- United Arab Emirates

- /

- Banks

- /

- ADX:UAB

Discovering Middle East's Undiscovered Gems For October 2025

Reviewed by Simply Wall St

As Middle Eastern markets show resilience with most Gulf indices gaining amid investor anticipation of earnings, the focus remains on key economic indicators and market sentiment that are shaping investment landscapes. Despite a dip in Saudi Arabia's bourse due to weaker banking results, other regions like Dubai and Abu Dhabi have seen modest gains, reflecting a cautious optimism among investors. In this dynamic environment, identifying promising stocks often involves looking for companies with strong fundamentals and growth potential that align with current market trends and economic conditions.

Top 10 Undiscovered Gems With Strong Fundamentals In The Middle East

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Al Wathba National Insurance Company PJSC | 10.97% | 10.37% | 3.14% | ★★★★★★ |

| Rimoni Industries | NA | 1.42% | -1.24% | ★★★★★★ |

| Sure Global Tech | NA | 10.11% | 15.42% | ★★★★★★ |

| Terminal X Online | 14.88% | 12.11% | 41.14% | ★★★★★★ |

| Nofoth Food Products | NA | 15.49% | 26.47% | ★★★★★★ |

| Najran Cement | 14.76% | -3.67% | -26.79% | ★★★★★★ |

| Mackolik Internet Hizmetleri Ticaret | 0.03% | 13.83% | 35.58% | ★★★★★☆ |

| Bulbuloglu Vinc Sanayi ve Ticaret Anonim Sirketi | 21.47% | 16.40% | 50.84% | ★★★★★☆ |

| Gür-Sel Turizm Tasimacilik ve Servis Ticaret | 7.00% | 41.89% | 59.39% | ★★★★★☆ |

| Mobiltel Iletisim Hizmetleri Sanayi ve Ticaret | 21.21% | 19.59% | -34.35% | ★★★★☆☆ |

We'll examine a selection from our screener results.

United Arab Bank P.J.S.C (ADX:UAB)

Simply Wall St Value Rating: ★★★★★☆

Overview: United Arab Bank P.J.S.C. offers commercial banking products and services to institutional and corporate clients in the United Arab Emirates, with a market capitalization of AED4.02 billion.

Operations: United Arab Bank P.J.S.C. generates revenue primarily from Wholesale Banking (AED468.96 million), followed by Treasury and Capital Markets (AED209.62 million) and Retail Banking (AED74.79 million).

United Arab Bank, with a total asset base of AED 23.9 billion and equity of AED 2.8 billion, is making waves with its recent 35.4% earnings growth, outperforming the industry average of 14.4%. The bank's low price-to-earnings ratio of 10.9x indicates good value compared to the AE market at 12.5x. Despite a high level of bad loans at 2.2%, UAB maintains a sufficient allowance for these, standing at 148%. Recent amendments to its Articles of Association and a follow-on equity offering highlight its strategic focus on capital expansion and growth.

- Unlock comprehensive insights into our analysis of United Arab Bank P.J.S.C stock in this health report.

Assess United Arab Bank P.J.S.C's past performance with our detailed historical performance reports.

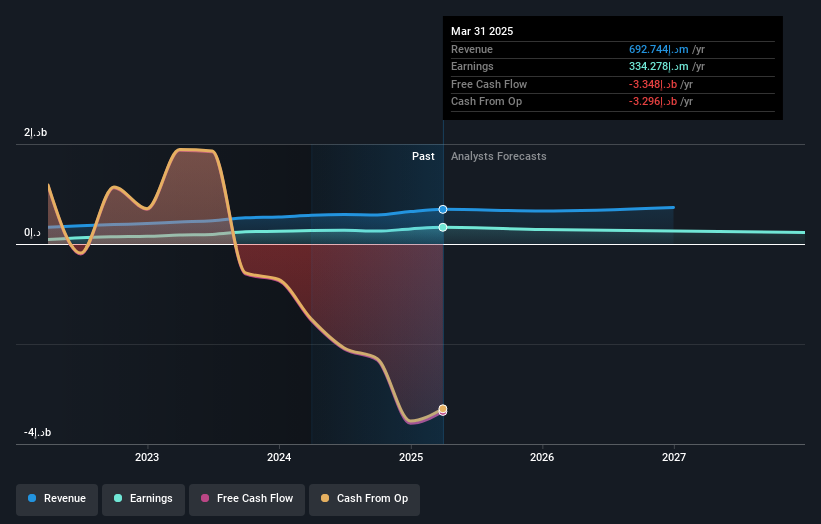

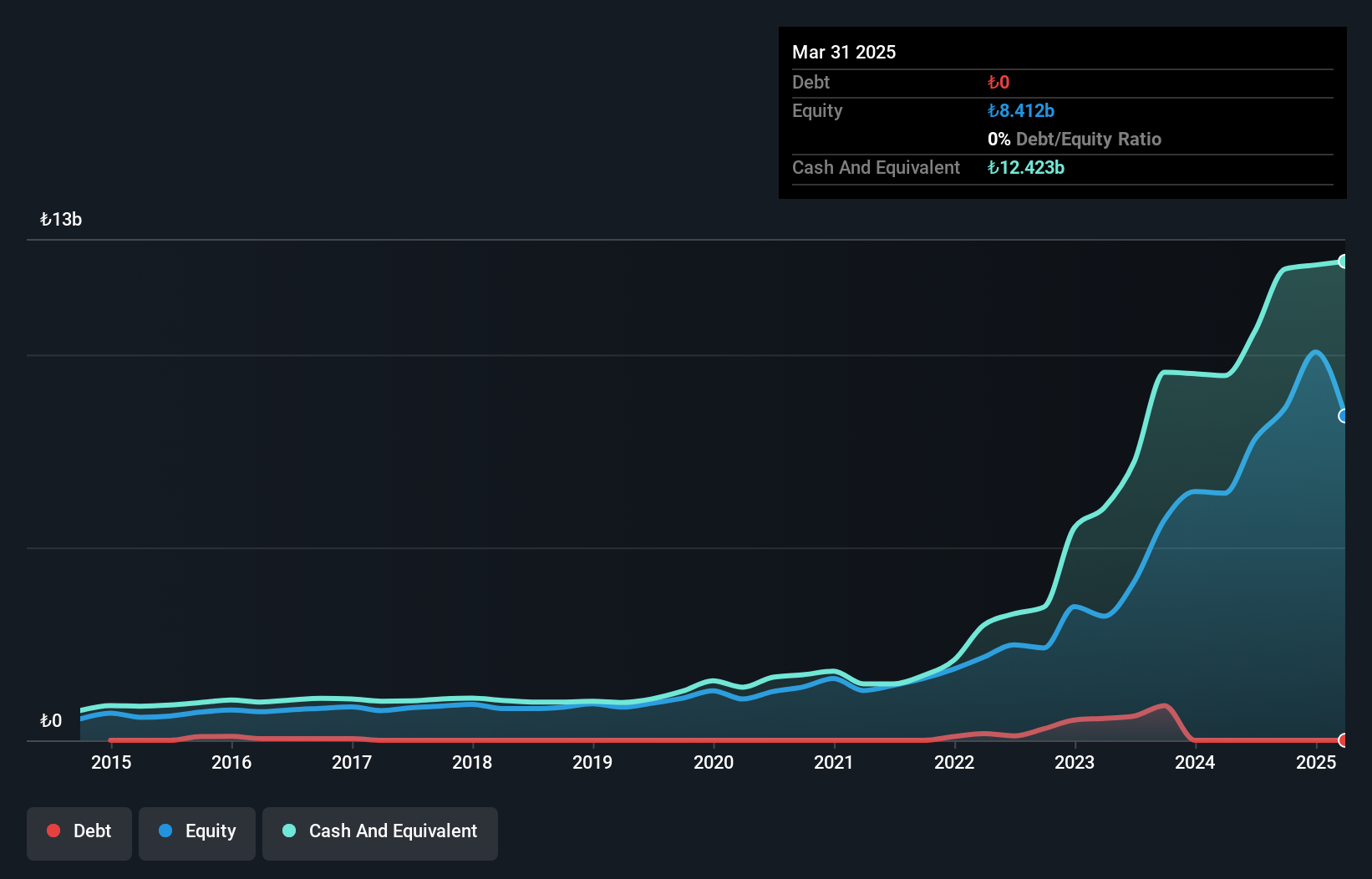

Anadolu Hayat Emeklilik Anonim Sirketi (IBSE:ANHYT)

Simply Wall St Value Rating: ★★★★★★

Overview: Anadolu Hayat Emeklilik Anonim Sirketi operates in Turkey, offering individual and group insurance and reinsurance services across life, retirement, and personal accident sectors with a market capitalization of TRY39.86 billion.

Operations: The company generates revenue primarily from its life insurance segment, amounting to TRY23.42 billion, followed by the retirement segment at TRY6.85 billion. The non-life insurance segment contributes minimally with TRY4.71 million in revenue.

Anadolu Hayat Emeklilik, a Turkish insurance player, showcases robust financial health with no debt, eliminating concerns over interest payments. Over the past five years, earnings have consistently grown at 47.6% annually, indicating solid performance. Despite a price-to-earnings ratio of 9.1x, which is notably lower than the TR market's 21.5x, the company remains a value proposition. Recent earnings reports reveal net income at TRY 1,416.78 million for Q2 2025, up from TRY 1,221.76 million the previous year, and a six-month figure of TRY 2,523.9 million, reflecting stable profitability.

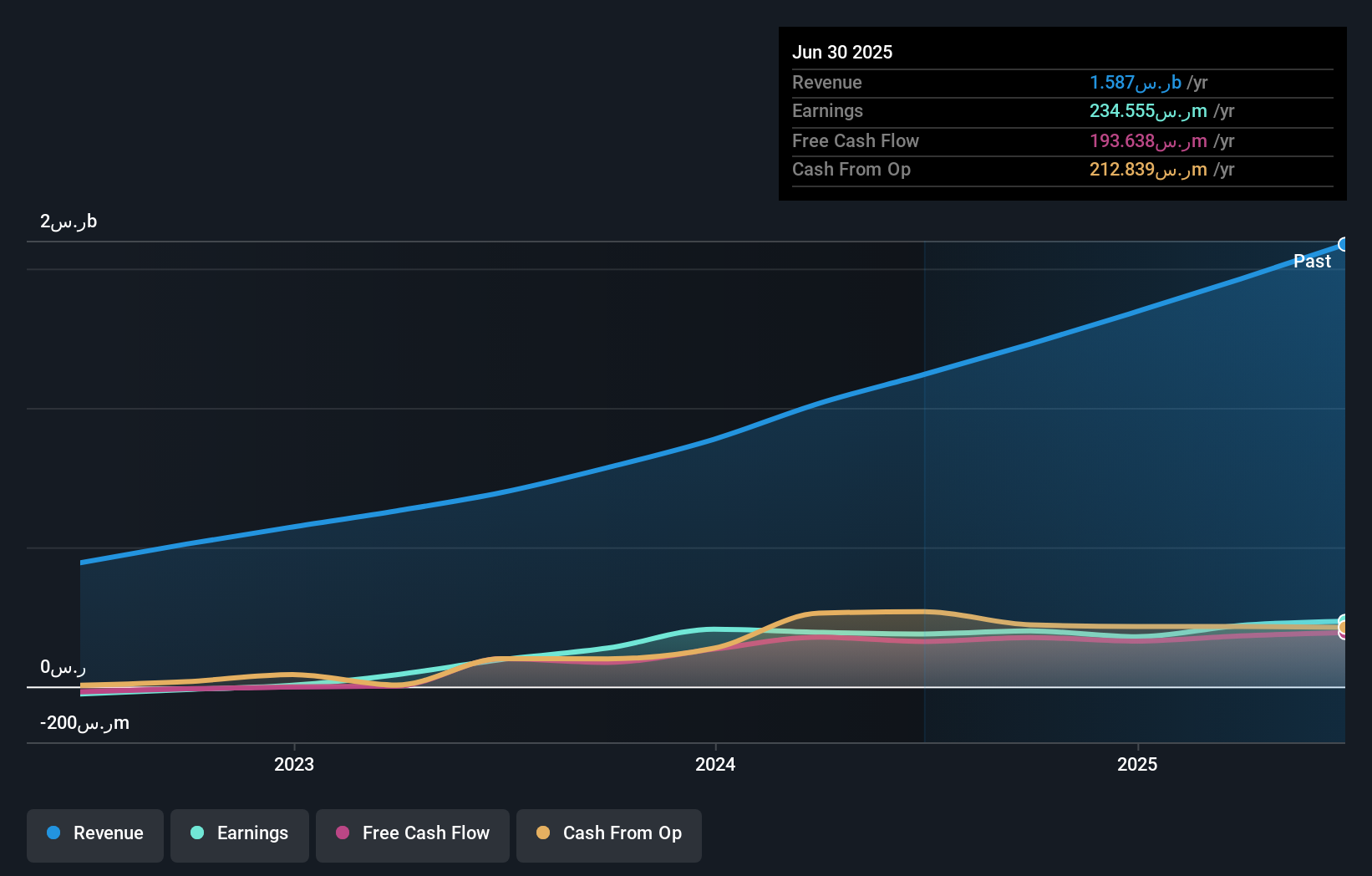

Etihad Atheeb Telecommunication (SASE:7040)

Simply Wall St Value Rating: ★★★★★☆

Overview: Etihad Atheeb Telecommunication Company offers telecommunication products and services to individuals and businesses in Saudi Arabia and internationally, with a market capitalization of SAR3.67 billion.

Operations: The company's revenue streams are primarily from data services generating SAR652.71 million and voice services contributing SAR837.64 million.

Etihad Atheeb Telecom, a notable player in the Middle East telecom sector, has shown impressive earnings growth of 24.2% over the past year, outpacing the industry average of 6.6%. The company's financial health is underscored by its cash position, which exceeds total debt, and a price-to-earnings ratio of 15.6x, offering good value compared to the SA market's 21x. Recent developments include a SAR 48.90 million project with the Ministry of National Guard Health Affairs and a SAR 10.20 million dividend distribution, reflecting robust operational and shareholder engagement strategies.

Turning Ideas Into Actions

- Reveal the 208 hidden gems among our Middle Eastern Undiscovered Gems With Strong Fundamentals screener with a single click here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ADX:UAB

United Arab Bank P.J.S.C

Together with its subsidiary, provides commercial banking products and services for institutional and corporate customers in the United Arab Emirates.

Excellent balance sheet with proven track record.

Market Insights

Community Narratives