- Saudi Arabia

- /

- Personal Products

- /

- SASE:4165

Exploring Three Undiscovered Gems in the Middle East Market

Reviewed by Simply Wall St

As the Middle East markets navigate a period of volatility driven by declining oil prices and fiscal repricing concerns, investors are increasingly scrutinizing small-cap stocks for their potential resilience and growth opportunities. In this dynamic landscape, identifying promising stocks involves looking for companies with strong fundamentals, strategic positioning, and the ability to adapt to shifting economic conditions.

Top 10 Undiscovered Gems With Strong Fundamentals In The Middle East

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Qassim Cement | NA | 4.02% | -11.40% | ★★★★★★ |

| Baazeem Trading | 10.02% | -1.27% | -1.66% | ★★★★★★ |

| Sure Global Tech | NA | 10.11% | 15.42% | ★★★★★★ |

| Payton Industries | NA | 3.44% | 14.24% | ★★★★★★ |

| Analyst I.M.S. Investment Management Services | NA | 31.20% | 44.24% | ★★★★★★ |

| Saudi Azm for Communication and Information Technology | 3.26% | 17.17% | 23.30% | ★★★★★★ |

| Terminal X Online | 12.94% | 13.43% | 44.27% | ★★★★★★ |

| Najran Cement | 14.49% | -4.20% | -30.16% | ★★★★★★ |

| Amir Marketing and Investments in Agriculture | 32.43% | 3.87% | 6.98% | ★★★★☆☆ |

| Birikim Varlik Yonetim Anonim Sirketi | 59.38% | 42.42% | 36.01% | ★★★★☆☆ |

We'll examine a selection from our screener results.

Sinpas Gayrimenkul Yatirim Ortakligi (IBSE:SNGYO)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Sinpas Gayrimenkul Yatirim Ortakligi A.S. is a Turkish real estate investment trust focusing on residential property developments, with a market capitalization of TRY18.60 billion.

Operations: The company's primary revenue stream is from residential real estate developments, generating TRY13.32 billion.

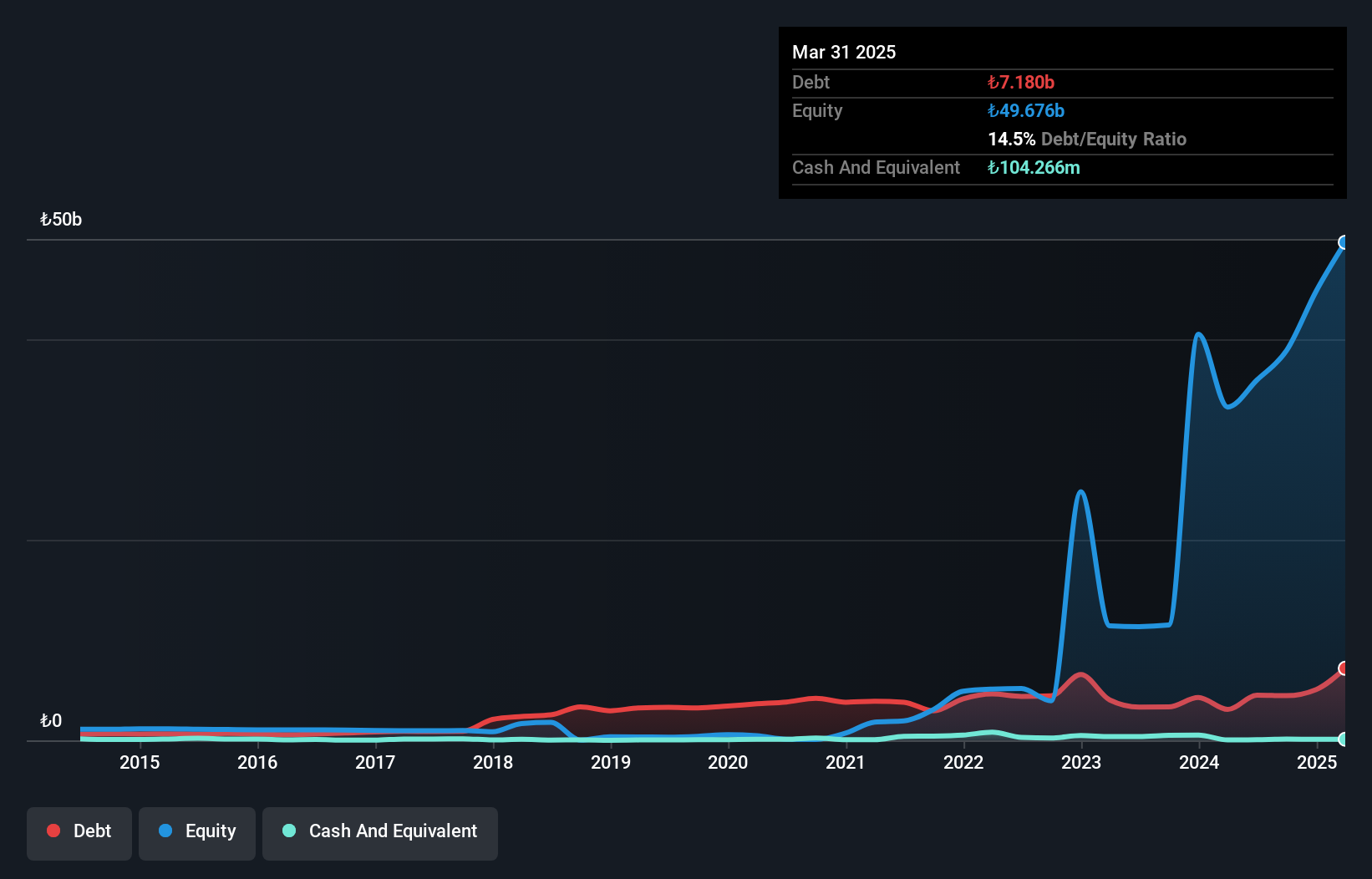

Sinpas Gayrimenkul Yatirim Ortakligi, a small player in the real estate sector, has shown impressive earnings growth of 256.4% over the past year, significantly outpacing its industry peers. Despite this surge, a notable TRY5.3 billion one-off gain has skewed recent financial results. The company's debt situation has improved dramatically, with its debt to equity ratio dropping from 4937.6% to 12.5% over five years, indicating better financial health. However, interest payments remain poorly covered by EBIT at just 2.1 times coverage. Its price-to-earnings ratio stands attractively low at 3.5x compared to the market's 17.6x.

Al Majed for Oud (SASE:4165)

Simply Wall St Value Rating: ★★★★★★

Overview: Al Majed for Oud Company operates in the wholesale and retail trade of perfumes across Saudi Arabia and the Gulf countries, with a market capitalization of SAR3.32 billion.

Operations: The company generates revenue primarily from the manufacturing and sale of perfumes, amounting to SAR1.09 billion.

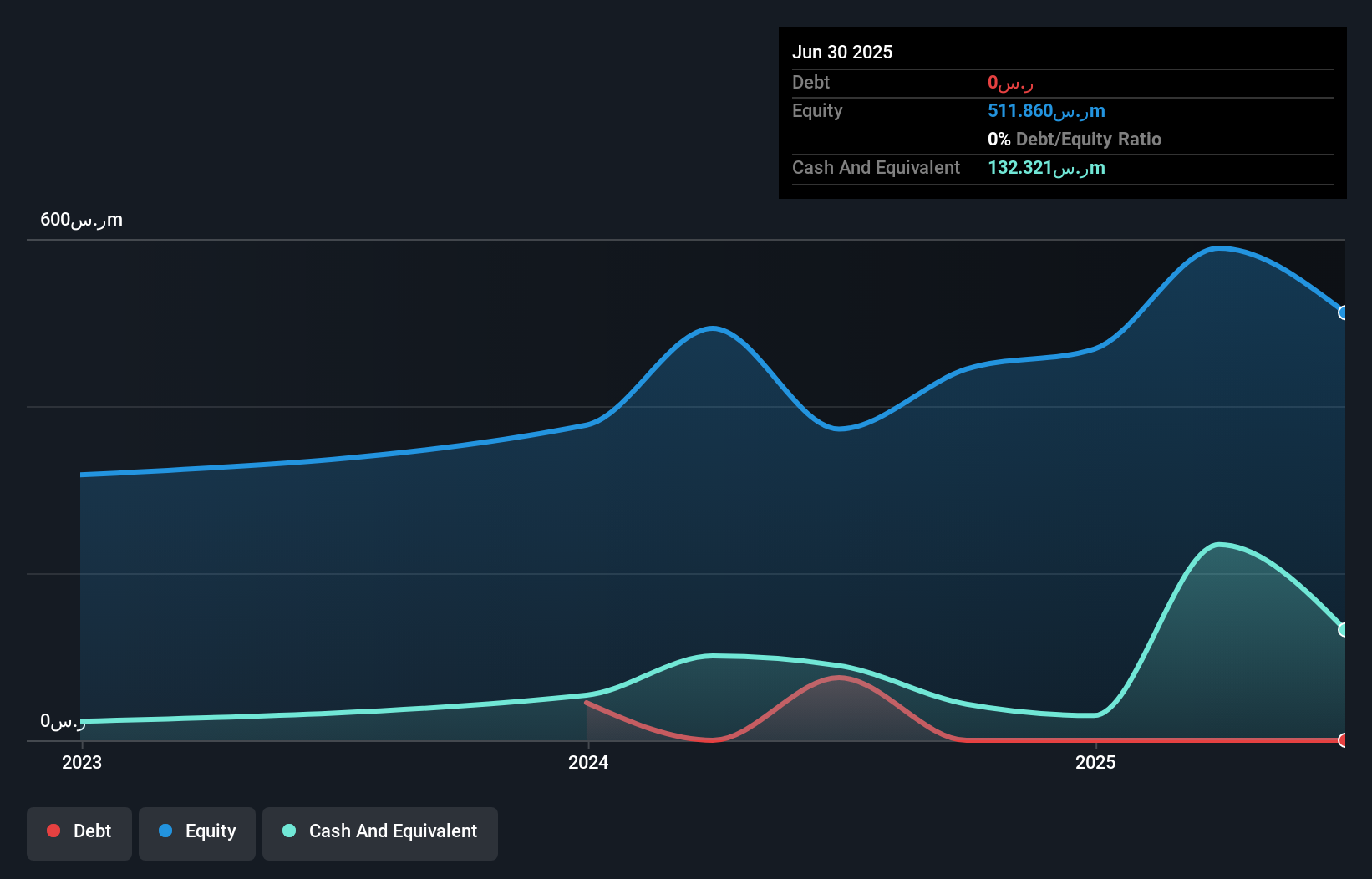

Al Majed for Oud, a compact player in the Middle East, is making waves with its robust financial health and strategic expansions. The firm reported a notable increase in third-quarter sales to SAR 232.44 million from SAR 174.76 million last year, while net income climbed to SAR 30.11 million from SAR 22.42 million. With no debt on its books and high-quality earnings, it's positioned favorably against the SA market with a P/E ratio of 17.4x compared to the market's 18.1x. Recent moves into Abu Dhabi Global Market could further bolster its regional footprint and operational efficiency.

Sumou Real Estate (SASE:4323)

Simply Wall St Value Rating: ★★★★★★

Overview: Sumou Real Estate Company, with a market cap of SAR 1.68 billion, operates in Saudi Arabia focusing on the construction of residential and non-residential properties through its subsidiaries.

Operations: Sumou Real Estate generates revenue primarily from its Contracting and Real Estate Project segment, accounting for SAR 339.91 million, followed by Real Estate Project Management at SAR 110.94 million. The company's net profit margin is not explicitly provided in the available data, so a detailed analysis of profitability trends cannot be conducted without further information.

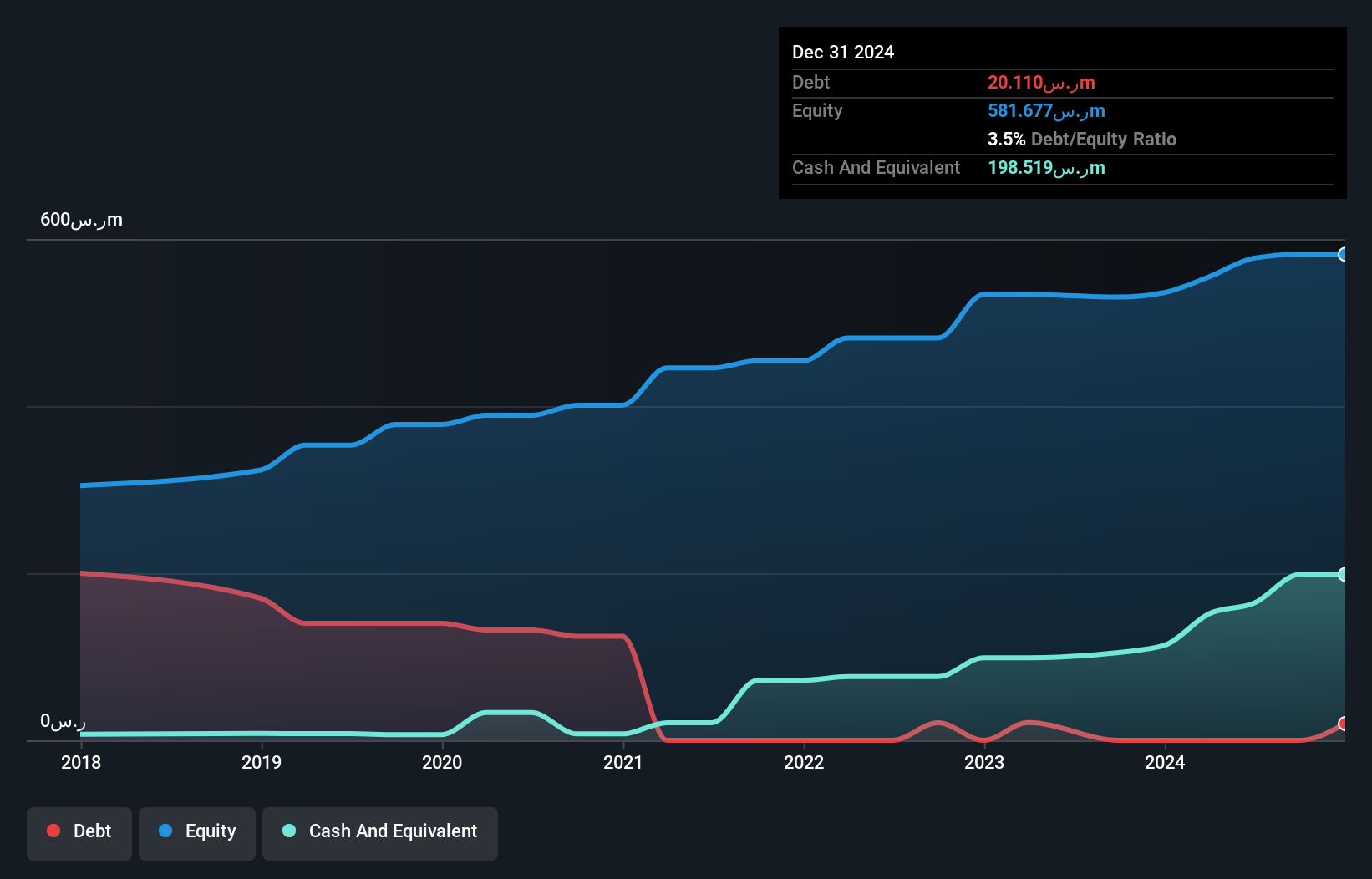

Sumou Real Estate, a promising player in the Middle East market, has demonstrated robust earnings growth of 10.5% annually over the past five years. Its recent third-quarter results showcased sales of SAR 148.58 million and net income of SAR 49.15 million, highlighting its solid performance compared to last year. With a favorable price-to-earnings ratio of 12.7x against the SA market's 18.1x, Sumou appears undervalued by comparison. The company is debt-free and recently secured significant projects like the Anara development in Riyadh and infrastructure works in Jeddah, potentially bolstering future revenue streams with an estimated project value of SAR 135 million excluding VAT.

- Get an in-depth perspective on Sumou Real Estate's performance by reading our health report here.

Assess Sumou Real Estate's past performance with our detailed historical performance reports.

Summing It All Up

- Click through to start exploring the rest of the 182 Middle Eastern Undiscovered Gems With Strong Fundamentals now.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SASE:4165

Al Majed for Oud

Engages in the wholesale and retail trade of perfumes in the Kingdom of Saudi Arabia and the Gulf countries.

Flawless balance sheet with moderate growth potential.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Stride Stock: Online Education Finds Its Second Act

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)