- Saudi Arabia

- /

- Basic Materials

- /

- SASE:3003

Should Income Investors Look At City Cement Company (TADAWUL:3003) Before Its Ex-Dividend?

Some investors rely on dividends for growing their wealth, and if you're one of those dividend sleuths, you might be intrigued to know that City Cement Company (TADAWUL:3003) is about to go ex-dividend in just three days. Investors can purchase shares before the 8th of March in order to be eligible for this dividend, which will be paid on the 21st of March.

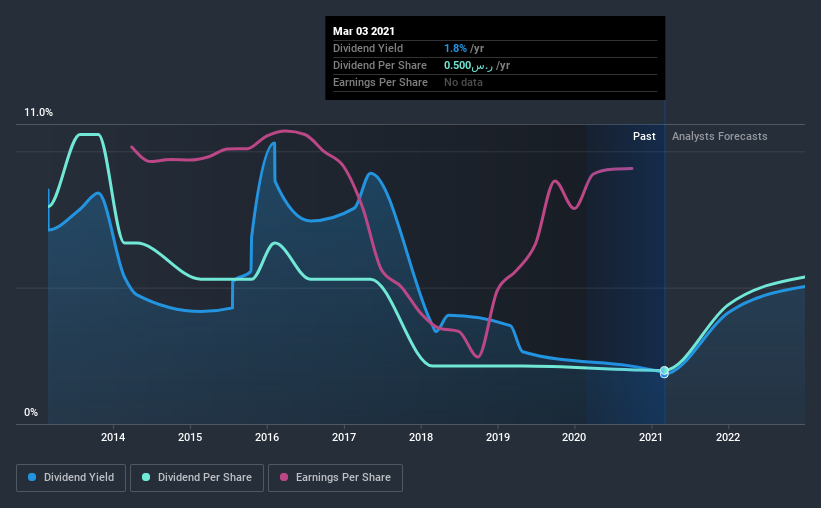

City Cement's upcoming dividend is ر.س0.50 a share, following on from the last 12 months, when the company distributed a total of ر.س0.50 per share to shareholders. Based on the last year's worth of payments, City Cement has a trailing yield of 1.8% on the current stock price of SAR27.25. We love seeing companies pay a dividend, but it's also important to be sure that laying the golden eggs isn't going to kill our golden goose! So we need to investigate whether City Cement can afford its dividend, and if the dividend could grow.

See our latest analysis for City Cement

Dividends are typically paid from company earnings. If a company pays more in dividends than it earned in profit, then the dividend could be unsustainable. That's why it's good to see City Cement paying out a modest 35% of its earnings. Yet cash flows are even more important than profits for assessing a dividend, so we need to see if the company generated enough cash to pay its distribution.

Click here to see the company's payout ratio, plus analyst estimates of its future dividends.

Have Earnings And Dividends Been Growing?

Companies that aren't growing their earnings can still be valuable, but it is even more important to assess the sustainability of the dividend if it looks like the company will struggle to grow. If earnings fall far enough, the company could be forced to cut its dividend. It's not encouraging to see that City Cement's earnings are effectively flat over the past five years. We'd take that over an earnings decline any day, but in the long run, the best dividend stocks all grow their earnings per share.

Many investors will assess a company's dividend performance by evaluating how much the dividend payments have changed over time. City Cement's dividend payments per share have declined at 16% per year on average over the past eight years, which is uninspiring.

Final Takeaway

From a dividend perspective, should investors buy or avoid City Cement? Earnings per share have been flat, although at least the company is paying out a low and conservative percentage of both its earnings and cash flow. It's definitely not great to see earnings falling, but at least there may be some buffer before the dividend gets cut. In summary, while it has some positive characteristics, we're not inclined to race out and buy City Cement today.

On that note, you'll want to research what risks City Cement is facing. Be aware that City Cement is showing 2 warning signs in our investment analysis, and 1 of those is a bit unpleasant...

A common investment mistake is buying the first interesting stock you see. Here you can find a list of promising dividend stocks with a greater than 2% yield and an upcoming dividend.

If you decide to trade City Cement, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

If you're looking to trade City Cement, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About SASE:3003

City Cement

City Cement Company with its subsidiaries manufactures and sells cement in the Kingdom of Saudi Arabia.

Flawless balance sheet with proven track record.

Market Insights

Community Narratives