- Saudi Arabia

- /

- Chemicals

- /

- SASE:2290

March 2025's Global Market Picks: Stocks That May Be Trading Below Fair Value Estimates

Reviewed by Simply Wall St

Amidst ongoing concerns about tariffs, inflation, and economic growth, global markets have experienced a turbulent week, with significant declines across major U.S. indices and mixed performances in Europe and Asia. As investors navigate this uncertainty, identifying stocks that may be trading below fair value could present opportunities for those seeking to capitalize on market fluctuations.

Top 10 Undervalued Stocks Based On Cash Flows

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Tabuk Cement (SASE:3090) | SAR13.26 | SAR26.45 | 49.9% |

| Avant Group (TSE:3836) | ¥1782.00 | ¥3541.84 | 49.7% |

| Telefonaktiebolaget LM Ericsson (OM:ERIC B) | SEK83.12 | SEK165.50 | 49.8% |

| Wienerberger (WBAG:WIE) | €34.58 | €68.85 | 49.8% |

| Guangdong Fenghua Advanced Technology (Holding) (SZSE:000636) | CN¥15.24 | CN¥30.40 | 49.9% |

| LITALICO (TSE:7366) | ¥1072.00 | ¥2130.58 | 49.7% |

| Star7 (BIT:STAR7) | €6.15 | €12.29 | 50% |

| Jiangsu Chuanzhiboke Education Technology (SZSE:003032) | CN¥8.52 | CN¥16.95 | 49.7% |

| Medical Data Vision (TSE:3902) | ¥422.00 | ¥839.80 | 49.8% |

| Doosan Fuel Cell (KOSE:A336260) | ₩15850.00 | ₩31514.79 | 49.7% |

We're going to check out a few of the best picks from our screener tool.

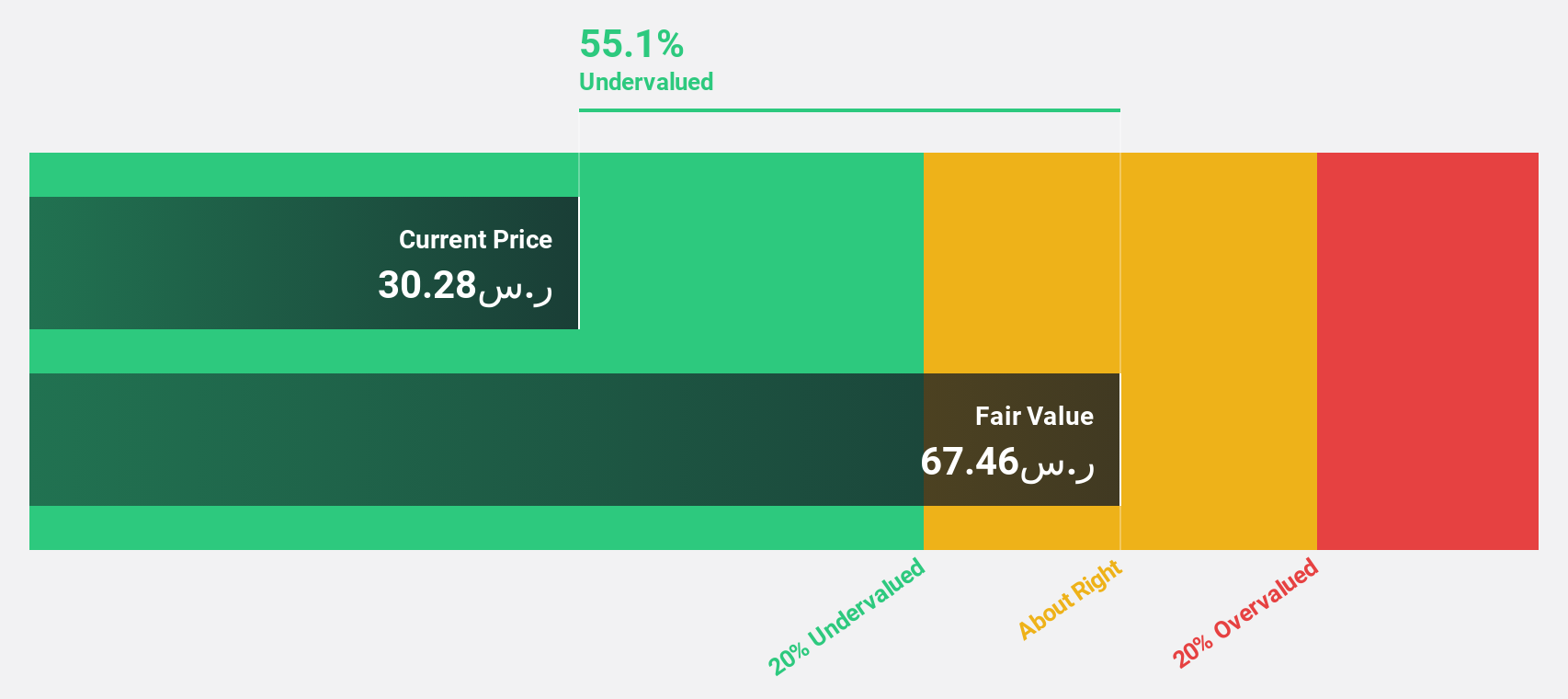

Yanbu National Petrochemical (SASE:2290)

Overview: Yanbu National Petrochemical Company manufactures and sells petrochemical products across various global markets, with a market cap of SAR19.24 billion.

Operations: The company's revenue is derived entirely from its petrochemical segment, which generated SAR6.16 billion.

Estimated Discount To Fair Value: 26.2%

Yanbu National Petrochemical is trading at SAR 34.3, significantly below its estimated fair value of SAR 46.46, suggesting it may be undervalued based on cash flows. Despite a dividend yield of 5.83% not being well covered by earnings, the company has turned profitable with net income of SAR 420.33 million for the year ending December 2024. Revenue growth is forecasted to outpace the Saudi Arabian market at 3.8% annually, while earnings are expected to grow significantly at over 25% per year.

- Our growth report here indicates Yanbu National Petrochemical may be poised for an improving outlook.

- Take a closer look at Yanbu National Petrochemical's balance sheet health here in our report.

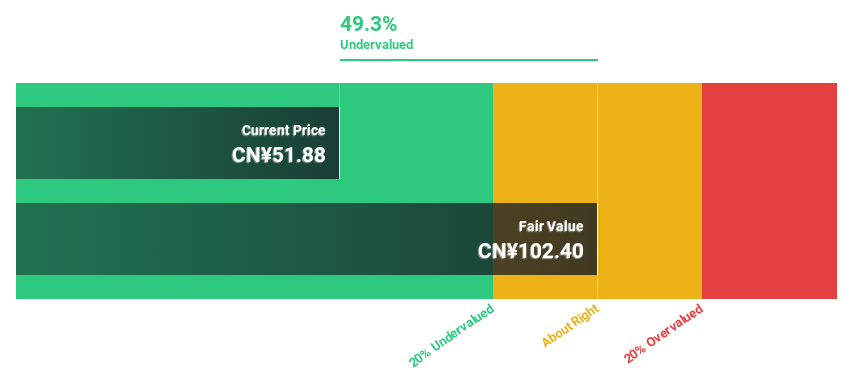

Zhejiang Jiecang Linear Motion TechnologyLtd (SHSE:603583)

Overview: Zhejiang Jiecang Linear Motion Technology Co., Ltd. (SHSE:603583) specializes in the production of linear motion systems and has a market cap of approximately CN¥18.58 billion.

Operations: The company's revenue from the Linear Drive Industry segment amounts to CN¥3.50 billion.

Estimated Discount To Fair Value: 49.3%

Zhejiang Jiecang Linear Motion Technology Ltd. is trading at CN¥51.88, which is significantly below its estimated fair value of CN¥102.4, indicating it may be undervalued based on cash flows. The company's earnings are projected to grow 29.14% annually over the next three years, outpacing the Chinese market's average growth rate of 25.5%. However, its return on equity is expected to remain low at 11.8%, and recent share price volatility could pose risks for investors.

- Our expertly prepared growth report on Zhejiang Jiecang Linear Motion TechnologyLtd implies its future financial outlook may be stronger than recent results.

- Delve into the full analysis health report here for a deeper understanding of Zhejiang Jiecang Linear Motion TechnologyLtd.

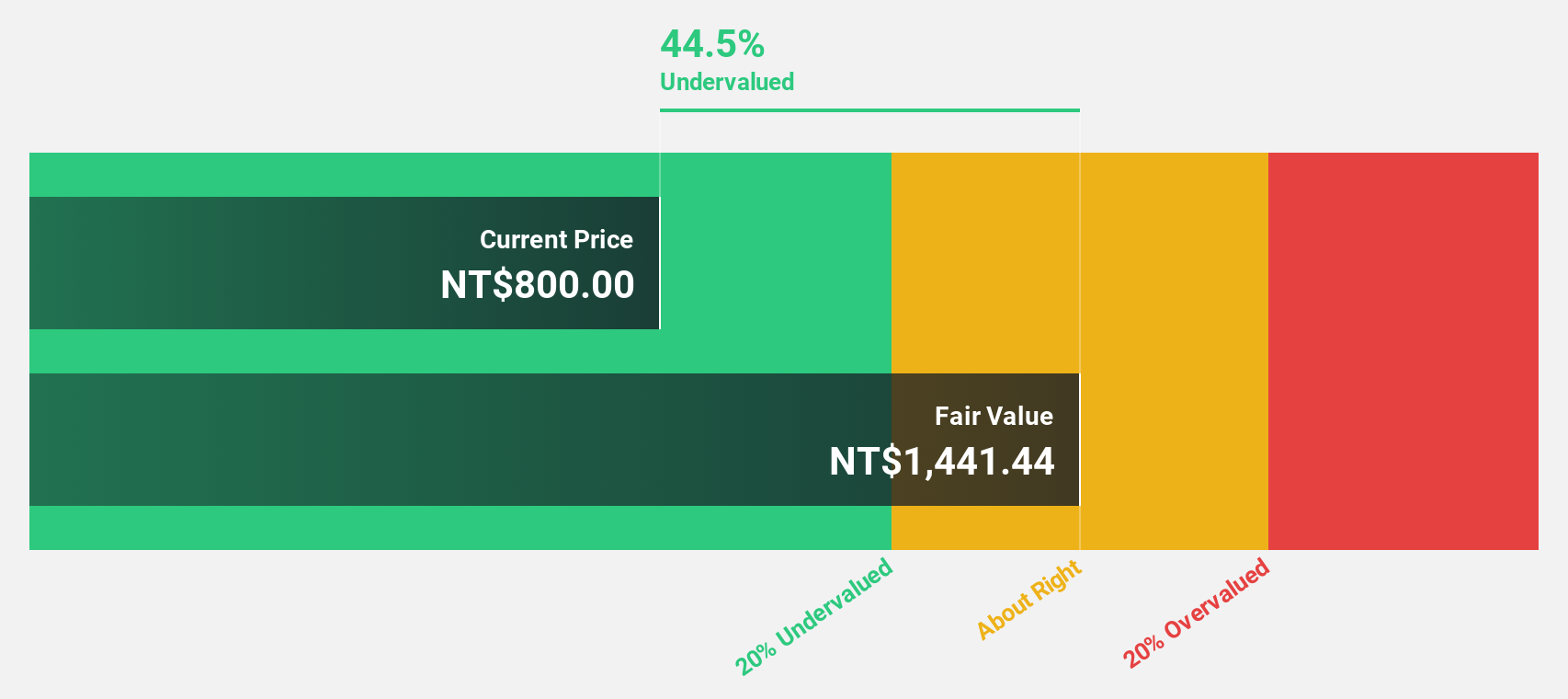

Fositek (TWSE:6805)

Overview: Fositek Corp. is involved in the manufacture and wholesale of electronic materials and components, with a market cap of NT$50.66 billion.

Operations: Fositek's revenue primarily comes from its Electronic Components & Parts segment, generating NT$7.20 billion.

Estimated Discount To Fair Value: 48.5%

Fositek is trading at NT$784, considerably below its estimated fair value of NT$1523.08, which suggests undervaluation based on discounted cash flow analysis. The company's earnings are forecast to grow significantly at 52.94% annually over the next three years, surpassing the Taiwan market's average growth rate of 17.1%. Despite recent share price volatility, analysts expect a potential price increase of 31.7%, with revenue growth projected to outpace market averages as well.

- Our earnings growth report unveils the potential for significant increases in Fositek's future results.

- Click here and access our complete balance sheet health report to understand the dynamics of Fositek.

Taking Advantage

- Delve into our full catalog of 502 Undervalued Global Stocks Based On Cash Flows here.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SASE:2290

Yanbu National Petrochemical

Engages in the manufacture and sale of petrochemical products in Saudi Arabia, the Americas, Africa, the Middle East, Europe, and Asia.

Flawless balance sheet with reasonable growth potential.

Market Insights

Community Narratives