- China

- /

- Construction

- /

- SZSE:002116

Promising Undiscovered Gems with Potential In December 2024

Reviewed by Simply Wall St

As global markets navigate a complex landscape of interest rate adjustments and economic indicators, small-cap stocks have faced notable challenges, with the Russell 2000 Index underperforming against larger indices like the S&P 500. Amidst this backdrop, investors often seek out promising undiscovered gems—stocks that may not yet have gained widespread attention but possess potential for growth due to unique market positions or innovative offerings.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Xiangtan Electrochemical ScientificLtd | 44.62% | 13.70% | 36.55% | ★★★★★★ |

| Morris State Bancshares | 17.84% | 4.83% | 6.58% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Wuxi Chemical Equipment | NA | 12.26% | -0.74% | ★★★★★★ |

| All E Technologies | NA | 27.05% | 31.58% | ★★★★★★ |

| Tianyun International Holdings | 10.09% | -5.59% | -9.92% | ★★★★★★ |

| Hunan Investment GroupLtd | 7.09% | 33.04% | 20.37% | ★★★★★☆ |

| Keli Motor Group | 21.66% | 9.99% | -12.19% | ★★★★★☆ |

| A2B Australia | 15.83% | -7.78% | 25.44% | ★★★★☆☆ |

| Practic | NA | 3.63% | 6.85% | ★★★★☆☆ |

Let's uncover some gems from our specialized screener.

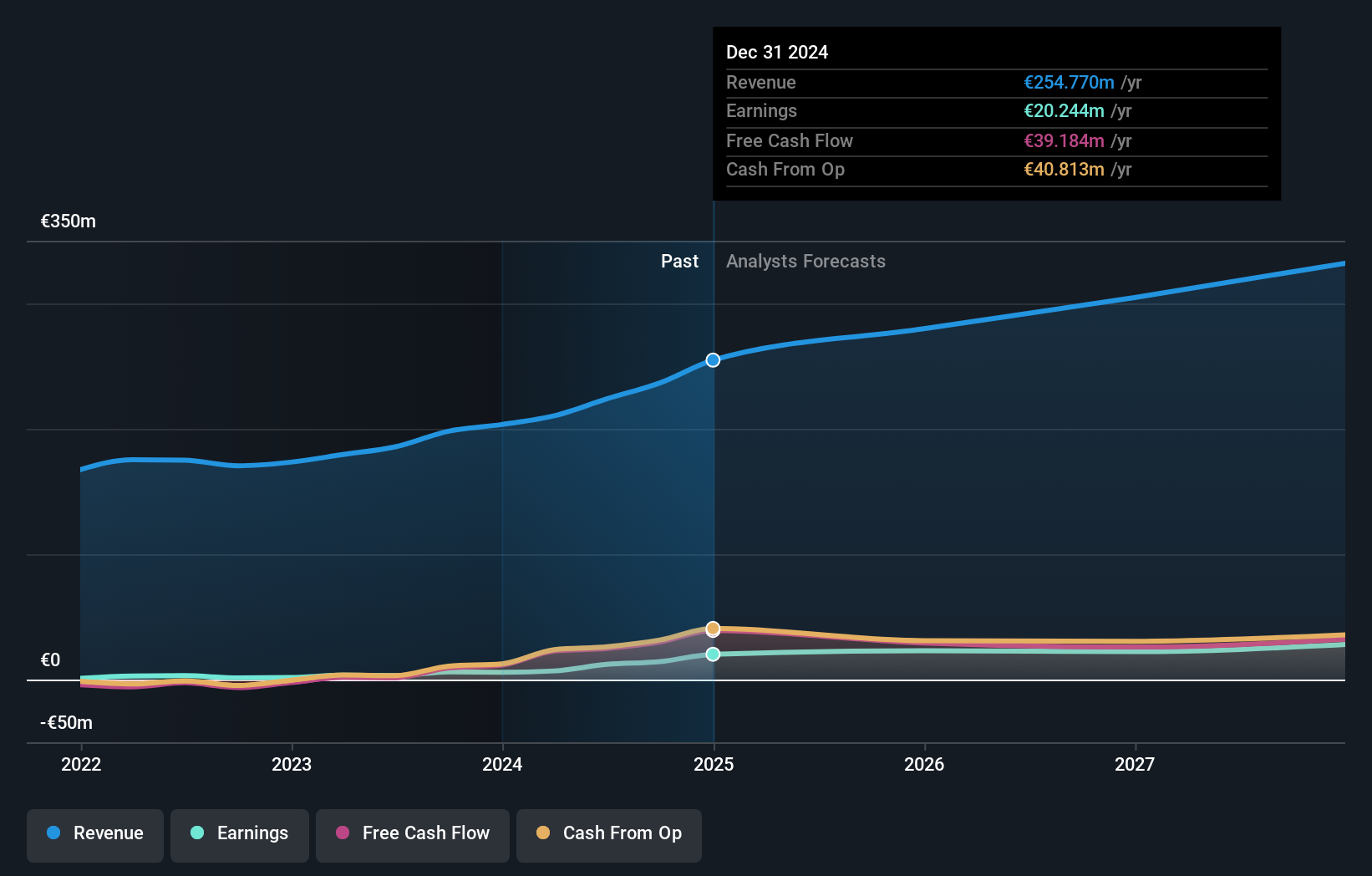

Arteche Lantegi Elkartea (BME:ART)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Arteche Lantegi Elkartea, S.A. specializes in the design, manufacture, integration, and supply of electrical equipment and solutions with a focus on renewable energies and smart grids both in Spain and internationally, with a market cap of €376.11 million.

Operations: Arteche Lantegi Elkartea generates revenue primarily through its Systems Measurement and Monitoring segment (€304.31 million), followed by Automation of Transmission and Distribution Networks (€85.32 million) and Network Reliability (€48.70 million).

Arteche Lantegi Elkartea, a nimble player in the electrical industry, showcases impressive earnings growth of 70.1% over the past year, outpacing its peers significantly. Despite its high net debt to equity ratio at 51.8%, interest payments are well covered by EBIT with a coverage of 3.9 times, indicating manageable debt servicing capabilities. The stock trades at a notable discount of 43.3% below estimated fair value, suggesting potential upside for investors eyeing undervalued opportunities. While volatile share prices may concern some investors, Arteche's high-quality earnings and positive free cash flow paint an encouraging picture for future prospects.

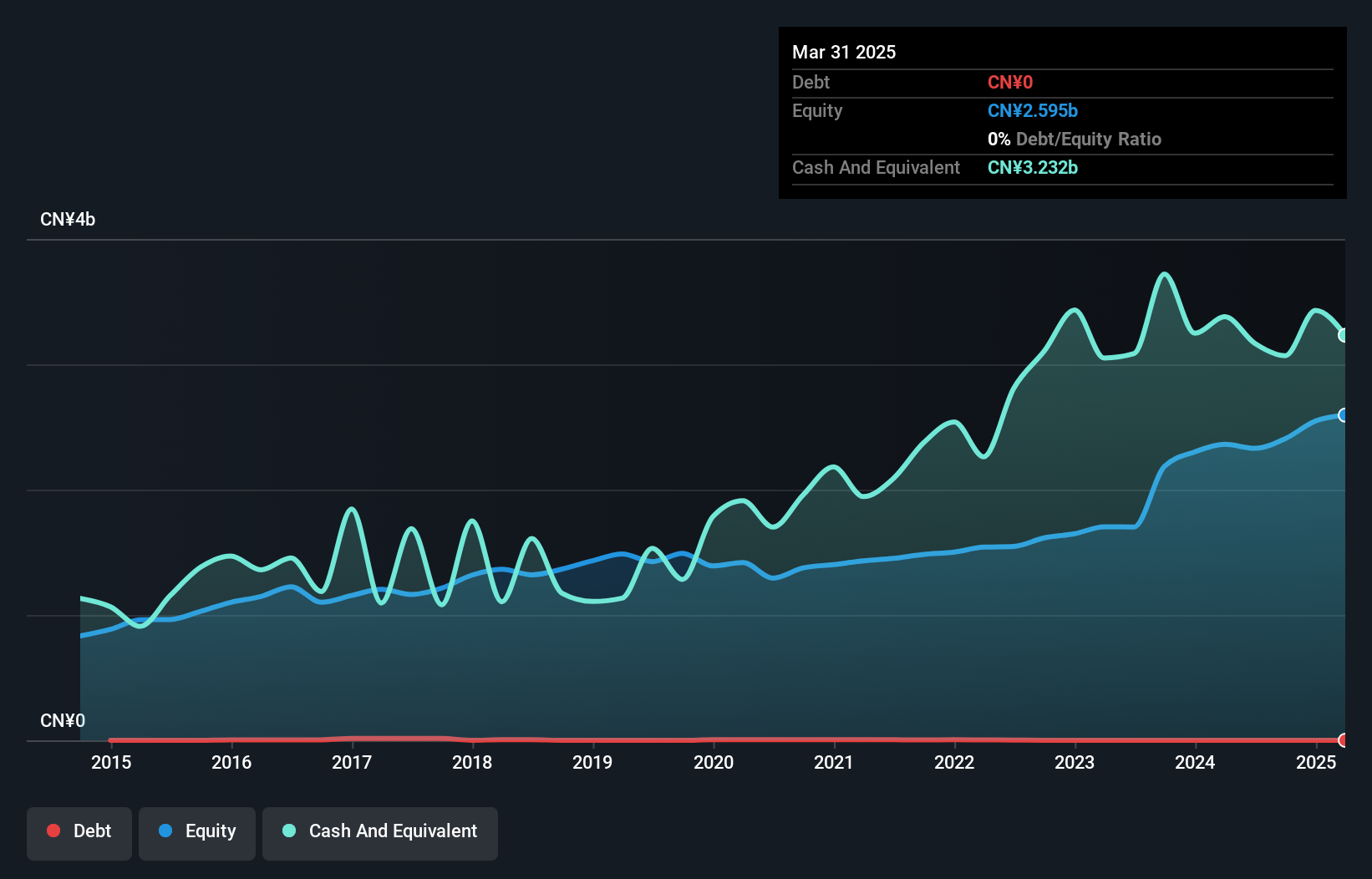

China Haisum Engineering (SZSE:002116)

Simply Wall St Value Rating: ★★★★★★

Overview: China Haisum Engineering Co., Ltd. provides engineering EPC, design, consultation, and supervision services with a market capitalization of CN¥5.10 billion.

Operations: The company generates revenue primarily through engineering EPC, design, consultation, and supervision services. Its financial performance includes a market capitalization of CN¥5.10 billion.

China Haisum Engineering, a smaller player in the construction sector, is making waves with its impressive earnings growth of 42.2% over the past year, outpacing the industry average of -3.9%. Despite trading at a substantial 69.6% below its estimated fair value, it continues to demonstrate high-quality earnings and remains debt-free. Recent reports show sales for the first nine months of 2024 reached CNY 4.29 billion compared to CNY 4.21 billion last year, while net income increased to CNY 213 million from CNY 197 million previously. Earnings per share held steady at CNY 0.46 during this period.

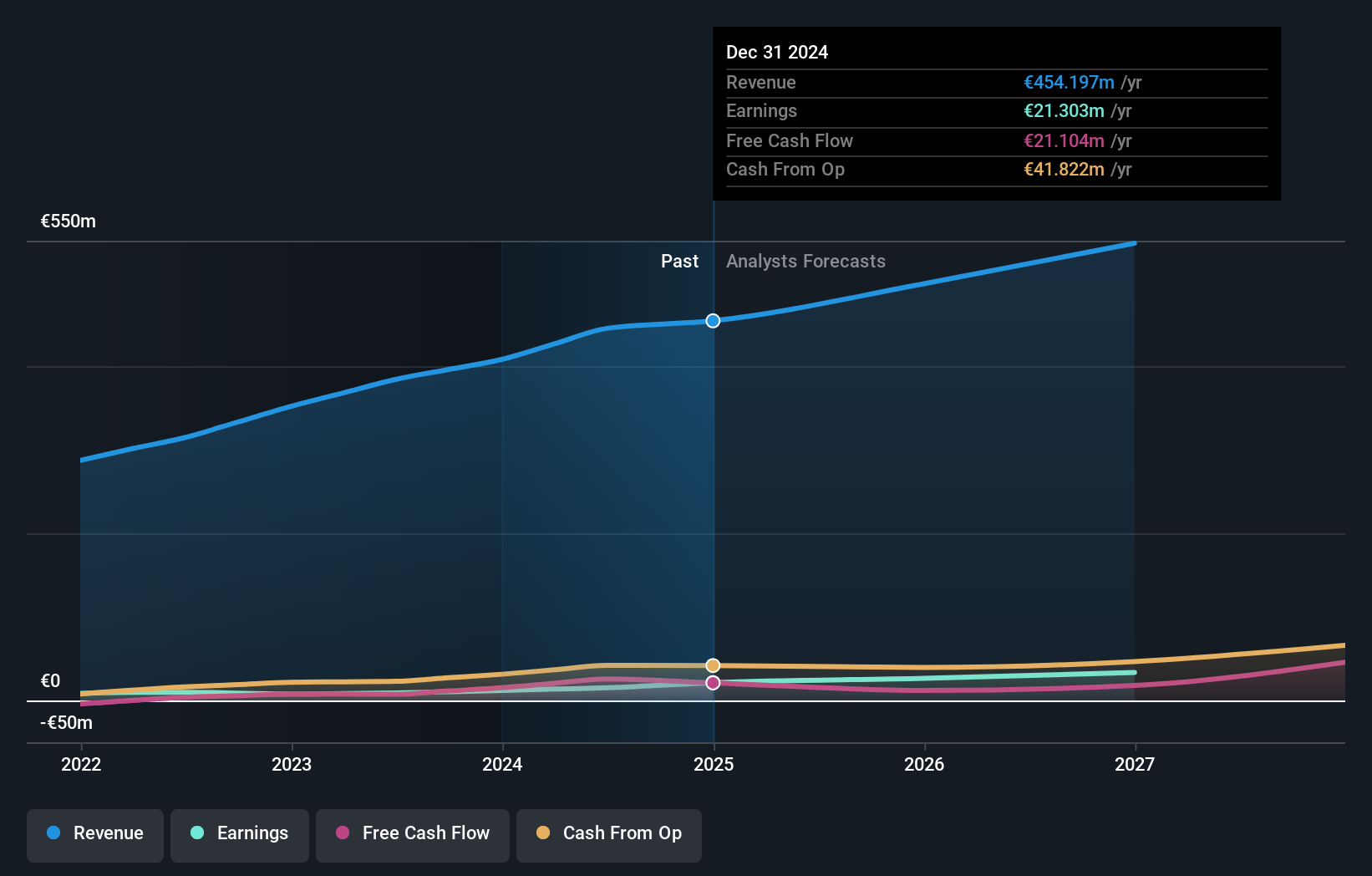

SNP Schneider-Neureither & Partner (XTRA:SHF)

Simply Wall St Value Rating: ★★★★★☆

Overview: SNP Schneider-Neureither & Partner SE provides software solutions for managing digital transformation processes and has a market capitalization of approximately €372.90 million.

Operations: SNP Schneider-Neureither & Partner SE generates revenue primarily from its Service segment (€145.14 million) and Software segment (€79.42 million), with a smaller contribution from EXA (€13.24 million). The company's net profit margin has shown variability over recent periods, reflecting changes in operational efficiency and cost management strategies.

SNP Schneider-Neureither & Partner, a smaller player in the IT sector, has shown impressive financial performance recently. The company reported third-quarter revenue of €66.8 million, up from €54.05 million last year, with net income reaching €5.04 million compared to €2.87 million previously. Over nine months, revenue hit €182.82 million and net income was €12.96 million, marking significant growth from prior periods. Their debt-to-equity ratio stands at a satisfactory 32%, and earnings have surged by 129% over the past year—far outpacing the industry average of 8%. Despite recent delisting news due to inactivity on OTC Equity markets, SNP's high-quality earnings and robust EBIT coverage (7.7x interest payments) suggest solid operational health moving forward.

Taking Advantage

- Explore the 4509 names from our Undiscovered Gems With Strong Fundamentals screener here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:002116

China Haisum Engineering

Engages in the engineering EPC, engineering design, consultation and supervision services.

Flawless balance sheet, undervalued and pays a dividend.

Market Insights

Community Narratives