- Saudi Arabia

- /

- Specialty Stores

- /

- SASE:4240

If You Had Bought Fawaz Abdulaziz AlHokair's (TADAWUL:4240) Shares Five Years Ago You Would Be Down 56%

Generally speaking long term investing is the way to go. But no-one is immune from buying too high. Zooming in on an example, the Fawaz Abdulaziz AlHokair & Co. (TADAWUL:4240) share price dropped 56% in the last half decade. That's not a lot of fun for true believers. And some of the more recent buyers are probably worried, too, with the stock falling 31% in the last year. Even worse, it's down 11% in about a month, which isn't fun at all. This could be related to the recent financial results - you can catch up on the most recent data by reading our company report.

View our latest analysis for Fawaz Abdulaziz AlHokair

To quote Buffett, 'Ships will sail around the world but the Flat Earth Society will flourish. There will continue to be wide discrepancies between price and value in the marketplace...' One way to examine how market sentiment has changed over time is to look at the interaction between a company's share price and its earnings per share (EPS).

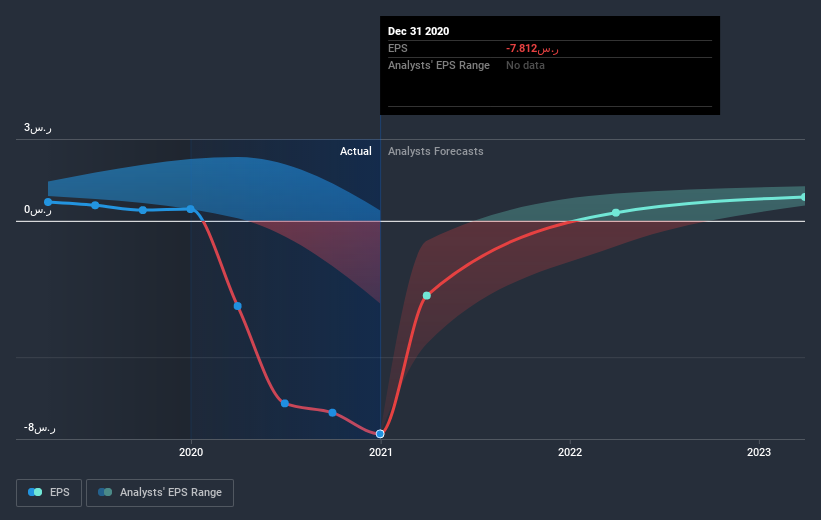

In the last half decade Fawaz Abdulaziz AlHokair saw its share price fall as its EPS declined below zero. Since the company has fallen to a loss making position, it's hard to compare the change in EPS with the share price change. But we would generally expect a lower price, given the situation.

You can see below how EPS has changed over time (discover the exact values by clicking on the image).

Dive deeper into Fawaz Abdulaziz AlHokair's key metrics by checking this interactive graph of Fawaz Abdulaziz AlHokair's earnings, revenue and cash flow.

A Different Perspective

Investors in Fawaz Abdulaziz AlHokair had a tough year, with a total loss of 31%, against a market gain of about 11%. However, keep in mind that even the best stocks will sometimes underperform the market over a twelve month period. Unfortunately, last year's performance may indicate unresolved challenges, given that it was worse than the annualised loss of 9% over the last half decade. We realise that Baron Rothschild has said investors should "buy when there is blood on the streets", but we caution that investors should first be sure they are buying a high quality business. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. Consider for instance, the ever-present spectre of investment risk. We've identified 1 warning sign with Fawaz Abdulaziz AlHokair , and understanding them should be part of your investment process.

For those who like to find winning investments this free list of growing companies with recent insider purchasing, could be just the ticket.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on SA exchanges.

If you’re looking to trade Fawaz Abdulaziz AlHokair, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About SASE:4240

Fawaz Abdulaziz Al Hokair

Operates as a franchise retailer of fashion products in the Kingdom of Saudi Arabia, Jordan, Egypt, the Republic of Kazakhstan, the United States, the Republic of Azerbaijan, Georgia, Armenia, and Morocco.

Reasonable growth potential and fair value.

Market Insights

Community Narratives