3 Growth Companies With High Insider Ownership Growing Earnings At 92%

Reviewed by Simply Wall St

As global markets navigate a complex landscape of monetary policy shifts and economic indicators, growth stocks have continued to outperform value stocks, with the Nasdaq Composite reaching new heights. In this environment, companies with high insider ownership and robust earnings growth can be particularly appealing to investors seeking stability and alignment of interests.

Top 10 Growth Companies With High Insider Ownership

| Name | Insider Ownership | Earnings Growth |

| People & Technology (KOSDAQ:A137400) | 16.4% | 37.3% |

| Archean Chemical Industries (NSEI:ACI) | 22.9% | 41.3% |

| SKS Technologies Group (ASX:SKS) | 27% | 24.8% |

| Kirloskar Pneumatic (BSE:505283) | 30.3% | 26.3% |

| Seojin SystemLtd (KOSDAQ:A178320) | 30.9% | 39.9% |

| Medley (TSE:4480) | 34% | 31.7% |

| Laopu Gold (SEHK:6181) | 36.4% | 34.2% |

| Brightstar Resources (ASX:BTR) | 16.2% | 84.5% |

| Fine M-TecLTD (KOSDAQ:A441270) | 17.2% | 131.1% |

| Fulin Precision (SZSE:300432) | 13.6% | 66.7% |

Let's dive into some prime choices out of the screener.

Techwing (KOSDAQ:A089030)

Simply Wall St Growth Rating: ★★★★★★

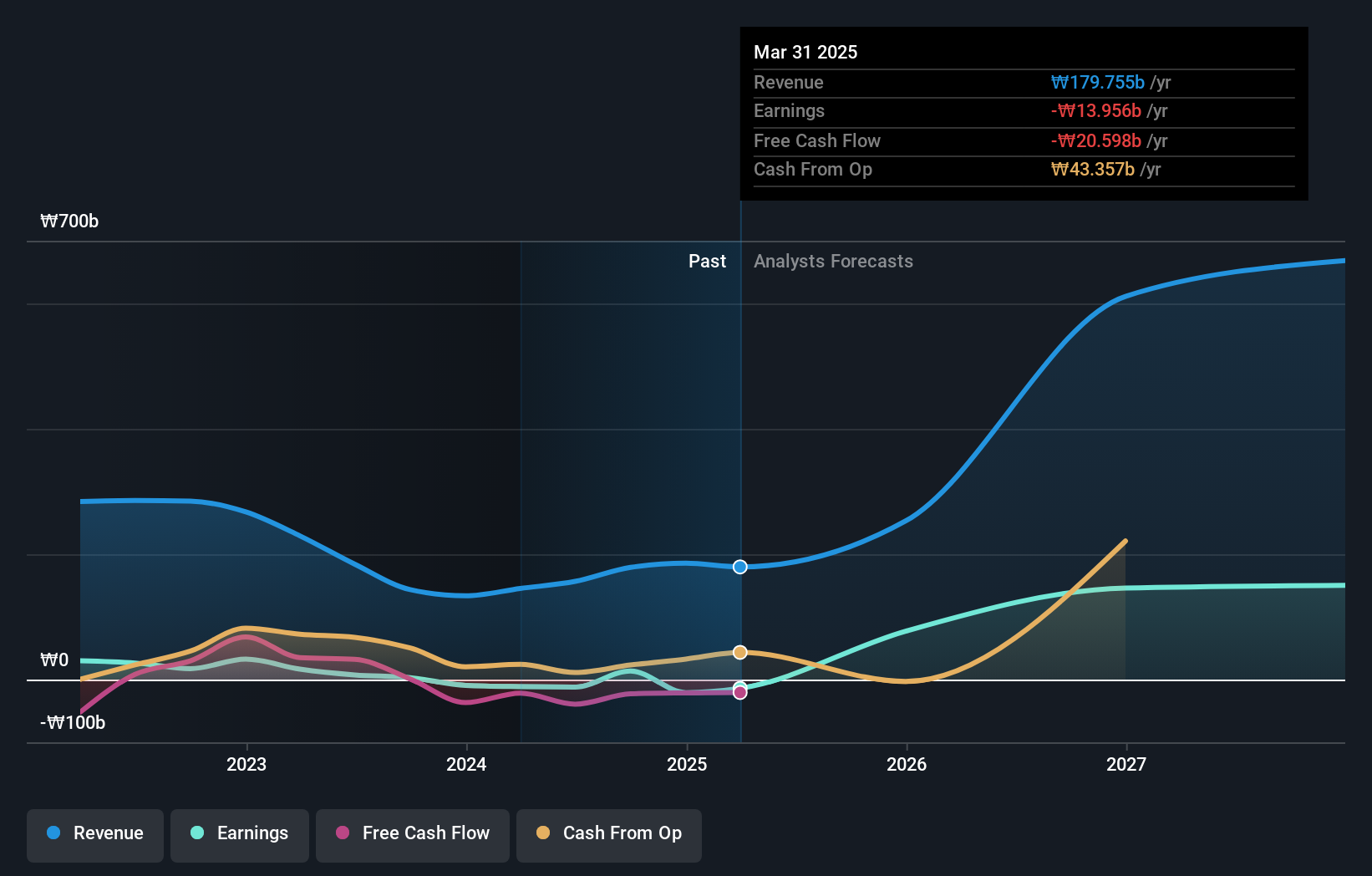

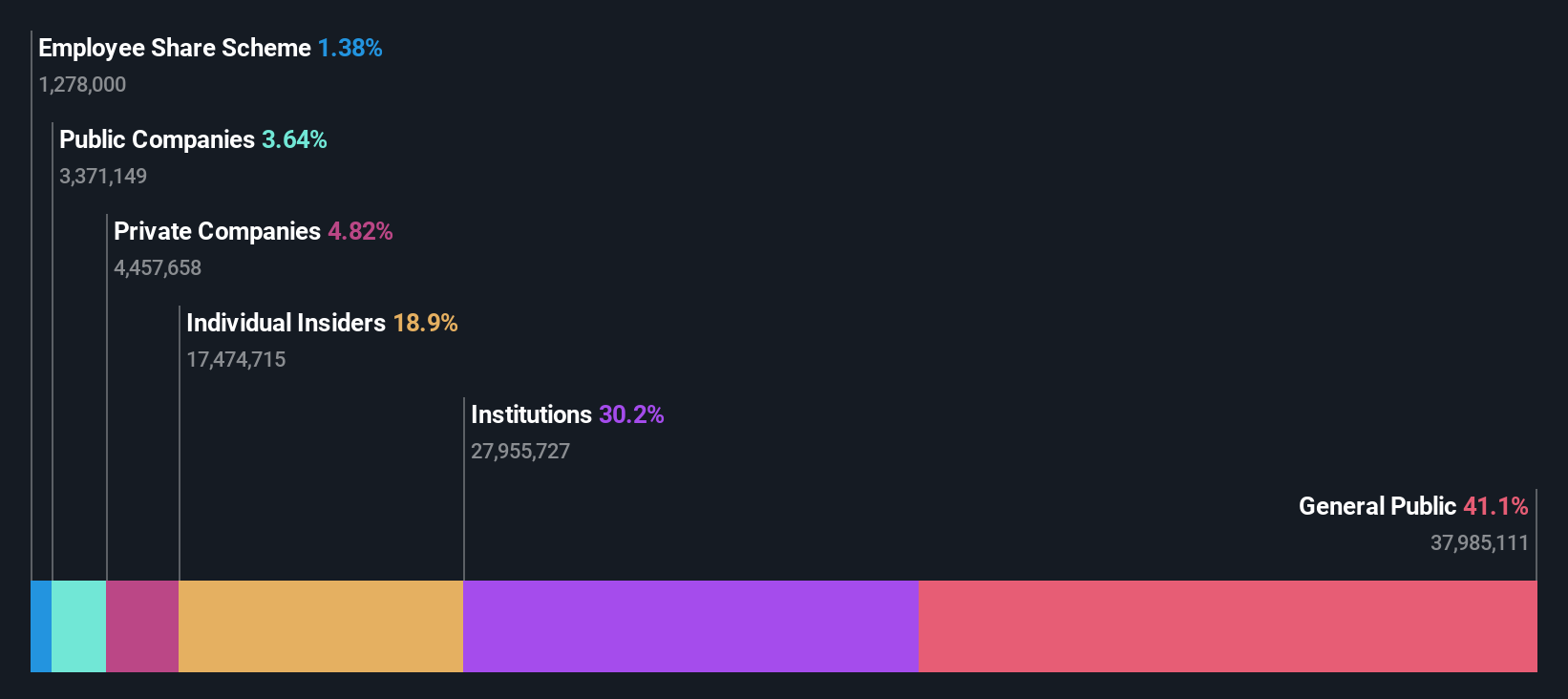

Overview: Techwing, Inc. develops, manufactures, sells, and services semiconductor inspection equipment in South Korea and internationally with a market cap of approximately ₩1.23 trillion.

Operations: Techwing's revenue is primarily derived from the development, manufacturing, sales, and servicing of semiconductor inspection equipment both domestically in South Korea and internationally.

Insider Ownership: 18.8%

Earnings Growth Forecast: 81.9% p.a.

Techwing's recent earnings report highlights significant progress, with sales reaching KRW 46.72 billion in Q3 2024, a substantial increase from the previous year. The company turned a net loss into a net income of KRW 14.60 million, reflecting strong financial recovery. Despite high share price volatility and debt concerns due to insufficient operating cash flow coverage, Techwing's forecasted revenue and earnings growth rates far exceed market averages, supported by very high projected return on equity in three years.

- Take a closer look at Techwing's potential here in our earnings growth report.

- Our valuation report here indicates Techwing may be overvalued.

Shenzhen SEICHI Technologies (SHSE:688627)

Simply Wall St Growth Rating: ★★★★★☆

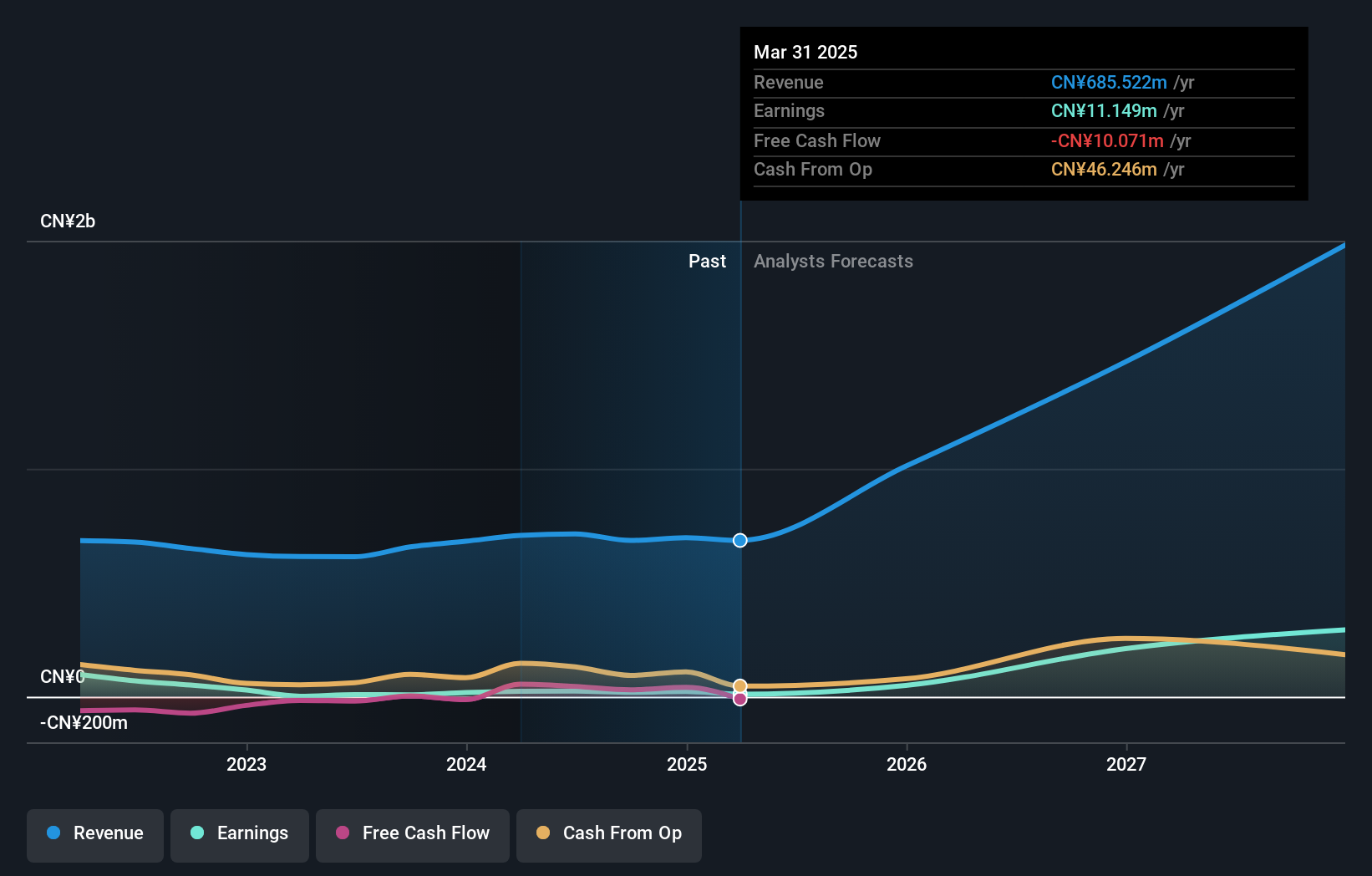

Overview: Shenzhen SEICHI Technologies Co., Ltd. focuses on the research, development, production, and sale of new display device testing equipment in China, with a market cap of CN¥6.64 billion.

Operations: Shenzhen SEICHI Technologies Co., Ltd. generates revenue through its operations in the research, development, production, and sale of innovative display device testing equipment within China.

Insider Ownership: 18.6%

Earnings Growth Forecast: 42.6% p.a.

Shenzhen SEICHI Technologies is experiencing robust revenue growth, forecasted at 29.1% annually, outpacing the Chinese market average. Despite a recent decline in profit margins from 20% to 13.3%, earnings are expected to grow significantly at 42.62% per year, surpassing market expectations. The company recently completed a share buyback of CNY 44.76 million, enhancing shareholder value despite volatile share prices and low projected return on equity of 11.5%.

- Click to explore a detailed breakdown of our findings in Shenzhen SEICHI Technologies' earnings growth report.

- In light of our recent valuation report, it seems possible that Shenzhen SEICHI Technologies is trading beyond its estimated value.

Suzhou Sunmun Technology (SZSE:300522)

Simply Wall St Growth Rating: ★★★★★★

Overview: Suzhou Sunmun Technology Co., Ltd. operates in China, focusing on the research, production, and sale of nano-coloring materials, functional nano-dispersions, special additives, intelligent color matching systems, and electronic chemicals with a market cap of CN¥4.21 billion.

Operations: Suzhou Sunmun Technology's revenue is derived from its activities in nano-coloring materials, functional nano-dispersions, special additives, intelligent color matching systems, and electronic chemicals within China.

Insider Ownership: 29.9%

Earnings Growth Forecast: 92.8% p.a.

Suzhou Sunmun Technology is poised for significant growth, with earnings forecasted to rise by 92.8% annually over the next three years, far exceeding the Chinese market's average. Revenue is also expected to grow at a robust 48.8% per year. Recent earnings showed slight increases in both sales and net income compared to last year. The company announced a private placement of shares worth up to CNY 310 million, indicating strong insider confidence and investment interest.

- Get an in-depth perspective on Suzhou Sunmun Technology's performance by reading our analyst estimates report here.

- The analysis detailed in our Suzhou Sunmun Technology valuation report hints at an inflated share price compared to its estimated value.

Make It Happen

- Navigate through the entire inventory of 1528 Fast Growing Companies With High Insider Ownership here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:300522

Suzhou Sunmun Technology

Engages in the research, production, and sale of nano-coloring materials, functional nano-dispersions, special additives, intelligent color matching systems, and electronic chemicals in China.

Exceptional growth potential with adequate balance sheet.

Market Insights

Community Narratives