- Sweden

- /

- Trade Distributors

- /

- OM:BERG B

Bergman & Beving (OM:BERG B): Extended Losses Challenge Bullish Forecasts for Profitability and Growth

Reviewed by Simply Wall St

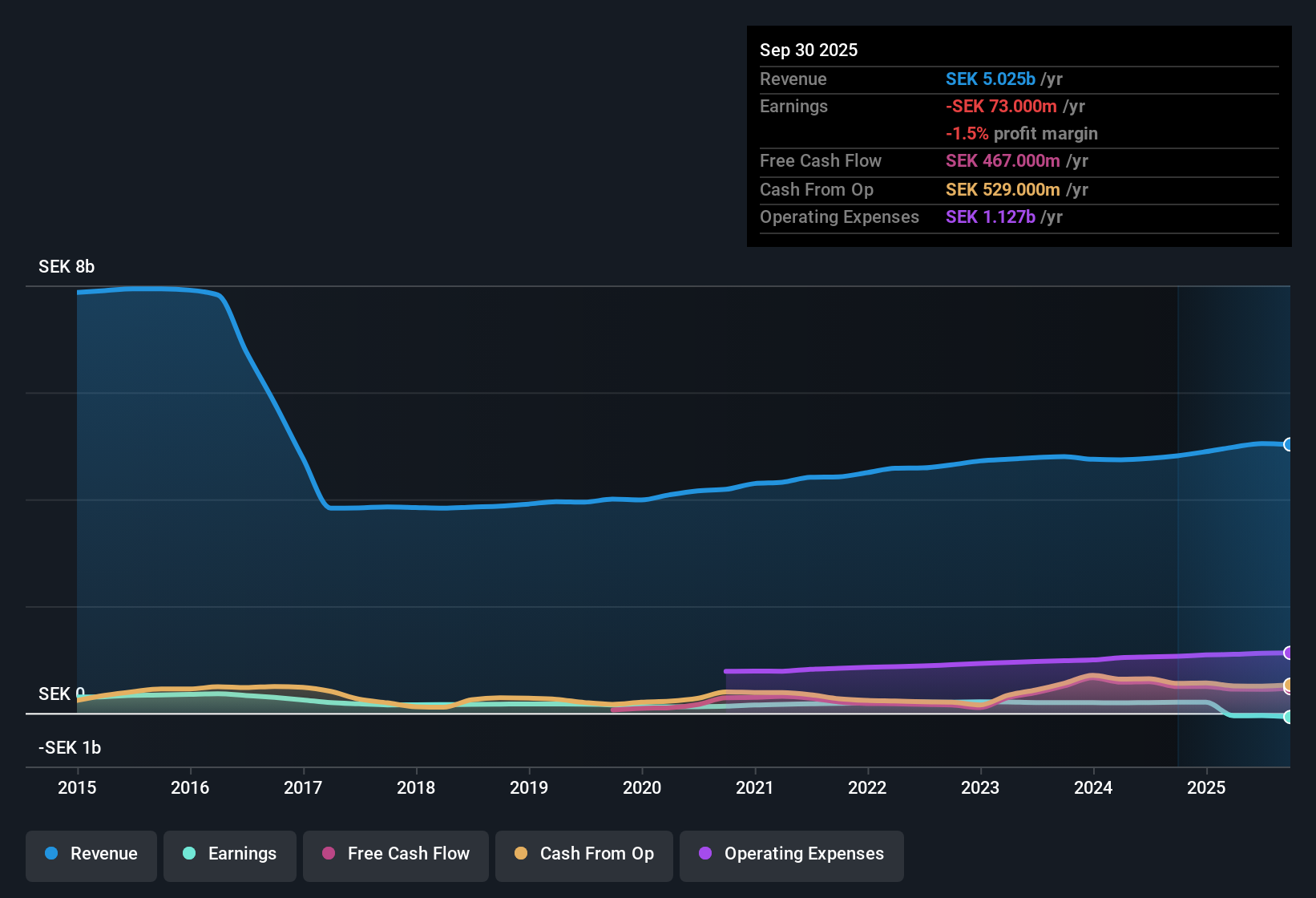

Bergman & Beving (OM:BERG B) is forecast to grow revenue at 4.1% per year, outpacing the Swedish market’s projected 3.3% annual growth. Although the company is currently unprofitable with losses having increased by 9.8% per year over the past five years, earnings are expected to rise by 19.9% per year and profitability could be reached within three years. Investors now face the task of weighing strong top-line growth forecasts against the persistent challenges of negative profit margins and a share price that trades above internal fair value estimates.

See our full analysis for Bergman & Beving.Next up, we will see how these earnings figures match up with the most widely followed stories and expectations around Bergman & Beving, and whether the numbers are shifting the narrative or reinforcing it.

See what the community is saying about Bergman & Beving

Acquisitions Drive Margin Expansion

- Bergman & Beving’s focus on acquiring higher-margin companies like Levypinta and Ovesta has directly supported EBITA margin improvements. The analysts’ consensus narrative views this as a core growth lever for the group.

- According to the consensus narrative, these strategic bolt-on deals are expected to enhance both revenue and profitability,

- analysts point to a target of 45% profitable working capital by fiscal year 2026/27, reinforcing the goal of sustained margin growth.

- Even as the Nordic markets remain weak, a 20-quarter streak of profit increases aligns with this acquisition-focused expansion theme.

- For those tracking how analysts balance monitoring working capital targets with margin trends, the consensus view can help clarify the rationale behind these expansion efforts.

See how analysts weigh acquisitions in the full consensus narrative for a deeper perspective. 📊 Read the full Bergman & Beving Consensus Narrative.

Financing Flexibility Amid Weak Balance Sheet

- While Bergman & Beving has expanded credit facilities and continues to generate strong cash flow, the EDGAR filing flags a major risk tied to the company’s weak financial position.

- Consensus narrative highlights both this heightened risk and the counterbalance:

- management’s strategy to use robust operating cash flow for acquisitions does provide flexibility in the near term,

- but ongoing dependence on external borrowing and lack of significant organic inventory reductions create vulnerability if future sales growth slows or integration lags.

Fair Value Gap and Peer Comparisons

- Bergman & Beving trades at a Price-To-Sales Ratio of 1.8x, less attractive than the European Trade Distributors industry average of 0.5x. However, this represents a relative discount to its direct peer average of 2.4x. The current share price of SEK 322.0 sits above the DCF fair value estimate of SEK 295.61.

- According to the analysts’ consensus narrative:

- the small gap between the current share price and the analyst price target (SEK 353.0) suggests the stock may be fairly valued when considering long-term growth and profitability assumptions,

- but investors are encouraged to stress-test analyst numbers, especially around margin expansion and future PE ratios, to decide if these expectations are achievable given the existing valuation premium versus broader industry benchmarks.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Bergman & Beving on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Have a fresh take on the figures? Take just a few minutes to shape your own narrative and put your perspective front and center. Do it your way

A great starting point for your Bergman & Beving research is our analysis highlighting 1 key reward and 2 important warning signs that could impact your investment decision.

See What Else Is Out There

Bergman & Beving’s reliance on external borrowing and a weak balance sheet leave it vulnerable if sales growth slows or if integration issues arise.

Prefer sturdier finances? Try solid balance sheet and fundamentals stocks screener (1980 results) to discover companies with lower debt and stronger balance sheets, purpose-built to handle market setbacks and uncertainty.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Bergman & Beving might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:BERG B

Bergman & Beving

Provides solutions for the manufacturing and construction sectors in Sweden, Norway, Finland, and internationally.

Reasonable growth potential with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives