- Saudi Arabia

- /

- Specialty Stores

- /

- SASE:4240

Fawaz Abdulaziz Al Hokair & Company's (TADAWUL:4240) 27% Dip In Price Shows Sentiment Is Matching Revenues

Unfortunately for some shareholders, the Fawaz Abdulaziz Al Hokair & Company (TADAWUL:4240) share price has dived 27% in the last thirty days, prolonging recent pain. The drop over the last 30 days has capped off a tough year for shareholders, with the share price down 47% in that time.

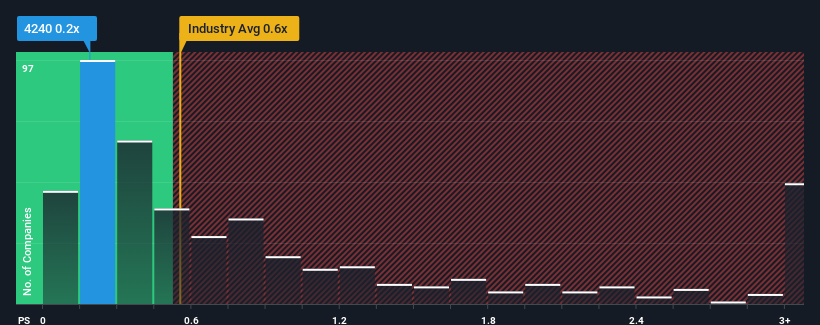

Since its price has dipped substantially, it would be understandable if you think Fawaz Abdulaziz Al Hokair is a stock with good investment prospects with a price-to-sales ratios (or "P/S") of 0.2x, considering almost half the companies in Saudi Arabia's Specialty Retail industry have P/S ratios above 1.3x. However, the P/S might be low for a reason and it requires further investigation to determine if it's justified.

Check out our latest analysis for Fawaz Abdulaziz Al Hokair

How Has Fawaz Abdulaziz Al Hokair Performed Recently?

While the industry has experienced revenue growth lately, Fawaz Abdulaziz Al Hokair's revenue has gone into reverse gear, which is not great. The P/S ratio is probably low because investors think this poor revenue performance isn't going to get any better. If you still like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Fawaz Abdulaziz Al Hokair.Do Revenue Forecasts Match The Low P/S Ratio?

There's an inherent assumption that a company should underperform the industry for P/S ratios like Fawaz Abdulaziz Al Hokair's to be considered reasonable.

Retrospectively, the last year delivered a frustrating 16% decrease to the company's top line. This has soured the latest three-year period, which nevertheless managed to deliver a decent 21% overall rise in revenue. So we can start by confirming that the company has generally done a good job of growing revenue over that time, even though it had some hiccups along the way.

Turning to the outlook, the next three years should generate growth of 1.4% each year as estimated by the five analysts watching the company. Meanwhile, the rest of the industry is forecast to expand by 12% per year, which is noticeably more attractive.

With this information, we can see why Fawaz Abdulaziz Al Hokair is trading at a P/S lower than the industry. Apparently many shareholders weren't comfortable holding on while the company is potentially eyeing a less prosperous future.

The Key Takeaway

Fawaz Abdulaziz Al Hokair's recently weak share price has pulled its P/S back below other Specialty Retail companies. We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

As expected, our analysis of Fawaz Abdulaziz Al Hokair's analyst forecasts confirms that the company's underwhelming revenue outlook is a major contributor to its low P/S. Right now shareholders are accepting the low P/S as they concede future revenue probably won't provide any pleasant surprises. The company will need a change of fortune to justify the P/S rising higher in the future.

Don't forget that there may be other risks. For instance, we've identified 3 warning signs for Fawaz Abdulaziz Al Hokair (1 makes us a bit uncomfortable) you should be aware of.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SASE:4240

Fawaz Abdulaziz Al Hokair

Operates as a franchise retailer of fashion products in the Kingdom of Saudi Arabia, Jordan, Egypt, the Republic of Kazakhstan, the United States, the Republic of Azerbaijan, Georgia, Armenia, and Morocco.

Reasonable growth potential and fair value.

Market Insights

Community Narratives