Many Still Looking Away From Husqvarna AB (publ) (STO:HUSQ B)

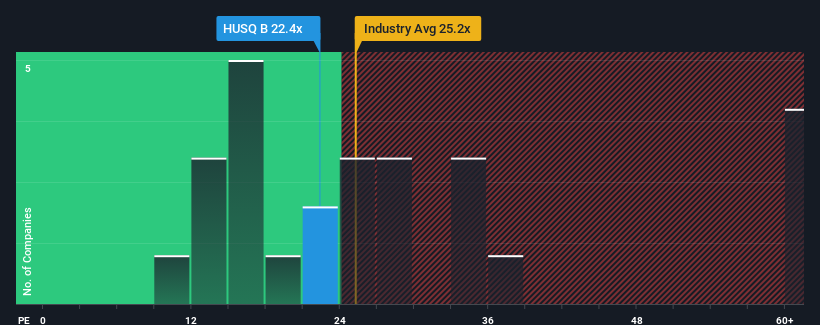

With a median price-to-earnings (or "P/E") ratio of close to 23x in Sweden, you could be forgiven for feeling indifferent about Husqvarna AB (publ)'s (STO:HUSQ B) P/E ratio of 22.4x. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/E.

Husqvarna could be doing better as its earnings have been going backwards lately while most other companies have been seeing positive earnings growth. It might be that many expect the dour earnings performance to strengthen positively, which has kept the P/E from falling. You'd really hope so, otherwise you're paying a relatively elevated price for a company with this sort of growth profile.

View our latest analysis for Husqvarna

How Is Husqvarna's Growth Trending?

Husqvarna's P/E ratio would be typical for a company that's only expected to deliver moderate growth, and importantly, perform in line with the market.

Taking a look back first, the company's earnings per share growth last year wasn't something to get excited about as it posted a disappointing decline of 21%. The last three years don't look nice either as the company has shrunk EPS by 60% in aggregate. Accordingly, shareholders would have felt downbeat about the medium-term rates of earnings growth.

Shifting to the future, estimates from the eight analysts covering the company suggest earnings should grow by 65% over the next year. With the market only predicted to deliver 31%, the company is positioned for a stronger earnings result.

With this information, we find it interesting that Husqvarna is trading at a fairly similar P/E to the market. Apparently some shareholders are skeptical of the forecasts and have been accepting lower selling prices.

The Bottom Line On Husqvarna's P/E

We'd say the price-to-earnings ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

Our examination of Husqvarna's analyst forecasts revealed that its superior earnings outlook isn't contributing to its P/E as much as we would have predicted. When we see a strong earnings outlook with faster-than-market growth, we assume potential risks are what might be placing pressure on the P/E ratio. At least the risk of a price drop looks to be subdued, but investors seem to think future earnings could see some volatility.

You always need to take note of risks, for example - Husqvarna has 2 warning signs we think you should be aware of.

Of course, you might also be able to find a better stock than Husqvarna. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

Valuation is complex, but we're here to simplify it.

Discover if Husqvarna might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About OM:HUSQ B

Husqvarna

Produces and sells outdoor power products, watering products, and lawn care power equipment.

Flawless balance sheet established dividend payer.