- Saudi Arabia

- /

- Transportation

- /

- SASE:4261

Insider-Owned Growth Stocks To Watch In December 2024

Reviewed by Simply Wall St

As global markets navigate a landscape of mixed economic signals, including rate cuts by the ECB and SNB and expectations for a Fed cut, growth stocks have continued to outperform value stocks, with the Nasdaq Composite reaching new heights. Amidst these market dynamics, insider ownership can be an important indicator of confidence in a company's growth potential.

Top 10 Growth Companies With High Insider Ownership

| Name | Insider Ownership | Earnings Growth |

| Archean Chemical Industries (NSEI:ACI) | 22.9% | 41.3% |

| Seojin SystemLtd (KOSDAQ:A178320) | 30.9% | 39.9% |

| Propel Holdings (TSX:PRL) | 36.9% | 37.6% |

| Medley (TSE:4480) | 34% | 31.7% |

| Laopu Gold (SEHK:6181) | 36.4% | 34.2% |

| Pharma Mar (BME:PHM) | 11.8% | 56.2% |

| Plenti Group (ASX:PLT) | 12.8% | 120.1% |

| Brightstar Resources (ASX:BTR) | 16.2% | 84.5% |

| Fine M-TecLTD (KOSDAQ:A441270) | 17.2% | 131.1% |

| Credo Technology Group Holding (NasdaqGS:CRDO) | 13.5% | 65.9% |

Let's review some notable picks from our screened stocks.

HANA Micron (KOSDAQ:A067310)

Simply Wall St Growth Rating: ★★★★★★

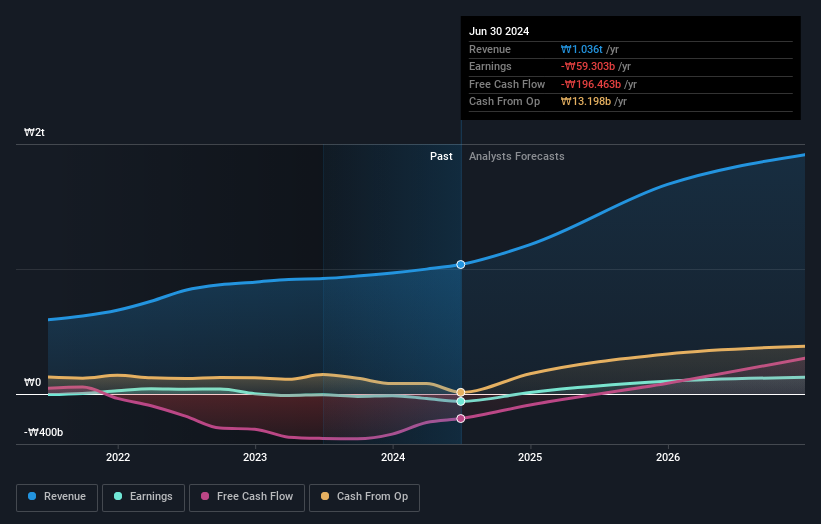

Overview: HANA Micron Inc. is a South Korean company specializing in semiconductor back-end process packaging solutions, with a market cap of approximately ₩576.15 billion.

Operations: The company's revenue is primarily derived from its semiconductor manufacturing segment, which accounts for ₩1.58 billion, followed by the semiconductor material segment at ₩227.92 million.

Insider Ownership: 18.4%

Return On Equity Forecast: 24% (2027 estimate)

HANA Micron is trading at a significant discount to its estimated fair value and relative to peers, suggesting potential for appreciation. Despite recent shareholder dilution and a net loss of KRW 29.97 billion for the first nine months of 2024, revenue growth is robust at an expected rate of 22.9% annually, outpacing market averages. The company is projected to achieve profitability within three years with strong forecasted earnings growth of over 110% annually.

- Click here to discover the nuances of HANA Micron with our detailed analytical future growth report.

- Our valuation report here indicates HANA Micron may be undervalued.

Theeb Rent A Car (SASE:4261)

Simply Wall St Growth Rating: ★★★★☆☆

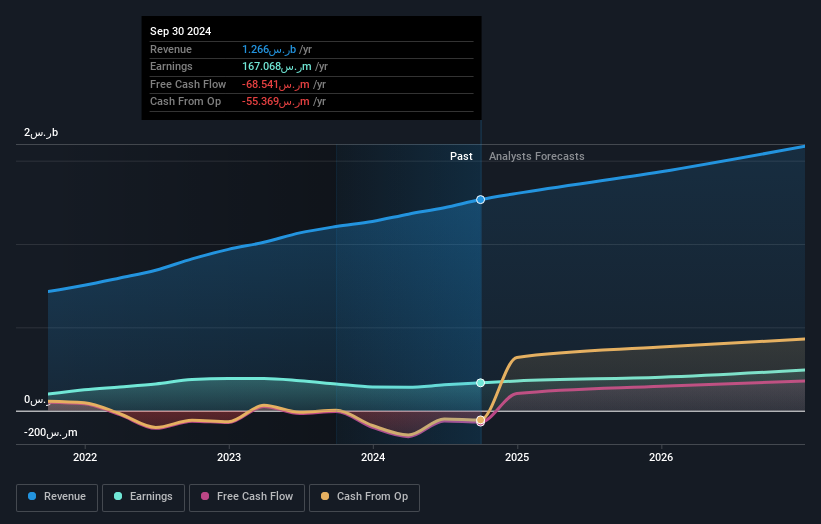

Overview: Theeb Rent A Car Company operates in the Kingdom of Saudi Arabia, offering car rental and leasing services, with a market capitalization of SAR3.42 billion.

Operations: The company's revenue segments comprise Lease services at SAR455.15 million, Car Sales at SAR312.68 million, and Short Term Lease services generating SAR498.59 million.

Insider Ownership: 25.5%

Return On Equity Forecast: 24% (2027 estimate)

Theeb Rent A Car's recent earnings report shows solid growth, with Q3 sales rising to SAR 337.4 million from SAR 288.41 million last year and net income increasing to SAR 46.49 million from SAR 34.33 million. Despite a slower forecasted revenue growth of 7.5% annually, it outpaces the Saudi Arabian market average decline of -1%. The company's earnings are expected to grow at a robust rate of 16.12% per year, exceeding market expectations, while maintaining a reasonable P/E ratio of 20.5x compared to the broader market's higher valuation.

- Unlock comprehensive insights into our analysis of Theeb Rent A Car stock in this growth report.

- Insights from our recent valuation report point to the potential overvaluation of Theeb Rent A Car shares in the market.

Grand Process Technology (TPEX:3131)

Simply Wall St Growth Rating: ★★★★★★

Overview: Grand Process Technology Corporation is a Taiwanese company focused on the manufacturing and sale of semiconductor equipment, with a market cap of NT$52.15 billion.

Operations: The company's revenue is derived from the Equipment Manufacturing Segment (NT$1.79 billion), Chemical Materials Manufacturing Department (NT$1.12 billion), Equipment Sales Agent Department (NT$912.46 million), and Software Sales Department (NT$62.60 million).

Insider Ownership: 12.5%

Return On Equity Forecast: 32% (2027 estimate)

Grand Process Technology's earnings report highlights significant growth, with Q3 sales reaching TWD 991.69 million, up from TWD 830.36 million last year, and net income rising to TWD 216.82 million from TWD 158.61 million. Despite past shareholder dilution and recent share price volatility, the company is expected to experience substantial annual earnings growth of 37.7%, outpacing the TW market average of 19.2%. Analysts anticipate a stock price increase of 22.5%.

- Delve into the full analysis future growth report here for a deeper understanding of Grand Process Technology.

- Our valuation report unveils the possibility Grand Process Technology's shares may be trading at a premium.

Seize The Opportunity

- Embark on your investment journey to our 1522 Fast Growing Companies With High Insider Ownership selection here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Valuation is complex, but we're here to simplify it.

Discover if Theeb Rent A Car might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SASE:4261

Theeb Rent A Car

Provides car rental and leasing services in the Kingdom of Saudi Arabia.

Moderate growth potential and slightly overvalued.

Similar Companies

Market Insights

Community Narratives