- Saudi Arabia

- /

- Specialty Stores

- /

- SASE:4240

Fawaz Abdulaziz Al Hokair (TADAWUL:4240) shareholders are up 13% this past week, but still in the red over the last five years

Fawaz Abdulaziz Al Hokair & Company (TADAWUL:4240) shareholders will doubtless be very grateful to see the share price up 45% in the last quarter. But spare a thought for the long term holders, who have held the stock as it bled value over the last five years. Like a ship taking on water, the share price has sunk 74% in that time. The recent bounce might mean the long decline is over, but we are not confident. The real question is whether the business can leave its past behind and improve itself over the years ahead.

On a more encouraging note the company has added ر.س158m to its market cap in just the last 7 days, so let's see if we can determine what's driven the five-year loss for shareholders.

View our latest analysis for Fawaz Abdulaziz Al Hokair

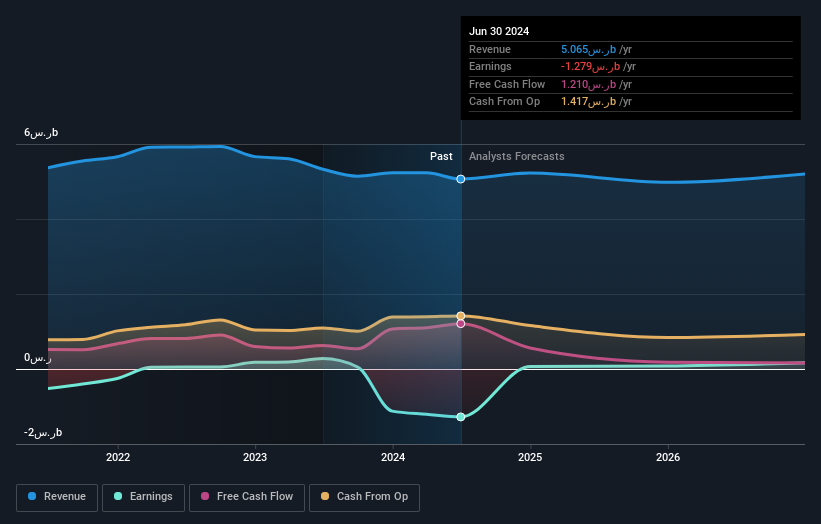

Because Fawaz Abdulaziz Al Hokair made a loss in the last twelve months, we think the market is probably more focussed on revenue and revenue growth, at least for now. Generally speaking, companies without profits are expected to grow revenue every year, and at a good clip. As you can imagine, fast revenue growth, when maintained, often leads to fast profit growth.

Over five years, Fawaz Abdulaziz Al Hokair grew its revenue at 2.2% per year. That's far from impressive given all the money it is losing. It's not so sure that share price crash of 12% per year is completely deserved, but the market is doubtless disappointed. While we're definitely wary of the stock, after that kind of performance, it could be an over-reaction. A company like this generally needs to produce profits before it can find favour with new investors.

The image below shows how earnings and revenue have tracked over time (if you click on the image you can see greater detail).

You can see how its balance sheet has strengthened (or weakened) over time in this free interactive graphic.

A Different Perspective

We regret to report that Fawaz Abdulaziz Al Hokair shareholders are down 37% for the year. Unfortunately, that's worse than the broader market decline of 5.2%. However, it could simply be that the share price has been impacted by broader market jitters. It might be worth keeping an eye on the fundamentals, in case there's a good opportunity. Unfortunately, last year's performance may indicate unresolved challenges, given that it was worse than the annualised loss of 12% over the last half decade. We realise that Baron Rothschild has said investors should "buy when there is blood on the streets", but we caution that investors should first be sure they are buying a high quality business. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. Like risks, for instance. Every company has them, and we've spotted 3 warning signs for Fawaz Abdulaziz Al Hokair (of which 2 are concerning!) you should know about.

If you are like me, then you will not want to miss this free list of undervalued small caps that insiders are buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Saudi exchanges.

If you're looking to trade Fawaz Abdulaziz Al Hokair, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SASE:4240

Fawaz Abdulaziz Al Hokair

Operates as a franchise retailer of fashion products in the Kingdom of Saudi Arabia, Jordan, Egypt, the Republic of Kazakhstan, the United States, the Republic of Azerbaijan, Georgia, Armenia, and Morocco.

Fair value with moderate growth potential.