Highlighting Undiscovered Gems with Potential In December 2024

Reviewed by Simply Wall St

As global markets navigate a period of mixed performances, with the Nasdaq reaching new heights while smaller-cap indices like the Russell 2000 face challenges, investors are keenly observing economic indicators such as inflation rates and labor market trends that could influence upcoming Federal Reserve decisions. Amidst these dynamics, identifying promising small-cap stocks can be particularly rewarding for those looking to capitalize on potential growth opportunities in less explored areas of the market.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Xiangtan Electrochemical ScientificLtd | 44.62% | 13.70% | 36.55% | ★★★★★★ |

| Morris State Bancshares | 17.84% | 4.83% | 6.58% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Wuxi Chemical Equipment | NA | 12.26% | -0.74% | ★★★★★★ |

| All E Technologies | NA | 27.05% | 31.58% | ★★★★★★ |

| Tianyun International Holdings | 10.09% | -5.59% | -9.92% | ★★★★★★ |

| Hunan Investment GroupLtd | 7.09% | 33.04% | 20.37% | ★★★★★☆ |

| Keli Motor Group | 21.66% | 9.99% | -12.19% | ★★★★★☆ |

| A2B Australia | 15.83% | -7.78% | 25.44% | ★★★★☆☆ |

| Practic | NA | 3.63% | 6.85% | ★★★★☆☆ |

Here we highlight a subset of our preferred stocks from the screener.

Arabian Pipes (SASE:2200)

Simply Wall St Value Rating: ★★★★☆☆

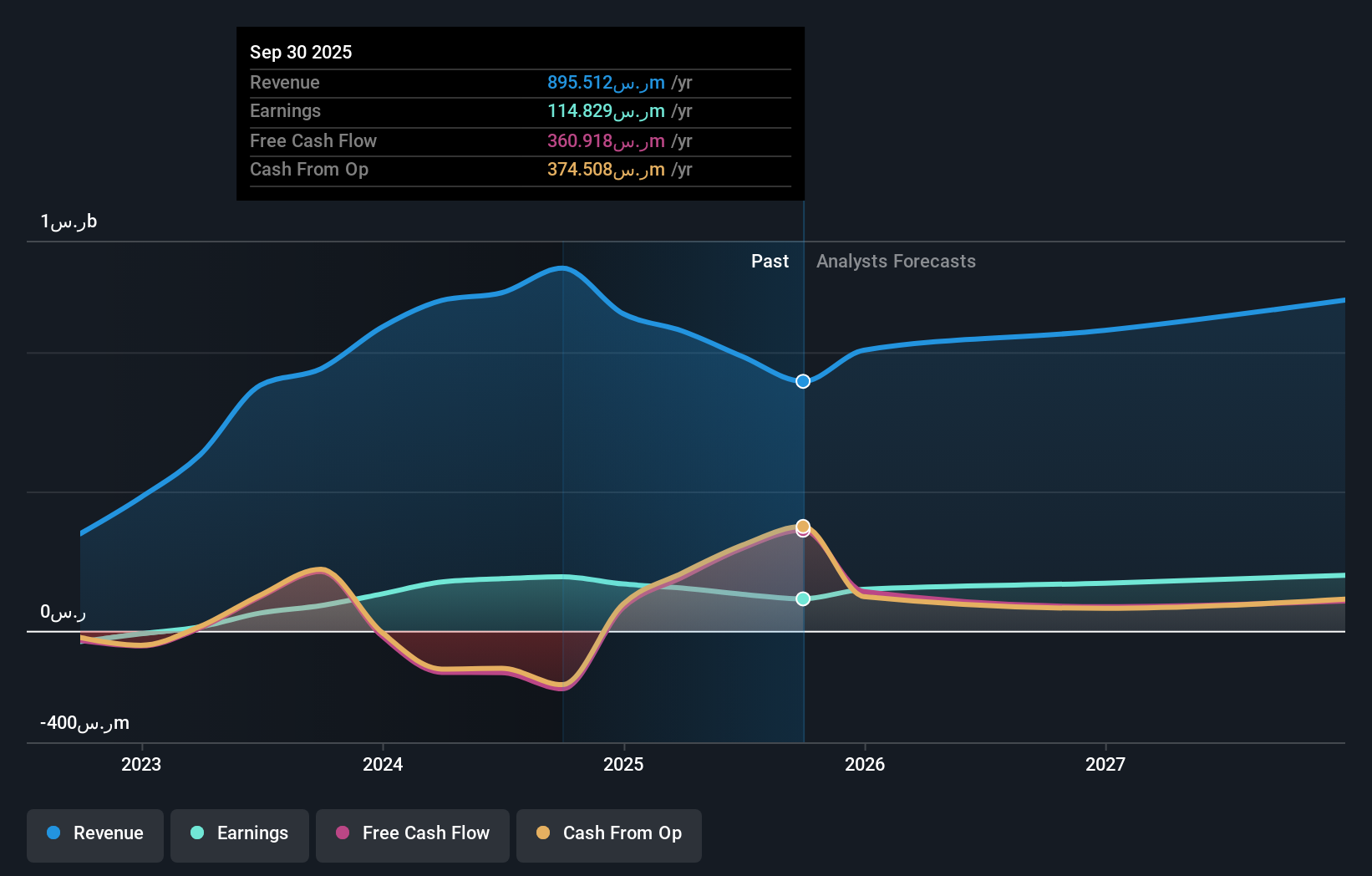

Overview: Arabian Pipes Company specializes in the production and sale of steel tubes in Saudi Arabia, with a market capitalization of SAR1.76 billion.

Operations: The company's primary revenue stream is from steel pipe production, generating SAR1.28 billion.

Arabian Pipes, a smaller player in the industry, has shown promising financial performance recently. The company's debt to equity ratio improved from 134.3% to 104.9% over five years, indicating better financial management. Its interest payments are well covered by EBIT at 5x coverage, suggesting strong operational earnings relative to its debt obligations. Despite having a high net debt to equity ratio of 93.7%, the company trades at a favorable price-to-earnings ratio of 9.1x compared to the SA market's 23.6x, highlighting its relative value appeal. Recent earnings reports revealed sales growth with SAR 318 million for Q3 and SAR 970 million for nine months ended September, bolstering confidence in its trajectory despite existing challenges with operating cash flow coverage.

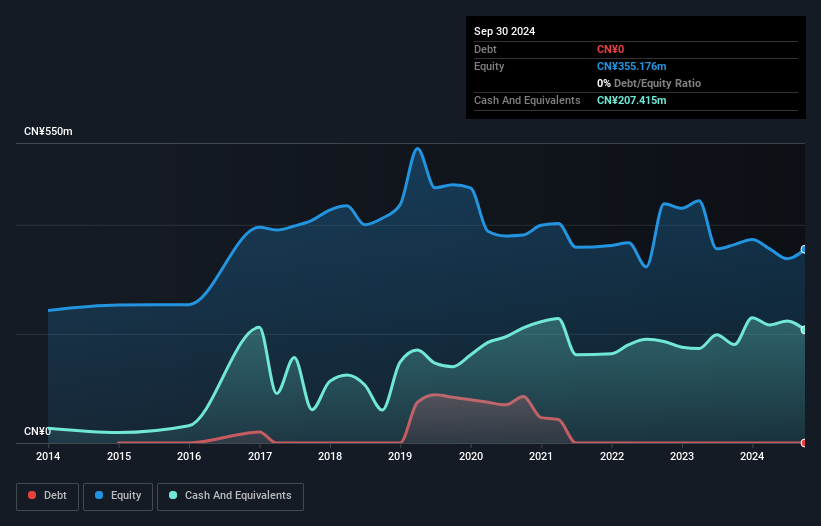

Guangdong New Grand Long Packing (SZSE:002836)

Simply Wall St Value Rating: ★★★★★★

Overview: Guangdong New Grand Long Packing Co., Ltd. operates in the packaging industry, specializing in the production and sale of various types of packaging materials, with a market cap of CN¥2.03 billion.

Operations: The company generates revenue primarily from the production and sale of packaging materials. It has a market capitalization of CN¥2.03 billion.

Guangdong New Grand Long Packing has shown impressive financial performance, with earnings soaring by 2549.8% over the past year, significantly outpacing the packaging industry's growth of 18.4%. The company is debt-free, enhancing its financial stability and eliminating concerns about interest coverage. Trading at 73.5% below its estimated fair value suggests potential undervaluation in the market. For the nine months ending September 2024, sales reached CNY 264.44 million, up from CNY 111.02 million a year earlier, while net income increased to CNY 45.77 million from CNY 10.21 million previously, reflecting strong operational efficiency and profitability gains in this small-cap entity.

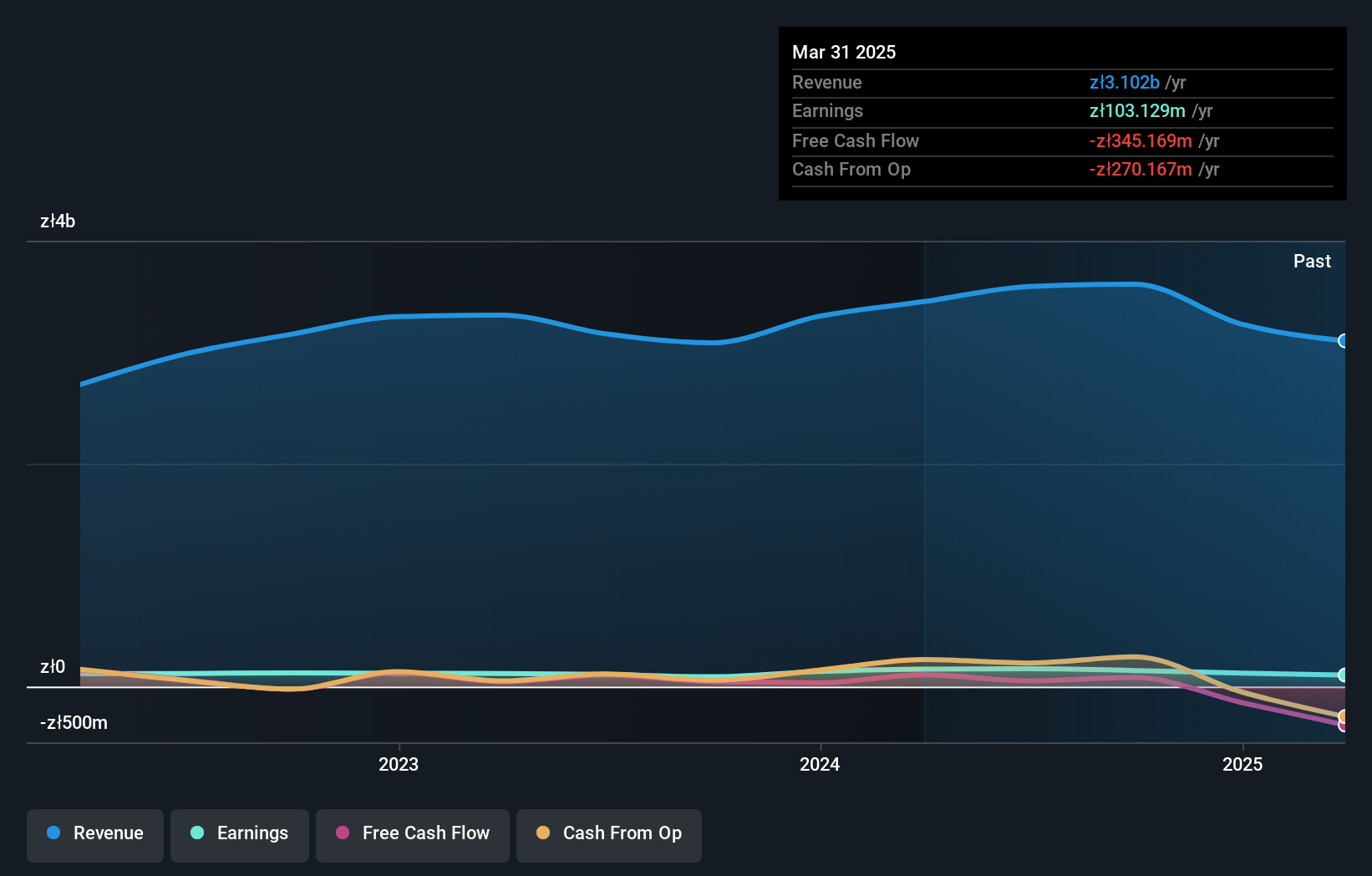

Mirbud (WSE:MRB)

Simply Wall St Value Rating: ★★★★★★

Overview: Mirbud S.A. operates as a general contractor in the construction industry in Poland with a market capitalization of PLN 1.20 billion.

Operations: Mirbud generates revenue primarily from Construction and Assembly Activity, contributing PLN 3.26 billion, followed by Real Estate Development Activity at PLN 345.14 million. Activities Related to Lease of Investment Property add PLN 44.75 million to its revenue streams.

Mirbud, a notable player in the construction industry, is trading at a significant discount of 96.2% below its estimated fair value, suggesting potential undervaluation. Despite facing challenges with a one-off loss of PLN158.2 million impacting recent financials, the company reported an impressive earnings growth of 63.5% over the past year, outpacing the industry's 8.5%. Mirbud's debt situation appears manageable as it holds more cash than total debt and has reduced its debt to equity ratio from 71.3% to 16% over five years. However, shareholder dilution occurred recently, which might concern some investors looking for stability in shareholding structure.

- Take a closer look at Mirbud's potential here in our health report.

Gain insights into Mirbud's historical performance by reviewing our past performance report.

Next Steps

- Dive into all 4509 of the Undiscovered Gems With Strong Fundamentals we have identified here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:002836

Guangdong New Grand Long Packing

Guangdong New Grand Long Packing Co., Ltd.

Flawless balance sheet with solid track record.