As we enter January 2025, global markets have shown mixed signals with U.S. consumer confidence dipping and major stock indexes experiencing moderate gains, largely influenced by large-cap growth stocks in a holiday-shortened week. In this environment, identifying high-growth tech stocks involves looking for companies that can navigate economic uncertainties while capitalizing on technological advancements and market opportunities.

Top 10 High Growth Tech Companies

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Seojin SystemLtd | 35.41% | 39.86% | ★★★★★★ |

| Yggdrazil Group | 30.20% | 87.10% | ★★★★★★ |

| eWeLLLtd | 26.41% | 28.82% | ★★★★★★ |

| Medley | 22.38% | 31.67% | ★★★★★★ |

| Mental Health TechnologiesLtd | 25.83% | 113.12% | ★★★★★★ |

| Pharma Mar | 25.43% | 56.19% | ★★★★★★ |

| Alkami Technology | 21.99% | 102.65% | ★★★★★★ |

| Fine M-TecLTD | 36.52% | 131.08% | ★★★★★★ |

| JNTC | 29.48% | 104.37% | ★★★★★★ |

| Travere Therapeutics | 28.68% | 62.50% | ★★★★★★ |

Click here to see the full list of 1261 stocks from our High Growth Tech and AI Stocks screener.

Here we highlight a subset of our preferred stocks from the screener.

izertis (BME:IZER)

Simply Wall St Growth Rating: ★★★★★☆

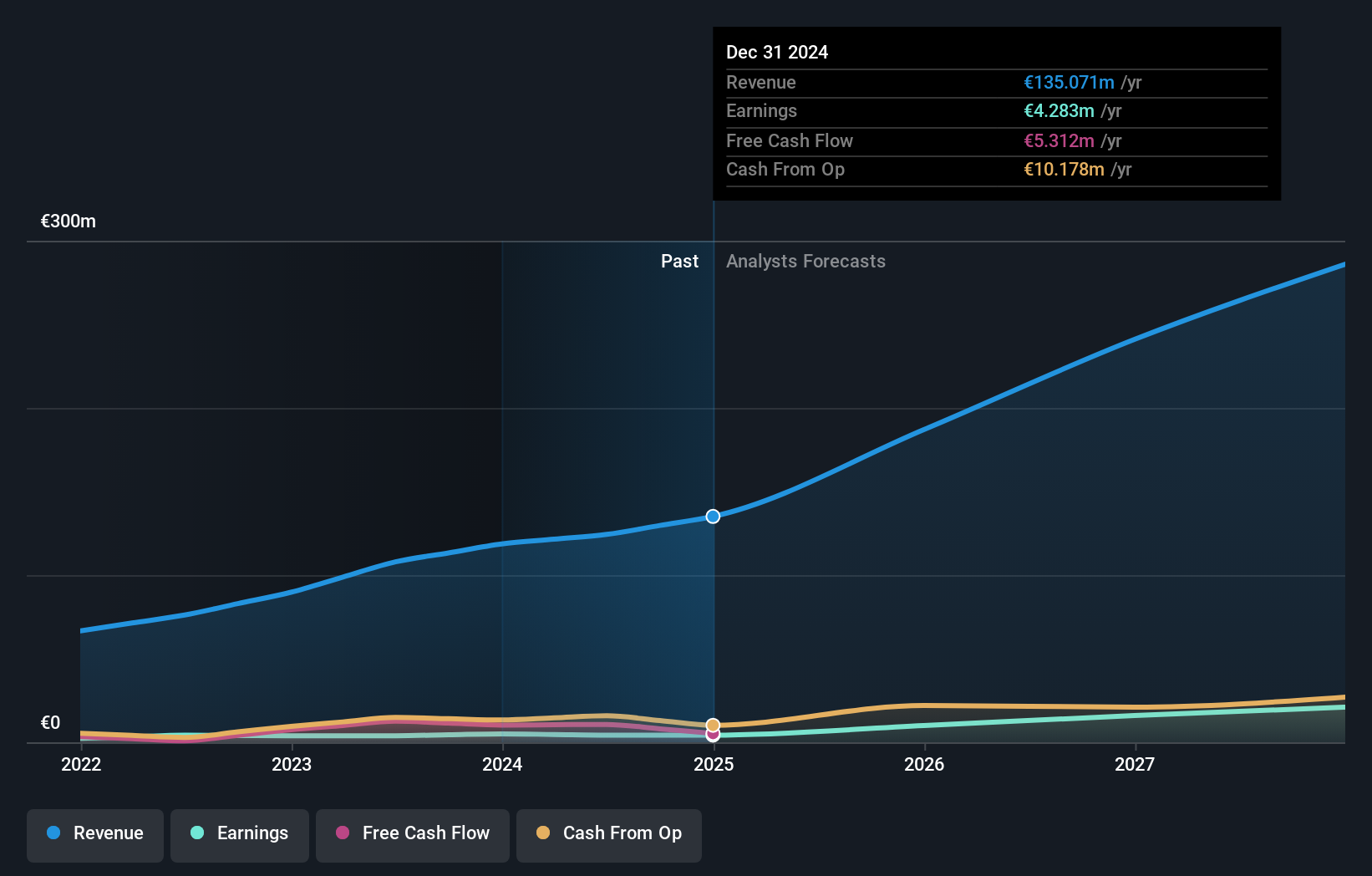

Overview: Izertis, S.A. is a company that offers technological consultancy services both in Spain and internationally, with a market capitalization of €260.41 million.

Operations: The company generates revenue primarily from its Technologies and Information (IT) segment, amounting to €124.33 million. It operates in the technological consultancy sector across Spain and international markets.

Izertis, a Spanish tech firm, demonstrates robust potential with its earnings forecast to surge by 40.86% annually, outpacing the local market's growth of 8.8%. This growth is supported by an impressive revenue increase at an annual rate of 22.3%, significantly higher than the broader Spanish market's 5%. Despite challenges like insufficient coverage of interest payments by earnings and recent shareholder dilution, Izertis maintains a strong financial stance with positive free cash flow and high-quality past earnings. The company recently reported a dip in net income for the first half of 2024 but continues to invest in innovation as reflected in its R&D expenses, ensuring it remains competitive in the fast-evolving tech landscape.

Speed Tech (TPEX:5457)

Simply Wall St Growth Rating: ★★★★☆☆

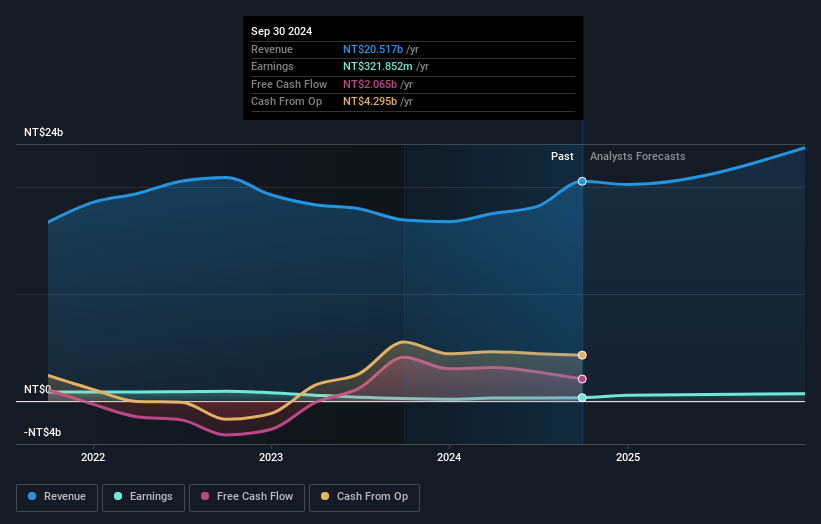

Overview: Speed Tech Corp. is engaged in the design, research and development, manufacturing, and sale of connectors for communication, computer, automotive, and consumer industries both in Taiwan and internationally with a market capitalization of NT$10.13 billion.

Operations: Speed Tech focuses on producing connectors for various sectors, including communication, computers, automotive, and consumer industries. The company operates both in Taiwan and internationally.

Speed Tech, amidst leadership changes, showcased robust financial performance with third-quarter sales soaring to TWD 7.12 billion from TWD 4.77 billion year-over-year and net income climbing to TWD 256.66 million from TWD 222.79 million. This growth trajectory is underpinned by a significant annual revenue increase of 12.7%, surpassing the broader Taiwanese market's growth rate of 12.2%. Furthermore, the company’s commitment to innovation is evident in its R&D investments, aligning with an anticipated earnings surge of 48.3% annually—a stark contrast to the industry's average growth rate of just over six percent—positioning Speed Tech well within a competitive tech landscape marked by rapid advancements and shifting executive roles.

- Click to explore a detailed breakdown of our findings in Speed Tech's health report.

Gain insights into Speed Tech's past trends and performance with our Past report.

Arizon RFID Technology (Cayman) (TWSE:6863)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Arizon RFID Technology (Cayman) Co., Ltd., along with its subsidiaries, is engaged in the design, development, manufacturing, and trading of radio-frequency identification systems across Taiwan, China, and international markets with a market cap of NT$17.52 billion.

Operations: Arizon focuses on the design, development, manufacturing, and trading of radio-frequency identification systems. The company generates revenue primarily from its wireless communications equipment segment, which amounts to NT$4.09 billion.

Arizon RFID Technology (Cayman) has demonstrated a compelling growth trajectory, with third-quarter sales doubling to TWD 1.15 billion from TWD 655.27 million year-over-year and net income more than doubling to TWD 171.09 million from TWD 86.96 million. This surge reflects an annual revenue growth of 21.4% and earnings growth of 22%, significantly outpacing the broader market's expansion rate of approximately 12%. The firm's robust investment in R&D, crucial for maintaining its competitive edge in the fast-evolving RFID sector, is evident as it continues to innovate and expand its market footprint amidst dynamic industry demands.

Summing It All Up

- Access the full spectrum of 1261 High Growth Tech and AI Stocks by clicking on this link.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechValuation is complex, but we're here to simplify it.

Discover if izertis might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About BME:IZER

izertis

Provides technological consultancy services in Spain, Portugal, and Mexico.

High growth potential with proven track record.

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Q3 Outlook modestly optimistic

Title: Market Sentiment Is Dead Wrong — Here's Why PSEC Deserves a Second Look

An amazing opportunity to potentially get a 100 bagger

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

MicroVision will explode future revenue by 380.37% with a vision towards success

Trending Discussion