- Saudi Arabia

- /

- Electric Utilities

- /

- SASE:5110

BFF Bank And Two More Stocks Considered Below Estimated True Value

Reviewed by Simply Wall St

As global markets exhibit a notably broad advance, with indices like the Russell 2000 Index showing significant gains, investors may find opportunities in sectors that are currently undervalued. In such an environment, identifying stocks that are trading below their estimated true value could offer potential for appreciation as market conditions evolve.

Top 10 Undervalued Stocks Based On Cash Flows

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Noble (NYSE:NE) | US$46.86 | US$93.04 | 49.6% |

| Truecaller (OM:TRUE B) | SEK35.40 | SEK70.79 | 50% |

| Hanjaya Mandala Sampoerna (IDX:HMSP) | IDR745.00 | IDR1483.43 | 49.8% |

| Metsä Board Oyj (HLSE:METSB) | €7.235 | €14.46 | 50% |

| RaySearch Laboratories (OM:RAY B) | SEK139.40 | SEK277.33 | 49.7% |

| Guerbet (ENXTPA:GBT) | €39.65 | €79.11 | 49.9% |

| INKON Life Technology (SZSE:300143) | CN¥7.39 | CN¥14.64 | 49.5% |

| Jiangsu Chuanzhiboke Education Technology (SZSE:003032) | CN¥8.70 | CN¥17.27 | 49.6% |

| Lumi Gruppen (OB:LUMI) | NOK12.90 | NOK25.78 | 50% |

| MediaAlpha (NYSE:MAX) | US$13.98 | US$27.76 | 49.6% |

Here's a peek at a few of the choices from the screener.

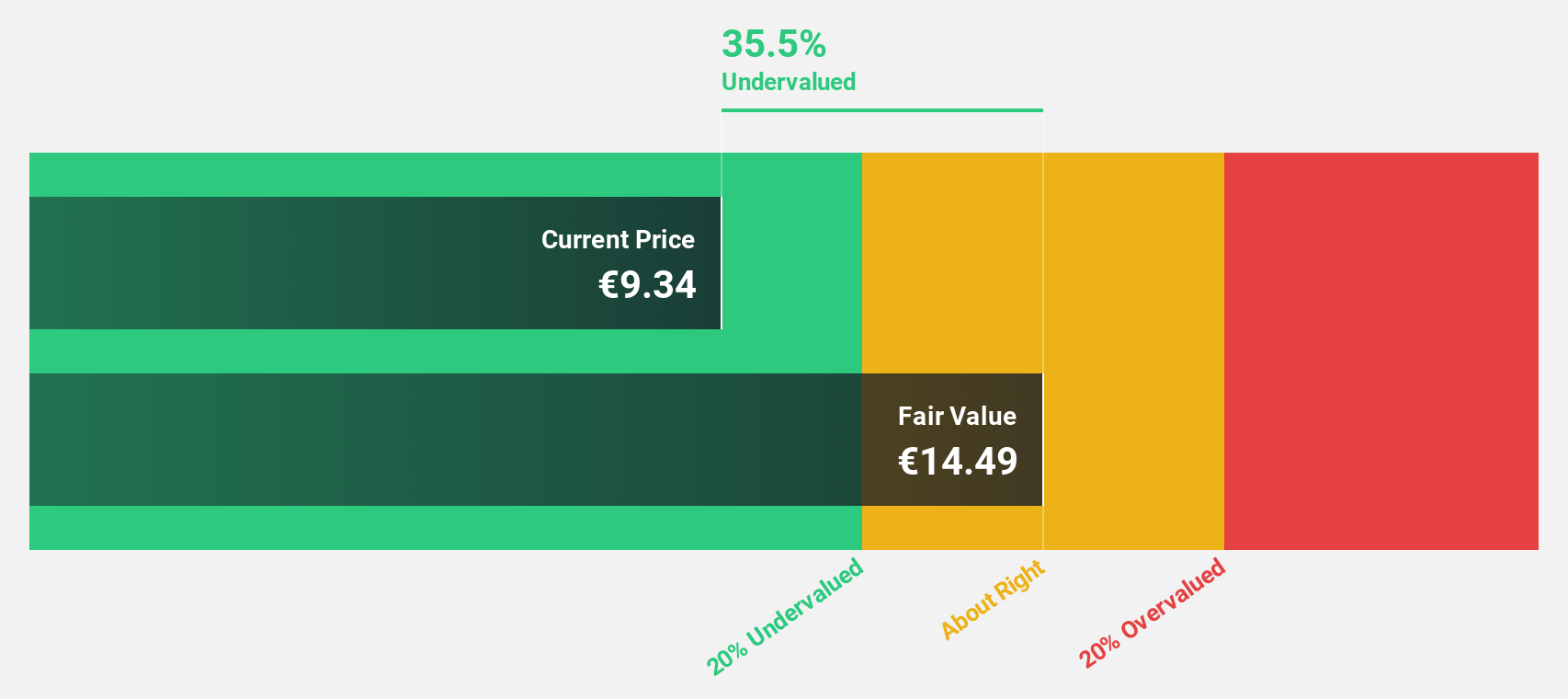

BFF Bank (BIT:BFF)

Overview: BFF Bank S.p.A. offers financial services to suppliers of the national health system and public administration sectors across Italy and several other European countries, with a market capitalization of approximately €2.01 billion.

Operations: The bank's revenue from commercial financial services totals approximately €0.41 billion.

Estimated Discount To Fair Value: 33.1%

BFF Bank, with a recent earnings report showing a net income of €39.31 million, down from €48.4 million last year, still holds potential based on cash flow analysis. Despite the decline, BFF is trading at 33.1% below its estimated fair value and is forecasted to grow earnings by 15.07% annually, outpacing the Italian market's 5.1%. However, its dividend sustainability is questionable as it isn't well covered by earnings or free cash flows. The bank's share price has shown high volatility recently.

- In light of our recent growth report, it seems possible that BFF Bank's financial performance will exceed current levels.

- Dive into the specifics of BFF Bank here with our thorough financial health report.

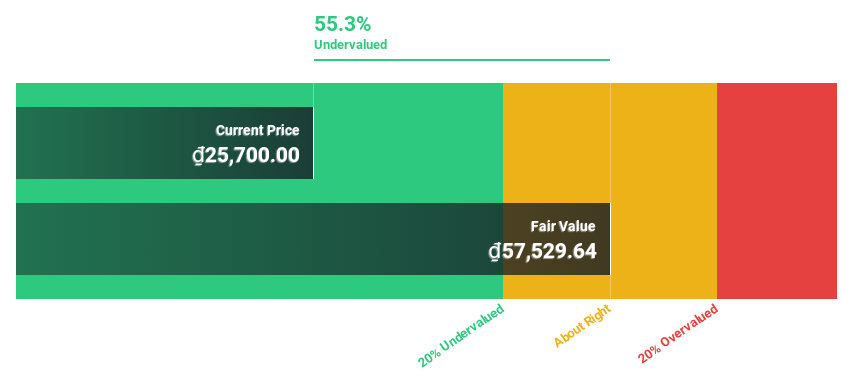

Military Commercial Bank (HOSE:MBB)

Overview: Military Commercial Joint Stock Bank offers banking services to both organizations and individuals domestically in Vietnam and on an international scale, with a market capitalization of approximately ₫132.13 trillion.

Operations: The bank generates its revenue through a variety of banking services provided to both corporate entities and private individuals across local and international markets.

Estimated Discount To Fair Value: 46.4%

Military Commercial Joint Stock Bank, despite a recent leadership overhaul and significant corporate actions like a VND 20,000 billion bond issuance, remains undervalued based on cash flow analysis. Trading at ₫24,900 against a fair value of ₫46,460.67 reflects a substantial discount. Forecasted revenue growth at 20.3% annually surpasses the Vietnamese market's 16.8%, with earnings expected to expand by 17.35% per year. However, its earnings growth slightly lags behind the broader market forecast of 18.2%.

- Our growth report here indicates Military Commercial Bank may be poised for an improving outlook.

- Get an in-depth perspective on Military Commercial Bank's balance sheet by reading our health report here.

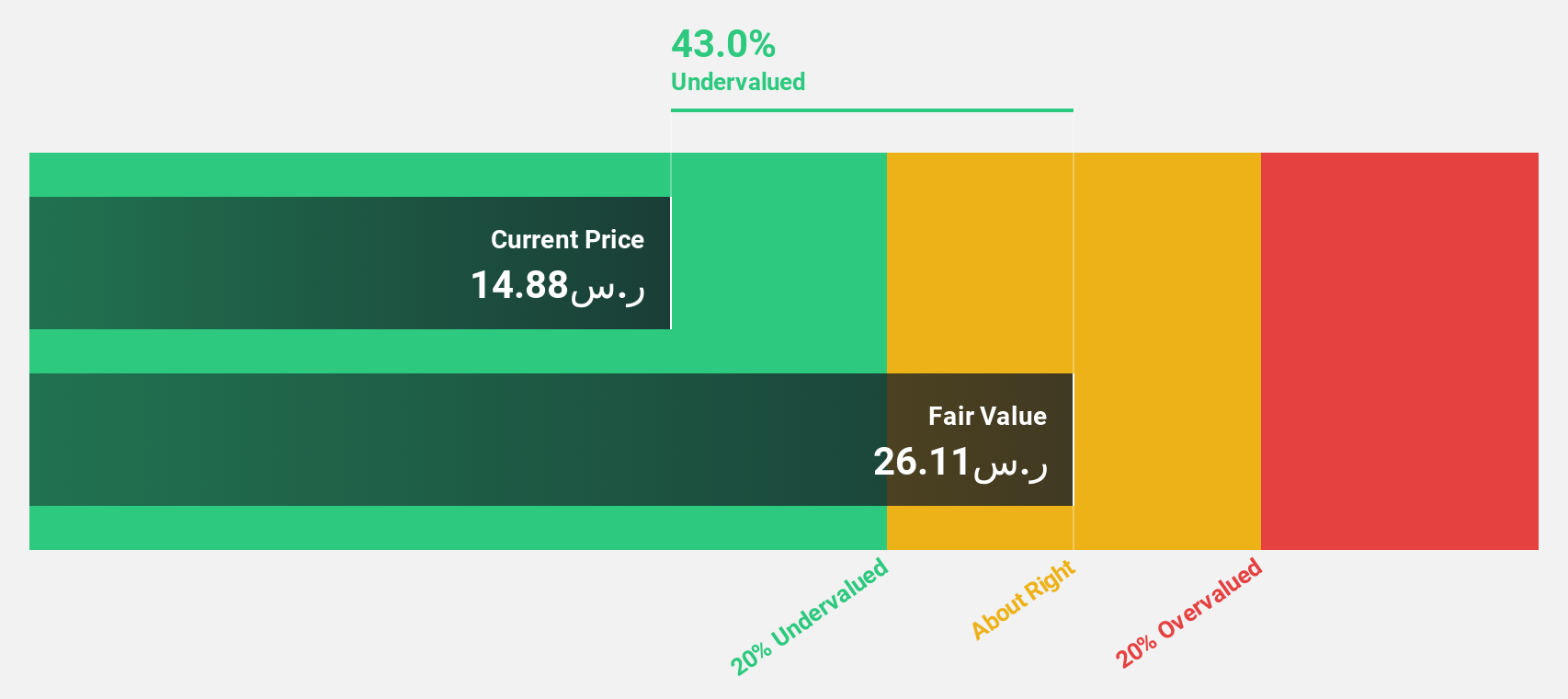

Saudi Electricity (SASE:5110)

Overview: Saudi Electricity Company, operating in Saudi Arabia, engages in the generation, transmission, and distribution of electricity across various sectors with a market capitalization of approximately SAR 69.83 billion.

Operations: The company generates significant revenue through its primary operations, with SAR 71.69 billion from its core activities and SAR 26.10 billion from the National Grid Company.

Estimated Discount To Fair Value: 23.7%

Saudi Electricity, with a current price of SAR16.8, appears undervalued by over 20%, assessed at a fair value of SAR22.02 based on discounted cash flow analysis. Despite this, challenges persist as the company's return on equity is expected to remain low at 7.3% in three years, and its dividend coverage by earnings and free cash flows is weak. Recent strategic moves include partnering with NAMI to innovate using 3D printing for spare parts production, aiming to cut costs and enhance supply chain efficiency which could support future financial performance.

- Our comprehensive growth report raises the possibility that Saudi Electricity is poised for substantial financial growth.

- Delve into the full analysis health report here for a deeper understanding of Saudi Electricity.

Seize The Opportunity

- Get an in-depth perspective on all 970 Undervalued Stocks Based On Cash Flows by using our screener here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SASE:5110

Saudi Electricity

Generates, transmits, and distributes electricity to governmental, industrial, agricultural, commercial, and residential consumers in the Kingdom of Saudi Arabia.

Reasonable growth potential second-rate dividend payer.

Market Insights

Community Narratives