- Saudi Arabia

- /

- Insurance

- /

- SASE:8240

Can You Imagine How Chubb Arabia Cooperative Insurance's (TADAWUL:8240) Shareholders Feel About The 59% Share Price Increase?

These days it's easy to simply buy an index fund, and your returns should (roughly) match the market. But you can significantly boost your returns by picking above-average stocks. To wit, the Chubb Arabia Cooperative Insurance Company (TADAWUL:8240) share price is 59% higher than it was a year ago, much better than the market decline of around 1.9% (not including dividends) in the same period. That's a solid performance by our standards! And shareholders have also done well over the long term, with an increase of 47% in the last three years.

Check out our latest analysis for Chubb Arabia Cooperative Insurance

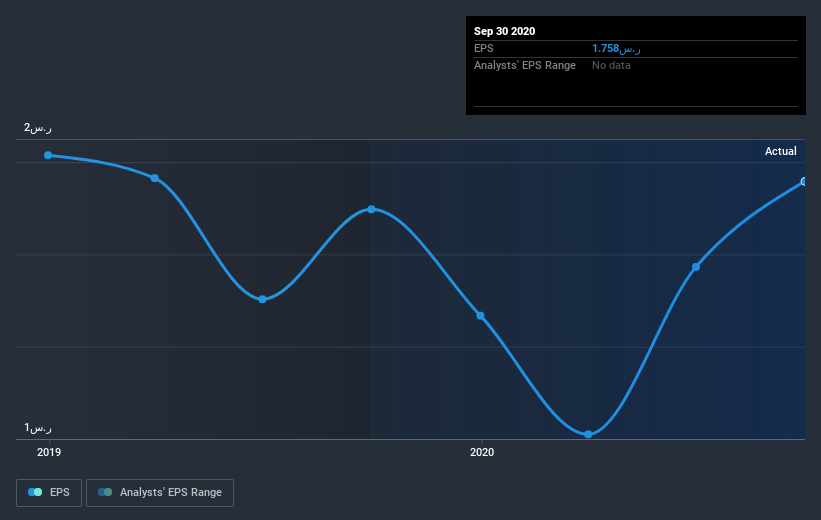

To paraphrase Benjamin Graham: Over the short term the market is a voting machine, but over the long term it's a weighing machine. By comparing earnings per share (EPS) and share price changes over time, we can get a feel for how investor attitudes to a company have morphed over time.

Chubb Arabia Cooperative Insurance was able to grow EPS by 3.7% in the last twelve months. The share price gain of 59% certainly outpaced the EPS growth. This indicates that the market is now more optimistic about the stock.

The company's earnings per share (over time) is depicted in the image below (click to see the exact numbers).

Dive deeper into Chubb Arabia Cooperative Insurance's key metrics by checking this interactive graph of Chubb Arabia Cooperative Insurance's earnings, revenue and cash flow.

A Different Perspective

It's good to see that Chubb Arabia Cooperative Insurance has rewarded shareholders with a total shareholder return of 59% in the last twelve months. That's better than the annualised return of 6% over half a decade, implying that the company is doing better recently. In the best case scenario, this may hint at some real business momentum, implying that now could be a great time to delve deeper. Before deciding if you like the current share price, check how Chubb Arabia Cooperative Insurance scores on these 3 valuation metrics.

If you like to buy stocks alongside management, then you might just love this free list of companies. (Hint: insiders have been buying them).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on SA exchanges.

If you decide to trade Chubb Arabia Cooperative Insurance, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

If you're looking to trade Chubb Arabia Cooperative Insurance, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About SASE:8240

Chubb Arabia Cooperative Insurance

Provides property and casualty insurance products in the Kingdom of Saudi Arabia and internationally.

Flawless balance sheet low.

Market Insights

Community Narratives