- Saudi Arabia

- /

- Metals and Mining

- /

- SASE:2240

Zamil Industrial Investment Company's (TADAWUL:2240) Share Price Boosted 25% But Its Business Prospects Need A Lift Too

Zamil Industrial Investment Company (TADAWUL:2240) shareholders have had their patience rewarded with a 25% share price jump in the last month. Taking a wider view, although not as strong as the last month, the full year gain of 11% is also fairly reasonable.

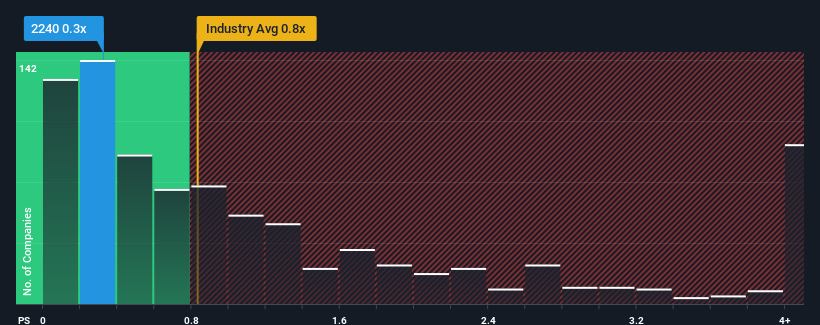

In spite of the firm bounce in price, given about half the companies operating in Saudi Arabia's Metals and Mining industry have price-to-sales ratios (or "P/S") above 1.4x, you may still consider Zamil Industrial Investment as an attractive investment with its 0.3x P/S ratio. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the reduced P/S.

View our latest analysis for Zamil Industrial Investment

How Zamil Industrial Investment Has Been Performing

With its revenue growth in positive territory compared to the declining revenue of most other companies, Zamil Industrial Investment has been doing quite well of late. Perhaps the market is expecting future revenue performance to follow the rest of the industry downwards, which has kept the P/S suppressed. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

Want the full picture on analyst estimates for the company? Then our free report on Zamil Industrial Investment will help you uncover what's on the horizon.How Is Zamil Industrial Investment's Revenue Growth Trending?

The only time you'd be truly comfortable seeing a P/S as low as Zamil Industrial Investment's is when the company's growth is on track to lag the industry.

Taking a look back first, we see that the company grew revenue by an impressive 22% last year. Pleasingly, revenue has also lifted 44% in aggregate from three years ago, thanks to the last 12 months of growth. So we can start by confirming that the company has done a great job of growing revenue over that time.

Looking ahead now, revenue is anticipated to climb by 4.7% during the coming year according to the one analyst following the company. With the industry predicted to deliver 11% growth, the company is positioned for a weaker revenue result.

With this information, we can see why Zamil Industrial Investment is trading at a P/S lower than the industry. Apparently many shareholders weren't comfortable holding on while the company is potentially eyeing a less prosperous future.

The Final Word

Zamil Industrial Investment's stock price has surged recently, but its but its P/S still remains modest. We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

We've established that Zamil Industrial Investment maintains its low P/S on the weakness of its forecast growth being lower than the wider industry, as expected. At this stage investors feel the potential for an improvement in revenue isn't great enough to justify a higher P/S ratio. It's hard to see the share price rising strongly in the near future under these circumstances.

And what about other risks? Every company has them, and we've spotted 2 warning signs for Zamil Industrial Investment you should know about.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

Valuation is complex, but we're here to simplify it.

Discover if Zamil Industrial Investment might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SASE:2240

Zamil Industrial Investment

Engages in the design and engineering, manufacturing, and fabrication of construction materials, pre-engineering steel buildings, steel structures, air conditions, and climate control systems for commercial, industrial, and residential applications, as well as for telecom and broadcasting towers, process equipment, fiberglass, rockwool and engineering plastic foam insulation, and solar power projects.

Reasonable growth potential low.

Similar Companies

Market Insights

Community Narratives