- Saudi Arabia

- /

- Specialty Stores

- /

- SASE:4240

Little Excitement Around Fawaz Abdulaziz Al Hokair & Company's (TADAWUL:4240) Revenues As Shares Take 27% Pounding

Fawaz Abdulaziz Al Hokair & Company (TADAWUL:4240) shareholders won't be pleased to see that the share price has had a very rough month, dropping 27% and undoing the prior period's positive performance. The drop over the last 30 days has capped off a tough year for shareholders, with the share price down 34% in that time.

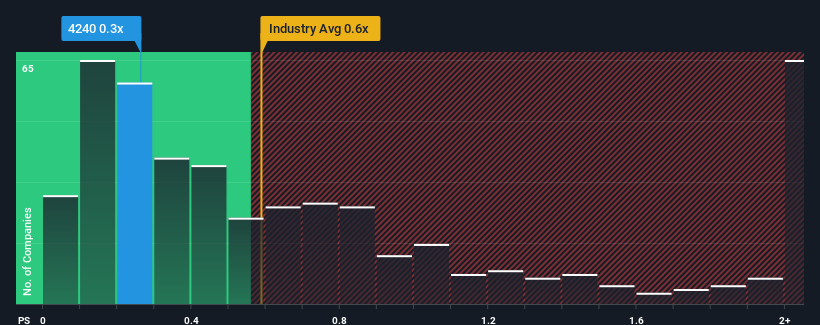

Since its price has dipped substantially, Fawaz Abdulaziz Al Hokair may be sending bullish signals at the moment with its price-to-sales (or "P/S") ratio of 0.3x, since almost half of all companies in the Specialty Retail industry in Saudi Arabia have P/S ratios greater than 1.3x and even P/S higher than 4x are not unusual. However, the P/S might be low for a reason and it requires further investigation to determine if it's justified.

See our latest analysis for Fawaz Abdulaziz Al Hokair

What Does Fawaz Abdulaziz Al Hokair's Recent Performance Look Like?

Fawaz Abdulaziz Al Hokair could be doing better as it's been growing revenue less than most other companies lately. It seems that many are expecting the uninspiring revenue performance to persist, which has repressed the growth of the P/S ratio. If this is the case, then existing shareholders will probably struggle to get excited about the future direction of the share price.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Fawaz Abdulaziz Al Hokair.How Is Fawaz Abdulaziz Al Hokair's Revenue Growth Trending?

There's an inherent assumption that a company should underperform the industry for P/S ratios like Fawaz Abdulaziz Al Hokair's to be considered reasonable.

Taking a look back first, we see that the company managed to grow revenues by a handy 4.2% last year. Still, lamentably revenue has fallen 6.6% in aggregate from three years ago, which is disappointing. Accordingly, shareholders would have felt downbeat about the medium-term rates of revenue growth.

Looking ahead now, revenue is anticipated to slump, contracting by 0.4% during the coming year according to the three analysts following the company. That's not great when the rest of the industry is expected to grow by 17%.

With this in consideration, we find it intriguing that Fawaz Abdulaziz Al Hokair's P/S is closely matching its industry peers. However, shrinking revenues are unlikely to lead to a stable P/S over the longer term. There's potential for the P/S to fall to even lower levels if the company doesn't improve its top-line growth.

The Key Takeaway

Fawaz Abdulaziz Al Hokair's P/S has taken a dip along with its share price. We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

It's clear to see that Fawaz Abdulaziz Al Hokair maintains its low P/S on the weakness of its forecast for sliding revenue, as expected. Right now shareholders are accepting the low P/S as they concede future revenue probably won't provide any pleasant surprises. Unless there's material change, it's hard to envision a situation where the stock price will rise drastically.

Before you settle on your opinion, we've discovered 3 warning signs for Fawaz Abdulaziz Al Hokair (1 is a bit unpleasant!) that you should be aware of.

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

If you're looking to trade Fawaz Abdulaziz Al Hokair, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SASE:4240

Fawaz Abdulaziz Al Hokair

Operates as a franchise retailer of fashion products in the Kingdom of Saudi Arabia, Jordan, Egypt, the Republic of Kazakhstan, the United States, the Republic of Azerbaijan, Georgia, Armenia, and Morocco.

Reasonable growth potential and fair value.

Market Insights

Community Narratives