- Sweden

- /

- Trade Distributors

- /

- OM:BUFAB

3 Undiscovered European Gems To Diversify Your Portfolio

Reviewed by Simply Wall St

As European markets continue to ride a wave of optimism, with the pan-European STOXX Europe 600 Index reaching record levels driven by a rally in technology stocks and expectations for lower U.S. borrowing costs, investors are increasingly looking to diversify their portfolios with promising small-cap opportunities. In this environment, identifying stocks that demonstrate resilience and potential for growth amidst shifting economic conditions can be key to enhancing portfolio diversification and capturing untapped value.

Top 10 Undiscovered Gems With Strong Fundamentals In Europe

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Caisse Régionale de Crédit Agricole Mutuel Brie Picardie Société coopérative | 37.61% | 3.36% | 6.34% | ★★★★★★ |

| Moury Construct | 2.06% | 11.11% | 23.28% | ★★★★★★ |

| Inversiones Doalca SOCIMI | 13.10% | 6.72% | 3.11% | ★★★★★☆ |

| va-Q-tec | 43.54% | 8.03% | -34.33% | ★★★★★☆ |

| Zespól Elektrocieplowni Wroclawskich KOGENERACJA | 13.23% | 20.22% | 17.99% | ★★★★★☆ |

| Deutsche Balaton | 4.58% | -18.46% | -16.14% | ★★★★★☆ |

| ABG Sundal Collier Holding | 46.02% | -6.02% | -15.62% | ★★★★☆☆ |

| Practic | NA | 4.86% | 6.64% | ★★★★☆☆ |

| Alantra Partners | 11.48% | -5.76% | -30.16% | ★★★★☆☆ |

| MCH Group | 124.09% | 12.40% | 43.58% | ★★★★☆☆ |

Below we spotlight a couple of our favorites from our exclusive screener.

Campine (ENXTBR:CAMB)

Simply Wall St Value Rating: ★★★★★☆

Overview: Campine NV operates in the circular metals and specialty chemicals sectors both in Belgium and internationally, with a market capitalization of €348 million.

Operations: Campine NV generates revenue primarily from its specialty chemicals segment, contributing €405.36 million, and its circular metals segment, which adds €213.75 million.

Campine, a notable player in the metals and mining sector, has seen impressive earnings growth of 209% over the past year, outpacing industry averages. The company's net debt to equity ratio stands at a satisfactory 38.8%, reflecting prudent financial management. Recent half-year results highlight sales reaching €383.92 million, more than doubling from €169.07 million last year, while net income surged to €36.29 million from €11.12 million previously. With a price-to-earnings ratio of 7x against the Belgian market's 16x and well-covered interest payments at 35x EBIT coverage, Campine presents an intriguing investment narrative despite share price volatility recently observed.

- Click to explore a detailed breakdown of our findings in Campine's health report.

Assess Campine's past performance with our detailed historical performance reports.

Bufab (OM:BUFAB)

Simply Wall St Value Rating: ★★★★★☆

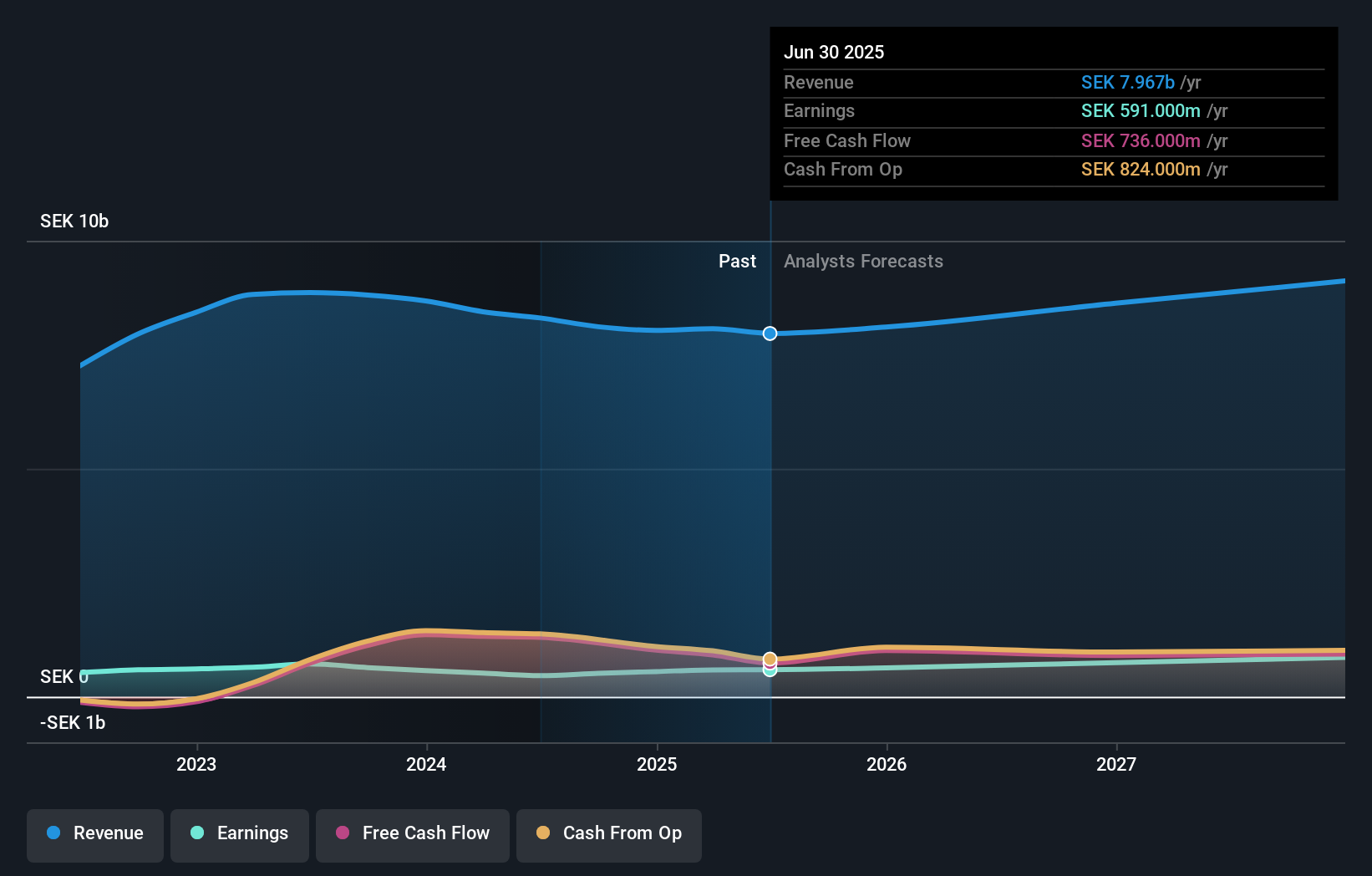

Overview: Bufab AB (publ) is a trading company that offers procurement, quality assurance, and logistics solutions for c-parts and technical components across various international markets, with a market capitalization of approximately SEK17.14 billion.

Operations: Bufab generates revenue primarily from its operations across various regions, with Europe North & East contributing SEK2.88 billion and Europe West adding SEK2.06 billion.

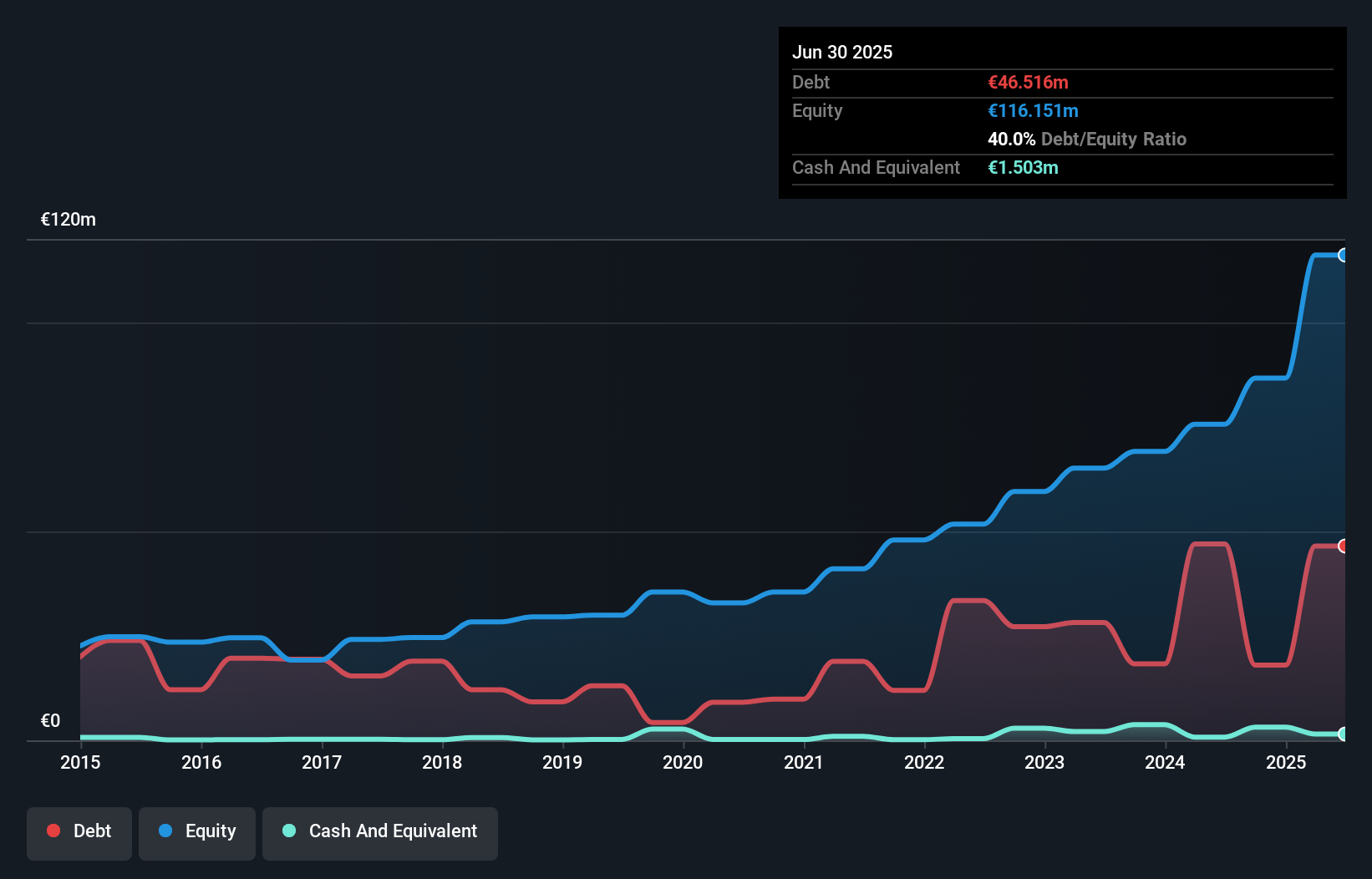

Bufab, a nimble player in the trade distribution sector, shows promise with its robust earnings growth of 27.9% over the past year, outpacing its industry peers. Despite a high net debt to equity ratio of 67.2%, Bufab's interest payments are comfortably covered by EBIT at 4.9 times, indicating financial resilience. Recent strategic moves in Asia Pacific and cost control initiatives have bolstered operating margins and positioned the company for further expansion. With shares trading below estimated fair value by 13.8%, Bufab presents an intriguing opportunity for those considering potential growth avenues in technical components procurement.

Sygnity (WSE:SGN)

Simply Wall St Value Rating: ★★★★★★

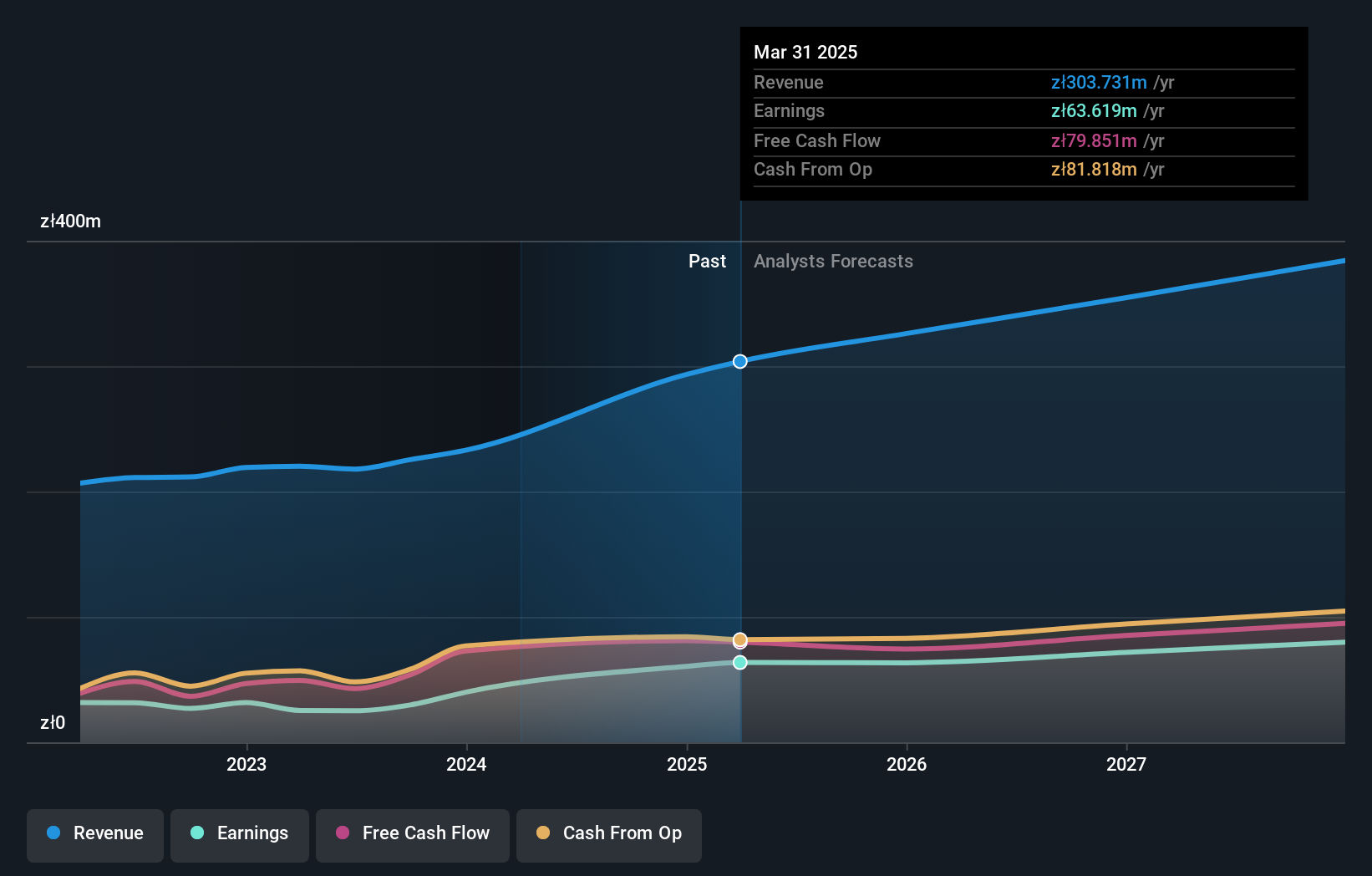

Overview: Sygnity S.A. is a company that manufactures and sells IT products and services both in Poland and internationally, with a market capitalization of PLN2.42 billion.

Operations: The primary revenue stream for Sygnity comes from its IT segment, which generated PLN320.20 million. The company's net profit margin is a key financial indicator to consider when evaluating its profitability.

Sygnity, a nimble player in the IT sector, has demonstrated impressive growth with earnings surging by 52% over the past year, outpacing the industry's -2.1%. The company's financial health appears robust as it reduced its debt to equity ratio from 41.3% to 2% over five years and maintains more cash than total debt. Recent performance highlights include half-year revenue of PLN 158.45 million and net income of PLN 30.63 million, showing significant improvement from last year's figures of PLN 131.43 million and PLN 14.87 million respectively, with basic EPS doubling to PLN 1.35 from PLN 0.65.

- Dive into the specifics of Sygnity here with our thorough health report.

Evaluate Sygnity's historical performance by accessing our past performance report.

Key Takeaways

- Get an in-depth perspective on all 327 European Undiscovered Gems With Strong Fundamentals by using our screener here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Bufab might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:BUFAB

Bufab

A trading company, provides solutions for procurement, quality assurance, and logistics for c-parts and technical components in Sweden, Denmark, the United States, the United Kingdom, and internationally.

Solid track record with excellent balance sheet.

Market Insights

Community Narratives