- Sweden

- /

- Aerospace & Defense

- /

- OM:CTT

Undiscovered European Gems With Strong Fundamentals December 2025

Reviewed by Simply Wall St

As European markets show resilience with the STOXX Europe 600 Index closing 2.35% higher and key indices in Germany, Italy, France, and the UK also on the rise, investors are increasingly turning their attention to small-cap stocks that may offer untapped potential amidst a stable inflation outlook. In this environment, stocks with strong fundamentals—such as solid financial health and growth prospects—are particularly appealing as they can provide stability and opportunity even when broader economic conditions fluctuate.

Top 10 Undiscovered Gems With Strong Fundamentals In Europe

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Evergent Investments | 3.63% | 11.51% | 22.05% | ★★★★★☆ |

| KABE Group AB (publ.) | 3.82% | 3.46% | 5.42% | ★★★★★☆ |

| Freetrailer Group | 38.17% | 23.13% | 31.09% | ★★★★★☆ |

| Inmocemento | 28.68% | 4.15% | 33.84% | ★★★★★☆ |

| Inversiones Doalca SOCIMI | 13.10% | 6.72% | 3.11% | ★★★★★☆ |

| Envirotainer | 43.54% | 8.03% | -34.33% | ★★★★★☆ |

| VNV Global | 15.38% | -18.33% | -18.19% | ★★★★★☆ |

| ABG Sundal Collier Holding | 35.58% | -7.59% | -18.30% | ★★★★☆☆ |

| Procimmo Group | 141.47% | 6.84% | 6.01% | ★★★★☆☆ |

| Alantra Partners | 11.36% | -6.39% | -33.69% | ★★★★☆☆ |

Here's a peek at a few of the choices from the screener.

TotalEnergies EP Gabon Société Anonyme (ENXTPA:EC)

Simply Wall St Value Rating: ★★★★☆☆

Overview: TotalEnergies EP Gabon Société Anonyme focuses on the mining, exploration, and production of crude oil in Gabon with a market capitalization of €841.50 million.

Operations: The primary revenue stream for TotalEnergies EP Gabon comes from its Oil & Gas - Exploration & Production segment, which generated $437.59 million. The company's financial performance is influenced by various factors, including market conditions and operational costs.

TotalEnergies EP Gabon, a compact player in the energy sector, has shown impressive earnings growth of 48% over the past year, outpacing the broader oil and gas industry. Its debt-to-equity ratio improved from 1.7 to 0.3 over five years, indicating stronger financial health. Despite not generating positive free cash flow recently, it trades at a significant discount of nearly 59% below its estimated fair value. Recently added to both the CAC All-Tradable and CAC Small Indexes, this inclusion highlights its growing recognition in European markets while maintaining high-quality earnings amidst industry challenges.

Smartoptics Group (OB:SMOP)

Simply Wall St Value Rating: ★★★★★★

Overview: Smartoptics Group ASA offers optical networking solutions and devices across various regions including the Americas, Europe, the Middle East, Africa, and the Asia-Pacific, with a market capitalization of NOK2.74 billion.

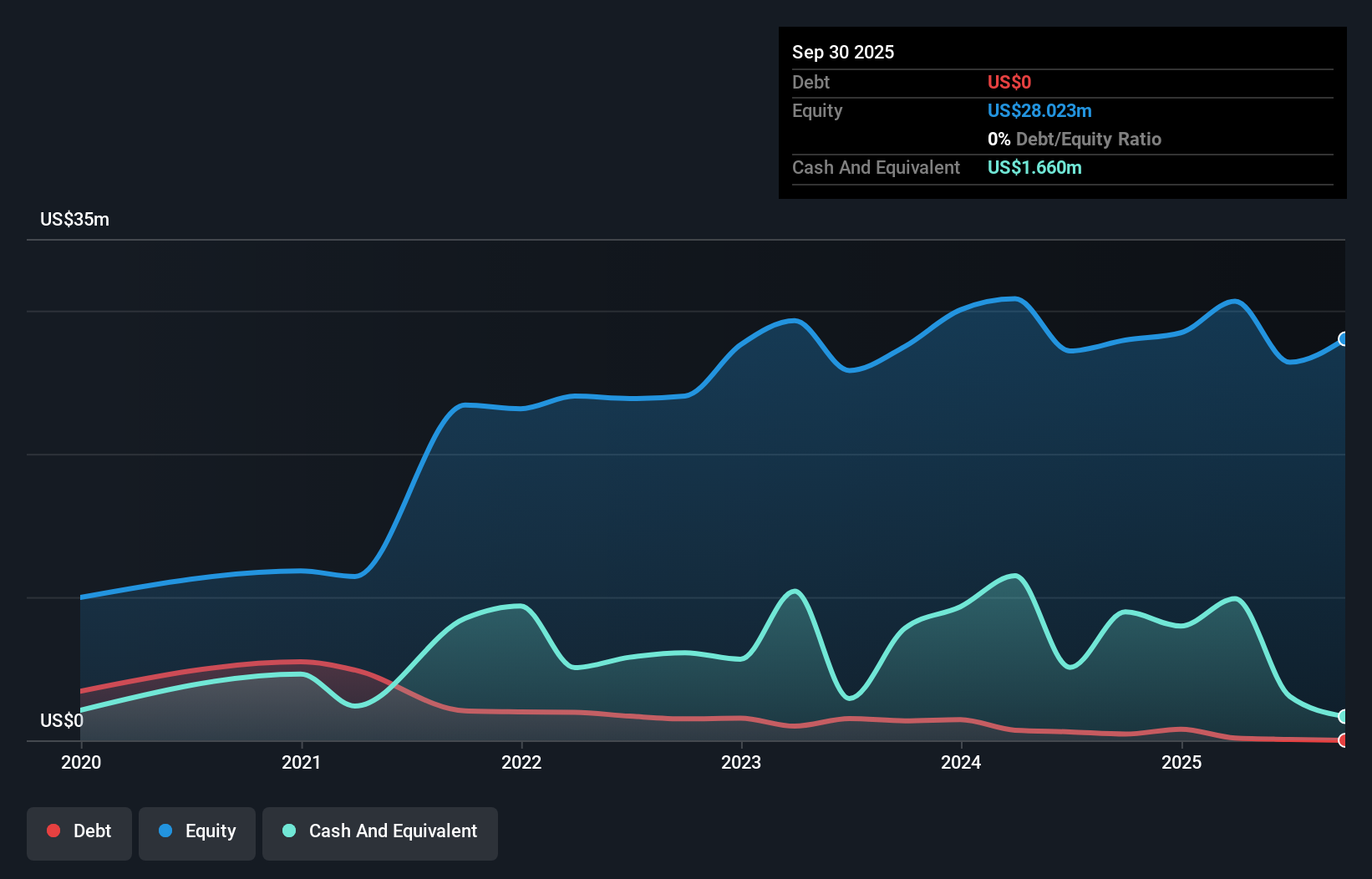

Operations: Smartoptics generates revenue primarily from its optical networking solutions and devices. The company's net profit margin is a key financial metric, reflecting the efficiency of its operations in converting revenue into profit.

Smartoptics Group, a nimble player in the communications sector, is making waves with its strategic focus on large accounts and advanced software innovations. The company reported third-quarter sales of US$19 million, up from US$12.97 million the previous year, with net income rising to US$1.37 million from US$0.54 million. Earnings per share increased to US$0.014 compared to last year's US$0.005, reflecting solid growth despite market volatility and macroeconomic challenges like potential tariffs and operational costs due to talent acquisition. Smartoptics' membership in the IOWN Global Forum underscores its commitment to pioneering optical network solutions for future growth prospects.

CTT Systems (OM:CTT)

Simply Wall St Value Rating: ★★★★★★

Overview: CTT Systems AB (publ) specializes in providing humidity control systems for aircraft across various international markets, with a market capitalization of approximately SEK2.39 billion.

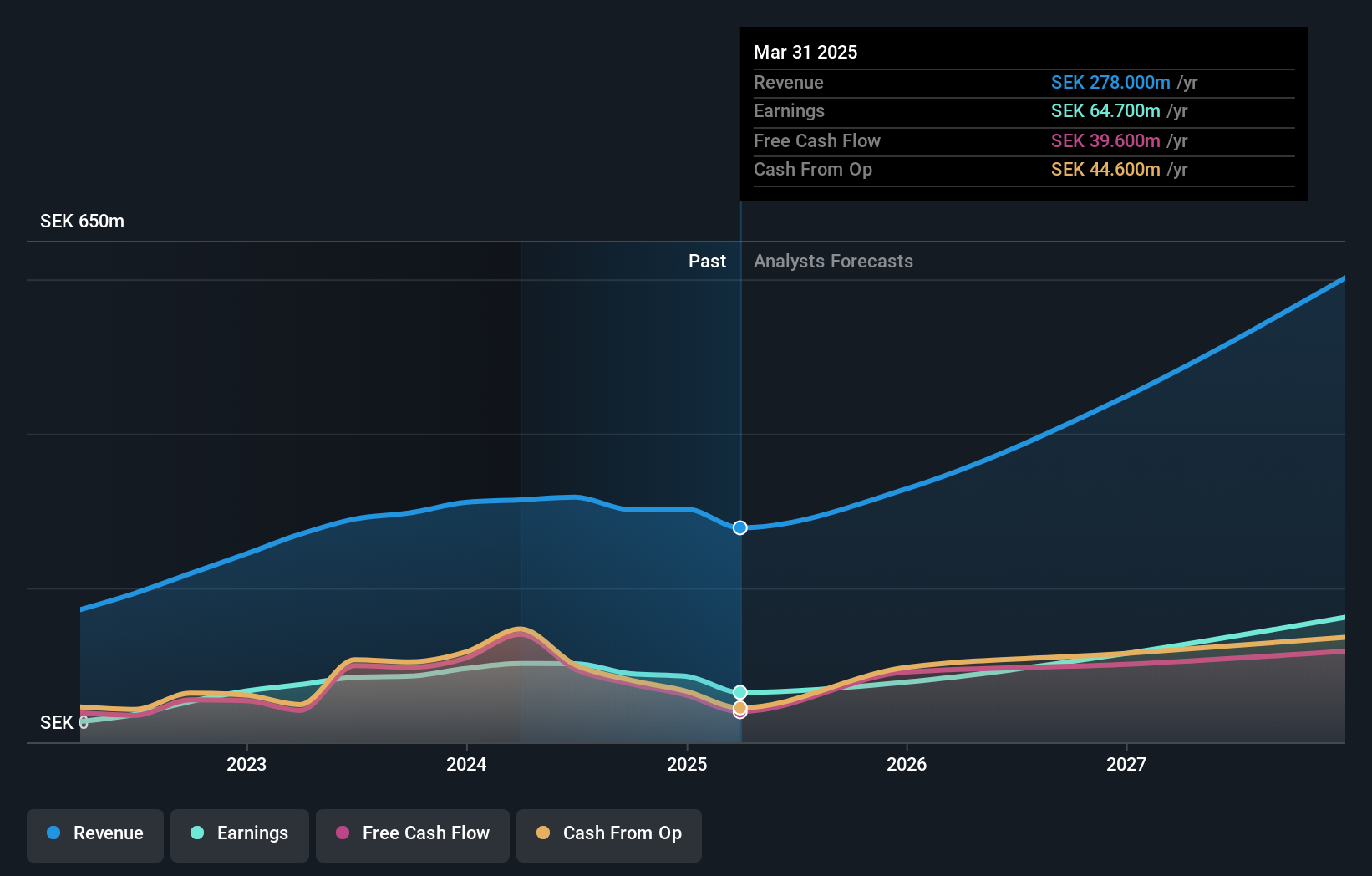

Operations: CTT Systems generates revenue primarily from its Aerospace & Defense segment, amounting to SEK291.20 million. The company's financial performance is highlighted by a notable gross profit margin trend, which provides insight into its cost efficiency and pricing strategy within the market.

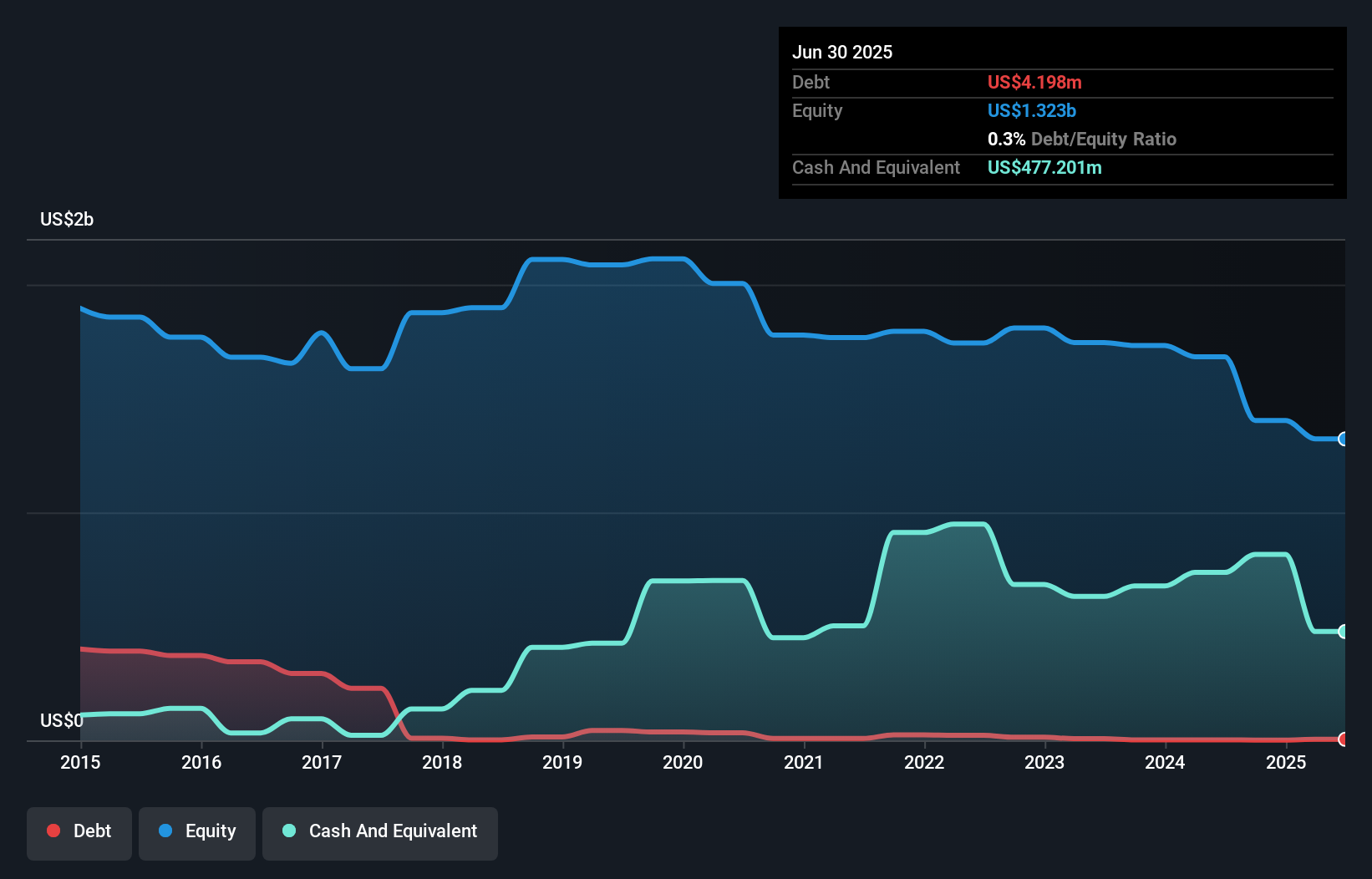

CTT Systems, a small player in the Aerospace & Defense sector, has had a challenging year with earnings growth at -35.6%, contrasting the industry average of 25.8%. Despite this, CTT's debt to equity ratio improved from 18.7% to 14.3% over five years, and its interest payments are well covered by EBIT at 139 times. The company reported third-quarter revenue of SEK 79.9 million compared to SEK 56 million last year and net income of SEK 14.4 million up from SEK 12.2 million previously, indicating some resilience despite lower profit margins now at 19.6% versus last year's 29.5%.

Key Takeaways

- Take a closer look at our European Undiscovered Gems With Strong Fundamentals list of 314 companies by clicking here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:CTT

CTT Systems

Provides humidity control systems for aircraft in Sweden, Denmark, France, the United States, and internationally.

Exceptional growth potential with flawless balance sheet.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

China Starch Holdings eyes a revenue growth of 4.66% with a 5-year strategic plan

PSIX The timing of insider sales is a serious question mark

The Great Strategy Swap – Selling "Old Auto" to Buy "Future Light"

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026