- Saudi Arabia

- /

- IT

- /

- SASE:9543

3 Middle Eastern Dividend Stocks Yielding Up To 6.6%

Reviewed by Simply Wall St

As Gulf markets experience gains driven by hopes of U.S. rate cuts, tempered by ongoing trade tensions, investors in the Middle East are closely watching economic indicators and third-quarter earnings reports for further cues. In this dynamic environment, dividend stocks can offer a stable income stream, making them an attractive option for those seeking to navigate the current market volatility.

Top 10 Dividend Stocks In The Middle East

| Name | Dividend Yield | Dividend Rating |

| Saudi Telecom (SASE:7010) | 9.33% | ★★★★★☆ |

| Saudi National Bank (SASE:1180) | 5.20% | ★★★★★☆ |

| Saudi Awwal Bank (SASE:1060) | 6.18% | ★★★★★☆ |

| Riyad Bank (SASE:1010) | 6.42% | ★★★★★☆ |

| National General Insurance (P.J.S.C.) (DFM:NGI) | 7.53% | ★★★★★☆ |

| National Bank of Ras Al-Khaimah (P.S.C.) (ADX:RAKBANK) | 6.54% | ★★★★★☆ |

| Emirates NBD Bank PJSC (DFM:EMIRATESNBD) | 3.89% | ★★★★★☆ |

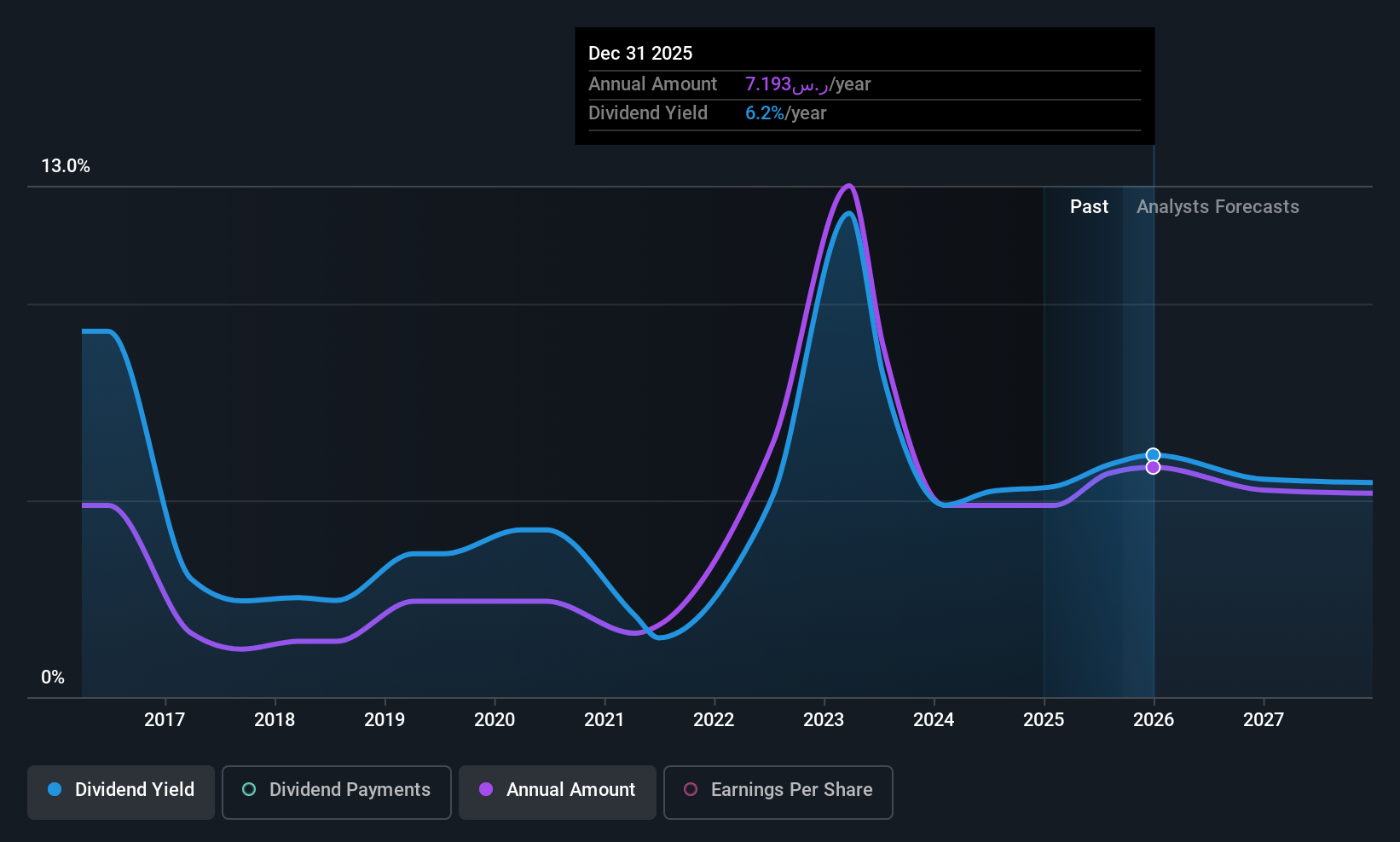

| Emaar Properties PJSC (DFM:EMAAR) | 7.19% | ★★★★★☆ |

| Commercial Bank of Dubai PSC (DFM:CBD) | 5.17% | ★★★★★☆ |

| Anadolu Hayat Emeklilik Anonim Sirketi (IBSE:ANHYT) | 6.29% | ★★★★★☆ |

Click here to see the full list of 68 stocks from our Top Middle Eastern Dividend Stocks screener.

We'll examine a selection from our screener results.

SABIC Agri-Nutrients (SASE:2020)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: SABIC Agri-Nutrients Company is involved in the production, conversion, manufacturing, marketing, and trade of agri-nutrients and chemical products across several countries including Singapore, the United States, India, and others; it has a market cap of SAR57.89 billion.

Operations: SABIC Agri-Nutrients Company's revenue primarily comes from its Agri-Nutrients segment, generating SAR11.72 billion, with an additional contribution of SAR506.94 million from Petrochemicals.

Dividend Yield: 5.8%

SABIC Agri-Nutrients offers a compelling dividend yield of 5.79%, placing it in the top 25% of payers in the SA market, though its sustainability is questionable due to coverage issues with free cash flows. Despite volatile and unreliable dividends over the past decade, recent financial performance shows growth, with Q2 2025 net income rising to SAR 1.06 billion from SAR 705.34 million year-on-year, supporting a recent interim dividend increase to SAR 3.5 per share.

- Click here to discover the nuances of SABIC Agri-Nutrients with our detailed analytical dividend report.

- Upon reviewing our latest valuation report, SABIC Agri-Nutrients' share price might be too pessimistic.

Saudi Networkers Services (SASE:9543)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Saudi Networkers Services Company operates in the implementation, establishment, maintenance, operation, installation, and management of telecommunication networks in Saudi Arabia and Algeria with a market cap of SAR462 million.

Operations: Saudi Networkers Services Company generates revenue from its Computer Services segment, totaling SAR586.10 million.

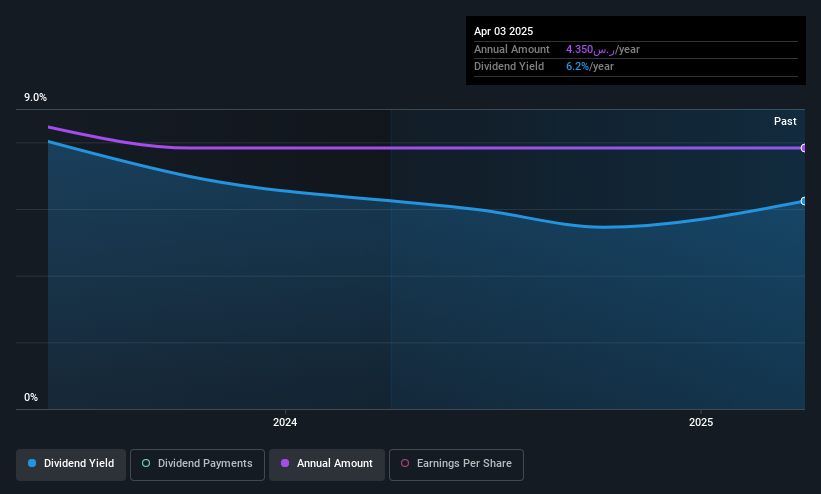

Dividend Yield: 5.6%

Saudi Networkers Services demonstrates a robust dividend profile, with a yield of 5.65% ranking among the top 25% in Saudi Arabia. Despite only three years of consistent payments, dividends are stable and supported by earnings and cash flows, evidenced by payout ratios of 72.5% and 70.3%, respectively. Recent board elections may influence future strategies but have not disrupted current dividend practices, as seen with the SAR 12 million distribution for H1 2025 at SAR 2 per share.

- Unlock comprehensive insights into our analysis of Saudi Networkers Services stock in this dividend report.

- According our valuation report, there's an indication that Saudi Networkers Services' share price might be on the expensive side.

Palram Industries (1990) (TASE:PLRM)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Palram Industries (1990) Ltd manufactures and sells thermoplastic sheets, panel systems, and finished products both in Israel and internationally, with a market cap of ₪1.97 billion.

Operations: Palram Industries (1990) Ltd generates revenue from several segments, including the PVC sector at ₪449.91 million, the Polycarbonate sector at ₪949.44 million, the Home Finished Products sector at ₪241.70 million, and the Sales and Display Stands sector at ₪232.73 million.

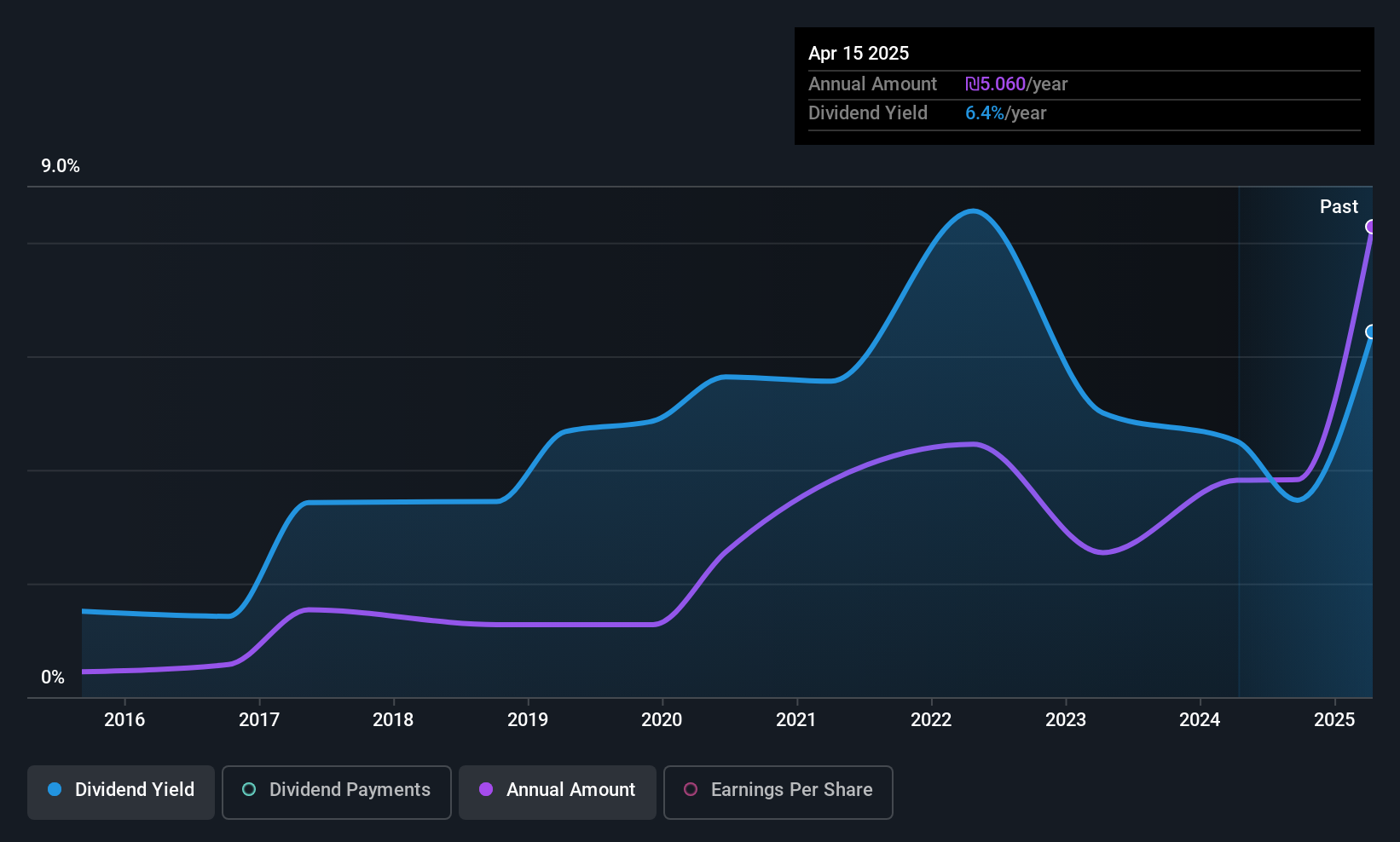

Dividend Yield: 6.6%

Palram Industries, recently added to the S&P Global BMI Index, offers a dividend yield of 6.62%, placing it in the top quartile of Israeli dividend payers. While dividends have grown over the past decade, they remain volatile and unreliable due to historical fluctuations. Despite this, dividends are well-supported by earnings and cash flows with payout ratios at 46.7% and 42%, respectively. Recent earnings showed decreased sales and net income compared to last year but maintained coverage for payouts.

- Delve into the full analysis dividend report here for a deeper understanding of Palram Industries (1990).

- Insights from our recent valuation report point to the potential undervaluation of Palram Industries (1990) shares in the market.

Taking Advantage

- Get an in-depth perspective on all 68 Top Middle Eastern Dividend Stocks by using our screener here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SASE:9543

Saudi Networkers Services

Engages in the implementing, establishing, maintaining, operating, installing, and managing of telecommunication networks in the Kingdom of Saudi Arabia and Algeria.

Flawless balance sheet average dividend payer.

Market Insights

Community Narratives