- China

- /

- Commercial Services

- /

- SZSE:301068

Discover 3 Hidden Small Caps with Promising Potential

Reviewed by Simply Wall St

As global markets navigate a complex landscape of shifting interest rates and economic indicators, small-cap stocks have faced particular challenges, with the Russell 2000 Index underperforming against larger counterparts like the S&P 500. Amidst this backdrop, identifying promising small-cap stocks requires a keen eye for companies that demonstrate resilience and potential growth despite broader market headwinds.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Morris State Bancshares | 17.84% | 4.83% | 6.58% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Wuxi Chemical Equipment | NA | 12.26% | -0.74% | ★★★★★★ |

| Tianyun International Holdings | 10.09% | -5.59% | -9.92% | ★★★★★★ |

| Indo Tech Transformers | 1.82% | 23.41% | 58.49% | ★★★★★☆ |

| TechNVision Ventures | 14.35% | 20.69% | 63.60% | ★★★★★☆ |

| Magadh Sugar & Energy | 50.50% | 6.14% | 14.35% | ★★★★☆☆ |

| REDtone Digital Berhad | 8.13% | 30.43% | 35.72% | ★★★★☆☆ |

| A2B Australia | 15.83% | -7.78% | 25.44% | ★★★★☆☆ |

| Practic | NA | 3.63% | 6.85% | ★★★★☆☆ |

We're going to check out a few of the best picks from our screener tool.

Launch Tech (SEHK:2488)

Simply Wall St Value Rating: ★★★★★☆

Overview: Launch Tech Company Limited, along with its subsidiaries, offers products and services to the automotive aftermarket and automobile industry both in China and internationally, with a market cap of HK$2.79 billion.

Operations: Launch Tech generates revenue primarily from the automotive aftermarket and automobile industry. The company's cost structure includes expenses related to production, marketing, and distribution of its products and services. Its financial performance is influenced by factors such as market demand, competitive pricing strategies, and operational efficiencies.

Launch Tech, a small player in the auto components sector, presents an intriguing mix of financial metrics and challenges. Over the past five years, its debt to equity ratio has risen from 24.1% to 31.2%, indicating increased leverage. Despite this, it holds more cash than total debt and covers interest payments comfortably. However, net profit margins have slipped from 26.1% last year to 13.7%. Earnings growth faced a setback with a -27.2% change compared to an industry average of -19.9%. Revenue is expected to grow by around 20% annually, suggesting potential future opportunities despite recent hurdles.

- Click here to discover the nuances of Launch Tech with our detailed analytical health report.

Assess Launch Tech's past performance with our detailed historical performance reports.

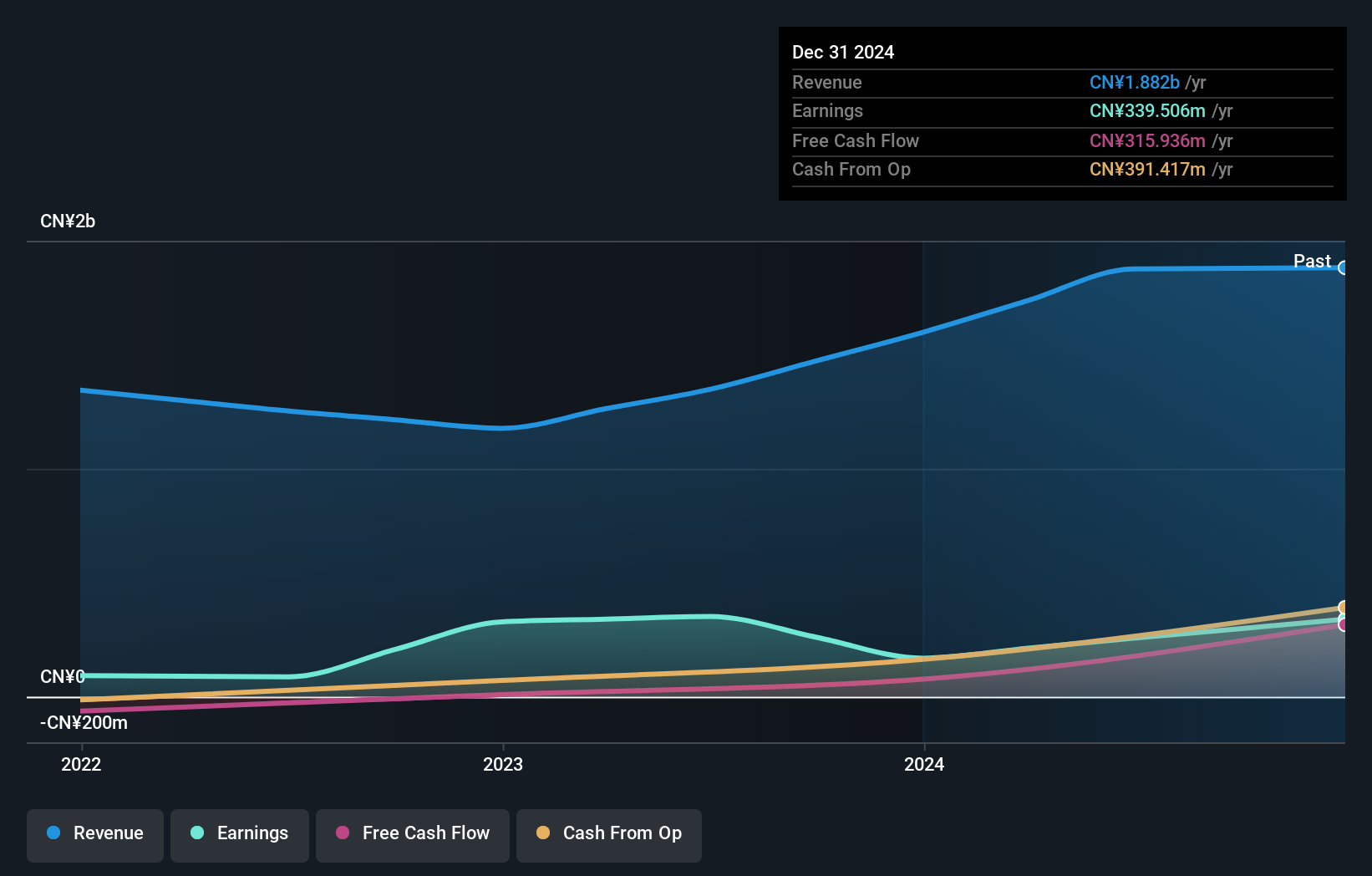

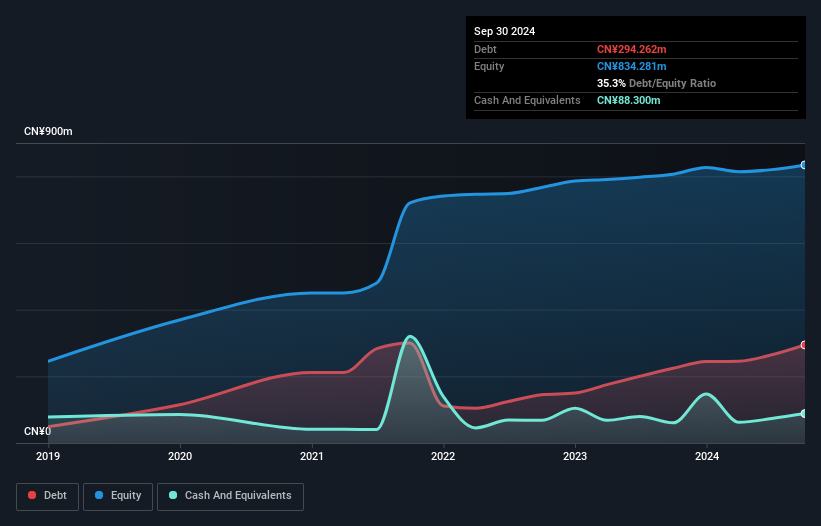

Hangzhou Dadi Haiyang Environmental Protection (SZSE:301068)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Hangzhou Dadi Haiyang Environmental Protection Co., Ltd. focuses on the comprehensive utilization of waste resources, with a market cap of CN¥3.26 billion.

Operations: The primary revenue stream for Hangzhou Dadi Haiyang Environmental Protection comes from the comprehensive utilization of waste resources, generating CN¥948.72 million. The company's net profit margin is an important metric to consider when evaluating its financial performance.

With a focus on environmental protection, Hangzhou Dadi Haiyang has demonstrated robust earnings growth of 27% over the past year, surpassing industry averages. Despite a 2.9% annual decline in earnings over five years, recent results show promise with net income rising to CNY 48.19 million from CNY 34.7 million last year and basic EPS increasing to CNY 0.5 from CNY 0.32. Debt levels remain manageable with an EBIT interest coverage of 8x and a net debt to equity ratio at a satisfactory level of about 25%. The company's strategic initiatives seem poised for future growth opportunities within its industry space.

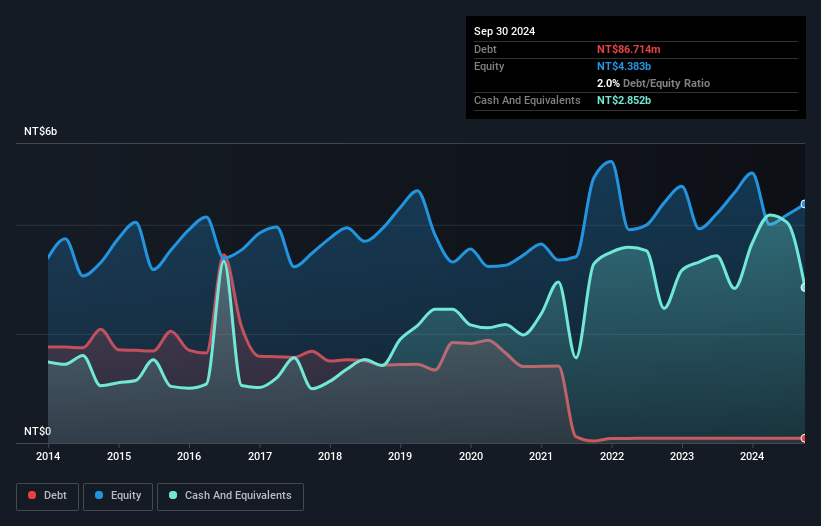

Formosa International Hotels (TWSE:2707)

Simply Wall St Value Rating: ★★★★★☆

Overview: Formosa International Hotels Corporation operates tourist hotels in Taiwan and internationally, with a market capitalization of NT$24.72 billion.

Operations: The company's primary revenue streams include the Room Segment generating NT$2.35 billion and the Catering Segment contributing NT$3.19 billion, alongside additional income from Leasing and Technical Services and Management.

Formosa International Hotels stands out as a promising player in the hospitality sector, trading at 26% below its estimated fair value. This company has shown resilience with earnings growth of 4.5% over the past year, surpassing the industry average of -9%. Its debt-to-equity ratio impressively dropped from 55.5% to just 2% over five years, reflecting strong financial health. The recent report highlights sales of TWD 1,447 million for Q3 and net income at TWD 222 million, slightly lower than last year’s figures but still robust. With high-quality earnings and positive free cash flow, Formosa seems well-positioned for future growth.

- Click here and access our complete health analysis report to understand the dynamics of Formosa International Hotels.

Understand Formosa International Hotels' track record by examining our Past report.

Make It Happen

- Click this link to deep-dive into the 4512 companies within our Undiscovered Gems With Strong Fundamentals screener.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade Hangzhou Dadi Haiyang Environmental Protection, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Hangzhou Dadi Haiyang Environmental Protection might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:301068

Hangzhou Dadi Haiyang Environmental Protection

Hangzhou Dadi Haiyang Environmental Protection Co., Ltd.

Solid track record with excellent balance sheet.

Market Insights

Community Narratives