- Saudi Arabia

- /

- Renewable Energy

- /

- SASE:2082

3 Stocks Estimated To Be Trading Below Their Intrinsic Value

Reviewed by Simply Wall St

As global markets experience a rebound, driven by easing core inflation in the U.S. and strong bank earnings, investors are increasingly focused on value stocks, which have recently outperformed growth shares. In this environment, identifying undervalued stocks—those trading below their intrinsic value—can be a prudent strategy for investors seeking opportunities amidst fluctuating economic conditions.

Top 10 Undervalued Stocks Based On Cash Flows

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Atlantic Union Bankshares (NYSE:AUB) | US$37.87 | US$75.61 | 49.9% |

| Dongsung FineTec (KOSDAQ:A033500) | ₩18390.00 | ₩36679.19 | 49.9% |

| Thai Coconut (SET:COCOCO) | THB10.80 | THB21.59 | 50% |

| Gaming Realms (AIM:GMR) | £0.36 | £0.72 | 49.9% |

| Sudarshan Chemical Industries (BSE:506655) | ₹1114.70 | ₹2219.89 | 49.8% |

| Equity Bancshares (NYSE:EQBK) | US$43.13 | US$86.02 | 49.9% |

| LifeMD (NasdaqGM:LFMD) | US$4.90 | US$9.77 | 49.8% |

| Shinko Electric Industries (TSE:6967) | ¥5879.00 | ¥11701.39 | 49.8% |

| Hd Hyundai MipoLtd (KOSE:A010620) | ₩129300.00 | ₩257307.05 | 49.7% |

| Vista Group International (NZSE:VGL) | NZ$3.11 | NZ$6.18 | 49.7% |

Underneath we present a selection of stocks filtered out by our screen.

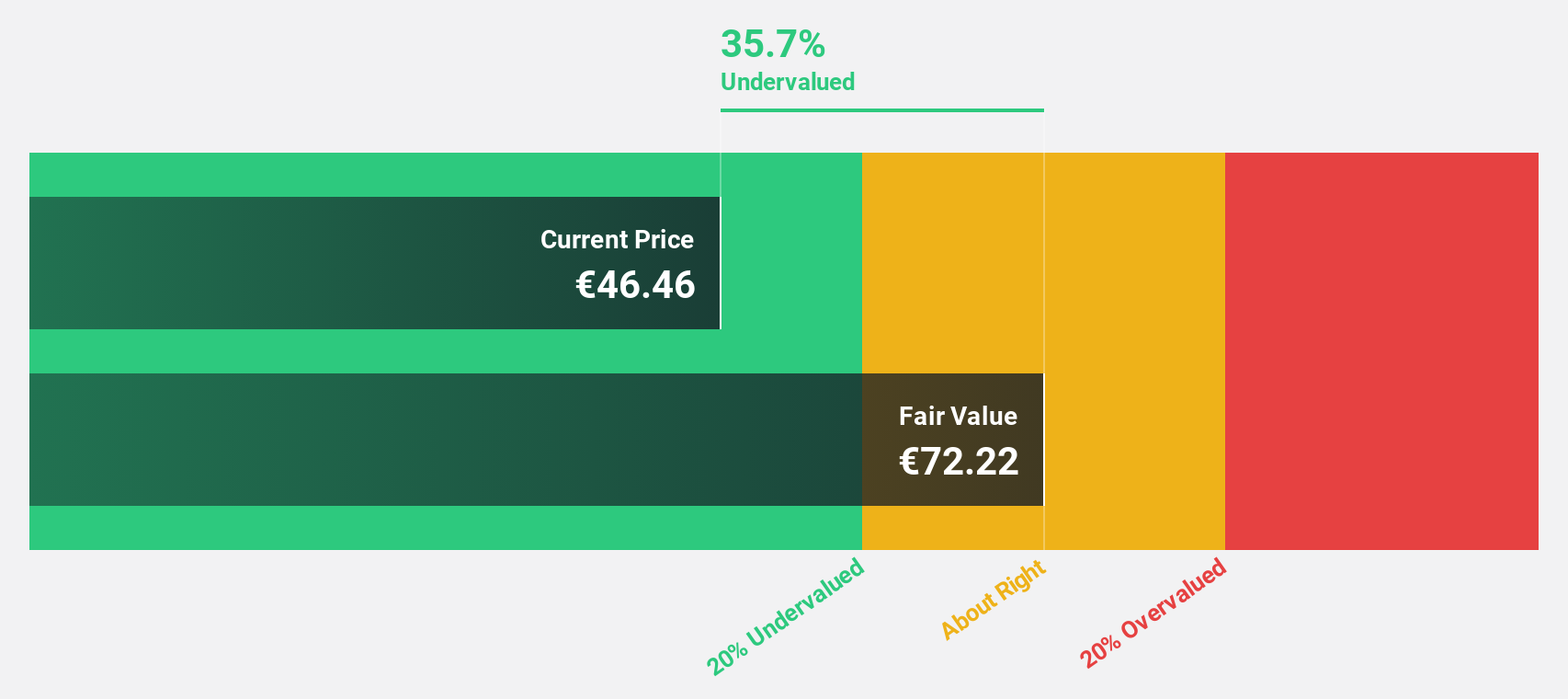

SPIE (ENXTPA:SPIE)

Overview: SPIE SA offers multi-technical services in energy and communications across France, Germany, the Netherlands, and internationally, with a market cap of €5.32 billion.

Operations: The company's revenue segments include €1.89 billion from North-Western Europe and €684.90 million from Global Services Energy.

Estimated Discount To Fair Value: 48%

SPIE is trading at €31.5, significantly below its estimated fair value of €60.57, suggesting it may be undervalued based on cash flows. Despite a high level of debt and large one-off items affecting earnings quality, SPIE's earnings are forecast to grow over 20% annually, outpacing the French market's growth rate. Analysts anticipate a potential stock price increase of nearly 30%. However, its dividend track record remains unstable.

- Our earnings growth report unveils the potential for significant increases in SPIE's future results.

- Click here to discover the nuances of SPIE with our detailed financial health report.

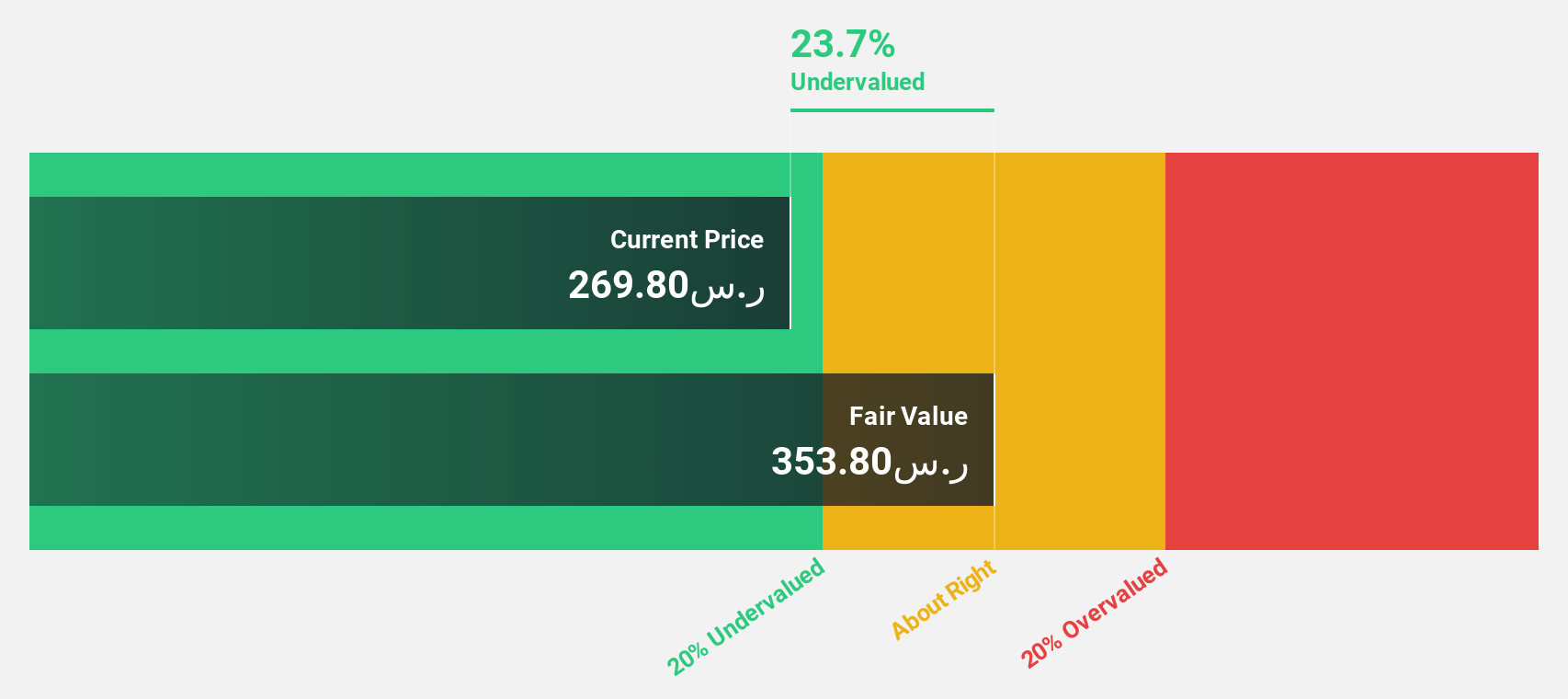

ACWA Power (SASE:2082)

Overview: ACWA Power Company, with a market cap of SAR318.81 billion, is involved in the investment, development, operation, and maintenance of power generation, water desalination, and green hydrogen production plants both in Saudi Arabia and internationally.

Operations: The company's revenue is derived from its operations in renewables, generating SAR1.71 billion, and thermal and water desalination, contributing SAR4.66 billion.

Estimated Discount To Fair Value: 22.8%

ACWA Power is trading at SAR 435.2, over 20% below its estimated fair value of SAR 563.85, indicating potential undervaluation based on cash flows. Despite interest payments not being well covered by earnings and a low forecasted return on equity of 13.2%, the company's earnings are expected to grow significantly by more than 22% annually, surpassing the Saudi market's growth rate. Recent board changes may also influence strategic direction positively.

- In light of our recent growth report, it seems possible that ACWA Power's financial performance will exceed current levels.

- Take a closer look at ACWA Power's balance sheet health here in our report.

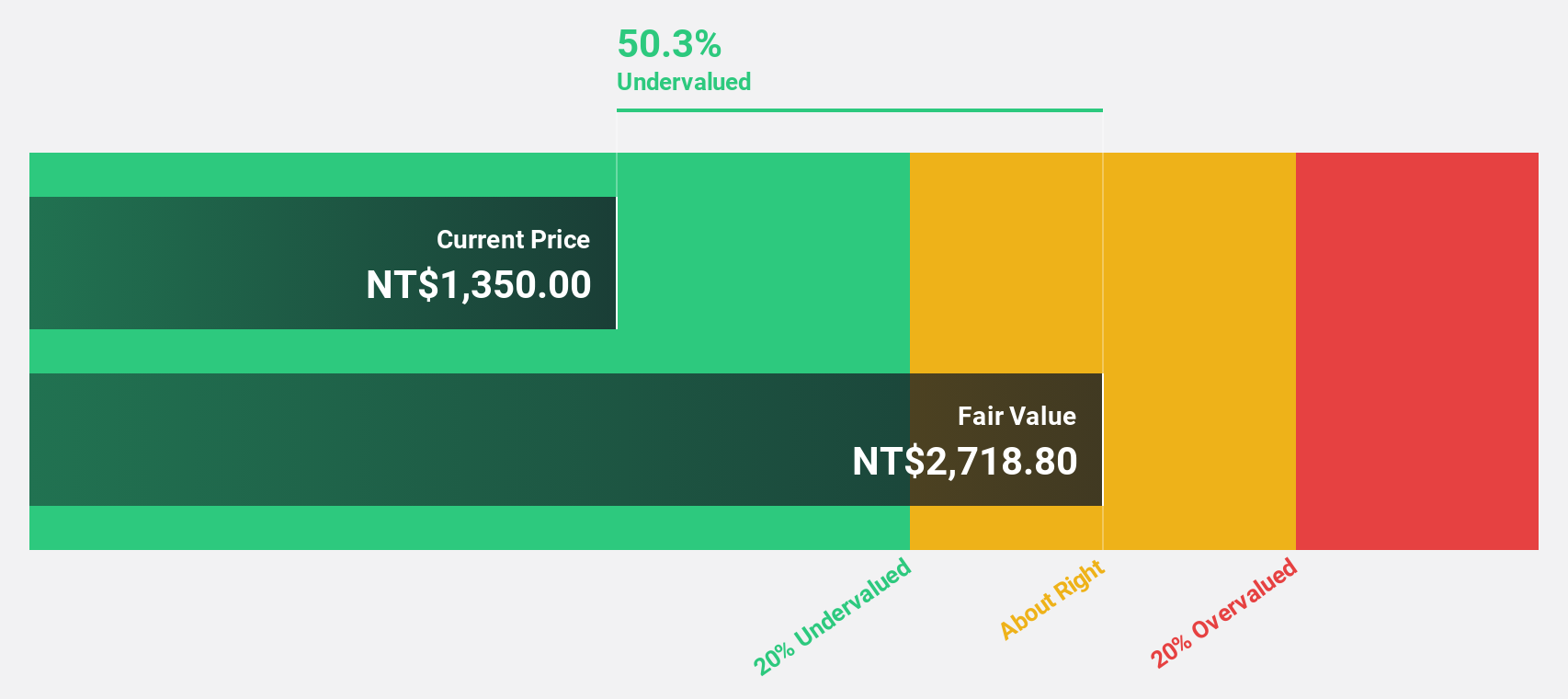

Lotes (TWSE:3533)

Overview: Lotes Co., Ltd designs, manufactures, and sells electronic interconnect and hardware components in Taiwan, Mainland China, and internationally with a market cap of NT$204.25 billion.

Operations: The company generates revenue primarily from its Electronic Components & Parts segment, which amounts to NT$28.36 billion.

Estimated Discount To Fair Value: 33.6%

Lotes is trading at NT$1,815, significantly below its estimated fair value of NT$2,733.75, suggesting potential undervaluation based on cash flows. The company's earnings grew by 31.8% over the past year and are forecast to grow at 20.3% annually, outpacing the Taiwan market's growth rate. Recent earnings reports show strong performance with third-quarter sales reaching NT$8.07 billion and net income rising to NT$2.06 billion from last year’s figures.

- Our expertly prepared growth report on Lotes implies its future financial outlook may be stronger than recent results.

- Click here and access our complete balance sheet health report to understand the dynamics of Lotes.

Summing It All Up

- Delve into our full catalog of 875 Undervalued Stocks Based On Cash Flows here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SASE:2082

ACWA Power

Engages in the investment, development, operation, and maintenance of power generation, water desalination, and green hydrogen production plants in the Kingdom of Saudi Arabia and internationally.

Reasonable growth potential with proven track record.