- Sweden

- /

- Trade Distributors

- /

- OM:BEGR

If EPS Growth Is Important To You, BE Group (STO:BEGR) Presents An Opportunity

The excitement of investing in a company that can reverse its fortunes is a big draw for some speculators, so even companies that have no revenue, no profit, and a record of falling short, can manage to find investors. Sometimes these stories can cloud the minds of investors, leading them to invest with their emotions rather than on the merit of good company fundamentals. Loss making companies can act like a sponge for capital - so investors should be cautious that they're not throwing good money after bad.

If this kind of company isn't your style, you like companies that generate revenue, and even earn profits, then you may well be interested in BE Group (STO:BEGR). While this doesn't necessarily speak to whether it's undervalued, the profitability of the business is enough to warrant some appreciation - especially if its growing.

See our latest analysis for BE Group

BE Group's Improving Profits

In business, profits are a key measure of success; and share prices tend to reflect earnings per share (EPS) performance. Which is why EPS growth is looked upon so favourably. Commendations have to be given in seeing that BE Group grew its EPS from kr15.05 to kr54.22, in one short year. While it's difficult to sustain growth at that level, it bodes well for the company's outlook for the future. But the key is discerning whether something profound has changed, or if this is a just a one-off boost.

Top-line growth is a great indicator that growth is sustainable, and combined with a high earnings before interest and taxation (EBIT) margin, it's a great way for a company to maintain a competitive advantage in the market. The good news is that BE Group is growing revenues, and EBIT margins improved by 6.1 percentage points to 12%, over the last year. That's great to see, on both counts.

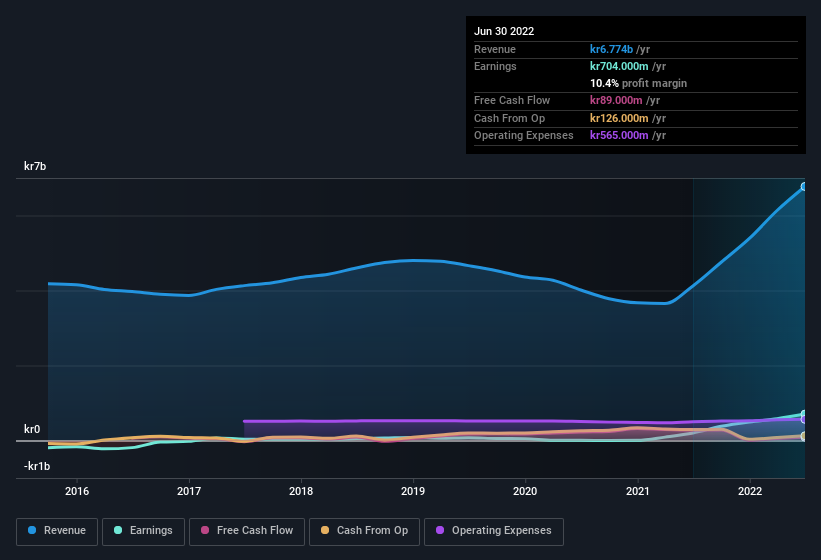

The chart below shows how the company's bottom and top lines have progressed over time. Click on the chart to see the exact numbers.

BE Group isn't a huge company, given its market capitalisation of kr1.5b. That makes it extra important to check on its balance sheet strength.

Are BE Group Insiders Aligned With All Shareholders?

It's said that there's no smoke without fire. For investors, insider buying is often the smoke that indicates which stocks could set the market alight. This view is based on the possibility that stock purchases signal bullishness on behalf of the buyer. However, small purchases are not always indicative of conviction, and insiders don't always get it right.

We note that BE Group insiders spent kr575k on stock, over the last year; in contrast, we didn't see any selling. That's nice to see, because it suggests insiders are optimistic. Zooming in, we can see that the biggest insider purchase was by Independent Chairman Jorgen Zahlin for kr477k worth of shares, at about kr119 per share.

On top of the insider buying, it's good to see that BE Group insiders have a valuable investment in the business. To be specific, they have kr392m worth of shares. That shows significant buy-in, and may indicate conviction in the business strategy. Those holdings account for over 27% of the company; visible skin in the game.

Is BE Group Worth Keeping An Eye On?

BE Group's earnings per share have been soaring, with growth rates sky high. Just as heartening; insiders both own and are buying more stock. These factors seem to indicate the company's potential and that it has reached an inflection point. We'd suggest BE Group belongs near the top of your watchlist. You should always think about risks though. Case in point, we've spotted 4 warning signs for BE Group you should be aware of, and 2 of them are a bit unpleasant.

There are plenty of other companies that have insiders buying up shares. So if you like the sound of BE Group, you'll probably love this free list of growing companies that insiders are buying.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

If you're looking to trade BE Group, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if BE Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About OM:BEGR

BE Group

Operates as a trading and service company in steel, stainless steel, and aluminum products in Sweden, Poland, Finland, and Baltics.

Excellent balance sheet and slightly overvalued.

Similar Companies

Market Insights

Community Narratives