- Saudi Arabia

- /

- Insurance

- /

- SASE:8190

Market Might Still Lack Some Conviction On United Cooperative Assurance Company (TADAWUL:8190) Even After 32% Share Price Boost

United Cooperative Assurance Company (TADAWUL:8190) shareholders would be excited to see that the share price has had a great month, posting a 32% gain and recovering from prior weakness. Looking back a bit further, it's encouraging to see the stock is up 46% in the last year.

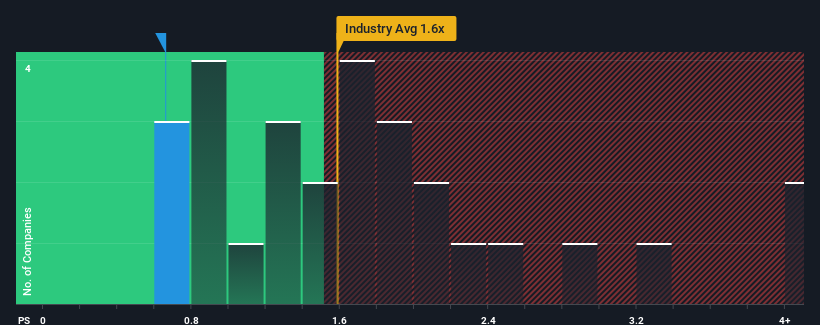

In spite of the firm bounce in price, when close to half the companies operating in Saudi Arabia's Insurance industry have price-to-sales ratios (or "P/S") above 1.6x, you may still consider United Cooperative Assurance as an enticing stock to check out with its 0.7x P/S ratio. However, the P/S might be low for a reason and it requires further investigation to determine if it's justified.

View our latest analysis for United Cooperative Assurance

How Has United Cooperative Assurance Performed Recently?

Recent times have been quite advantageous for United Cooperative Assurance as its revenue has been rising very briskly. It might be that many expect the strong revenue performance to degrade substantially, which has repressed the P/S ratio. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

We don't have analyst forecasts, but you can see how recent trends are setting up the company for the future by checking out our free report on United Cooperative Assurance's earnings, revenue and cash flow.Is There Any Revenue Growth Forecasted For United Cooperative Assurance?

There's an inherent assumption that a company should underperform the industry for P/S ratios like United Cooperative Assurance's to be considered reasonable.

Retrospectively, the last year delivered an exceptional 41% gain to the company's top line. The latest three year period has also seen an incredible overall rise in revenue, aided by its incredible short-term performance. Therefore, it's fair to say the revenue growth recently has been superb for the company.

This is in contrast to the rest of the industry, which is expected to grow by 19% over the next year, materially lower than the company's recent medium-term annualised growth rates.

With this information, we find it odd that United Cooperative Assurance is trading at a P/S lower than the industry. Apparently some shareholders believe the recent performance has exceeded its limits and have been accepting significantly lower selling prices.

What Does United Cooperative Assurance's P/S Mean For Investors?

United Cooperative Assurance's stock price has surged recently, but its but its P/S still remains modest. While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

Our examination of United Cooperative Assurance revealed its three-year revenue trends aren't boosting its P/S anywhere near as much as we would have predicted, given they look better than current industry expectations. When we see strong revenue with faster-than-industry growth, we assume there are some significant underlying risks to the company's ability to make money which is applying downwards pressure on the P/S ratio. While recent revenue trends over the past medium-term suggest that the risk of a price decline is low, investors appear to perceive a likelihood of revenue fluctuations in the future.

Before you settle on your opinion, we've discovered 1 warning sign for United Cooperative Assurance that you should be aware of.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SASE:8190

United Cooperative Assurance

Offers cooperative insurance and reinsurance products in the Kingdom of Saudi Arabia.

Flawless balance sheet and slightly overvalued.

Market Insights

Community Narratives