- Saudi Arabia

- /

- Specialty Stores

- /

- SASE:4240

What Percentage Of Fawaz Abdulaziz AlHokair & Co. (TADAWUL:4240) Shares Do Insiders Own?

A look at the shareholders of Fawaz Abdulaziz AlHokair & Co. (TADAWUL:4240) can tell us which group is most powerful. Institutions often own shares in more established companies, while it's not unusual to see insiders own a fair bit of smaller companies. Warren Buffett said that he likes "a business with enduring competitive advantages that is run by able and owner-oriented people." So it's nice to see some insider ownership, because it may suggest that management is owner-oriented.

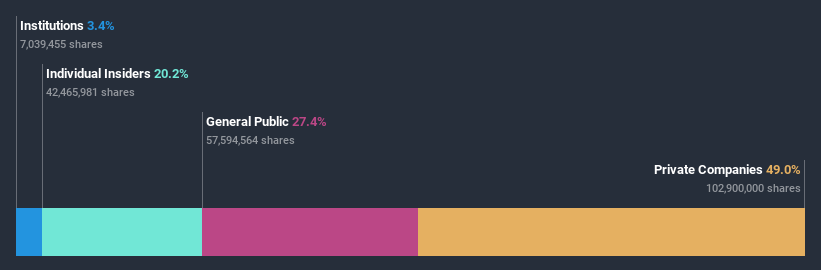

Fawaz Abdulaziz AlHokair isn't enormous, but it's not particularly small either. It has a market capitalization of ر.س4.5b, which means it would generally expect to see some institutions on the share registry. Taking a look at our data on the ownership groups (below), it seems that institutions are not really that prevalent on the share registry. Let's take a closer look to see what the different types of shareholders can tell us about Fawaz Abdulaziz AlHokair.

See our latest analysis for Fawaz Abdulaziz AlHokair

What Does The Institutional Ownership Tell Us About Fawaz Abdulaziz AlHokair?

Institutional investors commonly compare their own returns to the returns of a commonly followed index. So they generally do consider buying larger companies that are included in the relevant benchmark index.

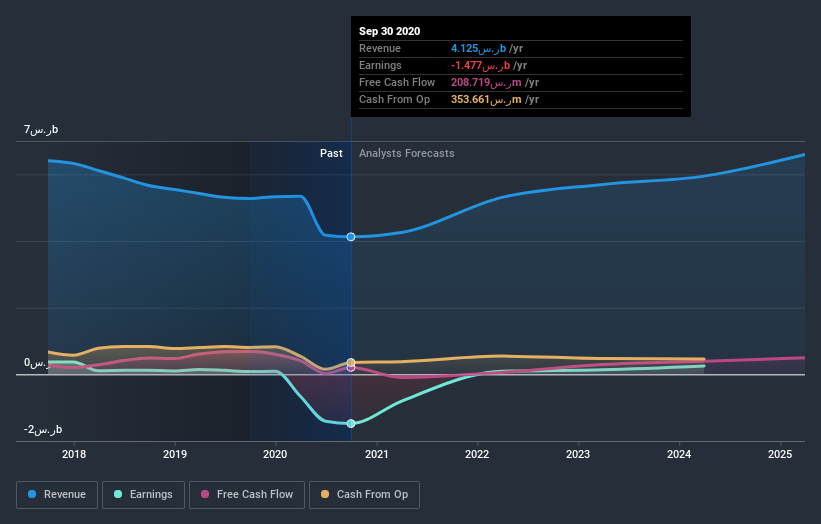

Institutions have a very small stake in Fawaz Abdulaziz AlHokair. That indicates that the company is on the radar of some funds, but it isn't particularly popular with professional investors at the moment. If the company is growing earnings, that may indicate that it is just beginning to catch the attention of these deep-pocketed investors. When multiple institutional investors want to buy shares, we often see a rising share price. The past revenue trajectory (shown below) can be an indication of future growth, but there are no guarantees.

We note that hedge funds don't have a meaningful investment in Fawaz Abdulaziz AlHokair. FAS Saudi Holding Company is currently the company's largest shareholder with 49% of shares outstanding. The second and third largest shareholders are Abdulmajeed Al Hokair and Salman Abdulaziz Al-Hokair, with an equal amount of shares to their name at 7.0%. Abdulmajeed Al Hokair, who is the second-largest shareholder, also happens to hold the title of President.

After doing some more digging, we found that the top 2 shareholders collectively control more than half of the company's shares, implying that they have considerable power to influence the company's decisions.

While it makes sense to study institutional ownership data for a company, it also makes sense to study analyst sentiments to know which way the wind is blowing. There are plenty of analysts covering the stock, so it might be worth seeing what they are forecasting, too.

Insider Ownership Of Fawaz Abdulaziz AlHokair

The definition of company insiders can be subjective and does vary between jurisdictions. Our data reflects individual insiders, capturing board members at the very least. Company management run the business, but the CEO will answer to the board, even if he or she is a member of it.

Insider ownership is positive when it signals leadership are thinking like the true owners of the company. However, high insider ownership can also give immense power to a small group within the company. This can be negative in some circumstances.

It seems insiders own a significant proportion of Fawaz Abdulaziz AlHokair & Co.. Insiders own ر.س916m worth of shares in the ر.س4.5b company. That's quite meaningful. It is good to see this level of investment. You can check here to see if those insiders have been buying recently.

General Public Ownership

The general public holds a 27% stake in Fawaz Abdulaziz AlHokair. This size of ownership, while considerable, may not be enough to change company policy if the decision is not in sync with other large shareholders.

Private Company Ownership

It seems that Private Companies own 49%, of the Fawaz Abdulaziz AlHokair stock. Private companies may be related parties. Sometimes insiders have an interest in a public company through a holding in a private company, rather than in their own capacity as an individual. While it's hard to draw any broad stroke conclusions, it is worth noting as an area for further research.

Next Steps:

It's always worth thinking about the different groups who own shares in a company. But to understand Fawaz Abdulaziz AlHokair better, we need to consider many other factors. Consider for instance, the ever-present spectre of investment risk. We've identified 1 warning sign with Fawaz Abdulaziz AlHokair , and understanding them should be part of your investment process.

Ultimately the future is most important. You can access this free report on analyst forecasts for the company.

NB: Figures in this article are calculated using data from the last twelve months, which refer to the 12-month period ending on the last date of the month the financial statement is dated. This may not be consistent with full year annual report figures.

If you decide to trade Fawaz Abdulaziz AlHokair, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About SASE:4240

Fawaz Abdulaziz Al Hokair

Operates as a franchise retailer of fashion products in the Kingdom of Saudi Arabia, Jordan, Egypt, the Republic of Kazakhstan, the United States, the Republic of Azerbaijan, Georgia, Armenia, and Morocco.

Reasonable growth potential and fair value.

Market Insights

Community Narratives