- Sweden

- /

- Trade Distributors

- /

- OM:BERG B

Assessing Bergman & Beving’s (OM:BERG B) Valuation After Recent Momentum in Share Price

Reviewed by Simply Wall St

There has not been a specific headline-worthy event driving Bergman & Beving (OM:BERG B) into the spotlight this week. However, the recent movements in its share price have started to pique investor curiosity. For shareholders and those on the sidelines, these subtle changes can sometimes be as telling as bigger market moves. It is worth asking whether the recent uptick signals the market's changing expectations or if it simply reflects the ebb and flow of sentiment in the Swedish capital goods sector.

Looking over the past year, Bergman & Beving’s share price has climbed around 15%, while posting a little over 4% return this month and nearly 12% over the past three months. This pattern hints at a gentle build-up in momentum. This steady performance follows annual revenue and net income growth, despite the company reporting a net loss. There have not been seismic news updates lately, but consistent operational progress and resilience give investors reasons to revisit the company’s valuation story.

After a year of upward movement, is Bergman & Beving trading at a discount, or are markets already looking ahead to price in its next phase of growth?

Most Popular Narrative: Fairly Valued

The current analyst narrative suggests that Bergman & Beving’s shares are fairly valued, trading just slightly above the consensus price target. This signals that analysts see market expectations as closely aligned with long-term financial projections.

The expansion of credit facilities and strong cash flow generation provide financial flexibility to continue their acquisition strategy. This supports long-term revenue and earnings growth. Continuous improvements in profitable working capital, with a target to reach 45% by fiscal year '26-'27, suggest enhancements in operational efficiency, which could improve net margins and overall profitability.

How does a company go from red ink to potential market leader? The market’s fair value math is built on ambitious acquisition fuel, profit turnaround, and an efficiency leap. Want the details behind the numbers driving this precise valuation call? The answer is in the bold projections for growth, margin expansion, and the secret sauce of improved working capital.

Result: Fair Value of SEK330.5 (ABOUT RIGHT)

Have a read of the narrative in full and understand what's behind the forecasts.However, a sluggish Nordic construction market and overreliance on acquisitions could challenge these positive projections if conditions do not improve meaningfully.

Find out about the key risks to this Bergman & Beving narrative.Another View: SWS DCF Model Paints a Different Picture

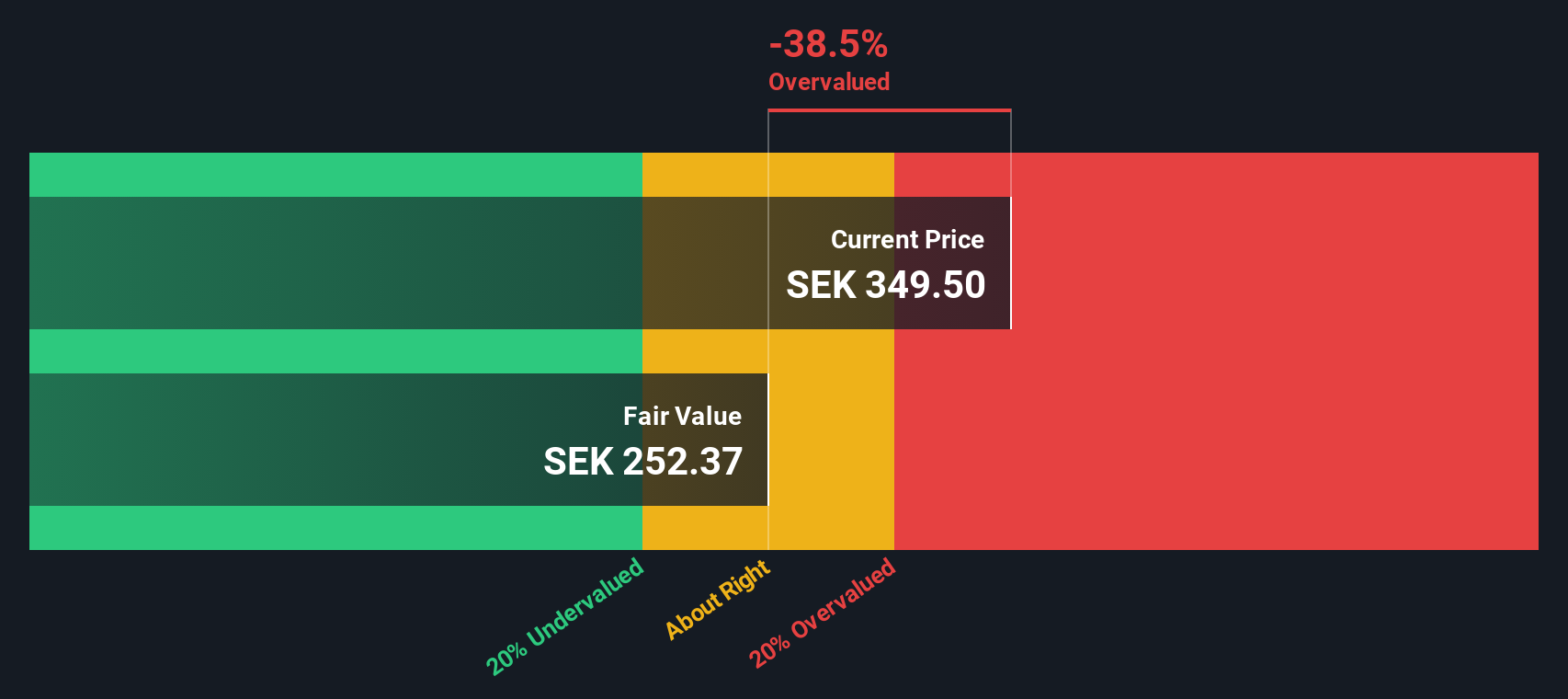

While analysts believe Bergman & Beving trades close to fair value, our SWS DCF model arrives at a much more conservative assessment. This suggests the shares are currently priced above their intrinsic worth. Could one method be overlooking something critical?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Bergman & Beving for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Bergman & Beving Narrative

If you believe a different perspective is warranted or would rather dig into the details yourself, crafting a personal narrative can be done quickly and easily. Often, this process takes less than three minutes. Do it your way

A great starting point for your Bergman & Beving research is our analysis highlighting 1 key reward and 1 important warning sign that could impact your investment decision.

Looking for More Investment Opportunities?

Don’t settle for just one option when the market is full of exciting possibilities. Take advantage of these proven methods to find your next smart move.

- Capitalize on fast-growing sectors by targeting companies making breakthroughs in medical technology with strong potential through healthcare AI stocks.

- Secure consistent income streams by seeking out shares offering robust yields via dividend stocks with yields > 3%.

- Uncover hidden gems trading below their real worth with our go-to route for undervalued market picks using undervalued stocks based on cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Bergman & Beving might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:BERG B

Bergman & Beving

Provides solutions for the manufacturing and construction sectors in Sweden, Norway, Finland, and internationally.

Moderate growth potential with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives