European Growth Stocks With High Insider Ownership In March 2025

Reviewed by Simply Wall St

As European markets continue to show resilience, with the STOXX Europe 600 Index marking its longest streak of weekly gains since 2012, investors are increasingly looking towards growth stocks with substantial insider ownership as potential opportunities. In this context, companies where insiders hold significant stakes may offer a unique alignment of interests and stability amidst broader economic uncertainties.

Top 10 Growth Companies With High Insider Ownership In Europe

| Name | Insider Ownership | Earnings Growth |

| TF Bank (OM:TFBANK) | 15.6% | 20% |

| Elicera Therapeutics (OM:ELIC) | 27.8% | 97.2% |

| Vow (OB:VOW) | 12.9% | 120.9% |

| Pharma Mar (BME:PHM) | 11.9% | 39.8% |

| CD Projekt (WSE:CDR) | 29.7% | 39.4% |

| Bergen Carbon Solutions (OB:BCS) | 12% | 50.8% |

| Truecaller (OM:TRUE B) | 29.7% | 24.8% |

| XTPL (WSE:XTP) | 27.9% | 118% |

| Elliptic Laboratories (OB:ELABS) | 22.6% | 89.9% |

| Circus (XTRA:CA1) | 26% | 51.4% |

Let's dive into some prime choices out of the screener.

P/F Bakkafrost (OB:BAKKA)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: P/F Bakkafrost, along with its subsidiaries, is engaged in the production and sale of salmon products across North America, Western Europe, Eastern Europe, Asia, and other international markets, with a market cap of NOK33.54 billion.

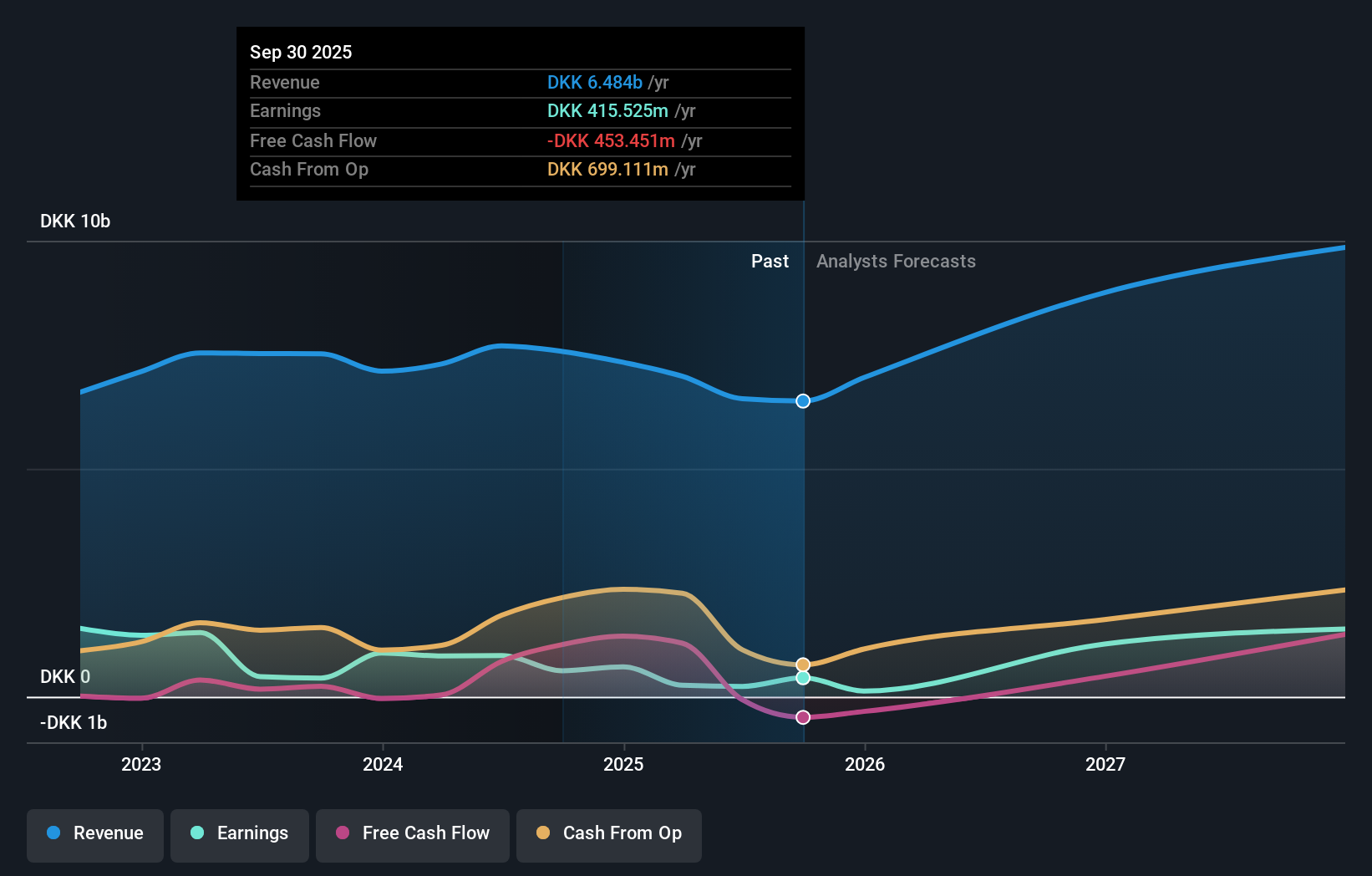

Operations: The company's revenue segments include Sales and Other at DKK10.21 billion, Farming Faroe Islands at DKK3.97 billion, Fishmeal, Oil and Feed at DKK2.73 billion, Farming Scotland at DKK1.84 billion, Services at DKK894.61 million, Freshwater Faroe Islands at DKK782.05 million, and Freshwater Scotland at DKK117.26 million.

Insider Ownership: 13.3%

Revenue Growth Forecast: 13.8% p.a.

P/F Bakkafrost's earnings are projected to grow at 34.9% annually, outpacing the Norwegian market's growth rate of 8.3%. Despite a decline in profit margins from last year, analysts expect the stock price to rise by 21.9%, and it trades significantly below its estimated fair value. Recent financials show sales increased to DKK 7.48 billion, though net income decreased compared to the previous year, reflecting challenges in maintaining profitability amidst growth expectations.

- Click here and access our complete growth analysis report to understand the dynamics of P/F Bakkafrost.

- In light of our recent valuation report, it seems possible that P/F Bakkafrost is trading behind its estimated value.

CTT Systems (OM:CTT)

Simply Wall St Growth Rating: ★★★★★☆

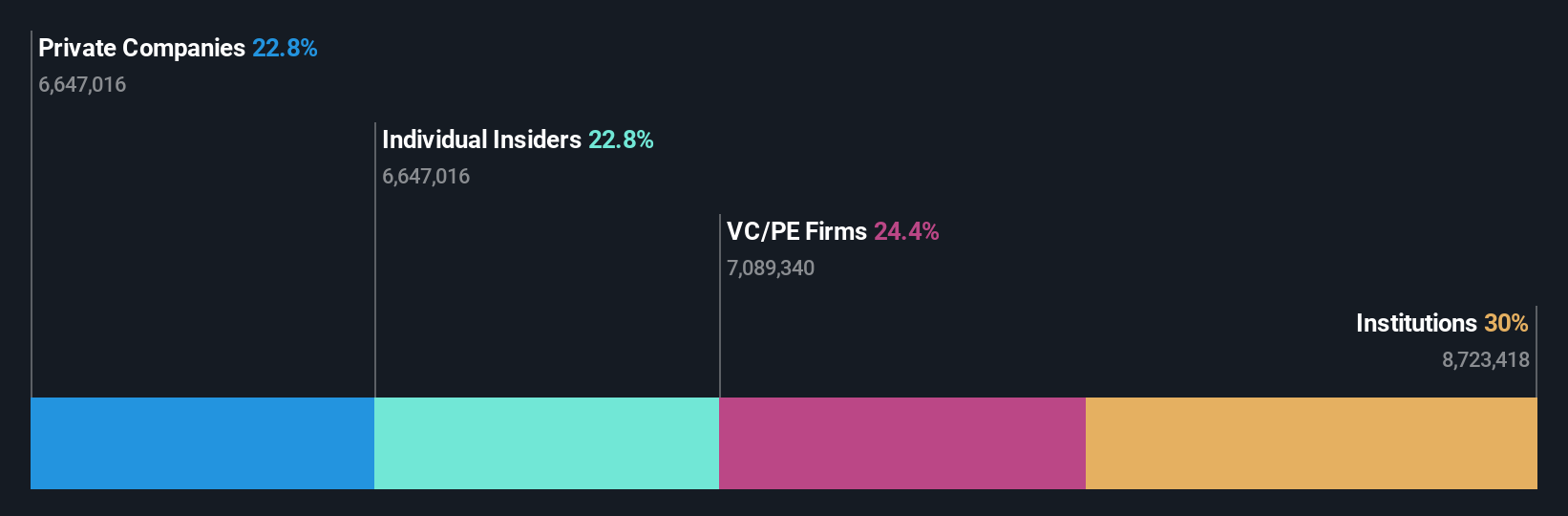

Overview: CTT Systems AB (publ) designs, manufactures, and sells humidity control systems for aircraft in Sweden, Denmark, France, the United States, and internationally with a market cap of SEK2.91 billion.

Operations: The company's revenue segment includes Aerospace & Defense, generating SEK302.30 million.

Insider Ownership: 16.9%

Revenue Growth Forecast: 19.5% p.a.

CTT Systems is positioned for substantial growth, with earnings expected to grow significantly at 25.9% annually, outpacing the Swedish market's 9.5%. Despite trading at 46% below estimated fair value, its revenue growth forecast of 19.5% per year is slightly below the high-growth threshold but exceeds the Swedish market average. Recent orders for Anti-Condensation systems from a European airline signal robust demand, though net income has slightly declined compared to last year.

- Click to explore a detailed breakdown of our findings in CTT Systems' earnings growth report.

- Our valuation report unveils the possibility CTT Systems' shares may be trading at a discount.

Shoper (WSE:SHO)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Shoper SA offers Software as a Service solutions for e-commerce in Poland, with a market cap of PLN1.16 billion.

Operations: The company's revenue is derived from its Solutions segment, generating PLN141.44 million, and Subscriptions, contributing PLN39.87 million.

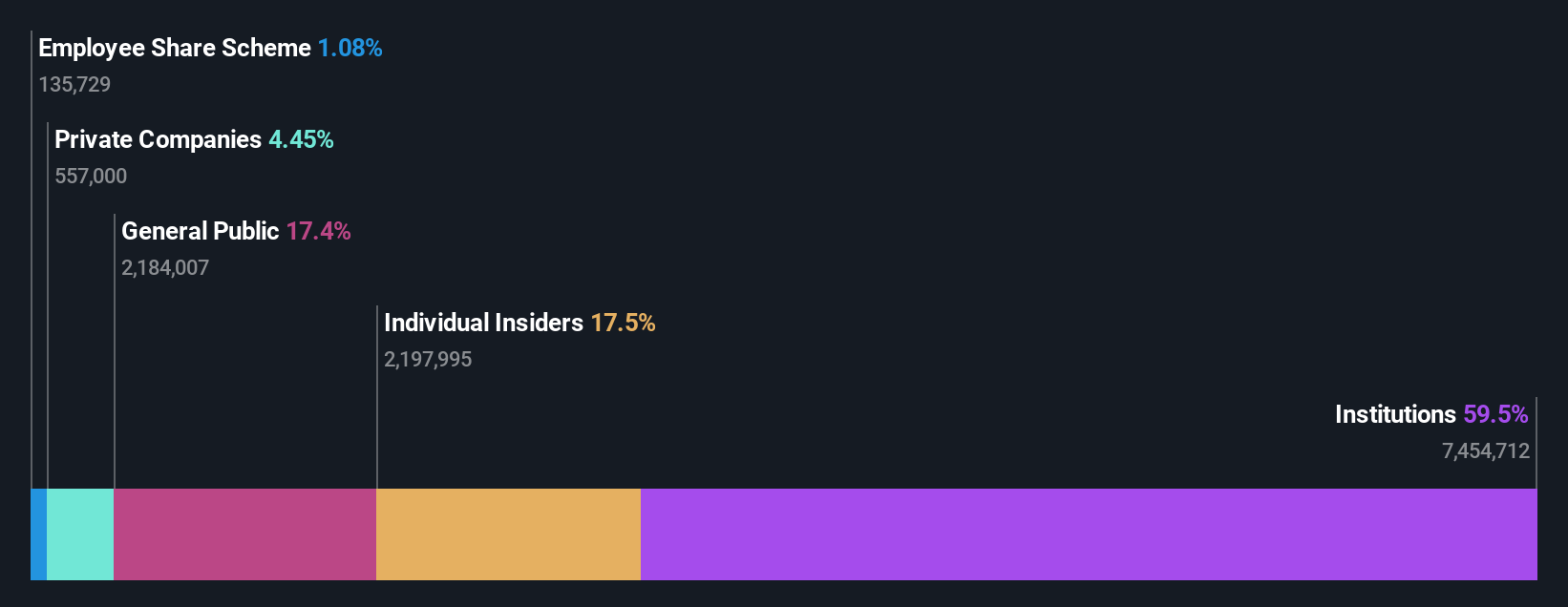

Insider Ownership: 23.6%

Revenue Growth Forecast: 14.8% p.a.

Shoper's earnings are projected to grow significantly at 26.56% annually, surpassing the Polish market's 14%. Despite trading at 23.5% below estimated fair value, its revenue growth of 14.8% per year lags behind the high-growth benchmark but exceeds local market expectations. Analysts agree on a potential stock price rise of 23.7%. A recent extraordinary shareholders meeting indicates active corporate governance, although no substantial insider trading activity was reported in the past three months.

- Delve into the full analysis future growth report here for a deeper understanding of Shoper.

- According our valuation report, there's an indication that Shoper's share price might be on the cheaper side.

Summing It All Up

- Access the full spectrum of 216 Fast Growing European Companies With High Insider Ownership by clicking on this link.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About WSE:SHO

Shoper

Shoper SA provides Software as a Service solutions for e-commerce in Poland.

Outstanding track record with high growth potential.

Market Insights

Community Narratives