- Norway

- /

- Oil and Gas

- /

- OB:VAR

Vår Energi And Two Other Companies Estimated To Be Trading Below Their Intrinsic Values

Reviewed by Simply Wall St

In the current global market landscape, investors are navigating a complex environment marked by cautious Federal Reserve commentary and political uncertainty, which have contributed to broad-based declines in U.S. stocks and volatility across international markets. Despite these challenges, opportunities may exist in stocks that are trading below their intrinsic values, offering potential for growth as market conditions stabilize. Identifying undervalued stocks involves assessing a company's financial health, growth prospects, and valuation metrics relative to its peers and broader market trends.

Top 10 Undervalued Stocks Based On Cash Flows

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Clear Secure (NYSE:YOU) | US$26.66 | US$53.14 | 49.8% |

| Sudarshan Chemical Industries (BSE:506655) | ₹1129.90 | ₹2252.82 | 49.8% |

| Hanza (OM:HANZA) | SEK76.20 | SEK151.92 | 49.8% |

| HealthEquity (NasdaqGS:HQY) | US$94.95 | US$189.22 | 49.8% |

| Aguas Andinas (SNSE:AGUAS-A) | CLP293.50 | CLP584.13 | 49.8% |

| Ingenia Communities Group (ASX:INA) | A$4.62 | A$9.19 | 49.7% |

| South Atlantic Bancshares (OTCPK:SABK) | US$15.02 | US$29.98 | 49.9% |

| KebNi (OM:KEBNI B) | SEK1.09 | SEK2.17 | 49.8% |

| RENK Group (DB:R3NK) | €18.342 | €36.50 | 49.7% |

| iFLYTEKLTD (SZSE:002230) | CN¥51.75 | CN¥103.29 | 49.9% |

We're going to check out a few of the best picks from our screener tool.

Vår Energi (OB:VAR)

Overview: Vår Energi AS is an independent upstream oil and gas company operating on the Norwegian continental shelf, with a market cap of NOK84.90 billion.

Operations: The company generates revenue of $7.39 billion from its oil and gas exploration and production activities on the Norwegian continental shelf.

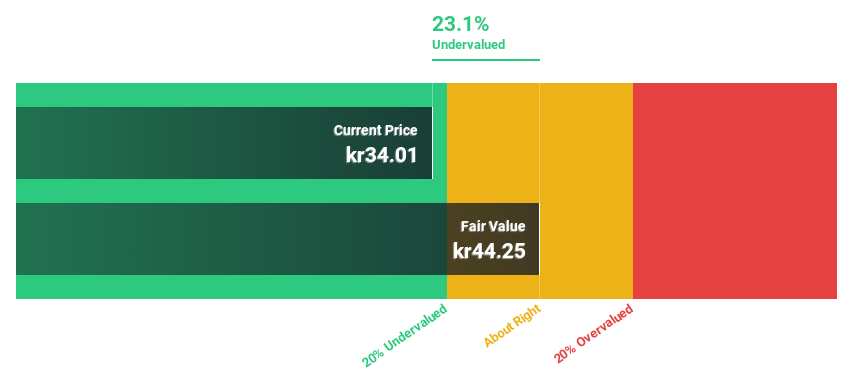

Estimated Discount To Fair Value: 23.1%

Vår Energi is trading at NOK34.01, below its fair value estimate of NOK44.23, suggesting it may be undervalued based on cash flows. Despite high debt levels and a dividend not well-covered by earnings, the company's forecasted earnings growth of 16.7% annually outpaces the Norwegian market's 9.6%. Recent oil discoveries in the Barents Sea enhance future production potential, while revenue for Q3 2024 increased to US$1.87 billion from US$1.62 billion year-over-year.

- Our earnings growth report unveils the potential for significant increases in Vår Energi's future results.

- Navigate through the intricacies of Vår Energi with our comprehensive financial health report here.

ACWA Power (SASE:2082)

Overview: ACWA Power Company, along with its subsidiaries, focuses on the investment, development, operation, and maintenance of power generation, water desalination, and green hydrogen production plants both in Saudi Arabia and internationally; it has a market cap of SAR283.06 billion.

Operations: The company's revenue is derived from its Renewables segment, which generated SAR1.71 billion, and its Thermal and Water Desalination segment, which contributed SAR4.66 billion.

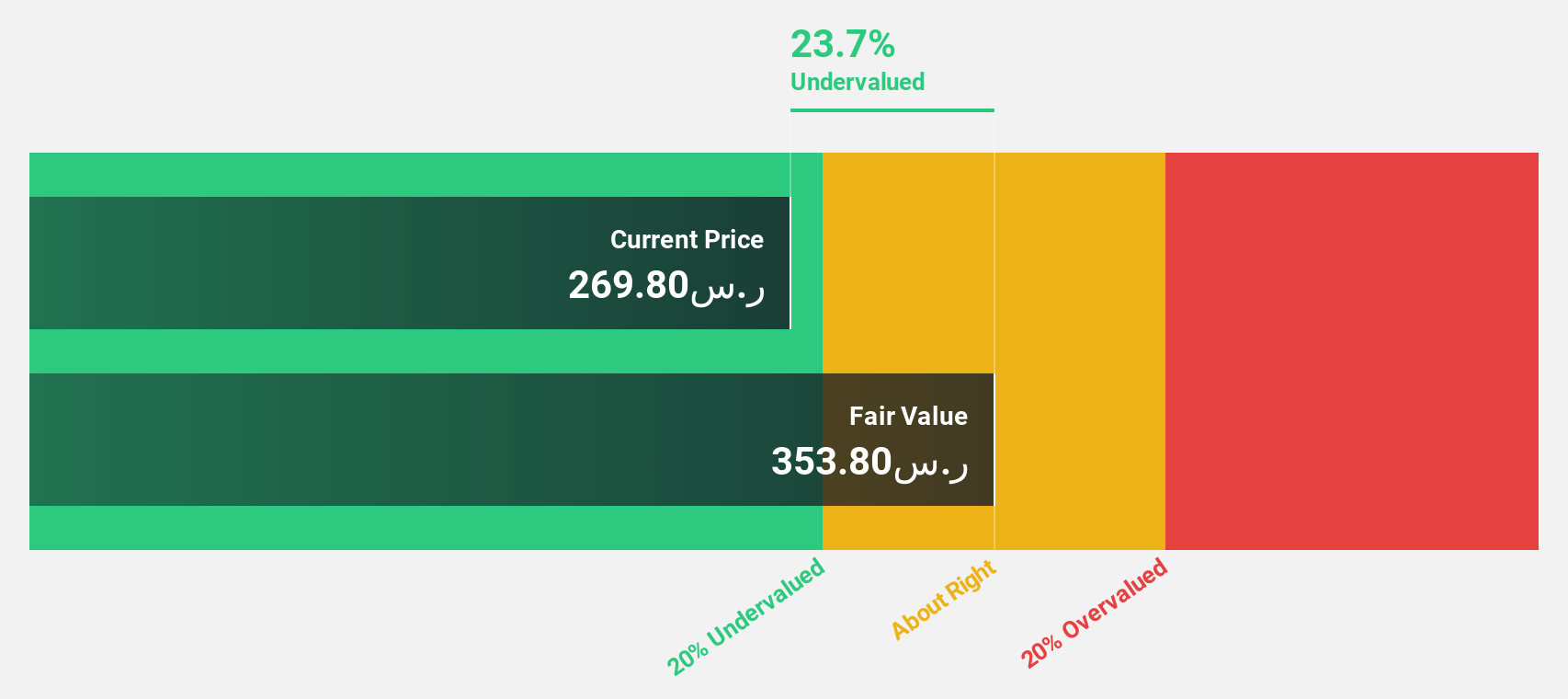

Estimated Discount To Fair Value: 34.4%

ACWA Power is trading at SAR386.4, significantly below its estimated fair value of SAR589.02, highlighting potential undervaluation based on cash flows. Despite interest payments not being well covered by earnings and a forecasted low return on equity of 13.2% in three years, the company's earnings are projected to grow significantly at 22.6% annually, surpassing the SA market's growth rate of 5.9%. Recent Q3 results showed increased sales but lower net income compared to last year.

- In light of our recent growth report, it seems possible that ACWA Power's financial performance will exceed current levels.

- Get an in-depth perspective on ACWA Power's balance sheet by reading our health report here.

Appier Group (TSE:4180)

Overview: Appier Group, Inc. is a software-as-a-service company that offers artificial intelligence platforms to help enterprises make data-driven decisions both in Japan and internationally, with a market cap of ¥155.21 billion.

Operations: The company's revenue is primarily derived from its AI SaaS Business, which generated ¥32.19 billion.

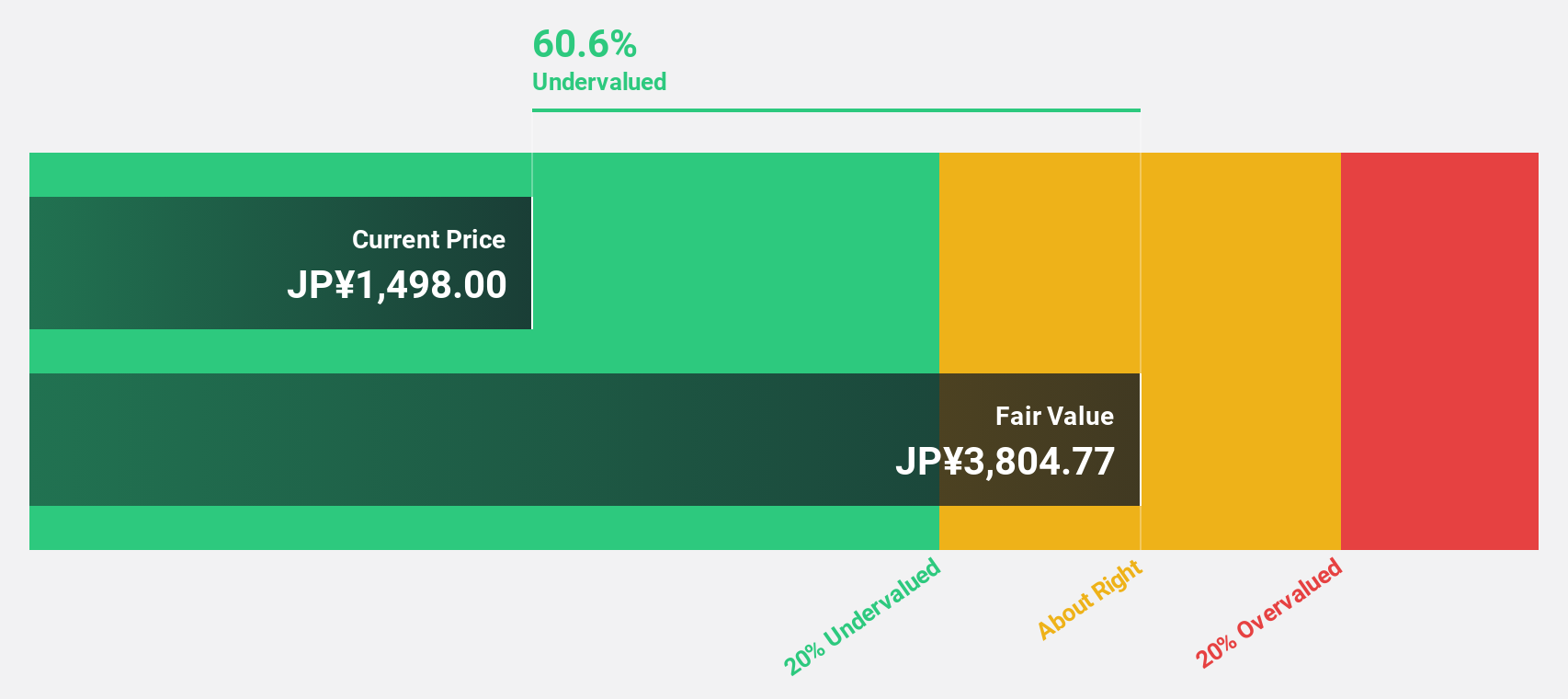

Estimated Discount To Fair Value: 48.2%

Appier Group, trading at ¥1522, is significantly undervalued with a fair value estimate of ¥2940.08. The company's earnings are expected to grow at 36.2% annually over the next three years, outpacing the JP market's growth rate of 7.9%. Despite high share price volatility recently and a forecasted low return on equity of 16.1%, Appier's strategic buybacks and dividend initiation reflect strong cash flow management and shareholder value focus.

- Insights from our recent growth report point to a promising forecast for Appier Group's business outlook.

- Click here and access our complete balance sheet health report to understand the dynamics of Appier Group.

Taking Advantage

- Take a closer look at our Undervalued Stocks Based On Cash Flows list of 875 companies by clicking here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OB:VAR

Vår Energi

Operates as an independent upstream oil and gas company on the Norwegian continental shelf in Norway.

Good value with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives