- Sweden

- /

- Electrical

- /

- OM:FERRO

With A 29% Price Drop For Ferroamp AB (publ) (STO:FERRO) You'll Still Get What You Pay For

Ferroamp AB (publ) (STO:FERRO) shareholders that were waiting for something to happen have been dealt a blow with a 29% share price drop in the last month. Instead of being rewarded, shareholders who have already held through the last twelve months are now sitting on a 23% share price drop.

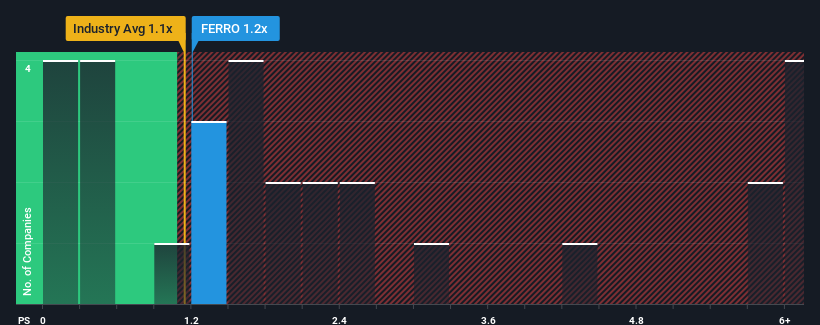

Even after such a large drop in price, there still wouldn't be many who think Ferroamp's price-to-sales (or "P/S") ratio of 1.2x is worth a mention when the median P/S in Sweden's Electrical industry is similar at about 1.6x. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/S.

Check out our latest analysis for Ferroamp

How Ferroamp Has Been Performing

Ferroamp could be doing better as its revenue has been going backwards lately while most other companies have been seeing positive revenue growth. Perhaps the market is expecting its poor revenue performance to improve, keeping the P/S from dropping. If not, then existing shareholders may be a little nervous about the viability of the share price.

Keen to find out how analysts think Ferroamp's future stacks up against the industry? In that case, our free report is a great place to start.Is There Some Revenue Growth Forecasted For Ferroamp?

Ferroamp's P/S ratio would be typical for a company that's only expected to deliver moderate growth, and importantly, perform in line with the industry.

Retrospectively, the last year delivered a frustrating 39% decrease to the company's top line. However, a few very strong years before that means that it was still able to grow revenue by an impressive 104% in total over the last three years. Although it's been a bumpy ride, it's still fair to say the revenue growth recently has been more than adequate for the company.

Shifting to the future, estimates from the one analyst covering the company suggest revenue should grow by 37% over the next year. With the industry predicted to deliver 35% growth , the company is positioned for a comparable revenue result.

In light of this, it's understandable that Ferroamp's P/S sits in line with the majority of other companies. It seems most investors are expecting to see average future growth and are only willing to pay a moderate amount for the stock.

What We Can Learn From Ferroamp's P/S?

Ferroamp's plummeting stock price has brought its P/S back to a similar region as the rest of the industry. Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

A Ferroamp's P/S seems about right to us given the knowledge that analysts are forecasting a revenue outlook that is similar to the Electrical industry. At this stage investors feel the potential for an improvement or deterioration in revenue isn't great enough to push P/S in a higher or lower direction. Unless these conditions change, they will continue to support the share price at these levels.

Having said that, be aware Ferroamp is showing 5 warning signs in our investment analysis, and 1 of those is significant.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:FERRO

Ferroamp

Provides energy and power optimization solutions for homeowners, tenant owner associations, and property owners in Sweden.

High growth potential with excellent balance sheet.

Market Insights

Community Narratives