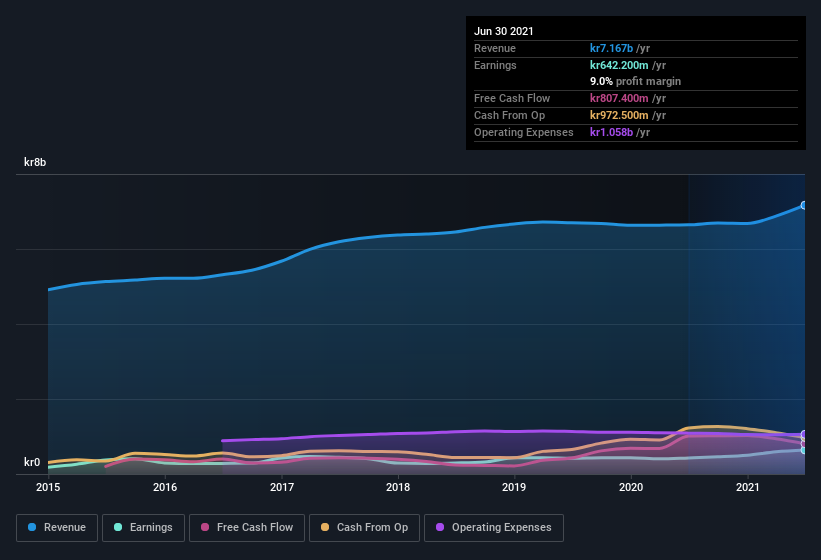

I like to take a look at earnings before interest and (EBIT) tax margins, as well as revenue growth, to get another take on the quality of the company's growth. Inwido shareholders can take confidence from the fact that EBIT margins are up from 9.4% to 12%, and revenue is growing. Ticking those two boxes is a good sign of growth, in my book.

The chart below shows how the company's bottom and top lines have progressed over time. For finer detail, click on the image.

While we live in the present moment at all times, there's no doubt in my mind that the future matters more than the past. So why not check this interactive chart depicting future EPS estimates, for Inwido?

Are Inwido Insiders Aligned With All Shareholders?

Like standing at the lookout, surveying the horizon at sunrise, insider buying, for some investors, sparks joy. That's because insider buying often indicates that those closest to the company have confidence that the share price will perform well. However, insiders are sometimes wrong, and we don't know the exact thinking behind their acquisitions.

We note that Inwido insiders spent kr630k on stock, over the last year; in contrast, we didn't see any selling. That puts the company in a nice light, as it makes me think its leaders are feeling confident.

Is Inwido Worth Keeping An Eye On?

For growth investors like me, Inwido's raw rate of earnings growth is a beacon in the night. The growth rate whets my appetite for research, and the insider buying only increases my interest in the stock. So on this analysis I believe Inwido is probably worth spending some time on. Still, you should learn about the 2 warning signs we've spotted with Inwido .

There are plenty of other companies that have insiders buying up shares. So if you like the sound of Inwido, you'll probably love this free list of growing companies that insiders are buying.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About OM:INWI

Inwido

Through its subsidiaries, engages in development, manufacture, and sale of windows and doors.

Flawless balance sheet, good value and pays a dividend.

Market Insights

Community Narratives