- Sweden

- /

- Trade Distributors

- /

- OM:BERG B

Undiscovered Gems in Sweden To Watch This August 2024

Reviewed by Simply Wall St

As global markets react positively to anticipated interest rate cuts, Sweden's Riksbank has also reduced borrowing costs, creating a favorable environment for small-cap stocks. Amid this backdrop, identifying promising investments becomes crucial; strong fundamentals and growth potential are key attributes of stocks worth watching in the current market climate.

Top 10 Undiscovered Gems With Strong Fundamentals In Sweden

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Softronic | NA | 3.58% | 7.41% | ★★★★★★ |

| Duni | 29.33% | 10.78% | 22.98% | ★★★★★★ |

| Bahnhof | NA | 9.02% | 15.02% | ★★★★★★ |

| AB Traction | NA | 5.38% | 5.19% | ★★★★★★ |

| Firefly | NA | 15.90% | 31.36% | ★★★★★★ |

| FM Mattsson | NA | 7.80% | 13.15% | ★★★★★★ |

| Creades | NA | -28.54% | -27.09% | ★★★★★★ |

| AQ Group | 7.30% | 14.89% | 22.26% | ★★★★★★ |

| Byggmästare Anders J Ahlström Holding | NA | 33.57% | -9.00% | ★★★★★★ |

| Linc | NA | 56.01% | 0.54% | ★★★★★★ |

Here we highlight a subset of our preferred stocks from the screener.

Beijer Alma (OM:BEIA B)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Beijer Alma AB (publ) and its subsidiaries operate in component manufacturing and industrial trading across Sweden, the Nordic region, Europe, North America, Asia, and internationally with a market cap of SEK12.62 billion.

Operations: Beijer Alma generates revenue primarily from its Lesjöfors and Beijer Tech segments, contributing SEK4.86 billion and SEK2.21 billion respectively.

Beijer Alma, a notable player in Sweden's machinery sector, reported Q2 2024 sales of SEK 1.89 billion and net income of SEK 142 million. The company's earnings have grown by 8.2% over the past year, outpacing the industry's 0.9%. Despite a high net debt to equity ratio of 57.8%, its interest payments are well covered by EBIT at 4.5x coverage. Trading at nearly 28% below estimated fair value, Beijer Alma shows promising growth potential with forecasted annual earnings growth of over 19%.

- Navigate through the intricacies of Beijer Alma with our comprehensive health report here.

Gain insights into Beijer Alma's historical performance by reviewing our past performance report.

Bergman & Beving (OM:BERG B)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Bergman & Beving AB (publ) offers solutions for the manufacturing and construction sectors in Sweden, Norway, Finland, and internationally with a market cap of SEK8.49 billion.

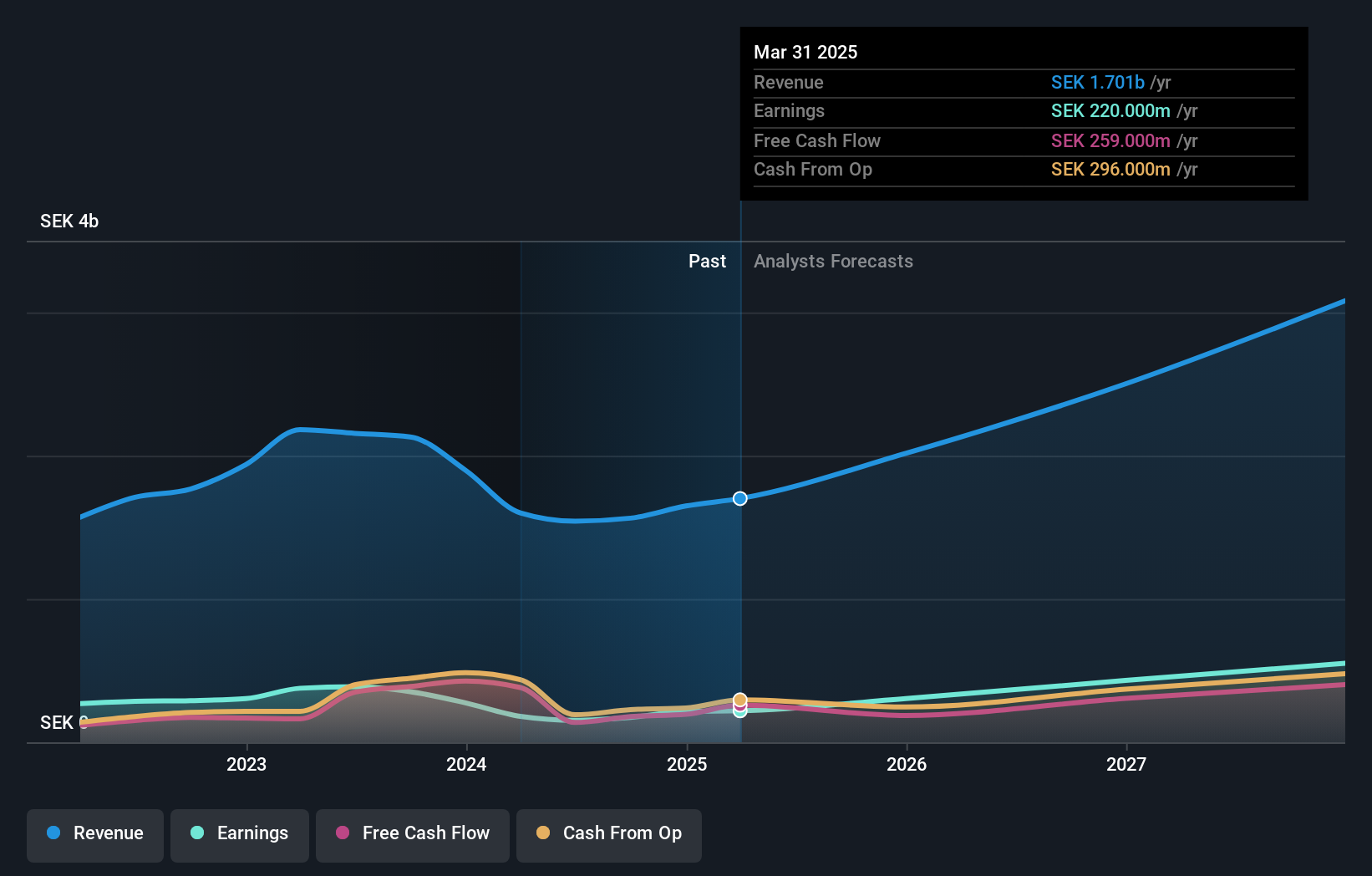

Operations: Bergman & Beving generates revenue from three primary segments: Core Solutions (SEK1.41 billion), Safety Technology (SEK1.62 billion), and Industrial Equipment (SEK1.76 billion). The company also reports a segment adjustment of -SEK31 million.

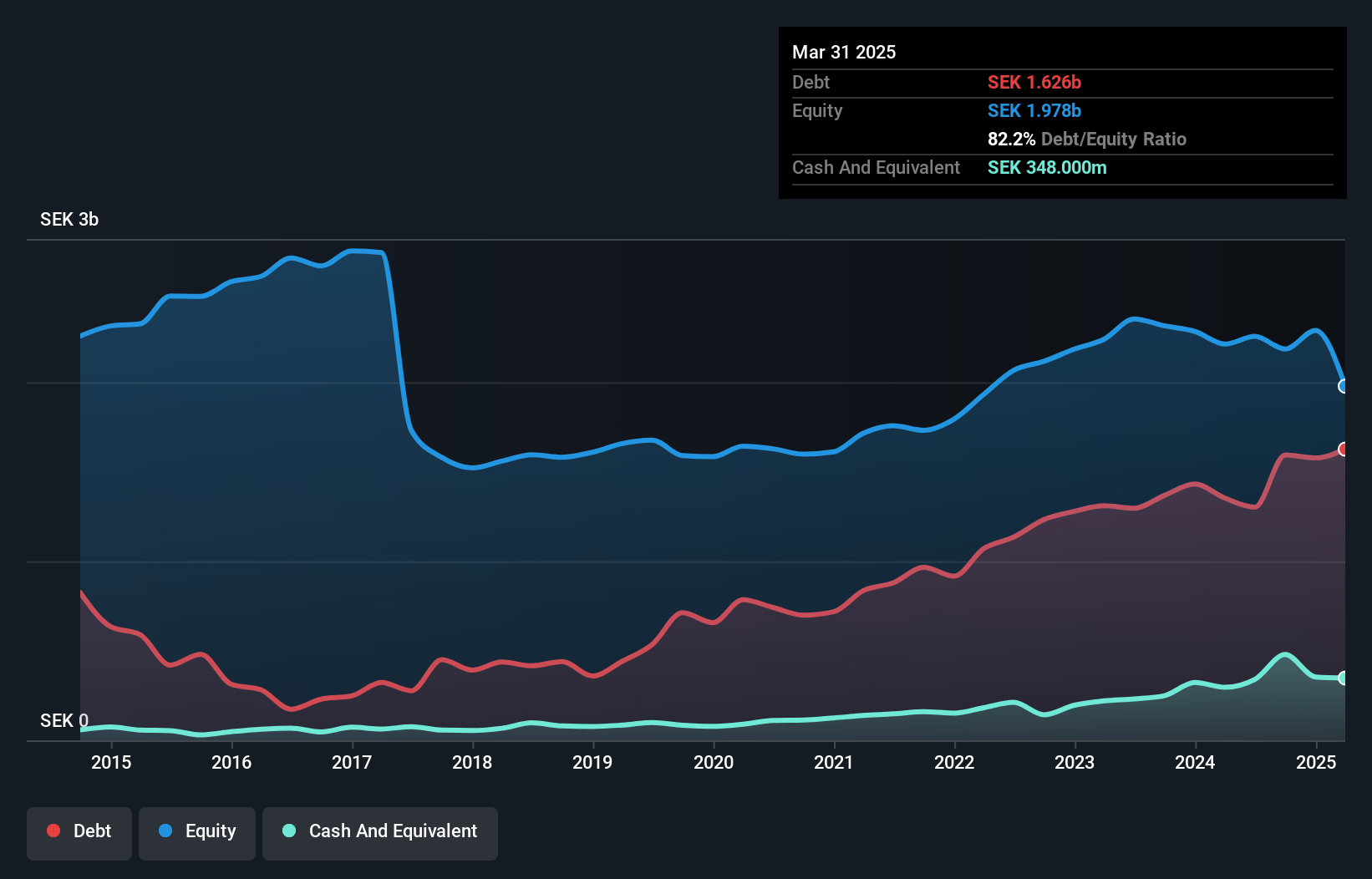

Bergman & Beving AB, a noteworthy player in Sweden's trade distribution sector, reported Q1 2024 sales of SEK 1.25 billion and net income of SEK 52 million. The company trades at a discount of nearly 28% below its estimated fair value. Despite high debt levels with a net debt to equity ratio of 42.6%, interest payments are well-covered by EBIT at four times coverage. Earnings are forecasted to grow annually by over 13%.

- Click here to discover the nuances of Bergman & Beving with our detailed analytical health report.

Examine Bergman & Beving's past performance report to understand how it has performed in the past.

engcon (OM:ENGCON B)

Simply Wall St Value Rating: ★★★★★☆

Overview: engcon AB (publ) engages in the design, production, and sale of excavator tools globally and has a market cap of SEK17.21 billion.

Operations: The company generates revenue primarily from the sale of construction machinery and equipment, amounting to SEK1.54 billion. Its net profit margin is %.

engcon's recent performance highlights some challenges and opportunities. The company's net profit margin dropped to 9.9% from 18% last year, reflecting a tough period with earnings growth at -60.6%. Despite this, its net debt to equity ratio stands at a satisfactory 8.5%, and interest payments are well covered by EBIT (20.4x). Second-quarter sales were SEK 450 million, down from SEK 508 million the previous year, while net income fell to SEK 55 million from SEK 83 million.

- Get an in-depth perspective on engcon's performance by reading our health report here.

Review our historical performance report to gain insights into engcon's's past performance.

Summing It All Up

- Take a closer look at our Swedish Undiscovered Gems With Strong Fundamentals list of 56 companies by clicking here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Bergman & Beving might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:BERG B

Bergman & Beving

Provides solutions for the manufacturing and construction sectors in Sweden, Norway, Finland, and internationally.

Moderate growth potential with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives