- Saudi Arabia

- /

- Specialty Stores

- /

- SASE:4240

Fawaz Abdulaziz Al Hokair & Company's (TADAWUL:4240) Prospects Need A Boost To Lift Shares

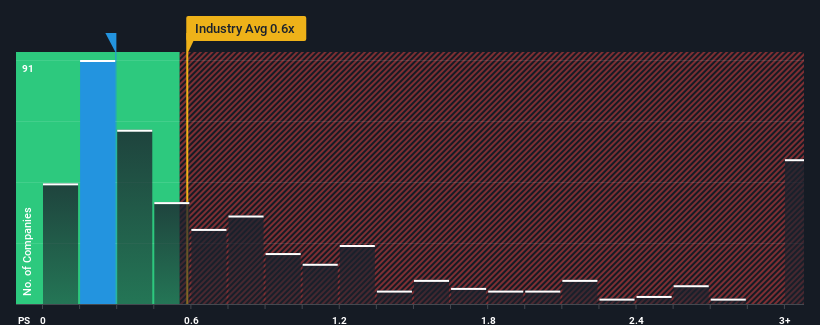

When you see that almost half of the companies in the Specialty Retail industry in Saudi Arabia have price-to-sales ratios (or "P/S") above 1.3x, Fawaz Abdulaziz Al Hokair & Company (TADAWUL:4240) looks to be giving off some buy signals with its 0.3x P/S ratio. However, the P/S might be low for a reason and it requires further investigation to determine if it's justified.

Check out our latest analysis for Fawaz Abdulaziz Al Hokair

What Does Fawaz Abdulaziz Al Hokair's Recent Performance Look Like?

Fawaz Abdulaziz Al Hokair hasn't been tracking well recently as its declining revenue compares poorly to other companies, which have seen some growth in their revenues on average. Perhaps the P/S remains low as investors think the prospects of strong revenue growth aren't on the horizon. If this is the case, then existing shareholders will probably struggle to get excited about the future direction of the share price.

Keen to find out how analysts think Fawaz Abdulaziz Al Hokair's future stacks up against the industry? In that case, our free report is a great place to start.How Is Fawaz Abdulaziz Al Hokair's Revenue Growth Trending?

The only time you'd be truly comfortable seeing a P/S as low as Fawaz Abdulaziz Al Hokair's is when the company's growth is on track to lag the industry.

In reviewing the last year of financials, we were disheartened to see the company's revenues fell to the tune of 2.0%. However, a few very strong years before that means that it was still able to grow revenue by an impressive 41% in total over the last three years. So we can start by confirming that the company has generally done a very good job of growing revenue over that time, even though it had some hiccups along the way.

Shifting to the future, estimates from the five analysts covering the company suggest revenue growth is heading into negative territory, declining 1.2% each year over the next three years. That's not great when the rest of the industry is expected to grow by 11% per annum.

With this information, we are not surprised that Fawaz Abdulaziz Al Hokair is trading at a P/S lower than the industry. However, shrinking revenues are unlikely to lead to a stable P/S over the longer term. There's potential for the P/S to fall to even lower levels if the company doesn't improve its top-line growth.

What We Can Learn From Fawaz Abdulaziz Al Hokair's P/S?

Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

As we suspected, our examination of Fawaz Abdulaziz Al Hokair's analyst forecasts revealed that its outlook for shrinking revenue is contributing to its low P/S. At this stage investors feel the potential for an improvement in revenue isn't great enough to justify a higher P/S ratio. Unless these conditions improve, they will continue to form a barrier for the share price around these levels.

There are also other vital risk factors to consider and we've discovered 3 warning signs for Fawaz Abdulaziz Al Hokair (1 is a bit concerning!) that you should be aware of before investing here.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SASE:4240

Fawaz Abdulaziz Al Hokair

Operates as a franchise retailer of fashion products in the Kingdom of Saudi Arabia, Jordan, Egypt, the Republic of Kazakhstan, the United States, the Republic of Azerbaijan, Georgia, Armenia, and Morocco.

Reasonable growth potential and fair value.

Market Insights

Community Narratives