- Saudi Arabia

- /

- Insurance

- /

- SASE:8200

Saudi Reinsurance Company's (TADAWUL:8200) Price Is Right But Growth Is Lacking After Shares Rocket 27%

Saudi Reinsurance Company (TADAWUL:8200) shares have continued their recent momentum with a 27% gain in the last month alone. The annual gain comes to 153% following the latest surge, making investors sit up and take notice.

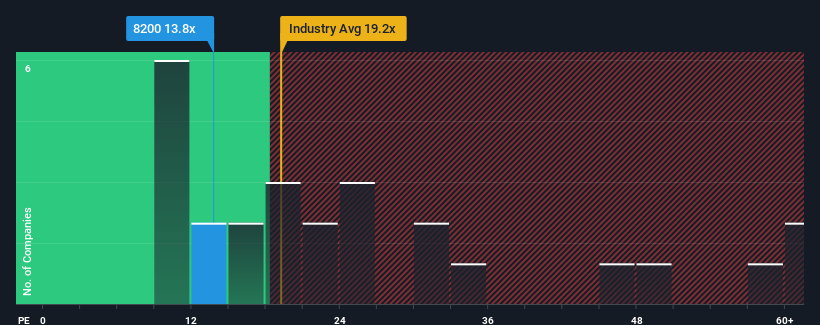

Even after such a large jump in price, Saudi Reinsurance may still be sending bullish signals at the moment with its price-to-earnings (or "P/E") ratio of 13.8x, since almost half of all companies in Saudi Arabia have P/E ratios greater than 25x and even P/E's higher than 42x are not unusual. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the reduced P/E.

With earnings growth that's superior to most other companies of late, Saudi Reinsurance has been doing relatively well. One possibility is that the P/E is low because investors think this strong earnings performance might be less impressive moving forward. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

See our latest analysis for Saudi Reinsurance

How Is Saudi Reinsurance's Growth Trending?

Saudi Reinsurance's P/E ratio would be typical for a company that's only expected to deliver limited growth, and importantly, perform worse than the market.

Retrospectively, the last year delivered an exceptional 336% gain to the company's bottom line. Pleasingly, EPS has also lifted 551% in aggregate from three years ago, thanks to the last 12 months of growth. Accordingly, shareholders would have probably welcomed those medium-term rates of earnings growth.

Looking ahead now, EPS is anticipated to slump, contracting by 75% during the coming year according to the one analyst following the company. That's not great when the rest of the market is expected to grow by 16%.

With this information, we are not surprised that Saudi Reinsurance is trading at a P/E lower than the market. Nonetheless, there's no guarantee the P/E has reached a floor yet with earnings going in reverse. Even just maintaining these prices could be difficult to achieve as the weak outlook is weighing down the shares.

What We Can Learn From Saudi Reinsurance's P/E?

The latest share price surge wasn't enough to lift Saudi Reinsurance's P/E close to the market median. While the price-to-earnings ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of earnings expectations.

As we suspected, our examination of Saudi Reinsurance's analyst forecasts revealed that its outlook for shrinking earnings is contributing to its low P/E. Right now shareholders are accepting the low P/E as they concede future earnings probably won't provide any pleasant surprises. Unless these conditions improve, they will continue to form a barrier for the share price around these levels.

Plus, you should also learn about these 4 warning signs we've spotted with Saudi Reinsurance (including 2 which are potentially serious).

You might be able to find a better investment than Saudi Reinsurance. If you want a selection of possible candidates, check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SASE:8200

Saudi Reinsurance

Provides various reinsurance products in the Kingdom of Saudi Arabia, rest of the Middle East, Africa, Asia, and internationally.

Solid track record with adequate balance sheet.