Exploring High Growth Tech Stocks And 2 More With Potential Growth

Reviewed by Simply Wall St

In recent weeks, global markets have experienced a mix of gains and declines, with major U.S. stock indexes achieving moderate increases despite falling consumer confidence and a dip in durable goods orders. As the technology-heavy Nasdaq Composite led early week rallies, it's clear that investor interest remains strong in high-growth tech sectors, making it crucial to identify stocks with solid fundamentals and innovative potential amidst fluctuating economic indicators.

Top 10 High Growth Tech Companies

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Seojin SystemLtd | 35.41% | 39.86% | ★★★★★★ |

| Yggdrazil Group | 30.20% | 87.10% | ★★★★★★ |

| eWeLLLtd | 26.41% | 28.82% | ★★★★★★ |

| Medley | 22.38% | 31.67% | ★★★★★★ |

| Mental Health TechnologiesLtd | 25.83% | 113.12% | ★★★★★★ |

| Pharma Mar | 25.43% | 56.19% | ★★★★★★ |

| Alkami Technology | 21.99% | 102.65% | ★★★★★★ |

| Fine M-TecLTD | 36.52% | 131.08% | ★★★★★★ |

| JNTC | 29.48% | 104.37% | ★★★★★★ |

| Travere Therapeutics | 28.68% | 62.50% | ★★★★★★ |

Click here to see the full list of 1261 stocks from our High Growth Tech and AI Stocks screener.

Here's a peek at a few of the choices from the screener.

Promotora de Informaciones (BME:PRS)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Promotora de Informaciones, S.A., along with its subsidiaries, is involved in media operations both in Spain and internationally, with a market capitalization of €326.13 million.

Operations: The company focuses on media operations, generating revenue primarily from its education segment, which contributes €456.72 million. The segment adjustment is noted at €446.99 million.

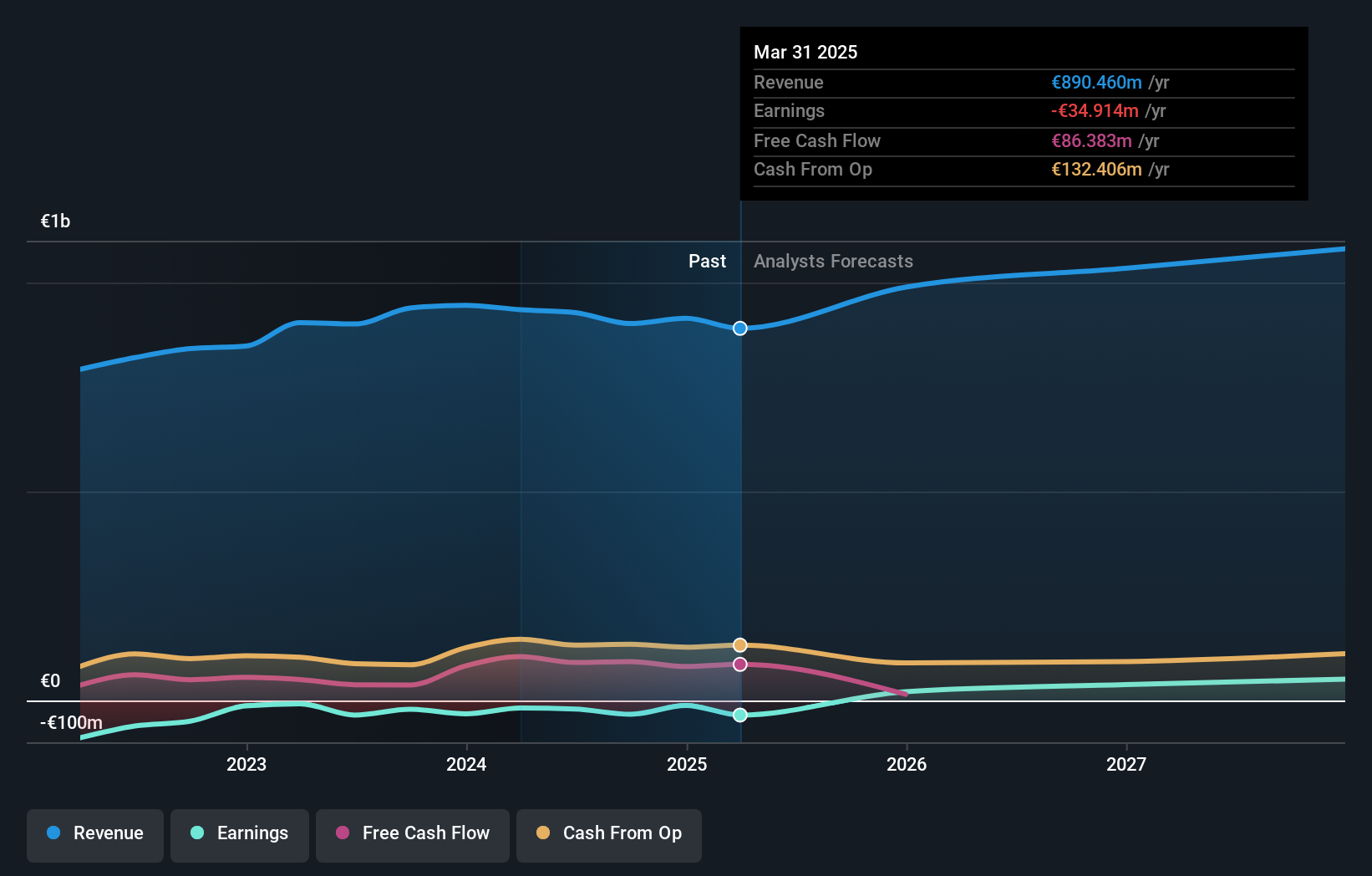

Promotora de Informaciones (PRS) stands at a pivotal juncture, with its earnings projected to surge by 125.9% annually, signaling robust potential despite current unprofitability. This growth trajectory is complemented by a forecasted revenue increase of 6% per year, modestly outpacing the broader Spanish market's 5%. However, challenges such as shareholder dilution over the past year and recent delisting from OTC Equity due to inactivity underscore some operational hurdles. The firm's commitment to turning profitable within three years could redefine its market stance, bolstered by positive free cash flow dynamics which enhance its financial flexibility amidst these transformative efforts.

Arabian Contracting Services (SASE:4071)

Simply Wall St Growth Rating: ★★★★★★

Overview: Arabian Contracting Services Company, with a market cap of SAR7.99 billion, operates in the printing industry through its subsidiaries in Saudi Arabia and Egypt.

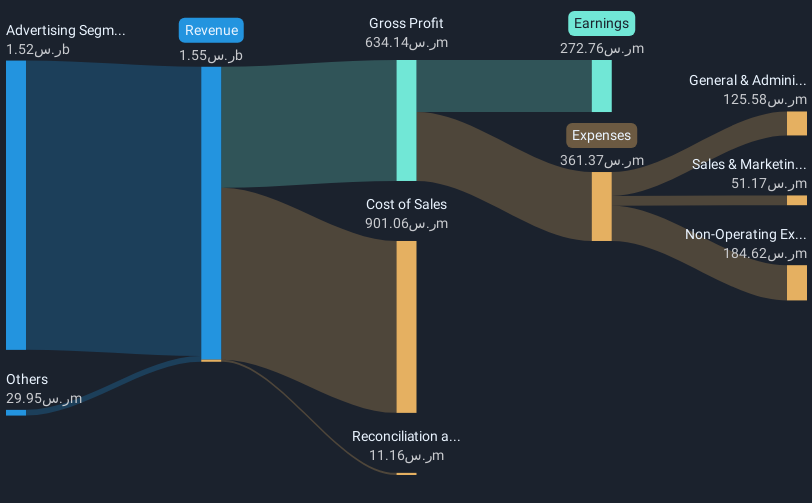

Operations: The company generates revenue primarily from its advertising segment, which contributes SAR1.52 billion.

Arabian Contracting Services has demonstrated a robust financial trajectory with an annual revenue growth forecast at 20.6% and earnings expected to surge by 26.8% per year, outpacing the broader Saudi market significantly. Despite a recent dip in net profit margins from 26.6% to 17.8%, the company's strategic maneuvers, including a notable M&A activity where a stake was sold for SAR 416.5 million, underscore its proactive approach in strengthening its financial base and liquidity amidst challenging market conditions. This blend of aggressive revenue targets coupled with strategic capital reallocation positions Arabian Contracting Services as a dynamic entity within the tech sector, navigating through volatility with strategic foresight and operational agility.

- Dive into the specifics of Arabian Contracting Services here with our thorough health report.

Understand Arabian Contracting Services' track record by examining our Past report.

COVER (TSE:5253)

Simply Wall St Growth Rating: ★★★★★★

Overview: COVER Corporation operates in the virtual platform, VTuber production, and media mix sectors with a market capitalization of ¥163.58 billion.

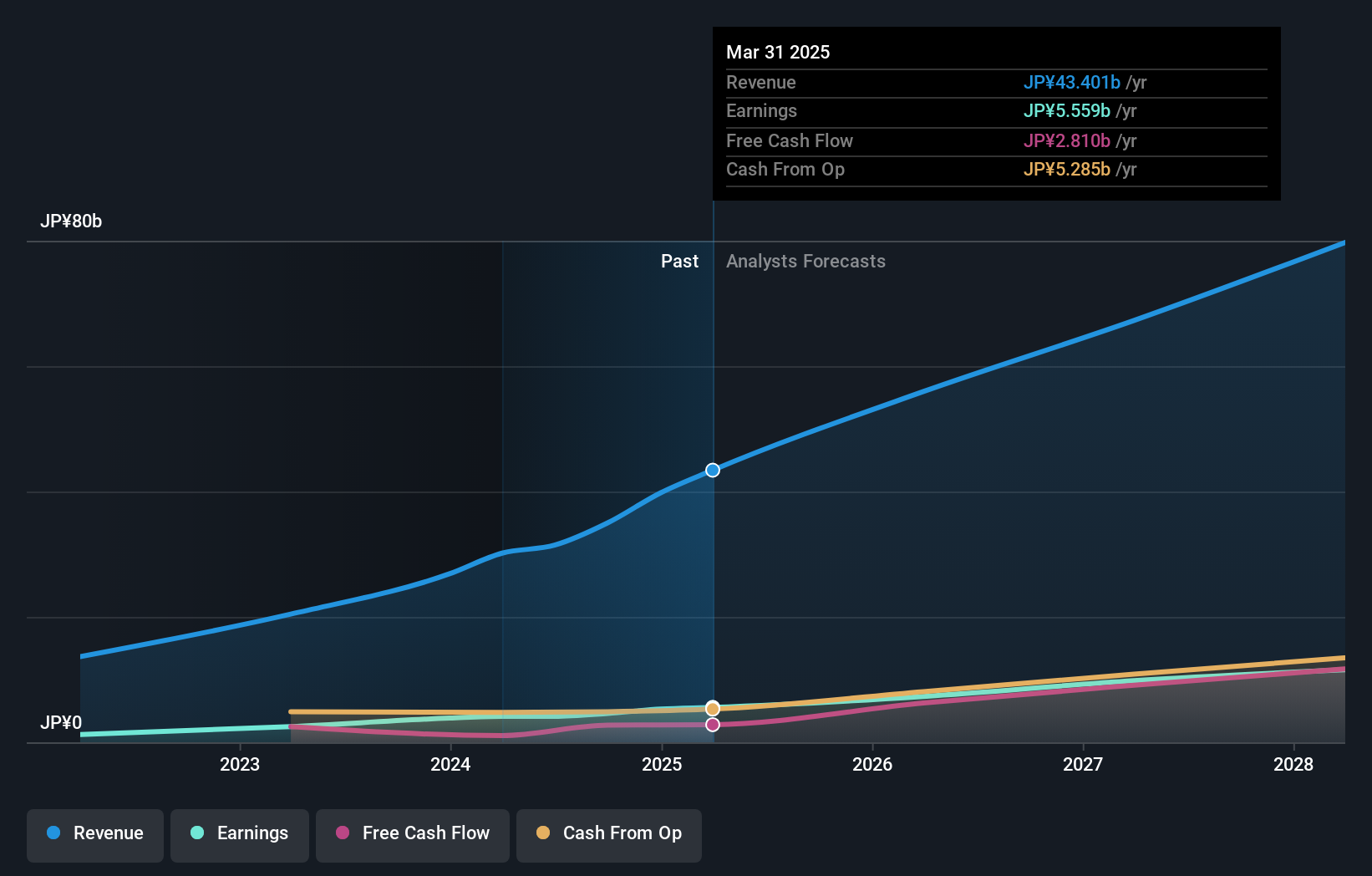

Operations: COVER Corporation's business model focuses on generating revenue through its virtual platform, VTuber production, and media mix activities. The company leverages its expertise in digital content creation to drive growth within these sectors.

COVER, a tech firm, is distinguishing itself in the high-growth sector with anticipated revenue and earnings expansions of 20.4% and 30.3% annually. This performance is underpinned by significant R&D investments, which have recently reached $1.2 billion, reflecting a strategic emphasis on innovation to stay ahead in competitive markets. Moreover, the company's agile adaptation to market demands through enhanced software solutions has solidified its client base, including industry leaders like TSMC. With such robust financial and operational strategies, COVER appears well-positioned for sustained growth amidst evolving technological landscapes.

- Click here to discover the nuances of COVER with our detailed analytical health report.

Explore historical data to track COVER's performance over time in our Past section.

Seize The Opportunity

- Unlock our comprehensive list of 1261 High Growth Tech and AI Stocks by clicking here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About BME:PRS

Promotora de Informaciones

Engages in the exploitation of media in Spain and internationally.

Reasonable growth potential and fair value.