Clavister Holding AB (publ.) (STO:CLAV shareholders incur further losses as stock declines 13% this week, taking five-year losses to 85%

It is a pleasure to report that the Clavister Holding AB (publ.) (STO:CLAV) is up 30% in the last quarter. But will that heal all the wounds inflicted over 5 years of declines? Unlikely. Five years have seen the share price descend precipitously, down a full 86%. It's true that the recent bounce could signal the company is turning over a new leaf, but we are not so sure. The fundamental business performance will ultimately determine if the turnaround can be sustained. We really feel for shareholders in this scenario. It's a good reminder of the importance of diversification, and it's worth keeping in mind there's more to life than money, anyway.

If the past week is anything to go by, investor sentiment for Clavister Holding AB (publ.) isn't positive, so let's see if there's a mismatch between fundamentals and the share price.

Check out our latest analysis for Clavister Holding AB (publ.)

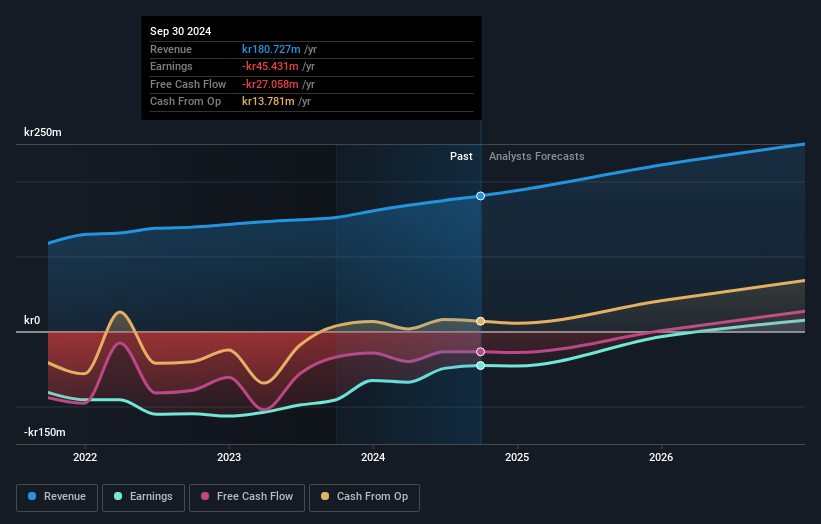

Because Clavister Holding AB (publ.) made a loss in the last twelve months, we think the market is probably more focussed on revenue and revenue growth, at least for now. Generally speaking, companies without profits are expected to grow revenue every year, and at a good clip. That's because it's hard to be confident a company will be sustainable if revenue growth is negligible, and it never makes a profit.

Over five years, Clavister Holding AB (publ.) grew its revenue at 7.3% per year. That's a fairly respectable growth rate. So it is unexpected to see the stock down 13% per year in the last five years. The truth is that the growth might be below expectations, and investors are probably worried about the continual losses.

The company's revenue and earnings (over time) are depicted in the image below (click to see the exact numbers).

This free interactive report on Clavister Holding AB (publ.)'s balance sheet strength is a great place to start, if you want to investigate the stock further.

A Different Perspective

It's good to see that Clavister Holding AB (publ.) has rewarded shareholders with a total shareholder return of 51% in the last twelve months. That certainly beats the loss of about 13% per year over the last half decade. We generally put more weight on the long term performance over the short term, but the recent improvement could hint at a (positive) inflection point within the business. It's always interesting to track share price performance over the longer term. But to understand Clavister Holding AB (publ.) better, we need to consider many other factors. Take risks, for example - Clavister Holding AB (publ.) has 4 warning signs (and 2 which are concerning) we think you should know about.

If you would prefer to check out another company -- one with potentially superior financials -- then do not miss this free list of companies that have proven they can grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Swedish exchanges.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About OM:CLAV

Clavister Holding AB (publ.)

Develops, produces, and sells cybersecurity solutions in Sweden, rest of Europe, Asia, and internationally.

Reasonable growth potential and fair value.

Market Insights

Community Narratives