Volvo Cars (OM:VOLCAR B): Valuation in Focus After US Expansion and New Hybrid Launch Plans

Reviewed by Kshitija Bhandaru

Volvo Car AB (publ.) (OM:VOLCAR B) just dropped some big news that is bound to catch the eye of anyone pondering their next stock move. The company is expanding production at its South Carolina plant and plans to launch a new hybrid model designed specifically for the US market before 2030. This strategy is about more than just rolling out another vehicle line; it signals Volvo’s efforts to localize manufacturing, adapt to shifting US demand, and side-step import tariffs that have squeezed global automakers in recent years.

This fresh direction comes as Volvo’s share price has seen both headwinds and hints of momentum. Over the past year, the stock has been under pressure, sliding 34%, but there has been a slight bounce in the past three months with a nearly 7% uptick. The latest move to expand stateside production caps off a year of notable change for the automaker, following both regulatory uncertainty and evolving consumer preferences in the US automotive sector.

With the stock still trading well below last year’s levels, the real question now is whether Volvo’s US production push could unlock new value, or if the shares already reflect the company’s future growth story.

Most Popular Narrative: 8% Overvalued

The prevailing narrative suggests that Volvo Car AB’s current share price sits above its calculated fair value, with analyst models factoring in a range of growth and risk assumptions. While opportunities around US manufacturing expansion exist, analysts remain cautious about upside from here.

Ongoing geopolitical instability and regulatory uncertainty around emissions standards require costly compliance investments and supply chain adaptations. These factors could further strain net margins and delay earnings improvement. Elevated investment needs for electrification, new technologies, and capacity expansions are suppressing free cash flow and delaying the timeline to return to sustainable cash generation. This heightens risks to earnings and capital allocation.

What is fueling this valuation call? The answer may surprise you. Hint: it comes down to bold, but highly debated, projections on future profit margins and how fast the company can pivot to electrification. Want to know the precise financial leaps analysts are baking in and what would need to go right to justify this price? The real drivers behind this fair value might change your mind about where the stock is headed next.

Result: Fair Value of $17.76 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, if Volvo’s local EV ramp-up succeeds or its cost-saving drive delivers results faster than expected, these factors could spark a positive re-rating for the stock.

Find out about the key risks to this Volvo Car AB (publ.) narrative.Another View: Discounted Cash Flow Model Paints a Different Picture

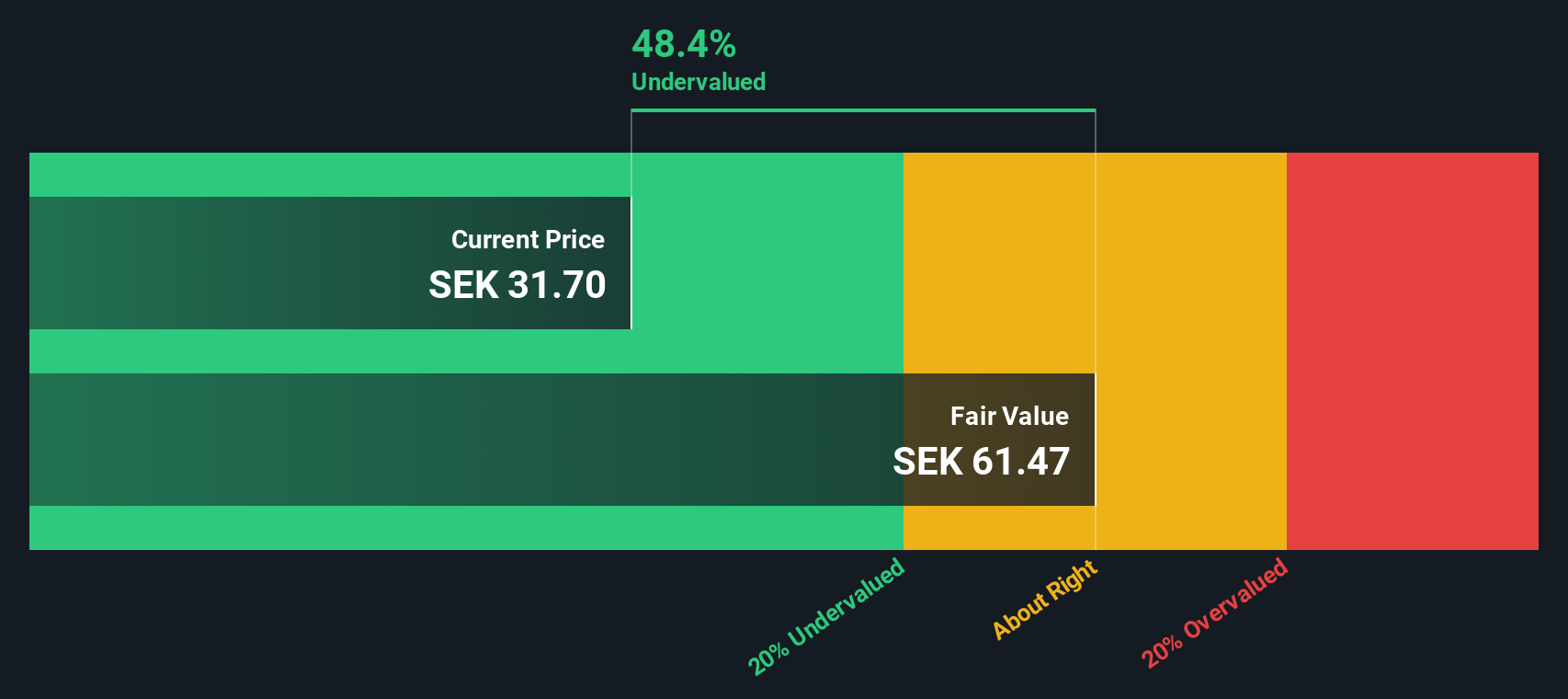

While the first valuation method suggests Volvo Car AB (publ.) may be overvalued, our DCF model offers a sharply contrasting perspective. This indicates the stock could actually be trading at a considerable discount. Which approach gets closer to the truth?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Volvo Car AB (publ.) Narrative

If you're looking to go beyond consensus or want a hands-on approach to analysis, you can dig into the data yourself and shape your own Volvo Car AB (publ.) outlook in just a few minutes. Do it your way

A great starting point for your Volvo Car AB (publ.) research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Investment Ideas?

Smart investors never limit themselves to one stock. Tap into tomorrow’s biggest opportunities by checking out these standout screens powered by Simply Wall Street’s research engine.

- Unlock fast-growing potential and unearth hidden gems by checking out penny stocks with strong financials that are shaking up the market with robust fundamentals.

- Bag strong income streams with companies that offer dividend stocks with yields > 3% yielding over 3%, giving your portfolio a steady boost.

- Ride the momentum of innovation by seeing what’s possible when you invest in AI penny stocks that are shaping entire industries with artificial intelligence breakthroughs.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:VOLCAR B

Volvo Car AB (publ.)

Designs, develops, manufactures, markets, and sells cars in Sweden and internationally.

Flawless balance sheet with moderate growth potential.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Agfa-Gevaert is a digital and materials turnaround opportunity, with growth potential in ZIRFON, but carrying legacy risks.

Hitit Bilgisayar Hizmetleri will achieve a 19.7% revenue boost in the next five years

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)