- Saudi Arabia

- /

- Insurance

- /

- SASE:8240

Revenues Not Telling The Story For Chubb Arabia Cooperative Insurance Company (TADAWUL:8240) After Shares Rise 27%

Despite an already strong run, Chubb Arabia Cooperative Insurance Company (TADAWUL:8240) shares have been powering on, with a gain of 27% in the last thirty days. The annual gain comes to 150% following the latest surge, making investors sit up and take notice.

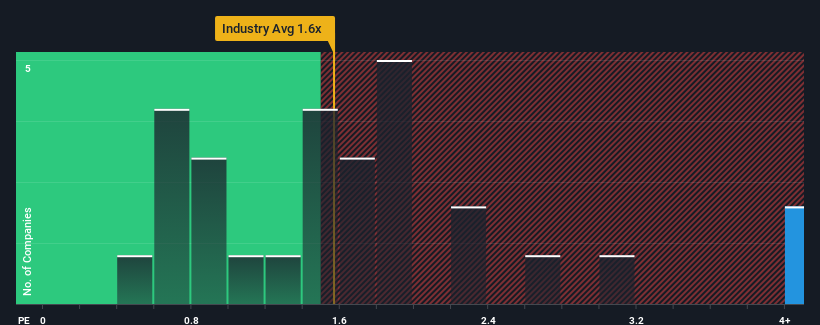

Since its price has surged higher, given around half the companies in Saudi Arabia's Insurance industry have price-to-sales ratios (or "P/S") below 1.6x, you may consider Chubb Arabia Cooperative Insurance as a stock to avoid entirely with its 8x P/S ratio. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly elevated P/S.

See our latest analysis for Chubb Arabia Cooperative Insurance

What Does Chubb Arabia Cooperative Insurance's P/S Mean For Shareholders?

For instance, Chubb Arabia Cooperative Insurance's receding revenue in recent times would have to be some food for thought. One possibility is that the P/S is high because investors think the company will still do enough to outperform the broader industry in the near future. If not, then existing shareholders may be quite nervous about the viability of the share price.

We don't have analyst forecasts, but you can see how recent trends are setting up the company for the future by checking out our free report on Chubb Arabia Cooperative Insurance's earnings, revenue and cash flow.What Are Revenue Growth Metrics Telling Us About The High P/S?

In order to justify its P/S ratio, Chubb Arabia Cooperative Insurance would need to produce outstanding growth that's well in excess of the industry.

In reviewing the last year of financials, we were disheartened to see the company's revenues fell to the tune of 27%. Regardless, revenue has managed to lift by a handy 27% in aggregate from three years ago, thanks to the earlier period of growth. Although it's been a bumpy ride, it's still fair to say the revenue growth recently has been mostly respectable for the company.

Comparing the recent medium-term revenue trends against the industry's one-year growth forecast of 18% shows it's noticeably less attractive.

In light of this, it's alarming that Chubb Arabia Cooperative Insurance's P/S sits above the majority of other companies. It seems most investors are ignoring the fairly limited recent growth rates and are hoping for a turnaround in the company's business prospects. Only the boldest would assume these prices are sustainable as a continuation of recent revenue trends is likely to weigh heavily on the share price eventually.

What Does Chubb Arabia Cooperative Insurance's P/S Mean For Investors?

The strong share price surge has lead to Chubb Arabia Cooperative Insurance's P/S soaring as well. While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

The fact that Chubb Arabia Cooperative Insurance currently trades on a higher P/S relative to the industry is an oddity, since its recent three-year growth is lower than the wider industry forecast. Right now we aren't comfortable with the high P/S as this revenue performance isn't likely to support such positive sentiment for long. Unless there is a significant improvement in the company's medium-term performance, it will be difficult to prevent the P/S ratio from declining to a more reasonable level.

It's always necessary to consider the ever-present spectre of investment risk. We've identified 2 warning signs with Chubb Arabia Cooperative Insurance, and understanding them should be part of your investment process.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

If you're looking to trade Chubb Arabia Cooperative Insurance, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SASE:8240

Chubb Arabia Cooperative Insurance

Provides property and casualty insurance products in the Kingdom of Saudi Arabia and internationally.

Flawless balance sheet low.

Market Insights

Community Narratives