December 2024's Top Three Stocks That May Be Trading Below Estimated Value

Reviewed by Simply Wall St

As global markets navigate a landscape marked by mixed performances across major indices and geopolitical developments, investors are keenly observing sectors that have recently shown both strength and weakness. With growth stocks rallying and value stocks lagging, the current market environment presents potential opportunities for discerning investors to identify stocks trading below their estimated value. In such conditions, a good stock might be one that is fundamentally strong yet overlooked due to broader market trends or sector-specific challenges.

Top 10 Undervalued Stocks Based On Cash Flows

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Hunan Jiudian Pharmaceutical (SZSE:300705) | CN¥26.21 | CN¥52.08 | 49.7% |

| Ficont Industry (Beijing) (SHSE:605305) | CN¥28.18 | CN¥56.17 | 49.8% |

| UMB Financial (NasdaqGS:UMBF) | US$122.36 | US$244.39 | 49.9% |

| Aguas Andinas (SNSE:AGUAS-A) | CLP288.85 | CLP577.11 | 49.9% |

| Acerinox (BME:ACX) | €10.03 | €20.04 | 49.9% |

| EnomotoLtd (TSE:6928) | ¥1446.00 | ¥2882.86 | 49.8% |

| U.S. Physical Therapy (NYSE:USPH) | US$94.06 | US$187.03 | 49.7% |

| Ingenia Communities Group (ASX:INA) | A$4.60 | A$9.14 | 49.7% |

| Equifax (NYSE:EFX) | US$265.29 | US$529.48 | 49.9% |

| Almacenes Éxito (BVC:EXITO) | COP2190.00 | COP4369.08 | 49.9% |

We're going to check out a few of the best picks from our screener tool.

Middle East Company for Manufacturing and Producing Paper (SASE:1202)

Overview: Middle East Company for Manufacturing and Producing Paper, along with its subsidiaries, produces and sells container boards and industrial papers across the Kingdom of Saudi Arabia, the Middle East, Africa, Asia, and Europe with a market cap of SAR3.23 billion.

Operations: The company's revenue segments include Trading, generating SAR244.58 million, and Manufacturing, contributing SAR969.23 million.

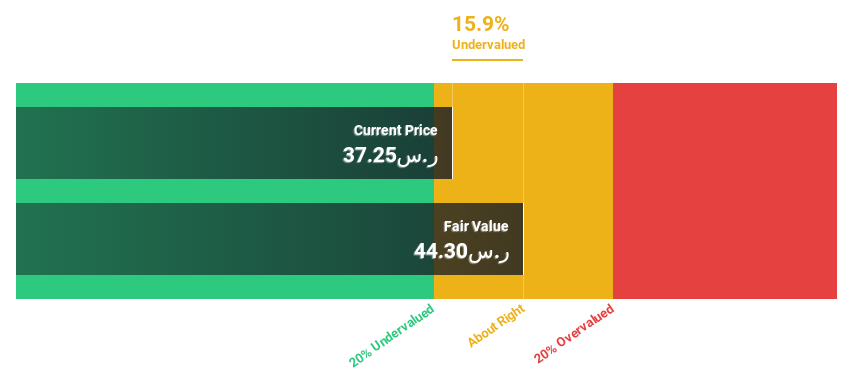

Estimated Discount To Fair Value: 15.7%

Middle East Company for Manufacturing and Producing Paper is trading at SAR 37.25, below its estimated fair value of SAR 44.2, suggesting it may be undervalued based on cash flows. Despite recent net losses, the company has shown revenue growth with sales reaching SAR 276.89 million in Q3 2024 from SAR 229.18 million a year ago. However, its dividend yield of 2.68% is not well covered by earnings or free cash flows, and shareholders experienced dilution over the past year.

- In light of our recent growth report, it seems possible that Middle East Company for Manufacturing and Producing Paper's financial performance will exceed current levels.

- Dive into the specifics of Middle East Company for Manufacturing and Producing Paper here with our thorough financial health report.

Moriya Transportation Engineering and ManufacturingLtd (TSE:6226)

Overview: Moriya Transportation Engineering and Manufacturing Co., Ltd. (TSE:6226) specializes in the engineering and manufacturing of transportation systems, with a market cap of ¥48.75 billion.

Operations: Moriya Transportation Engineering and Manufacturing Co., Ltd. (TSE:6226) has revenue segments that focus on the engineering and manufacturing of transportation systems.

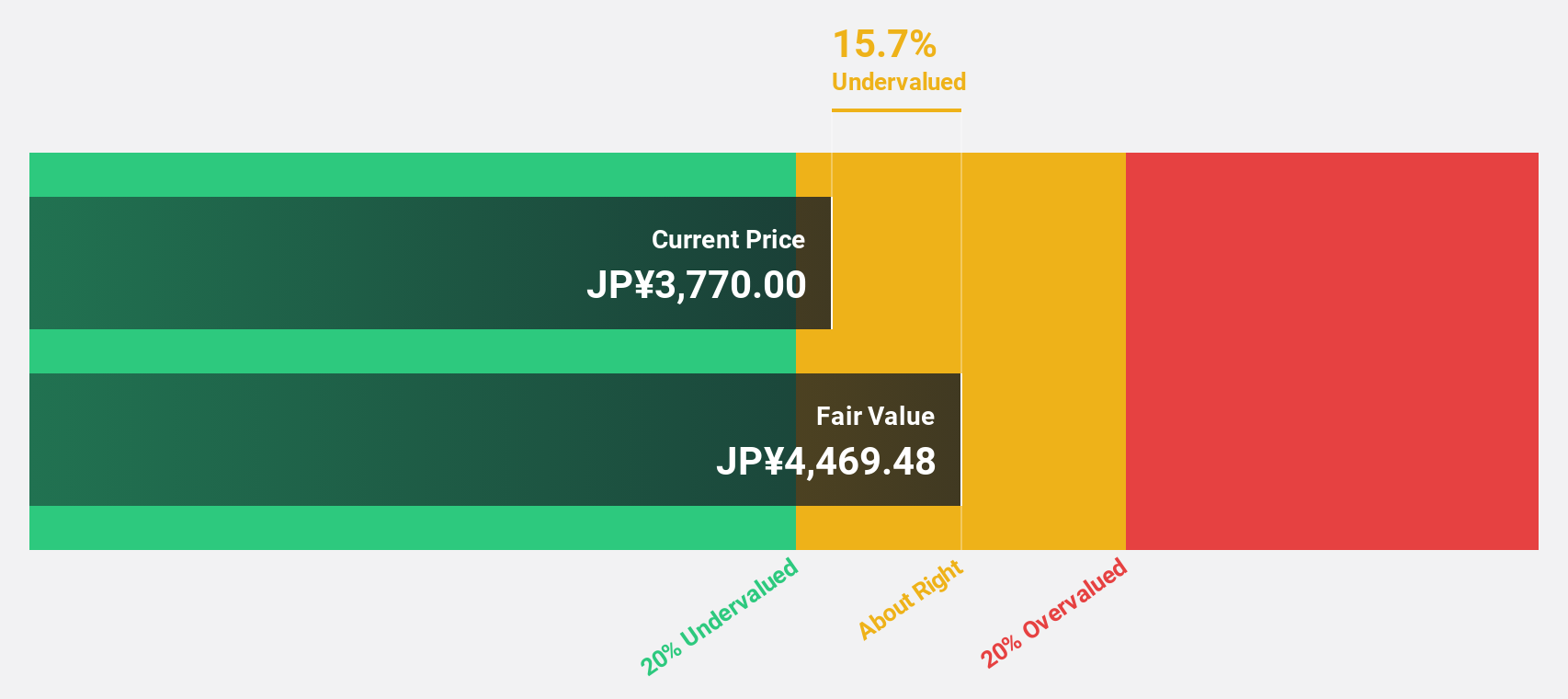

Estimated Discount To Fair Value: 13%

Moriya Transportation Engineering and Manufacturing Ltd. is trading at ¥2,742, below its fair value estimate of ¥3,152.44, reflecting potential undervaluation based on cash flows. The company recently completed a share buyback program aimed at increasing shareholder value. Despite high share price volatility over the past three months, earnings are expected to grow 12.28% annually, outpacing the broader Japanese market's forecasted growth rate of 7.9%.

- According our earnings growth report, there's an indication that Moriya Transportation Engineering and ManufacturingLtd might be ready to expand.

- Get an in-depth perspective on Moriya Transportation Engineering and ManufacturingLtd's balance sheet by reading our health report here.

Shoper (WSE:SHO)

Overview: Shoper SA offers Software as a Service solutions for e-commerce in Poland and has a market capitalization of PLN1.15 billion.

Operations: The company generates revenue from its Solutions segment, amounting to PLN141.44 million, and Subscriptions segment, totaling PLN39.87 million.

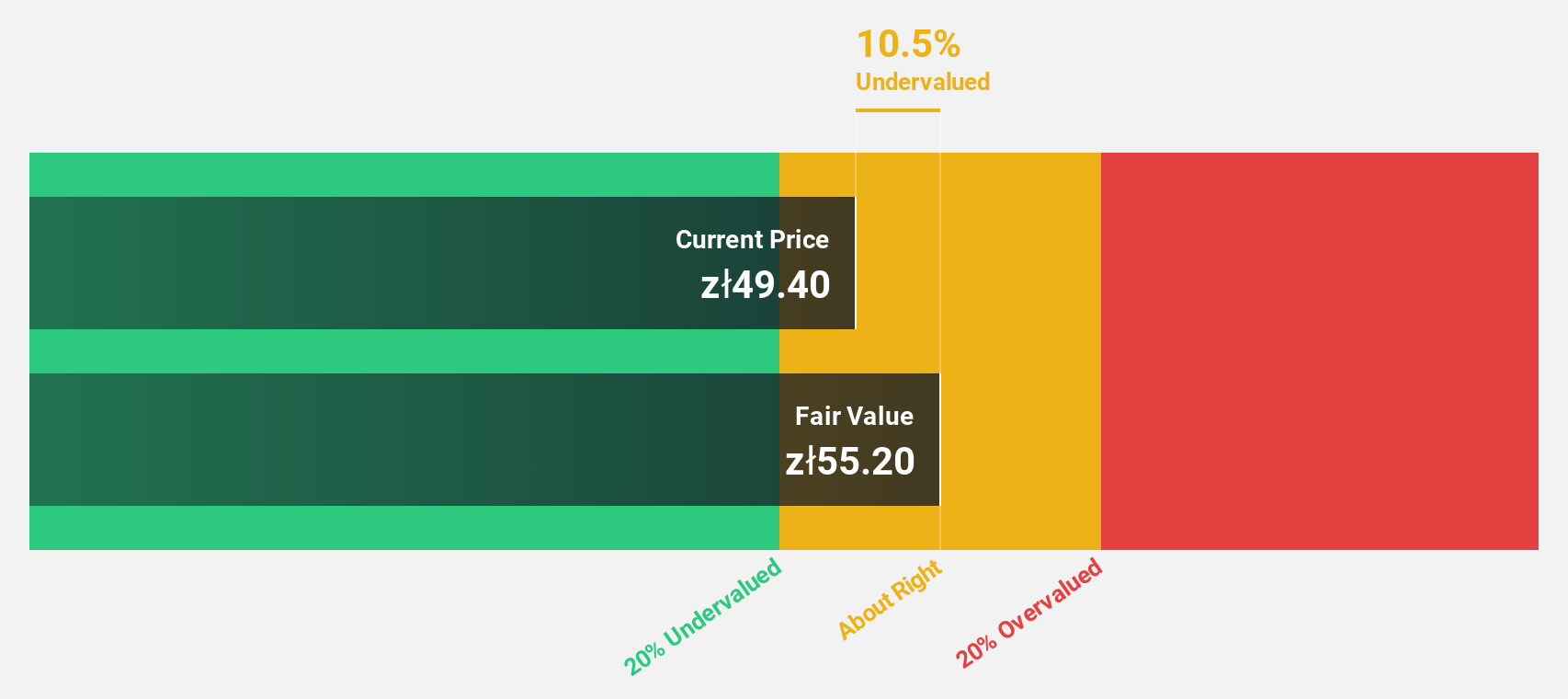

Estimated Discount To Fair Value: 26.4%

Shoper S.A. is trading at PLN 41, below the estimated fair value of PLN 55.68, suggesting potential undervaluation based on cash flows. Recent earnings show net income growth to PLN 23.64 million from PLN 17.14 million year-on-year, with earnings projected to grow significantly at 26.6% annually, surpassing the Polish market's growth rate of 16.1%. A recent M&A transaction valued Shoper shares at PLN 39 each, further highlighting its current market position.

- Our earnings growth report unveils the potential for significant increases in Shoper's future results.

- Click here and access our complete balance sheet health report to understand the dynamics of Shoper.

Next Steps

- Delve into our full catalog of 917 Undervalued Stocks Based On Cash Flows here.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About WSE:SHO

Shoper

Shoper SA provides Software as a Service solutions for e-commerce in Poland.

Outstanding track record with high growth potential.