- Sweden

- /

- Aerospace & Defense

- /

- OM:CTT

Swedish Stocks Estimated To Be Trading Below Fair Value In October 2024

Reviewed by Simply Wall St

As geopolitical tensions in the Middle East escalate, European markets have seen a cautious retreat, with the pan-European STOXX Europe 600 Index falling by 1.80%, reflecting broader investor concerns. Amidst this environment of uncertainty and potential monetary easing by the European Central Bank, identifying stocks that may be trading below their fair value becomes increasingly important for investors seeking opportunities in Sweden's market.

Top 10 Undervalued Stocks Based On Cash Flows In Sweden

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Concentric (OM:COIC) | SEK215.00 | SEK406.02 | 47% |

| Husqvarna (OM:HUSQ B) | SEK68.70 | SEK125.38 | 45.2% |

| Biotage (OM:BIOT) | SEK182.40 | SEK363.94 | 49.9% |

| Lindab International (OM:LIAB) | SEK275.20 | SEK528.41 | 47.9% |

| Nolato (OM:NOLA B) | SEK51.25 | SEK98.78 | 48.1% |

| Dometic Group (OM:DOM) | SEK57.80 | SEK106.46 | 45.7% |

| Mentice (OM:MNTC) | SEK26.50 | SEK50.97 | 48% |

| Tourn International (OM:TOURN) | SEK8.90 | SEK16.46 | 45.9% |

| BHG Group (OM:BHG) | SEK14.26 | SEK26.62 | 46.4% |

| Lyko Group (OM:LYKO A) | SEK119.20 | SEK218.29 | 45.4% |

Below we spotlight a couple of our favorites from our exclusive screener.

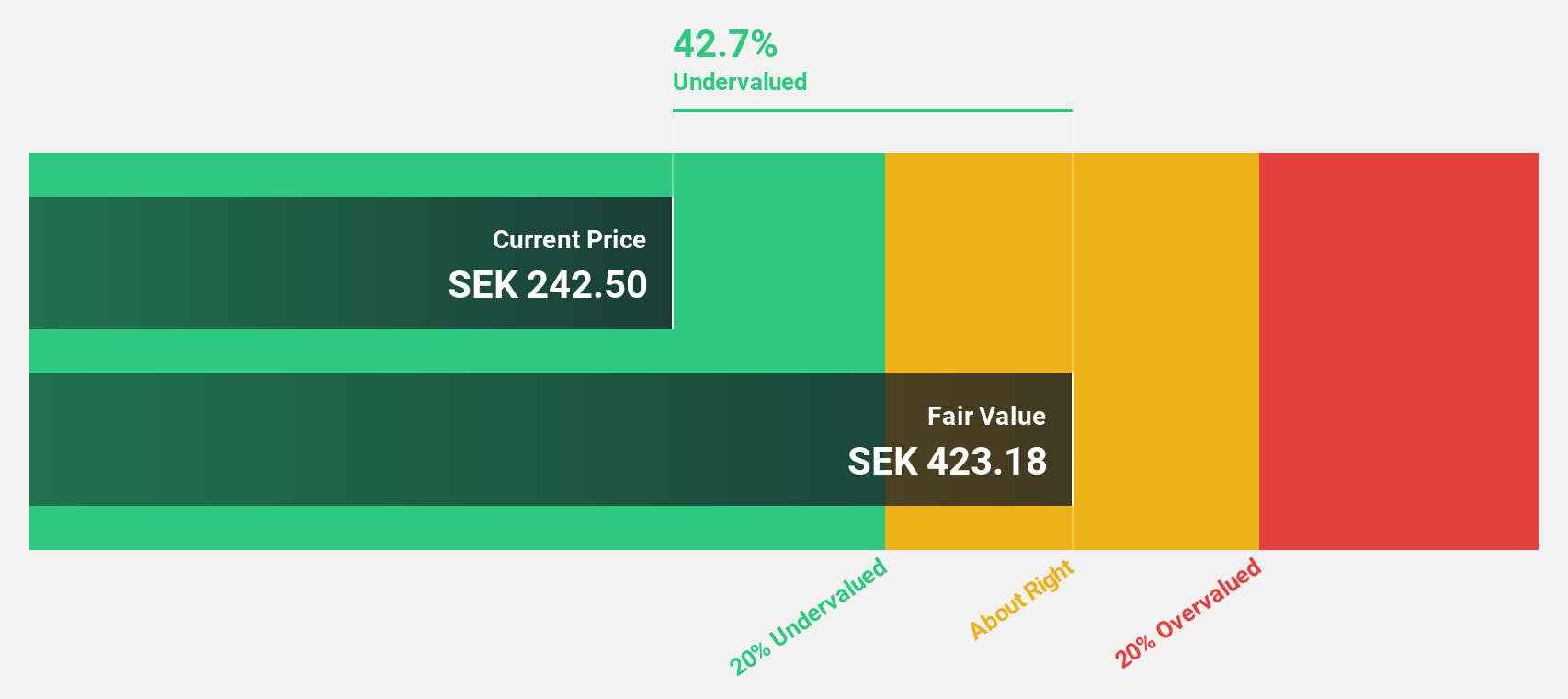

CTT Systems (OM:CTT)

Overview: CTT Systems AB (publ) designs, manufactures, and sells humidity control systems for aircraft across Sweden, Denmark, France, the United States, and other international markets with a market cap of SEK3.40 billion.

Operations: The company generates revenue from its Aerospace & Defense segment, amounting to SEK317.70 million.

Estimated Discount To Fair Value: 45%

CTT Systems is trading at SEK271, significantly below its estimated fair value of SEK492.87, suggesting it may be undervalued based on cash flows. The company forecasts robust revenue growth of 21.9% annually, outpacing the Swedish market's 1.4%, with earnings projected to grow by 24.8% per year over the next three years. Despite an unstable dividend history, CTT's recent inclusion in the S&P Global BMI Index highlights its growing prominence in the market.

- According our earnings growth report, there's an indication that CTT Systems might be ready to expand.

- Click here to discover the nuances of CTT Systems with our detailed financial health report.

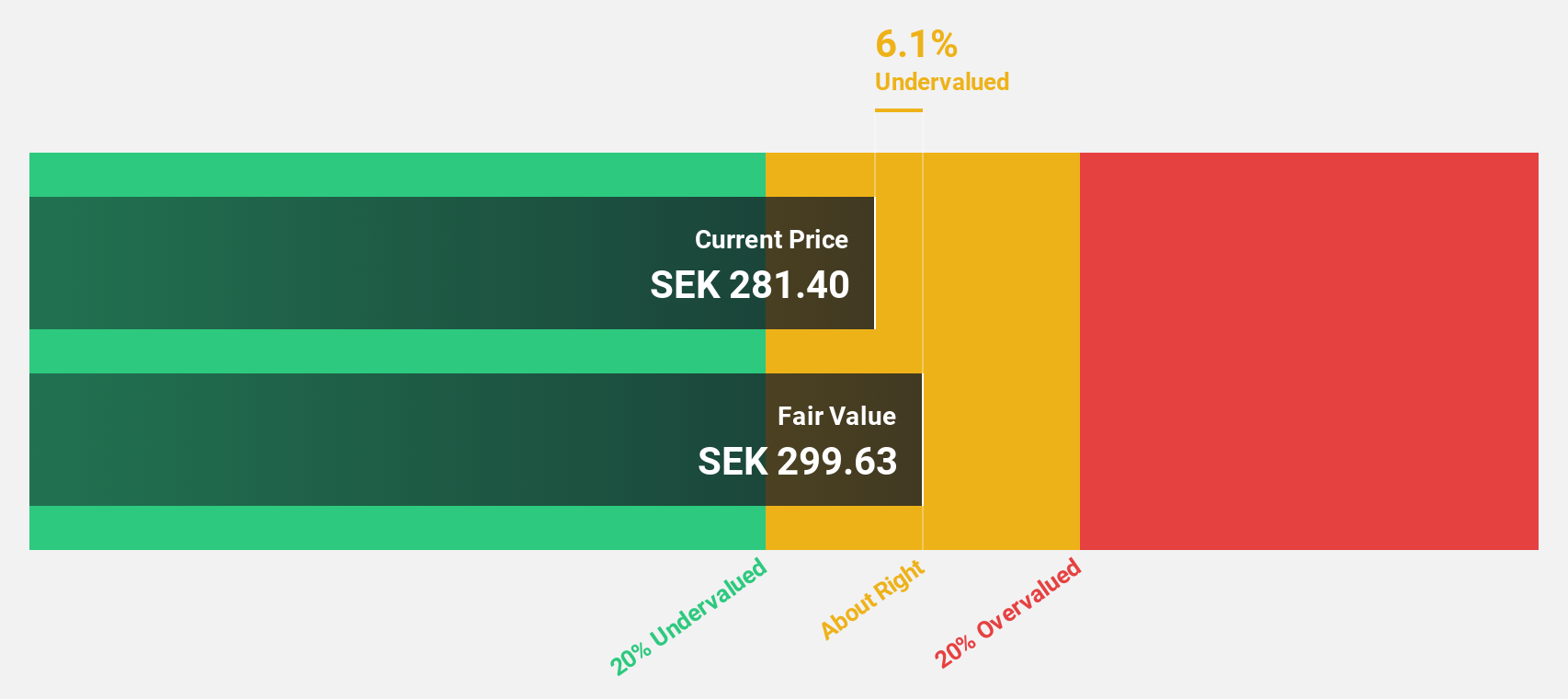

EQT (OM:EQT)

Overview: EQT AB (publ) is a global private equity firm focused on private capital and real asset segments, with a market cap of SEK392.91 billion.

Operations: The company generates revenue from its segments as follows: €37.20 million from Central, €878.70 million from Real Assets, and €1.28 billion from Private Capital.

Estimated Discount To Fair Value: 10.1%

EQT AB is trading at SEK332.6, slightly below its estimated fair value of SEK370.17, indicating potential undervaluation based on cash flows. The company's earnings are forecast to grow significantly at 34.5% annually over the next three years, surpassing the Swedish market average of 15.2%. However, recent insider selling and large one-off items affecting financial results may raise concerns about earnings quality despite strong growth projections and active involvement in M&A activities globally.

- In light of our recent growth report, it seems possible that EQT's financial performance will exceed current levels.

- Click to explore a detailed breakdown of our findings in EQT's balance sheet health report.

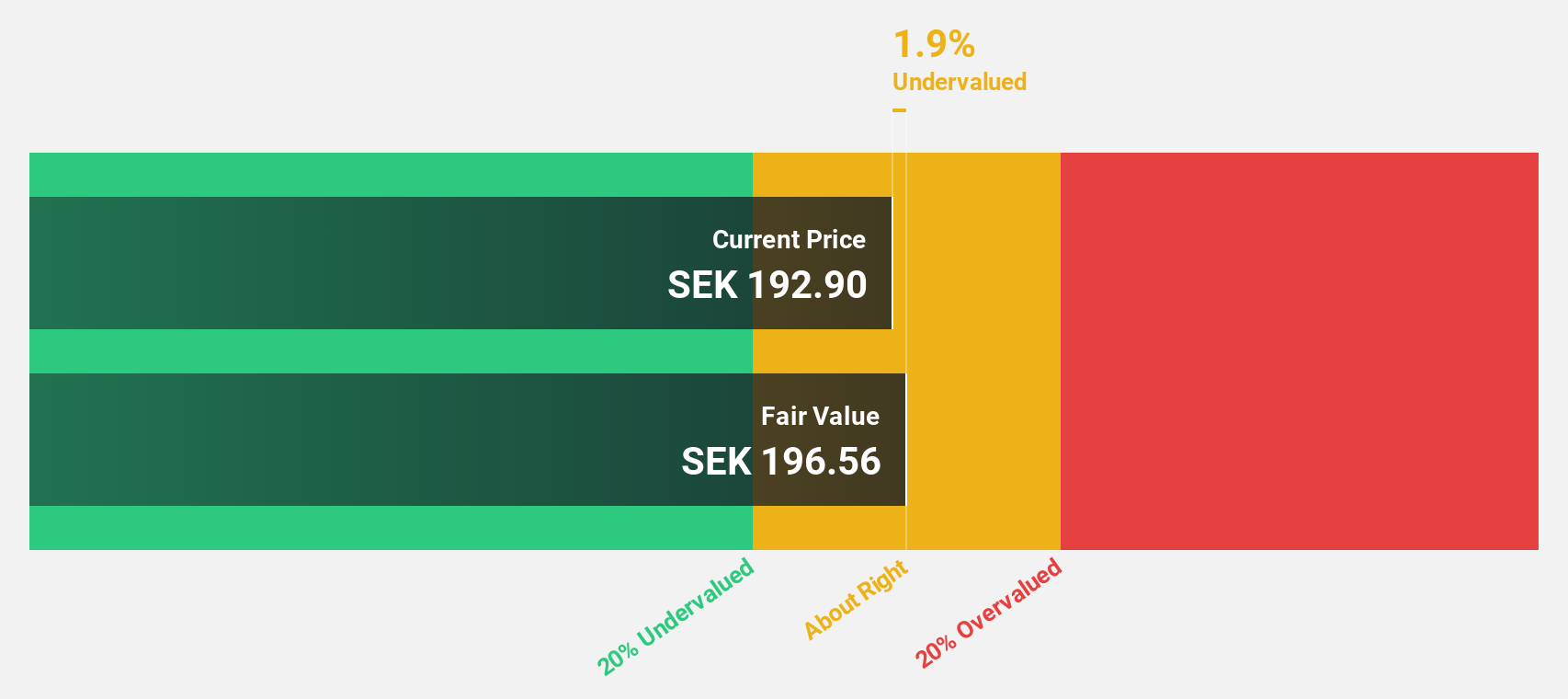

Paradox Interactive (OM:PDX)

Overview: Paradox Interactive AB (publ) develops and publishes strategy and management games for PC and consoles across various regions, with a market cap of SEK19.54 billion.

Operations: The company's revenue is primarily derived from its computer graphics segment, which generated SEK2.48 billion.

Estimated Discount To Fair Value: 29.3%

Paradox Interactive is trading at SEK185, significantly below its estimated fair value of SEK261.66, highlighting potential undervaluation based on cash flows. Despite a drop in profit margins from 32.5% to 13% and lower recent earnings, the company's earnings are forecast to grow substantially at 40.2% annually over the next three years. Recent product announcements like the Grand Archive Story Pack for Stellaris may bolster future revenue growth, though dividend coverage remains weak at 1.62%.

- Our comprehensive growth report raises the possibility that Paradox Interactive is poised for substantial financial growth.

- Navigate through the intricacies of Paradox Interactive with our comprehensive financial health report here.

Make It Happen

- Delve into our full catalog of 41 Undervalued Swedish Stocks Based On Cash Flows here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:CTT

CTT Systems

Provides humidity control systems for aircraft in Sweden, Denmark, France, the United States, and internationally.

Exceptional growth potential with flawless balance sheet.

Market Insights

Community Narratives